BANKING TECH AWARDS USA 2023 FINALIST: ChargeAfter

ChargeAfter has been selected as a finalist in the Best Embedded Finance System – Lending category for their project ChargeAfter POS financing platform in the Banking Tech Awards USA 2023.

ChargeAfter

ChargeAfter is the embedded lending platform for point-of-sale financing for merchants and financial institutions. Powered by a network of lenders and a data-driven matching engine, ChargeAfter streamlines the distribution of credit into a single, secure, and reliable embedded lending platform. Merchants can rapidly implement ChargeAfter’s omnichannel platform online, in-store, and at every point of sale, enabling them to provide personalized financing choices to all their customers.

THE PLATFORM

ChargeAfter has created an easy plugin platform that enables merchants, banks, and financial institutions (FIs) to offer a full spectrum of financial products and post-sales management. With ChargeAfter’s white-label options, banks and FIs can launch their unique customized lending issuance products under their brand within weeks.

One Unified Finance Experience

Our state-of-the-art platform standardizes the lending process across multiple lenders. It seamlessly integrates with in-person stores, e-commerce sites, tele-sales, and other points of sale systems, creating a single and simple finance application and approval experience.

Lender Connectivity

ChargeAfter eliminates the headache of separately integrating individual lenders, each with its compliance requirements, underwriting processes, and regulations. We seamlessly connect all lenders into a single streamlined and compliant application experience. An extensive network of over 40 lenders supports every consumer geography, credit score, and vertical.

Live Matching Engine

The platform enables merchants to match customers to “right-fit” lenders through its matching engine. The platform’s dynamic waterfall offers instant access to any lending product or program for a personalized customer experience, across the credit spectrum.

Process Management & Analytics

The platform’s advanced back-office module means it has never been easier for merchants to manage and optimize their customers’ lending journeys, including all post-sales activities such as authorizations, charges, and refunds.

Additionally, our comprehensive reporting and analytics suite provides insights merchants need to optimize financing programs and increase lifetime value.

UNIQUE BENEFITS FOR MERCHANTS

Boosted Approvals

With a seamless financing journey, merchants can offer all their customers personalized and optimized financing options within seconds, resulting in 80% approval rates.

Unlocked Choices

Our lending network and financial products match the needs of every customer, regardless of their credit history or score, and in every vertical.

Increased Loyalty

The ChargeAfter platform offers a frictionless financing experience integrated into every checkout, enhancing the customer journey and building loyalty and trust.

UNIQUE BENEFITS FOR BANKS & FINANCIAL INSTITUTIONS

Expanded Offer

Banks and FIs seamlessly expand their lending issuance and products in a single lending hub.

Fast GTM

The platform directly integrates with leading e-commerce platforms and point-of-sale devices for fast go-to-market.

White Label

The platform offers a white-label point-of-sale solution from origination to reconciliation in one platform.

Improved satisfaction

Banks and FIs improve merchant satisfaction and retention with higher revenues, approvals, and conversion.

BACKGROUND

Unlike other areas of the customer journey, point-of-sale financing continues to lack choice and personalization and is a very fragmented experience. While BNPLs and other single lenders have become popular, they do not adequately serve merchants, consumers, or lenders.

Our research shows that most retailers achieve financing approval rates of under 60% with their current lending and financing offers. This results in lost sales for the merchant and a poor customer experience. Shoppers who are declined for financing at the point of sale either reapply for alternatives or often abandon their cart. When the decline happens in a brick-and-mortar store, it can cause embarrassment and distress to the customer.

As merchants adopt new consumer financing trends and technologies, banks lose an estimated $8 to $10 billion annually to fintech companies. In addition, they are losing access to a critical acquisition channel and the potential to serve lending products to highly engaged younger consumers, embracing lending as an integral part of their shopping journeys.

ChargeAfter is leveraging technology to revolutionize consumer financing. Our embedded lending platform meets the needs of consumers across the credit spectrum, the merchants who serve them, and the lenders who can supply them with a loan that matches their credit score and personal preferences.

To remain competitive, banks and financial institutions are embracing change and leveraging emerging technologies to their advantage. ChargeAfter is trusted by some of the largest retailers in the US, has a network of more than 40 lenders, and works directly with tier-one financial institutions to white-label their point-of-sale financing offers.

INNOVATION - INTRODUCING A PLATFORM-FIRST APPROACH TO FINANCING

Our system is the abstraction layer that seamlessly connects merchants to multiple lenders and financing products at every point of sale, creating a unified financing experience on a single platform. ChargeAfter is the easy way to embed financing choices into omnichannel customer journeys.

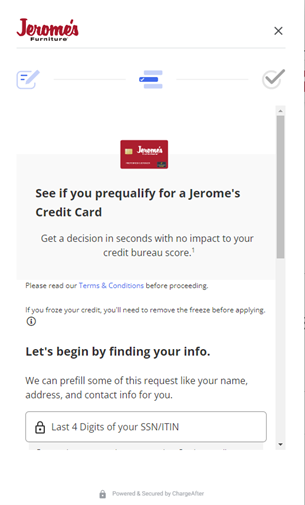

USE CASES:Jerome’s Furniture

Jerome's Furniture faced a challenge in offering point-of-sale financing that meets the needs of all its customers. To achieve this, they understood that they needed to work with different lenders so that they could offer prime, near-prime, and subprime lending options.

The team recognized that managing multiple lenders is challenging to handle in-house. Each lender has its systems and requirements making it burdensome for the store to manage, and even worse - it provides a less-than-ideal customer experience.

Jerome’s Furniture achieved a 67% increase in consumer financing adoption, with high approval rates after integrating ChargeAfter’s platform.

The store now integrates consumer financing into every stage of the funnel - from robust campaigns during the consideration stage to seamless, convenient processes during the decision stage, to efficient follow-up and personalized financing offers post-purchase.

USE CASES: Raymour & Flanigan

Raymour & Flanigan’s focus on providing exceptional customer experiences led it to partner with ChargeAfter’s data-driven matching engine and network of lenders. With a single integration, ChargeAfter connects Raymour & Flanigan’s existing prime, near-prime, and sub-prime lenders, allowing the integrated process to approve up to 85 percent of customer applications.

During checkout, customers will complete a single, quick application and instantly receive the best-approved financing offer based on their unique credit profile and needs. This improved flexibility, simplicity, and ability to get customers approved is anticipated to help Raymour & Flanigan grow its financed sales by 25% in the coming years.