An InsurTech start-up’s guide to navigating an insurance carrier

Collaboration between start-ups and incumbent insurance carriers will be crucial for both the remain competitive in the ever changing industry. Here, Stephen Goldstein presents his step-by-step guide for start-ups looking to work with insurance carriers, ahead of his presentations at InsurTech Rising US this May.

Imagine this. You are the founder of an InsurTech start-up. You’ve got a great solution which could deliver meaningful results for any insurance carrier that brings you on. You’ve been through an accelerator (or two), have received initial funding and have your advisory board in place. You may even have a couple of pilots under your belt.

Now, it’s time to really start cranking up your sales/partnerships.

So, I thought it would be useful to provide a guide for start-ups to consider when preparing to meet with their next prospective carrier.

Collaboration between InsurTech start-ups and insurance carriers is a topic near and dear to my heart. While the focus is primarily for B2B start-ups, many of the same principles outlined below apply to D2C start-ups, which are looking to partner with an Insurance carrier for distribution purposes.

The framework for this guide is as follows:

- Know your value

- Know your customer

- Find out who holds Profit & Loss (P&L)

- Help them understand how you’ll bring value to them

- Sign LOI and agree on a Pilot

- The ‘art’ and ‘science’ of the sale

Know your value

Start-ups, need to keep the following question in mind when you are reading the rest of the article.

Is your solution one that is going to help an carrier save costs and/or increase revenue?

Have a clear value proposition and give tangible examples of what you do (i.e. use cases where it is already working).

For example:

- Saving costs – DO YOU remove the need for manual/high cost processes? Identify opportunities to improve lapse rates, persistency ratios, loss ratios? Provide the carrier with new data sets for better and more accurate modeling?

- Driving revenue – DO YOU increase a carriers number of prospects? Increase conversion rate? Increase sales volume because of a new niche product capturing a new market?

If you can not answer this question, you may want to focus on this first before reading the rest of this article. Or at the very least, have that question answered before you follow the advice provided in this article.

Know your customer

You know what value you provide to carriers. Now, it’s time to go meet with them.

Wrong.

Before you meet with a carrier, do your homework and be specific about which carriers you want to target.

Information you should know about the carriers you are targeting:

- What is their organizational direction?

- Who is their main competition and what has their competition been doing when it comes to innovation?

- Who are the key players within the organization? (see next section)

- Has the carrier done anything really big/meaningful in the market recently?

The more you know about a company when you walk in, the better. Don’t you feel good when someone knows a bit about your solution when you first meet them?

There are plenty of ways to get this information. Read about the company and research whatever is publicly available online. Use LinkedIn and your network to find out more if you can’t find it online.

Once you’ve done your homework and know who you are going to target, work on getting in the door. LinkedIn and your network will be powerful here too.

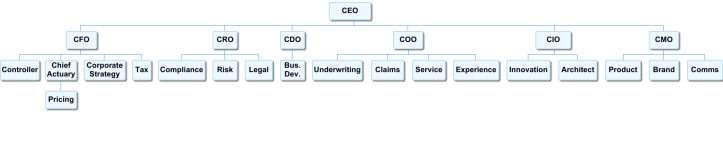

However, before you meet with a carrier, it’s important to know who in the organization you will and need to meet with. Consider the organisational chart for a typical insurance carrier below:

Now, it’s time to meet with the carrier. So, who do you target?

Find out who holds Profit and Loss (P&L)

Ultimately, any initiative that an Insurance carrier undergoes must have some sort of return on it. As such, as part of the approvals process for an Insurance carrier (we’ll get more on that later), the people that have the most say as to whether or not to bring a solution on board will be the ones who hold a P&L.

Why are those who hold a P&L important?

Because they will be the ones who are ultimately ‘measured’ on the success of an initiative and the people that you will have to convince to ‘buy’ your solution.

The ones who hold the P&L are important, but so are the others. It is important to know who all the players are and what motivates them, as all will have different and important roles throughout the whole sales cycle.

Who are the players?

Keep in mind what your solution is offering and who the person is that you are ultimately going to need to get the most buy in from.

The top

CEO

The ‘control’ functions – these are people that may not be a ‘user’ of your Insurtech solution, but will want to analyze it to the nth degree to make sure it’s good for the organization as a whole.

CFO – The CFO monitors/controls the P&L. They may even be one of the most important, as in some cases, the CEO will only sign off on a project (if they need to), once the CFO has endorsed it. That question I asked before (save cost and/or increase revenue) is of utmost importance to this person. Expect the answer to that question to get heavily scrutinized too.

Chief Actuary/Appointed Actuary – As mentioned before, I’ve seen this position report directly to a CEO and to a CFO. Regardless of who they report to, their questions are going to be financial in nature. If you have a solution that claims to improve lapse rates, increase persistency or anything else that touches pricing, be ready for some detailed questions from this department.

CRO – With variations, but for the most part, risk will encompass compliance, risk and legal.

The profit centers – these are the ones who will likely ‘use’ your InsurTech solution and the ones who will ultimately get measured of the effectiveness of your solution (i.e. P&L).

Chief Distribution Officer – This position will vary depending on the organization and its primary goals are to grow revenue (i.e. Sales, Business Development, Commercial). If your solution has anything to do with any part of the sales value chain, then they will be a key stakeholder to get buy in from. This can also mean customer facing solutions, whereby the Distribution team has the primary relationship with the customer.

COO – Operations departments have a variety of functions under them – from underwriting to customer service to claims. If your solution has anything to do with back office operations and/or the customer, then this is another key stakeholder for you.

Both of these definitions are wide for a purpose. These two departments have the most interaction with a customer/policyholder and will be very particular about anything that is going to impact that relationship. They will need to be convinced that the solution being implemented does not disrupt that relationship.

Many InsurTech solutions are targeted at improving the customer experience. However, these two departments have the experience in actually doing it for their existing customers, and will feel very particular about saying what can be done to improve that existing relationship. Be mindful of this when you start engaging with people from these departments.

Lastly, I do note that the aim of many carriers is to make more prominent the role of the Chief Customer Officer, or a Customer Experience department. For the moment, I put that position into the ‘advocate’ category below, unless they specifically hold a P&L.

The advocates – these are typically the ones you will meet with first and the ones who will be very important in convincing the the ‘profit center’ category that your solution should be taken on board.

Advocates include the CMO, CIO and IT departments. While you will need to convince these of the importance of your solution and that it is technically sound, these are unlikely to make a all on your solution from a business needs standpoint.

Help them understand how you'll bring value to them

As mentioned above, the first meeting will likely be to one/some of the advocates. These may be of the manager/senior manager level, who are knowledgeable enough to do the first round of vetting for their more senior managers/key stakeholders in the organization.

This session is an opportunity for the carrier to get a high level understanding of what is being proposed to see if they should bring this solution forward. You will need to at least demonstrate the answer to that key question above during this session.

After a few of these sessions, assuming they are interested, they will then bring in their more senior management/other key stakeholders to get their view. If you start seeing more senior level personnel in your meetings and/or people that fall into the ‘profit center’ bucket, then you are on the right track. If you keep only meeting with advocates, it may be time to start questioning whether you are making progress or not.

It’s also fair to ask the carrier who will be held accountable for the success or failure of the solution being implemented. It will help to understand this in order to get those people involved and excited early on.

Getting people excited and on board is half the battle. It’s an exciting moment, because it feels like the deal is done. Then, the red tape comes in.

Queue, the approvals process.

Approvals to undergo a new initiative for an Insurance carrier can be cumbersome. The person who is leading the project will need to do a write-up/report of the solution being on-boarded for the rest of the organization to evaluate (this will include some combination of people from the control function, profit center and advocates).

This write-up/report will include:

- Why the carrier should do this project (qualitative and quantitative analysis that will include costs/benefits/KPIs)

- The technical architecture of the solution

- Risks associated with the solution with mitigating controls (technical and non technical)

- Regulatory/legal implications

- And more

This may be seem like a lot, but for multi billion dollar corporations, they need to ensure they have a paper trail of initiatives that they do. (Side note – you should always have an audit trail yourselves!)

For a start-up, the more you can help with this and prepare yourselves for these questions, the better. Think of ones that are specific to your solution. You will save time if you address these early on.

The carrier will also want to assess your solution against 3 or 4 others in the market. Hence, it is important to know your competition and how you stack up in these areas too. Again, if you have this upfront you will save time later.

You will want to be constantly communicating with your key contact(s) at the carrier throughout the approvals process, helping them and being with them to answer any questions that may come up. Once approval comes in, they will want to start work, so you better be ready.

Sign the LOI and agree on a Pilot

Once all the approvals are done, get your LOI signed and agree on a pilot. An Insurance carrier typically will not do this until they have done all of their internal approvals.

The "art" and "science" of the sale

Sales is an ‘art’ and a ‘science’. The ‘science’ is a lot of what I mentioned above; know your prospect, have a sales pitch down and close.

The ‘art’ are things that you learn through more practice, such as non-verbal queues and cultural nuances. If you are doing cross-border collaboration (i.e. an American start-up going to Asia or vice versa) there are a ton of non-verbal queues and cultural nuances to be mindful of.

Lastly, I’ll repeat some advice that I mentioned in my ITC review from Mr Benoît Claveranne, Group Chief Transformation Officer of AXA:

-

When a start-up approaches an incumbent, they should make clear what they are looking for – to be invested in, bought out, or partnered with. A lot of time is wasted on this during early engagement, and will help move the conversation along if it is clear early on.

-

For start-ups – make a call after 1-2 meetings to see if the incumbent is serious about doing business. Do they have a budget and a team to develop it? If not, it may be time to move on to the next client.

Stephen Goldstein is an experienced Insurance executive and InsurTech dealmaker with a core focus on growing revenue, launching go to market initiatives and advising industry leaders.

This article was originally published on DailyFinTech.com - see the original here >>