20th May, 2025

This AUD CREDIT REPORT is currently in its beta version stage. We highly value your feedback as it will play a crucial role in refining this content to best align with our clients' needs. Kindly share your thoughts and suggestions by reaching out to your IGM sales representative via email at igmsales@informa.com and/or andrew.perrin@informa.com

Headlines (20-May-2025)

** Lloyds Banking Group taking IOIs for 6NC5 A$ Holdco Senior offering

** ACGBs hit fresh session highs as RBA cuts cash rate by 25bp

Daily AUD issuance volume (19-May-2025) - AUD millions | Weekly AUD issuance volume (w/e 23-May-2025) - AUD millions | Monthly AUD issuance volume (May-2025) - AUD millions | Annual AUD issuance volume (2025 YTD) - AUD millions |

0 | 0 | 10,380 | 105,185 |

The silence in the AUD primary market has been broken by Lloyds Banking Group on Tuesday, which started taking IOIs following a mandate announcement earlier in the session.

Lloyds Banking Group, rated A+ (Stable) by Fitch, A3 (Stable) by Moody's and BBB+ (Stable) by S&P, has mandated ANZ, Barclays/Barrenjoey, CBA, J.P. Morgan, Lloyds Bank Corporate Markets and Nomura for a potential A$ benchmark 6NC5 FXD and/or FRN Senior Kangaroo transaction. The Notes are expected to be rated A+ by Fitch, A3 by Moody's and BBB+ by S&P.

IPTs: 3mBBSW / SQ ASW+165bps area.

LLoyds is a familiar face to many in the Kangaroo market, having accessed it twice in both 2023 and 2024. Their most recent issuance in August 2024 comprised of a dual-tranche 10NC5 Subordinated Tier II transaction, made up of a A$500m floating and A$250m Fixed-to-Floating tranche. As a recap, the deal priced at 3mBBSW / ASW+218bps, having tightened from IPG of +230-235bps.

Meanwhile, in a similar format to this upcoming transaction would be Lloyds' A$600m 6NC5 Senior Holdco transaction that was issued in February 2024. As a recap, the transaction comprised of a A$450m 5.687% 06-Mar-2030 Fixed and a A$150m 3mBBSW+168 06-Mar-2030 FRN. Supported by a final orderbook of >A$2.24bn (incl A$85m JLM int) across 128 accounts, that allowed pricing to be slashed by 12bps from IPG of 3mBBSW / ASW+180bps area to a landing of +168bps. Full distribution stats can be sourced here. These two lines are also included as part of the official comps list below.

** COMPS **

Comps (TW Mid 19th May 2025)

LLOYDS FRN March 30-29 +146.3

LLOYDS 5.687% March 30-29 +149.5

EUR Comps (BVAL Bid)

LLOYDS 3.625% March 36-35 BBSW+168

GBP Comps (BVAL Bid)

LLOYDS 5.250% October 31-30 BBSW+151

USD Comps (BVAL Bid)

LLOYDS 5.721% June 30-29 BBSW+129

In terms of relative value, the outcome is notably different when calculations are driven by the issuer's existing AUD curve (using those two A$ lines in the comps list specifically), or when we factor in the valuations of the issuer's offshore USD and GBP lines.

That said, assuming a 3s5s AUD curve of 15bps and extrapolating from the existing LLOYDS Mar-2030s (callable Mar-2029) will get us to ca. 3mBBSW / ASW+157 for a new May-2031 (callable May-2030) line, when accounting for the additional 14-months or so to the first call date this time around and also taking the average spreads of the March 30-29 fixed and floating rate pair.

However, if we also factor in the issuer's offshore USD and GBP lines which are marked at tighter levels, the fair value estimates are then closer to 3mBBSW / ASW+140a when adjusting the curve from the LLOYDS USD June 30-29 and ca. 3mBBSW+148a when doing the same versus the LLOYDS GBP Oct 31-30, which we acknowledge looks tight compared the issuer's AUD curve.

In summary, fair value looks to be in the 3mBBSW / SQ ASW +157 area versus the existing AUD curve but a notably tighter +144a when factoring in the average valuations of the group's offshore lines, based on the official comps list. That would imply a premium of 8bps using the former approach and a notably heftier 21bps when using the latter.

Round up of price action in the AUD government bond market on Tuesday 20th May and the drivers behind it. This report was originally published at 14:59 Sydney time today by Mooris Tjioe from the IGM Asia

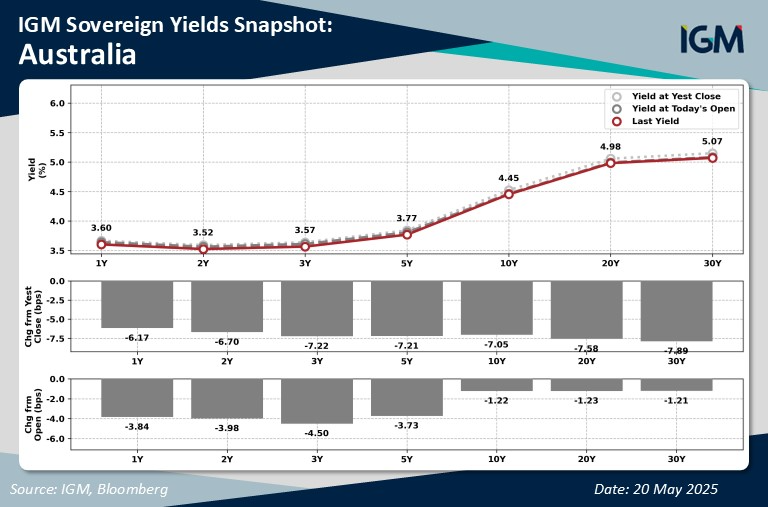

ACGBs operate around fresh bests heading into the close, having richened at a decent clip after the RBA opted to cut the cash rate target by 25bp. The post-RBA richening in ACGBs has reversed a mid-session cheapening impetus, sending yields well past their opening levels, adding to the richening impetus from overnight moves in core global bonds

- 3-Year ACGB yields are at ~3.56%, down from a pre-RBA high of ~3.62%. The tenor has kept away from its 15 May 1.5-month high of ~3.68%, although it remains ~25bp cheaper on the month so far

- 10-Year ACGB yields are at ~4.45%, down from a pre-RBA peak of ~4.49%. The tenor is down from its 15 May four-month peak of ~4.57%, but still running ~25bp cheaper on the month of May so far

- Both YM and XM are +8.0 apiece, surging to fresh session highs after the RBA's decision. Bills run 3 to 6 ticks richer through the reds

On the RBA's decision, the move to cut the cash rate target had been widely expected, with RBA officials having done little in preceding weeks to dissuade markets of the notion re: a modest cut in May, while economic data had broadly proved supportive for such a move amidst a deteriorating/uncertain external outlook

- Note that RBA Gov Bullock will be speaking at the usual post-meeting presser scheduled for 1530 local time (0530GMT)

The RBA said in its statement that today's decision to cut leaves monetary policy in a slightly less restrictive position, implying comfort at keeping rates at current levels should more work on inflation be required. The Board emphasised that it remains "cautious about the outlook, particularly given the heightened level of uncertainty about both aggregate demand and supply" (RBA Statement here)

- Looking ahead, the Board emphasised that "it will pay close attention to developments in the global economy and financial markets, trends in domestic demand, and the outlook for inflation and the labour market"

Looking at forecasts, the cash rate is seen at ~3.25% come end-'27, down from ~3.50% in the Feb Statement. The forecast table for May points to scope for one (more likely) or two (less likely)more 25bp cuts from current levels throughout the remainder of '25(Feb Statement here)

- Growth forecasts were bumped lower across the near term - with GDP expected to expand at +1.8% by end-Jun '25 (+2.0% in Feb Statement), before accelerating at a more modest pace of +2.1% by end-'25 (+2.4% in Feb Statement)

- The RBA still sees the unemployment rate rising to 4.2% by end-Jun '25, before edging up and holding at 4.3% from Dec '25 out to the end of the forecast horizon come end-Q2 '27 (was 4.2% between Q2 '25 to Q2 '27 in Feb Statement)

- Trimmed mean CPI is expected to moderate at a quicker pace, decelerating to +2.6% Y/Y by end-Jun '25 *(+2.7% in Feb Statement) before holding at that pace out to end-Jun '27

- Headline CPI is expected to decelerate at a quicker pace overall - hitting +2.1% Y/Y in end-Jun '25 (+2.4% in Feb Statement). A forecast rebound in end-'25 was largely erased - with CPI now seen at +3.0% Y/Y by end-'25 - down from +3.7% in the Feb Statement

---- Subscribe to read more ----

To receive this analysis plus much more, subscribe to IGM. Request your free trial of the service today.