Asset management: Transformation is already here

Fundamental changes in the asset management industry have been building for some time. A new and wide-ranging BNY Mellon research study covering 200 asset managers around the globe shows that such changes have reached a point of no return.

Geopolitical and demographic shifts have redefined the market landscape. The global COVID-19 pandemic has intensified the industry’s focus on the ability to operate digitally with resiliency. Our survey participants told us again and again—there is no going back.

How asset managers see their future

Our research uncovered five themes that illustrate asset managers’ perceptions of the industry’s future, along with the concerns they have about what it takes to succeed in such a future.

In summary, these themes are below. We will also be releasing in-depth chapters to explore perceptions and concerns in each area.

1. Data determines destiny

2. Digital imperatives dominate

3. The product lineup is realigning

4. The distribution game has new rules

5. Focus on the core is key

An initial snapshot of market thinking

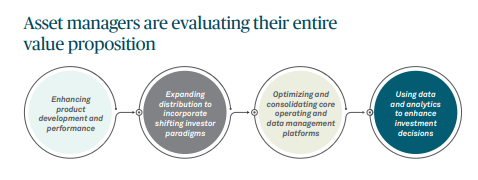

The transformative power of technology and the importance of data underlie all of the themes that asset managers highlighted in our surveys. Forward-thinking leaders in asset management take a holistic view of technology’s impact on every aspect of their business, from front-to-back office.

A plurality of our survey respondents highlighted this view. They named the evolution of digital technology as the top trend in asset management over the next three to five years. Combined with other digital concerns—data/analytics and tokenization—technology becomes the majority view, with 54% of respondents designating a technology-based trend as their top choice.

In this technology-driven world, every aspect of the end-to-end investment lifecycle is open to fundamental redefinition.

Product- and market-related trends rank next in the hierarchy of asset managers’ thinking. Growth of private markets, use of ETFs as a wrapper for active and passive funds, and integration of ESG criteria combine as the top trend for 37% of respondents.

Although a minority view, we would also note the emergence of consolidation as a top-of-mind trend. More broadly, we see an increased rate of consolidation within the industry.

Consolidation helps give firms a lever for gaining access to new products and markets, achieving economies of scale, and succeeding with an ambitious technology agenda. The consolidation trend is likely to continue and potentially accelerate in the coming years.

Asset managers unlikely to go it alone

Intensifying industry pressures and challenges are forcing asset managers to re-evaluate the way they do business. To fuel the front-to-back engine, asset managers must combine data with complex operating platforms while simultaneously scaling, achieving resiliency, and managing transparency and oversight requirements. COVID-19 has thrown additional variables into an already complex mix of imperatives.

In this context, asset managers have begun to realize they must focus on their core competencies. The question for many is where to start and how to address the critical technology, data management/analytics, and operating platform challenges that fall outside that core.

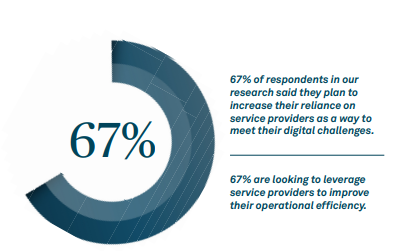

For many firms, it is undesirable or impossible to bring all of the required expertise in-house. As a result, they are considering outsourcing non-investment functions as a strategy for growth.

Getting outsourcing decisions right is more important than ever because of the increased complexity of the industry. Asset managers need outsourced assistance to help bring together and evaluate disparate data. They seek out those who can deliver modular and flexible solutions that enable them to adapt.

The key to success is to find providers who have invested in their technology and infrastructure and are committed to supporting long-term initiatives. Successful relationships require both asset managers and their providers to engage fully, with collaboration and agility, to limit risk and help identify opportunities for transformation now and in the future.

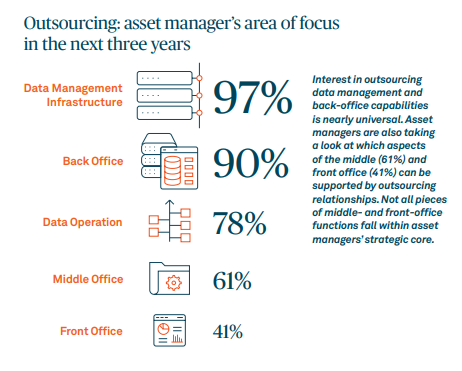

Data management, back-office capabilities and data operations represent the largest areas where significant majorities of asset managers plan to explore or expand such outsourcing.

The future is agile, the architecture is open, and the stakes are high

The survey results track well with broader industry trends that we see in the asset management landscape. Client demand for investment growth and performance has increased and, at the same time, has become more nuanced. Flexibility and collaboration are needed for firms to evolve to a new level of data-centric processes. In other words, frictionless operating models must be offered that lets asset managers focus on serving their end clients and achieve long-term growth in this newly arrived future.

Still, asset managers do not want to chase every technical innovation. There is a greater recognition that firms must have a small number of core providers that offer scale, resiliency and the expertise to support integrations and enable agile change.

Simpler times are not coming back. Firms that successfully move past this point of no-return will put data and new technology at the core of their transformation. Integrated, modular approaches will give them the agility and flexibility to thrive. But those that stay with the status quo may soon reach the end of the line. As the industry advances, they will struggle to meet the evolving needs of new generations of investors seeking lower fees, new products, and enhanced transparency.

Both our survey and our broader experience point to five critical areas where potential providers or collaborators help firms achieve operational transformation and future-proof their business:

• Orchestrating solutions and information across the entire investment process

• Bringing together disparate data across the entire enterprise to gain new insights

• Enabling preservation of choice and flexibility through a modular, open-architecture data-centric platform

• Building a provider-agnostic model that incorporates flexible technology for future providers and partners

• Creating a resilient, frictionless front-to-back operating model that lets asset managers focus on their priorities

Download the overview report for insights into asset manager’ perspectives about their future ability to generate alpha and grow their investor base.

BNY Mellon are a gold sponsor of the upcoming FundForum International event live in Monaco, 20-21 October 2021. Find out more about the event.