Exchange-traded funds (ETFs) are a growing segment in the global financial industry: The first ETFs were launched in the 1990s, and since then they have evolved from a niche investment option to become one of the most popular, disruptive, and widely discussed trends in the industry. The latest challenge posed by the COVID-19 pandemic has underscored both the remarkable resilience and growth potential of the ETF market.

industry: The first ETFs were launched in the 1990s, and since then they have evolved from a niche investment option to become one of the most popular, disruptive, and widely discussed trends in the industry. The latest challenge posed by the COVID-19 pandemic has underscored both the remarkable resilience and growth potential of the ETF market.

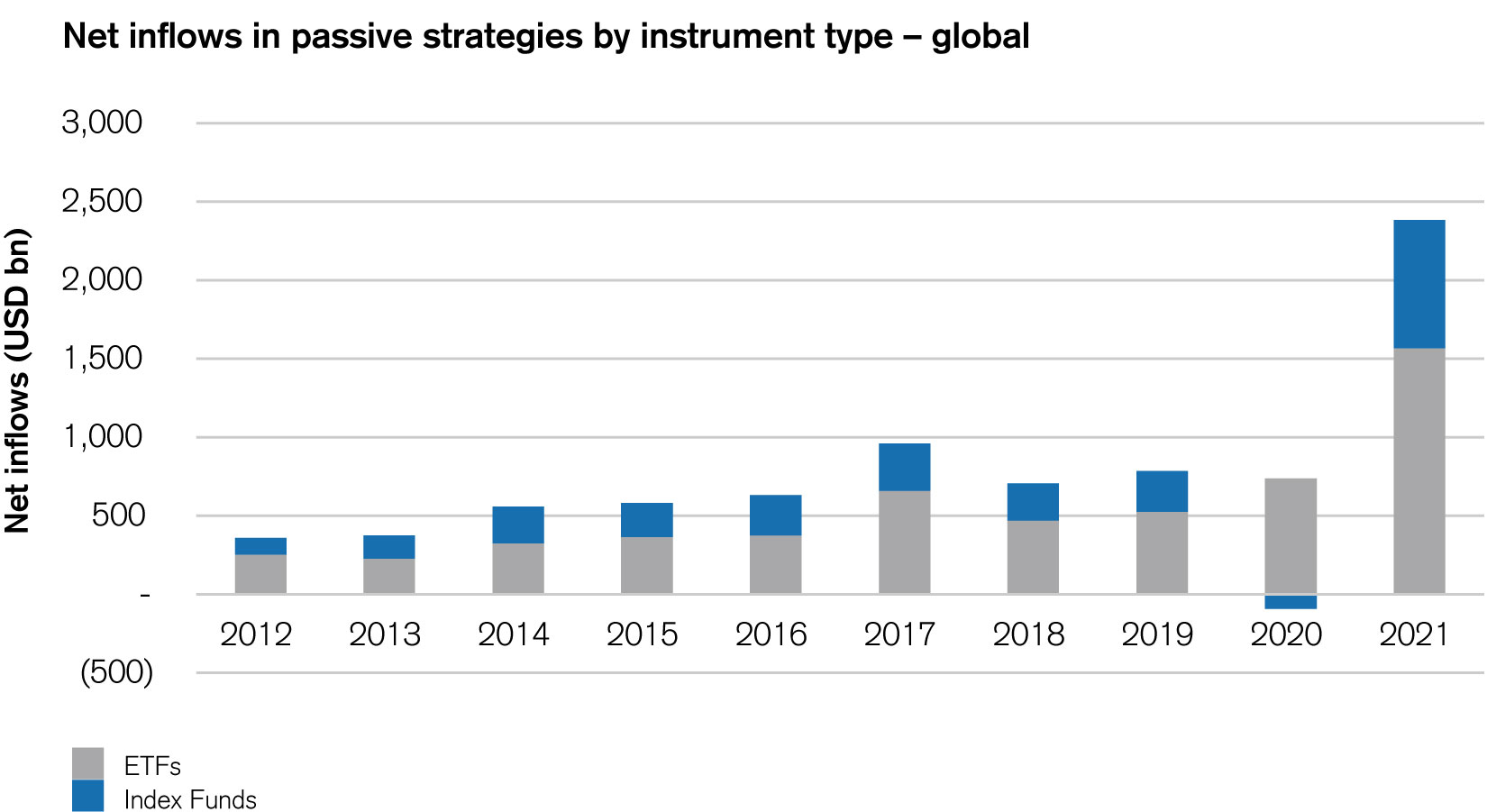

ETFs have proven to be a reliable instrument for investing in fixed-income securities such as corporate investment-grade and high-yield bonds, including during the historic liquidity crunch of March and April 2020. On many occasions, they have played a key role in price discovery. Having navigated the pandemic in 2020 and 2021, ETFs are emerging from the crisis stronger than ever. Both listed (ETFs) and unlisted index funds have benefited from this market backdrop, reaching record net inflows in 2021.

Source: Morningstar, Bloomberg. Data in USD bn as of the end of December 2021. For illustrative purposes only.

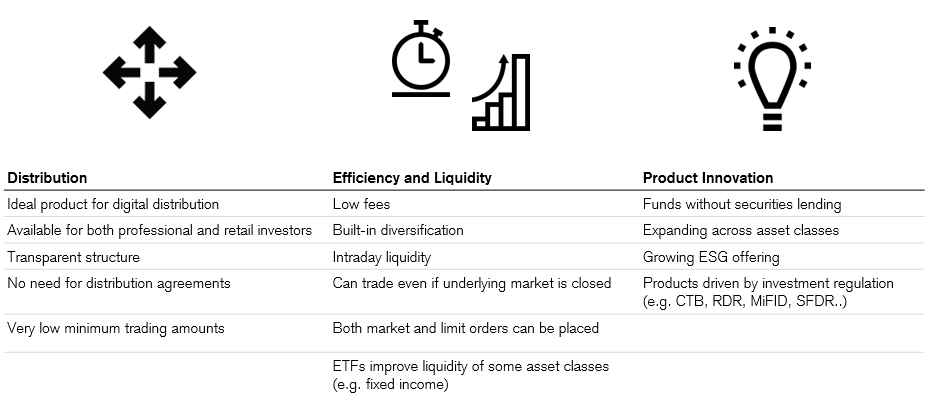

Practitioners often justify this success by focusing on the low fee component, which we think is only one of the reasons for this trend. We believe the distribution potential is what makes ETFs a disruptive innovation in the financial industry: as listed retail products, ETFs are accessible to anyone connected to a stock exchange.

Lockdowns spurred ETF boom

This lean distribution mechanism allows ETFs to be extremely versatile and widespread across different investor types, from sophisticated institutional buyers to retail investors. What’s more, ETFs may serve various purposes, ranging from short-term deployments (such as cash equitisation) to long-term allocation.

During the pandemic, we witnessed growing interest from retail investors. Private clients were often unable to meet their relationship managers in person, which allowed digitally enabled investments such as ETFs to thrive.

SFDR: Sustainable Finance Disclosure Regulation; RDR: Retail Distribution Review; MiFID: Markets in Financial Instruments Directive.

According to Deloitte, more than ten million Americans opened a new brokerage account in 2020, with retail investors generating an equity trading volume nearly as high as mutual funds and hedge funds combined. The same trend could be observed across Europe, with many brokerage firms reaching record results on the back of higher volumes.

ESG at the heart of ETF growth

As a result, many ETF issuers shifted their focus toward a hybrid distribution model, offsetting a limited commercial presence with a more content-heavy strategy that includes virtual channels and even social media. In this context, two of the main catalysts for generating innovation were ESG-focused and sustainable ETFs.

Rigorous ESG criteria pair well with the quantitative portfolio construction of ETFs, spurring the strong growth of ESG-themed and ESG-integration products in recent years. One prominent example of this was the European UCITS market in 2021, where two out of every three new ETFs were classified as sustainable.

We expect the market to become increasingly focused on products designed around ESG integration techniques that adopt both exclusions and positive selection in order to further focus on sustainability. This will come at the expense of the very first ESG products (referred to as “light green products”), which are limited to only excluding certain product sectors. These less sophisticated concepts are now being placed under scrutiny by regulators and investors as a mere proxy to traditional market cap-weighted strategies.

We anticipate a very bright future for ETFs. The months of isolation caused by the pandemic accelerated an already sparkling ETF market. We believe that although the record growth of 2021 was most likely an exception, the forces reshaping the retail investor market will not fade away anytime soon.

Credit Suisse are gold sponsors of IMpower Incorporating FundForum 2022. Find out more about the 2022 event and agenda here >>

This material constitutes marketing material of Credit Suisse Group AG and/or its affiliates (hereafter "CS"). This material does not constitute or form part of an offer or invitation to issue or sell, or of a solicitation of an offer to subscribe or buy, any securities or other financial instruments, or enter into any other financial transaction, nor does it constitute an inducement or incitement to participate in any product, offering or investment. Nothing in this material constitutes investment research or investment advice and may not be relied upon. It is not tailored to your individual circumstances, or otherwise constitutes a personal recommendation. The information and views expressed herein are those of CS at the time of writing and are subject to change at any time without notice. They are derived from sources believed to be reliable. CS provides no guarantee with regard to the content and completeness of the information and where legally possible does not accept any liability for losses that might arise from making use of the information. If nothing is indicated to the contrary, all figures are unaudited. The information provided herein is for the exclusive use of the recipient. The information provided in this material may change after the date of this material without notice and CS has no obligation to update the information. This material may contain information that is licensed and/or protected under intellectual property rights of the licensors and property right holders. Nothing in this material shall be construed to impose any liability on the licensors or property right holders. Unauthorised copying of the information of the licensors or property right holders is strictly prohibited. In addition, there may be conflicts of interest with regard to the investment. In connection with the provision of services, Credit Suisse AG and/or its affiliates may pay third parties or receive from third parties, as part of their fee or otherwise, a one-time or recurring fee (e.g., issuing commissions, placement commissions or trailer fees). Prospective investors should independently and carefully assess (with their tax, legal and financial advisers) the specific risks described in available materials, and applicable legal, regulatory, credit, tax and accounting consequences prior to making any investment decision.

Copyright © 2022 CREDIT SUISSE GROUP AG and/or its affiliates. All rights reserved.

Distributor: Credit Suisse Asset Management (Switzerland) Ltd., Kalandergasse 4, CH-8045 Zurich I Regulator / Supervisor legal entity: Swiss Financial Market Supervisory Authority (FINMA)