22nd May, 2025

The AUD CREDIT REPORT is currently in its beta version stage. We highly value your feedback as it will play a crucial role in refining this content to best align with our clients' needs. Kindly share your thoughts and suggestions by reaching out to your IGM sales representative via email at igmsales@informa.com and/or andrew.perrin@informa.com

Headlines (22-May-2025)

** Trio of issuers wrap up transactions following 2-day execution processes

** Contact Energy poised to extend AUD maturity curve with 6.5-year Green offering

** ACGBs are cheaper heading into the close although they are sharply off session lows

Daily AUD issuance volume (21-May-2025) - AUD millions | Weekly AUD issuance volume (w/e 23-May-2025) - AUD millions | Monthly AUD issuance volume (May-2025) - AUD millions | Annual AUD issuance volume (2025 YTD) - AUD millions |

850 | 850 | 11,230 | 106,035 |

Supply continues to flow through the AUD primary market with a trio of issuers looking to wrap up their transactions later today following a 2-day execution process which began yesterday.

These deals comprise Metropolitan Life's dual-tranche 5-year FA-backed Kangaroo, Macquarie Bank's dual-tranche Subordinated Tier II notes and Transurban's 7.25-year Senior Secured transaction.

First up, we have Metropolitan Life's A$600m FA-backed 5-year Kangaroo, evenly split between the FRN and Fixed Rate tranches, both of which will mature on 30-May-2030. Supported by a final orderbook of >A$870m, the transaction tightened 5bps from IPG, landing at 3mBBSW / SQ ASW+110bps, which implies a NIC of ca. 5bps based on our FV calculations.

Meanwhile, Macquarie Bank is looking to bolster their capital buffers with a dual-tranche 10.5NC5.5 FRN and 15NC10 Fixed-to-Floating Subordinated Tier II notes. The last update we received at FPG saw total demand in excess of A$[6.35]bn (including A$35m JLM interest), which was skewed towards the 15NC10 tranche at >A$3.95bn.

That in turn allowed spreads to be set at 3mBBSW+185bps and SQ ASW+195bps for the 10.5NC5.5 FRN and the 15NC10 Fixed Rate tranche, 20bps and 35bps tighter from IPG respectively. Based on our FV calculations, that implied a NIC of 3bps for the 10.5NC5.5 Floating rate tranche.

Making up the trio is Australian toll road operator Transurban's 7.25-year Senior Secured line. The last update we received at FPG saw the price set at SQ ASW+157bps, supported by >A$940m of orders (incl A$42m JLM int). Based on FV of +154bps that we derived yesterday, it implies a NIC of 3bps for this transaction.

Contact Energy poised to extend AUD maturity curve with 6.5-year Green offering

At the time of writing on Thursday morning, there was one live transaction announced in the shape of Contact Energy Limited's ("Contact Energy") 6.5-year AUD-denominated Green Fixed Rate Senior Unsecured transaction. The issuer, rated BBB (Stable) by S&P, is taking IOIs at initial price guidance of SQ ASW+170bps area.

This follows a series of fixed income investor meetings which commenced on Tuesday, 20th May 2025.

The upcoming transaction also marks the issuer's return to the denomination after 18-months and is set to extend the issuer's maturity curve.

Contact Energy's previous issuance in November 2023 comprised of a A$400m 6.398% 21-Nov-2030 line that priced at SQ ASW+170 from IPTs of +175-180a.

The deal was supported by a book of >A$760m, equating to a cover ratio of 1.9x. That is the issuer's only outstanding AUD line currently and is also included as part of the official comps list below.

*** COMPS: CONTACT ENERGY 6.5YR A$ GREEN BOND ***

+ AUD Comps (TW mids, close 21 May 2025)

Ticker Issue Rating Coupon Maturity Day ASM (q)

CENNZ BBB 6.40% Nov-2030 145.4

MCYNZ BBB+ 5.25% Mar-2031 138.7

TRGRID Baa2 5.77% May-2030 134.4

ELECTR Baa2 5.30% Jul-2031 147.5

ORGAU Baa2 5.35% Sep-2031 162.7

Extrapolating from the issuer's existing Nov-2030 bond and applying a 5s7s curve of ca. 20bp, we derive an RV of ca. ASW+155 for the new CENNZ 6.5-year line (maturing Nov-2031).

This number also looks broadly in line with the average of +157bps derived from similarly rated ELECTR Jul-2031s (Baa2) and ORGAU Sep-2031s (Baa2), after adjusting for slight maturity differences.

Snapshot of AUD issues live on 22-May-2025 at the time of writing. Click on the links for the most recent updates:

| Issuer | Country | Market | Type | Issue Rating (M/S/F) | Terms | IPG/IPTs | FPG/Guidance | Spread Set | COMPS | Latest Book Update | JBRs/JLMs |

| Contact Energy Limited | NEW ZEALAND | Kangaroo | Senior Unsecured Green Bond | -/BBB/- | AUD 6.5-year benchmark | SQ ASW+170a | COMPS | ANZ/NAB/Westpac | |||

| Macquarie Bank Ltd | AUSTRALIA | Domestic | Subordinated Tier 2 | A3/BBB+/BBB+ | AUD 10.5NC5.5 | 3mBBSW+205a | 3mBBSW+185(#) | 3mBBSW+185(#) | COMPS | >A$2.4bn at FPG | ANZ / BOC / CBA / MBL / NAB / WESTPAC |

| Macquarie Bank Ltd | AUSTRALIA | Domestic | Subordinated Tier 2 | A3/BBB+/BBB+ | AUD15NC10 | SQ ASW+225a | SQ ASW+195-200 (WPIR) | SQ ASW+195(#) | COMPS | >A$3.95bn at FPG | ANZ / BOC / CBA / MBL / NAB / WESTPAC |

| Transurban Queensland Finance Pty Limited | AUSTRALIA | Domestic | Senior Secured | -/BBB/- | AUD 7.25-year | SQ ASW+170a | SQ ASW+157-160 (WPIR) | SQ ASW+157(#) | COMPS | FINAL > A$940m (incl A$42m JLM int) | ANZ / CBA / SMBC NIKKO |

Snapshot of AUD deals priced in the week ending 23-May-2025. Click on the link for the full pricing details.

| Pricing Date | Issuer | Country | Market | Type | Issue Rating (M/S/F) | Deal Size (A$ millions) | Coupon | Maturity Date | ISIN | IPG/IPTs | Guidance/ Launch | FPG | Priced | COMPS | Latest Book Update | NICs | JBRs/JLMs |

| 21-May-25 | Lloyds Banking Group PLC | UNITED KINGDOM | Kangaroo | Senior Unsecured Holdco | A3/BBB+/A+ | 450 | 5.189% | 28-May-2031 (callable 28-May-2030) | AU3CB0322063 | SQ ASW+165a | SQ ASW+165a | SQ ASW+155 (#) | SQ ASW+155 / 100 / 5.189% | COMPS | FINAL >A$730m (excl JLM int) | -2 | ANZ / BARC / Barrenjoey Markets Pty Ltd / CBA / JPM / LLOYDS / NOM |

| 21-May-25 | Lloyds Banking Group PLC | UNITED KINGDOM | Kangaroo | Senior Unsecured Holdco | A3/BBB+/A+ | 400 | 3mBBSW+155 | 28-May-2031 (callable 28-May-2030) | AU3FN0098950 | 3mBBSW+165a | 3mBBSW+165a | 3mBBSW+155 (#) | 3mBBSW+155 / 100 | COMPS | FINAL >A$810m (excl JLM int) | -2 | ANZ / BARC / Barrenjoey Markets Pty Ltd / CBA / JPM / LLOYDS / NOM |

| 22-May-25 | Metropolitan Life Global Funding I | UNITED STATES | Kangaroo | Funding Agreement Backed Notes | Aa3/AA-/AA- | 300 | 4.75% | 30-May-2030 | AU3CB0322188 | SQ ASW+115a | SQ ASW+115a | SQ ASW+110(#) | SQ ASW+110 / 99.929 / 4.7661% | FINAL >369m | 5 | BARC / Barrenjoey Markets Pty Ltd / DB / NAB / TD | |

| 22-May-25 | Metropolitan Life Global Funding I | UNITED STATES | Kangaroo | Funding Agreement Backed Notes | Aa3/AA-/AA- | 300 | 3mBBSW+110 | 30-May-2030 | AU3FN0098976 | 3mBBSW+115a | 3mBBSW+115a | 3mBBSW+110(#) | 3mBBSW+110 / 100 | FINAL >503m | 5 | BARC / Barrenjoey Markets Pty Ltd / DB / NAB / TD |

AUD New Issue Pipeline

See the AUD new issue pipeline for details of issuers who have made their funding plans known.

ACGBs

Round up of price action in the AUD government bond market on Thursday 22nd May 2025 and the drivers behind it. This report was originally published at 14:58 Sydney time today by Mooris Tjioe from IGM Asia.

Aussie bonds are cheaper heading into the close although they are sharply off session lows, having spent the entirety of the session paring their early cheapening bias after opening in the red on the bearish lead from losses in Aussie bond futures overnight. The move higher has come alongside a modest bid in US Treasuries, with nothing particularly standout seen domestically re: relevant macro headlines nor data releases

YM is flat, back from an early dip to fresh lows at -7.0, and up from its overnight close (-3.0). XM is -3.0, itself up from an early trough at -9.0 and its own overnight close (-6.0), although it has quite some distance to cover to its overnight peak of +1.5. Bills run flat to 1 tick richer through the reds

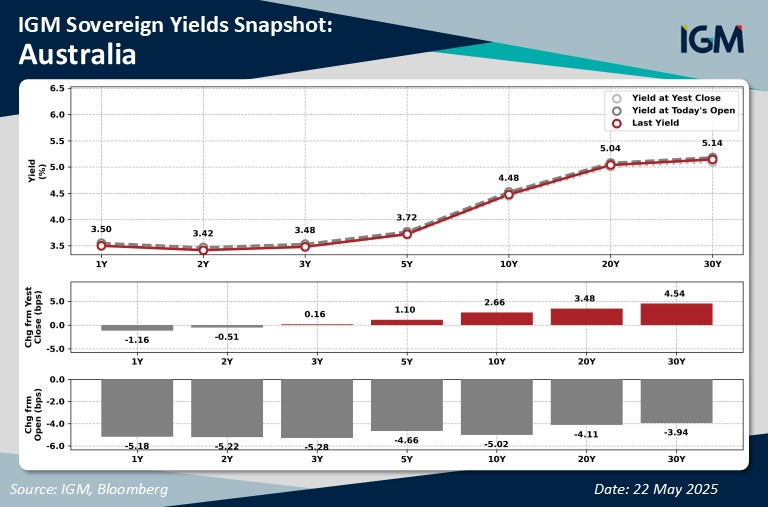

- 3-Year ACGB yields are at ~3.49%, far down from its 15 May 1.5-month high of ~3.68%, and currently trades ~18bp cheaper than levels seen at the start of May

- 10-Year ACGB yields are at ~4.48%, keeping away from its 15 May four-month peak of ~4.57%, and currently running ~30bp cheaper than levels seen at the start of May - underscoring the recent underperformance in long end ACGBs as the curve has steepened

The latest flash PMIs for May showed the Australian private sector slipping back towards stalling speed overall, with the manufacturing sector expanding at the same, lukewarm pace as in Apr, while the services sector approached to within range of the neutral 50.0 mark (S&P Global PMI here)

- May P Manufacturing PMI 51.7; Apr 51.7

- May P Services PMI 50.5; Apr 51.0

- May Composite PMI 50.6; Apr 51.0

S&P Global described the report as a "mixed bag", observing that while there were "continued expansions in output and new orders across the private sector, growth rates eased and were among the weakest seen in 2025 so far, suggesting a lack of momentum in the economy"

- "Business sentiment also waned, but companies were confident enough in the near-term outlook to keep hiring additional staff at a solid pace"

- S&P Global said that "this added capacity should help to keep output rising in the near-term at least"

- There was also "some anecdotal evidence in May to suggest that the election period had contributed to slower growth of new orders", and that "we could potentially see a pick-up in the months ahead"

The latest sale of A$100mn of ACGBi Aug-35 (#CAIN410) went well, with cover rising to 3.55x (3.41x prev.), although noting that there was a much smaller amount on offer today (A$100mn vs A$150mn prev.), which would have positively skewed cover. The weighted average yield printed a solid 1.31bp through prevailing mids, nevertheless signalling strength in demand

- There were 42 bids in total (47 prev.), of which 15 were successful (11 prev.) and 12 were awarded in full (9 prev.)

- The amount allotted at the highest accepted yield as a % of the amount bid at that yield was 10.7% (53.3%)

- There wasn't much by way of a discernible, lasting response in Aussie bonds following the release of results from the auction

---- Subscribe to read more ----

To receive this analysis plus much more, subscribe to IGM. Request your free trial of the service today.