Hunting the unicorn hunters

Over the past decade, thousands of new venture capital firms have been launched around the world and billions of dollars have been deployed in pursuit of outlier returns. The results have been extraordinary with over 360 companies reaching unicorn status in 2021 alone, the same number as the previous seven years combined.

But recent market corrections aside, did LPs get the expected participation in this growth through their existing GP relationships?

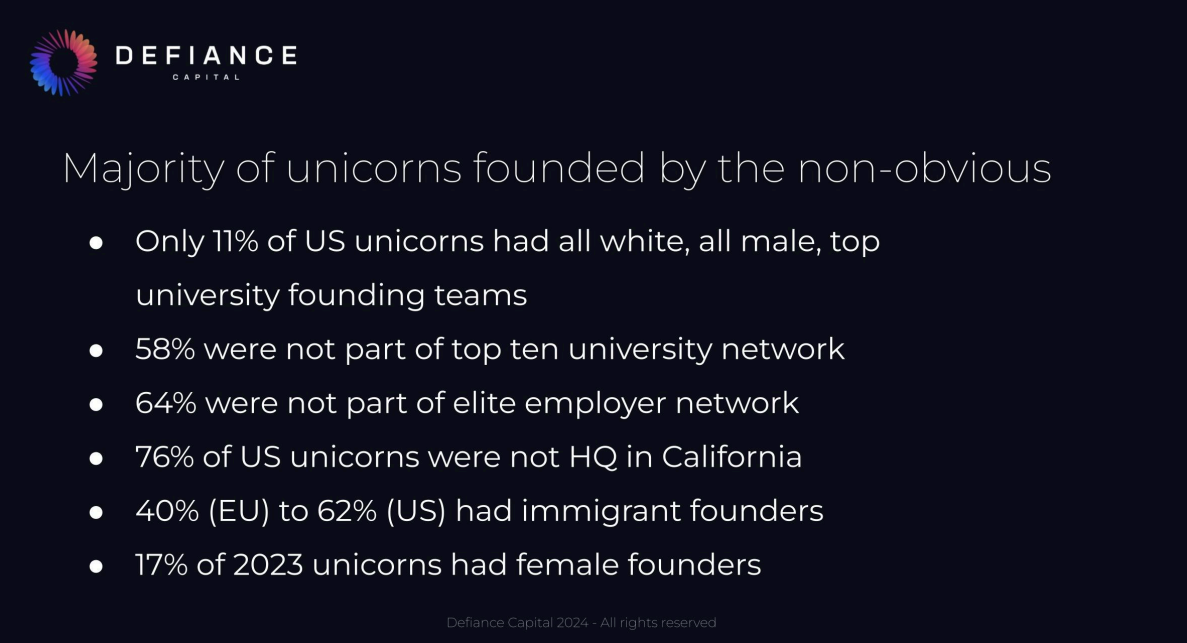

In our recent Unicorn Founder DNA Report, we analysed the backgrounds of all new unicorn founders in the US and Europe between 2013 and 2023 and we documented the seed funds market share of unicorns. The results offer a wake up call to LPs as less than 30 funds have over 1% market share and even top seed funds like Sequoia achieving less than 3% in market share. Another interesting data point is that only 24% (Europe) to 26% of all the unicorns in the past decade raised seed funding from a top ten fund!

The clear winners in this unicorn bonanza were the LPs that backed emerging managers. Why are emerging managers so successful in winning seed stage unicorn deals?

Firstly, like successful software entrepreneurs, emerging managers are forced to work a lot harder than established managers, who often have raised so much capital that they choose to overpay at Series A and Series B.

Secondly, the majority of emerging managers over the past decade were either spin offs from top funds, funded by their former employers, or successful entrepreneurs, backed by their former investors. In other words, the emerging manager category grew, by design, as feeder funds.

But thirdly and perhaps most importantly, emergent managers have been so successful because they have been willing to look outside the Silicon Valley bubble, as illustrated by the fact that 76% of all unicorns in the past decade were built outside of California.

This trend is also manifested by Y Combinator that secured a clear #1 position, being in 10% of all new unicorns over the past decade. The reasons are clear; firstly YC’s portfolio strategy applies the power law better than any other fund and secondly, YC has developed a unique, merit based founder assessment method that has allowed them back founders that didn’t fit the conventional criteria. In fact, 50% of YC portfolio companies didn’t go to a top ten university or worked for an elite employer before becoming entrepreneurs.

What emerging managers will be the winners of the 2024 and 2025 vintages?

To answer this question, one needs to look more carefully at the backgrounds and motivations of the unicorn founders over the past decade. See the Unicorn Founder DNA Report for more details.

The emerging managers that focus on backing all white, male, elite university graduates will not only be fishing in a small pool, but they will be facing fierce competition and mostly forced to accept unattractive terms.

The most successful emerging managers will be the ones who focus on “non obvious founders”, where they can get better terms. But without the comfort of “box ticking” emerging managers will have to either hold off investing until the startups have very strong product-market fit (the new seed fund battle field) or they will have to become masters at picking founder pre-product.

At the pre-product stage, serial founders will be the safest bet for emerging managers, but again, serial founders will mostly be term makers and not term takers so the best emerging managers will be the ones that have brands that appeal strongly (e.g. accelerators, local proximity, sector experts, immigrant focus, gender focus, etc.) to the founders and investors with sophisticated methods of qualifying founders psychologically (hunger, intelligence, resilience, etc).

Through our research we have identified three major types of motivation factors in unicorn founders;

1. No Plan B

● Stakes are very high, founders are forced to embrace risk

● No support and founders are forced to develop a growth mindset

● Values and behaviour typically developed in early childhood

We typically observe these traits in founders from less privileged backgrounds including immigrants from emerging markets and working class families.

2. Chip on the Shoulder

● History of feeling limited in their native environment

● Feeling unfairly treated, put down upon

We often observe these traits in 2nd generation immigrants, female founders, 1st generation university graduates, founders of colour and founders with atypical backgrounds.

3. Unlimited Self-Belief

● These are the ambitious rebels, often motivated by a greater cause and with extremely high risk appetite

● Strong family role models and high quality peer networks

These traits are very common among founders from middle class families where parents have STEM backgrounds or were entrepreneurs themselves, especially immigrants from India and Israel in both the US and Europe. At Defiance Capital we have developed a community of more than 50 non-obvious unicorn founders who are active not only in refining our founder assessment methods, but also in educating our LPs and portfolio founders across our Defying the Odds Spotify show, through regular online Q&A sessions and through in-person mentoring at our founder events.

At Defiance Capital we have developed a community of more than 50 non-obvious unicorn founders who are active, not only in refining our founder assessment methods, but also in educating our LPs and portfolio founders across our Defying the Odds Spotify show, through regular online Q&A sessions and through in-person mentoring at our founder event.

To receive a copy of the Unicorn Founder DNA Report and get access to the open sourced data set and bespoke LLM for analysis, please register at www.defiancecapital.com

Want to hear more? Join us in Berlin for SuperVenture 2024!