The streaming war is heating up, and Netflix is in the hot seat. For years, Netflix enjoyed a dominant spot in the streaming business, but with big players like Disney, Apple and Warner Media about to enter the market, the company finally has real challengers who could potentially change the game.

The new kids on the block are coming out with guns blazing, putting together talent and content that promise to attract consumers. Apple will have Reece Witherspoon, Jennifer Aniston and Oprah on its side. Disney will have Star Wars, Marvel and Pixar.

As streaming’s top dog, Netflix may seem like it has everything to lose and nothing to gain. But is that really the case? At Reach3 Insights, we work with many companies in media and tech, and we believe our clients need to pay attention to what’s happening in streaming. We wanted to explore, in depth, the impact of new challengers and understand the opportunities for new players as well as the impact to related industries.

For a deeper dive into this space, we did a conversational chat study asking 300+ US-based consumers about their current streaming habits, their perceptions about the players of the space and people’s future intentions. We used software from Rival Technologies, our sister company, to allow us to engage with these consumers via SMS and other mobile messaging platforms.

One key insight from our study is that Netflix’s future is secured—at least for the foreseeable future. There are three main reasons why this is the case.

A healthy — and significant — head start

In 2018, the slang “Netflix and chill” was officially added to the dictionary — a demonstration of how the company’s name has become synonymous with over-the-top subscription video streaming.

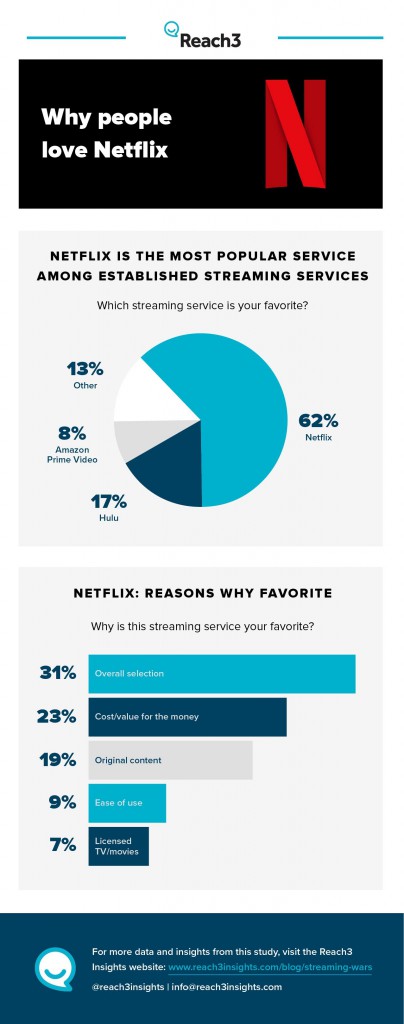

Among current streamers, Netflix is way ahead: 62% named Netflix as their favorite, 17% chose Hulu, while only 8% chose Amazon Prime Video.

Interestingly, we found that challengers are facing an uphill battle in terms of awareness and future intent. Among the consumers we talked to, 62% said they are aware of Disney’s upcoming streaming service and that 35% are “excited” about it. However, only 11% said they are likely to replace one of their streaming services with Disney’s.

Apple’s situation is not any better. Only 42% are aware that Apple’s streaming service is coming, with 13% saying they are likely to replace their current service.

Consumers subscribe to more than one service

If you read headlines in the media, you’d get the impression that streaming is a zero-sum game. The assumption is that Disney’s and Apple’s gains will be Netflix’s lost. But our data doesn’t support this thinking.

Consumers are subscribing to more than one service, with many having Netflix in the mix. Our study shows that the average consumer is subscribed to two services, with 39% of consumers subscribed to three or more services. Netflix is in the mix for most people: 90% of Hulu subscribers also subscribe to Netflix, and 87% of Amazon Prime Video users also subscribe to Netflix.

The good news for Netflix and its competitors is that a majority of streaming users are not concerned yet with the number of options available. Only 5% feel there are too many. While a quarter feel we are on the cusp of saturation, 72% said the options in the market are not too many at all.

In short, the streaming market can tolerate the addition of new competitors without impacting Netflix. We don’t think this means Netflix needs to be complicit, but it does show that even a successful launch from either Disney or Apple won’t mean a significant decline for Netflix.

Original content is a big factor

This year, Netflix is expected to spend $12 billion on original content — a 25% increase from last year. The company views this expense in original programming as a long-term investment — something that will deliver value to its 139.3 million subscribers and keep them coming back to the company’s service.

Our data confirms that this investment in originals is indeed a wise business idea. We asked people about their preferences towards original versus syndicated content, and there’s a big skew towards originals. Among all streaming users, only 7% of streamers said licensed content is their favorite part of the service, while 20% favored original content. Furthermore, 23% of streamers who chose Netflix as their favorite cited original content as the primary reason. “Stranger Things,” in particular, seems to resonate with fans — 3% of streaming users named the show in their open-ended response when we asked why they love Netflix.

With Netflix investing heavily in original programming — something that consumers want — we expect the company to continue to attract a solid subscriber base even with Disney and Apple in the mix.

Game over for Disney and Apple?

Our data re-affirms Netflix’s strong position in the streaming business, but this doesn’t mean new players have no chance of winning or at least taking some share of subscribers from Netflix. After all, Disney is well-established and has a great reputation for great content. Our study actually shows that 20% of current subscribers said they plan to check out Disney+ when it comes out. Apple, on the other hand, has proven time and time again that it can win in the long term. When Apple first entered the music-streaming business, it looked hopeless, but now Apple Music has surpassed Spotify in the US.

That said, our data shows that new players won’t take too much from Netflix’s pie — at least in the short term. Both Disney and Apple need the time and money to establish awareness and demand for their offerings. To reduce Netflix’s substantial lead, these challenger brands should consider investing in ongoing consumer insights to understand evolving consumer attitudes and learn how they can change people’s minds and hearts.

When Disney and Apple finally launch their services, it will just be a battle in what should be an epic war. Competitors should be in it for the long haul. The streaming war may be heating up, but it’s far from over.