28th May, 2025

The APAC USD primary market got back on track on Tuesday after the long weekend in the US, where five diverse regional issuers raised a collective US$3.208bn.

That was headlined from a deal size perspective by Australian lender National Australia Bank Limited (NAB) which boosted its Covered Bond curve with a new benchmark US$1.75bn 4.37% 03-Jun-2030 144A/RegS Covered bond, guaranteed by Perpetual Corporate Trust Limited in its capacity as trustee of the nab Covered Bond Trust. The expected security ratings are Aaa/AAA by Moody’s/Fitch.

We did not see any book updates during execution although demand was sufficient for the reoffer spread to be set at SOFR MS+71 versus an initial marketing level of +75a.

In the offshore RegS market on Tuesday was Shanghai Construction Group Co., Ltd (Baa2/BBB/BBB) which sold a US$600m 4.60% 03-Jun-2028 Sustainability bond via issuing subsidiary Yongda Investment Limited.

The last update we received when final price guidance was announced pegged demand at >US$3bn (incl. US$1.35bn JLM interest & an additional US$49m PROP per SFC code), which in turn allowed pricing at par to yield 4.60%, revised from IPG at 5.20%.

That, coupled with a pair of small deals from Chinese LGFVs Tianfu Bond Insurance Co., Ltd and Kaifeng Development and Investment Group Co., Ltd, and a benchmark US$700m 7.75% 03-Jun-2030 144A/RegS line from high yield sovereign The Kyrgyz Republic (-/B+/B), nudged monthly issuance volume in May up to a more credible US$22.8009bn.

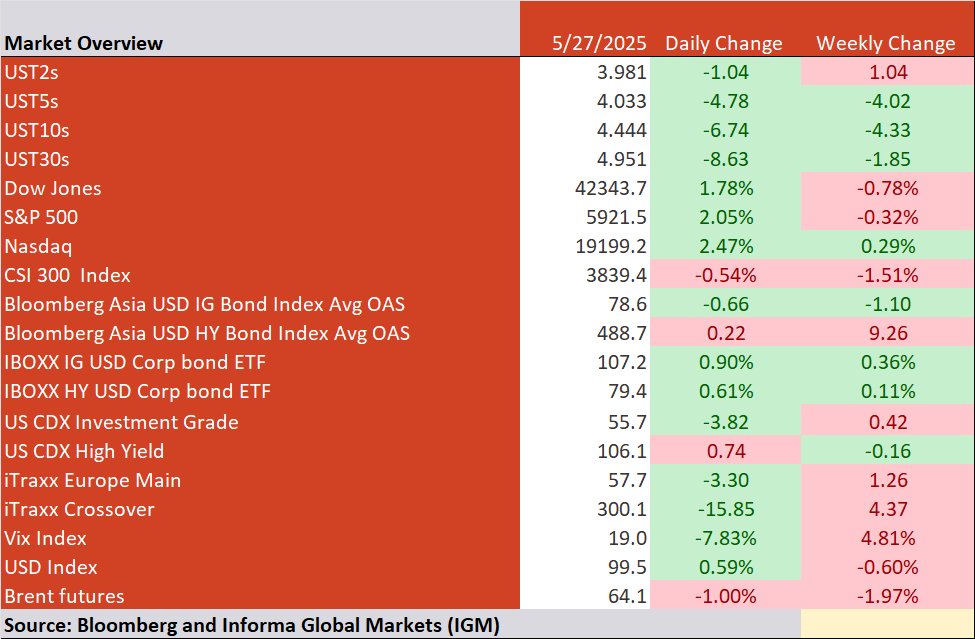

US stocks rally hard while US Treasury curve bull flattens amid a slew of impulses

Riskier assets in Asia could benefit from a bullish session overnight on Wall Street, where US President Trump's extension of the 50% EU tariff deadline, declining US Treasury yields, and a spike in Conf Board Consumer Confidence (98.0 versus a revised 85.7 prior and versus 87.1 expected), all served to put the bulls in the driving seat as US markets re-opened in style following the long Memorial Day weekend.

The Nasdaq led the major indices higher with a jump of 2.47% while the S&P500 and Dow Jones rallied by 2.05% and 1.78% respectively.

Meanwhile, the US Treasury curve bull flattened with the 30-year yield pulling back below the psychological 5.0% level, after Japan’s Ministry of Finance hinted at reducing long-term supply in the wake of sharp rises in JGB yields, which triggered a rally in local bond markets that knocked on into their counterparts in the west.

The 2-year UST yield dipped by 1.04bp to 3.981%, while the 10- and 30-year yields fell by 6.74bps and 8.63bps to 4.444% and 4.951%.

That was compounded by some weak Durable Goods Orders and Housing Prices data along with a decent US$69bn 2-year note auction, which came 3.955%, through the screen bid of 3.965% by 1.0 bps with 90.40% at the stop. The bid/cover was 2.57 versus 2.52 previously and a prior 5-auction average of 2.62%.

Looking ahead to Wednesday’s headline US event risk, where attention will be on the FOMC minutes from the 7th May meeting as well as another busy data docket, where Richmond Fed Manufacturing Index, Business Conditions for May, Dallas Fed Services Activity and MBA Mortgage Applications for the week up to 23 May, are all on the menu.

For a more comprehensive look at Tuesday’s price action and a look ahead to what events markets across the globe will have a close eye on Wednesday, see IGM’s Asia Breakfast Briefing.

Source: IHS Markit iTraxx & Bloomberg

Snapshot of APAC USD, EUR, CNH, CNY, HKD, SGD, AUD & NZD issues priced on 27th May 2025. Click on the links for the most recent updates:

| Issuer | Country | Market | Type | Issue Rating (M/S/F) | Terms | IPG/IPTs | FPG/Guidance | Priced | COMPS | Latest Book Update |

| USD | ||||||||||

| Yongda Investment Limited (Guarantor: Shanghai Construction Group Co., Ltd.) | CHINA | RegS only | Senior Unsecured Sustainability Bond | Baa2/-/- | USD600m 4.60% 3-Jun-2028 | 5.20% area | 4.60% (#) | 4.60% / 100 | COMPS | >US$3bn (Incl. US$1.35bn JLM interest + US$49m prop per HK SFC code) at FPG |

| Chengdu Tianfu Dagang Group (Guarantor: Tianfu Bond Insurance Co., Ltd) | CHINA | RegS only | Senior Unsecured Sustainability-Linked Bonds | Unrated | USD54.5m 7.00% 29-May-2027 | N/A | 7.00% (#) | 7.00% / 100 | ||

| National Australia Bank Limited (Guarantor: Perpetual Corporate Trust Limited in its capacity as trustee of the nab Covered Bond Trust) | AUSTRALIA | 144A/RegS | Covered Bonds | Aaa/-/AAA | USD1.75bn 4.37% 3-Jun-2030 | SOFR MS+75a | SOFR MS+71 (#) | SOFR MS+71 / 100 | ||

| Kaifeng Development and Investment Group Co., Ltd. | CHINA | RegS only | Senior Unsecured Sustainability Bonds | Unrated | USD103.4m 6.50% 4-Jun-2028 | N/A | 6.50% (#) | 6.50% / 100 | ||

| The Kyrgyz Republic | KYRGYZSTAN | 144A/RegS | Senior Unsecured | -/B+/B | USD700m 7.75% 3-Jun-2030 | mid-to-high 8% | 8.125-8.25% | 8% / 98.986 / T+396.7 | FINAL >US$1.18bn | |

| CNH | ||||||||||

| PSA Treasury Pte. Ltd. (Guarantor: PSA International Pte. Ltd.) | SINGAPORE | RegS only | Senior Unsecured | Aa1/-/- | CNH1.25bn 2.70% 3-Jun-2035 | 3.10% area | 2.70% (#) | 2.70% / 100 | ||

| AUD | ||||||||||

| Westpac Banking Corporation | AUSTRALIA | Domestic | Subordinated Tier 2 | A3/A-/A- | AUD1.5bn 5.815% 15NC10 due 4-Jun-2040 (Callable: 4-Jun-2035) | SQ ASW+195a | SQ ASW+178 (#) | SQ ASW+178 / 100 | FINAL >A$3.14bn (including A$5m LM interest) | |

| GAIF Bond Issuer Pty Limited (Guarantor: Goodman Australia Industrial Partnership) | AUSTRALIA | Domestic | Senior Unsecured | A3/A-/- | AUD500m 4.742% 3-Jun-2030 | SQ ASW+135a | SQ ASW+120 (#) | SQ ASW+120 / 100 | COMPS | FINAL >A$1.797b (incl. A$95m JLM) |

US Credit

The 30-day EU tariff reprieve provided a better-than-expected backdrop for those high-grade borrowers who were waiting in the wings to forge ahead with their respective financing plans. So much so, that 10 showed up, raising $10.9bln in the process. For more colour, see IGM's THE ENDGAME.

European Credit

The mood was positive in Europe on Tuesday, following the long weekend in US and UK and on the back of expectations that an EU/US trade deal could be arrived at that was better than Trump's recent gambit that 50% was 'right'. The EUR market was quick out of the blocks and despite a lack of both SSA issuers (there was only 1 euro SSA transaction) and multi-tranche deals from US corporates (which have been a growing theme) we saw EUR11.8bn print on the day (assuming NGGLN sticks with its expected EUR1bn total deal size). For all the details see IGM’s DAILY EUR NICS & BOOKS. In addition, BT, along with its new long 9yr EUR line tapped the sterling market for a new hybrid bond with a 30.5NC5.5 structure pricing the deal at 6.5% (from 6.875-7% IPTs). The details for that can be found in IGM's DAILY GBP NICS & BOOKS. For more colour, see the EUROPEAN DAILY CLOSE.

---- Subscribe to read more ----

To receive this analysis plus much more, subscribe to IGM. Request your free trial of the service today.