20th May, 2025

The AUD CREDIT REPORT is currently in its beta version stage. We highly value your feedback as it will play a crucial role in refining this content to best align with our clients' needs. Kindly share your thoughts and suggestions by reaching out to your IGM sales representative via email at igmsales@informa.com and/or andrew.perrin@informa.com

Headlines (21-May-2025)

** MetLife treads a familiar path with first AUD offering for a year

** Transurban turns attention to domestic market after a successful European tour

** Macquarie Bank poised to boost its Sub Tier 2 curve with first deal in 2025

** Bank of us eyes comeback with short-dated 1-year senior unsecured issue

** Lloyds Banking Group refreshes senior unsecured curve with well-received 6NC5 exercise

** ACGBs are mostly in the red heading into the close having sharply reversed an earlier richening bias

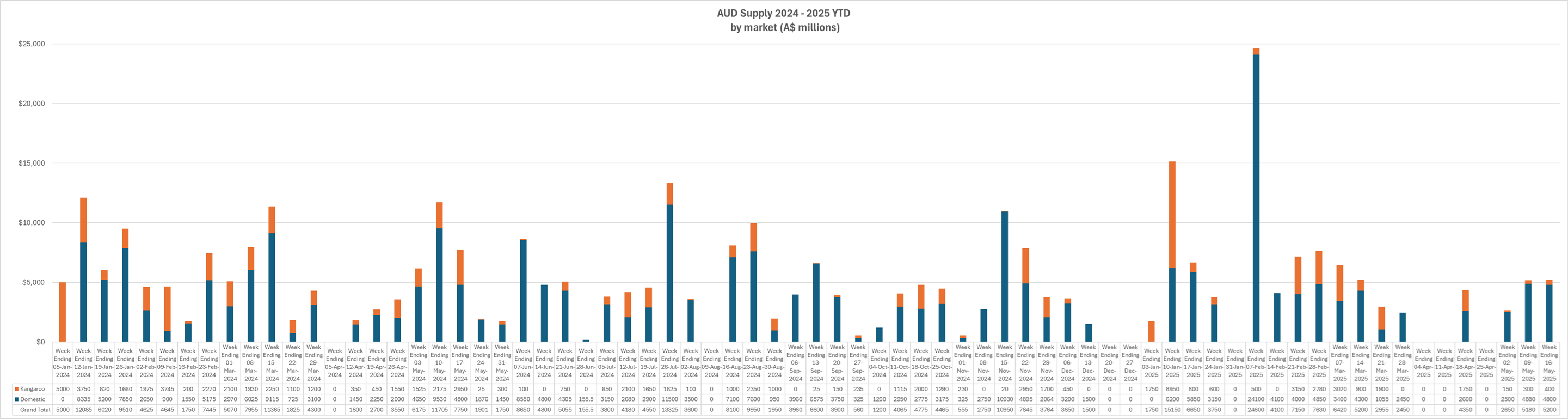

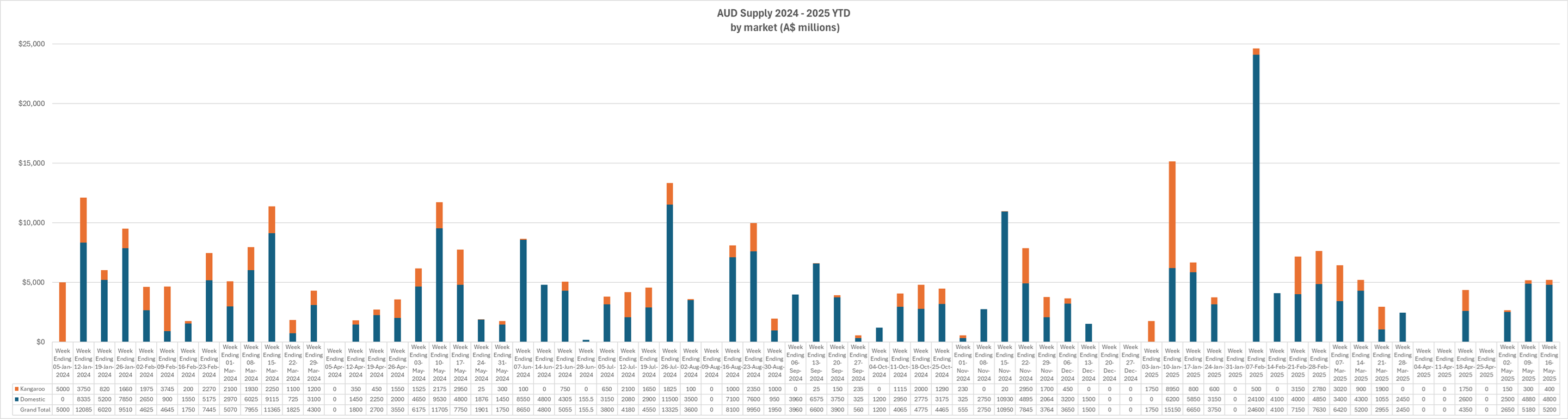

Daily AUD issuance volume (20-May-2025) - AUD millions | Weekly AUD issuance volume (w/e 23-May-2025) - AUD millions | Monthly AUD issuance volume (May-2025) - AUD millions | Annual AUD issuance volume (2025 YTD) - AUD millions |

0 | 0 | 10,380 | 105,185 |

The AUD primary market has exploded into life as a trio of new issuers have joined the pipeline since yesterday, in the shape of Metropolitan Life Global Funding, Macquarie Bank Ltd, Transurban Queensland Group and B&E Ltd, trading as Bank of us. Meanwhile, Lloyds Bank is on course to price its 2-part fixed and floating rate senior unsecured 6NC5 line later on Wednesday.

MetLife treads a familiar path with first AUD offering for a year

Kicking off our commentary with the new names in the pipeline, where Metropolitan Life Global Funding I, rated Aa3 (stable) by Moodys, AA- (Stable) by S&P and AA- (Stable) by Fitch, is taking Indications of Interest for a new AUD Benchmark 5-year FXD and/or FRN Funding Agreement Backed Kangaroo transaction (due 30-May-2030). The expected issue rating is Aa3/AA-/AA- by Moody’s/S&P/Fitch.

Initial price guidance is SQ ASW / 3m BBSW +115bps area.

The transaction is expected to launch in the near future, subject to market conditions.

Barclays/Barrenjoey, Deutsche Bank, NAB and TD Securities are Joint Lead Managers.

The US insurance heavyweight has been active in the international bond markets this year having already raised USD, EUR and CHF through six transactions, although this marks the issuer’s first visit to the AUD market in around 12-months when it mirrored the same 5-year fixed and floating rate structure in early June 2024.

And it's probably fair to say that MetLife will be hoping for a more enthusiastic response from investors this time around, after the A$400m 3mBBSW+115 11-Jul-2029 and A$250m 5.40% 11-Jul-2029 lines triggered orders at reoffer of >A$740m and A>$300m, equating to modest cover ratios of 1.80x and 1.20x respectively.

That did allow pricing to be tightened by 5bps to SQ ASW / 3mBBSW+115 from IPG at +120a, however. See the full distribution statistics here.

Comps (TW Mid 20th May 2025)

ISSUER ISSUE RTG (M/S/F) MATURITY DATE FRN

MET (Aa3/AA-/AA-) Jul-29 98.5

NYLIFE (Aa1/AA+/AAA) Jul-29 96

CBAAU (Aa2/AA-/AA-) Aug-29 79.3

NAB (Aa2/AA-/-) Mar-30 82

USD comps (BVAL Bid)

MET (Aa3/AA-/AA-) Jan-30 G + 53.4 bps --> BBSW + 90

The aforementioned MET Jul 2029s provide a natural barometer to gauge relative value on the new 5-year transaction at a spread of +98.5, while not included among the official comps is an older A$300m 4.00% 13-Jul-2027 line at an indicative +87 when we checked the screens this morning.

An extrapolation of the two takes us to fair value on the new 30-May-2030 line at ca. SQ ASW / 3mBBSW +105a, which in turn indicates that a premium of ca. 10bps is on the table at the outset.

Also worth highlighting that FV of +105a outlines a larger 15bp premium when compared to the issuer's USD Jan-2030 line which is marked at BBSW+90 equivalent as per the comps list.

Transurban turns its attention back to domestic market after a successful European tour

The first name to announce its funding plans on Tuesday was Transurban Queensland Finance Pty Limited, the financing entity for the Transurban Queensland Group (BBB stable by S&P), which also held a group investor call earlier today (21-May-2025) before subsequently hitting the market with an AUD 7.25-year fixed rate senior secured benchmark issue.

IOIs are currently being taken at Initial Price Guidance of SQ ASW+170a

Bookrunners are ANZ, CBA and SMBC Nikko.

The group previously tapped its domestic bond market last year when it sold a A$250m 5.623% 28-Aug-2034 senior secured line in August. The well-received transaction commanded >A$1.168bn of orders at reoffer, equating to a cover ratio of 4.67x, IGM data shows.

That allowed the price to be tightened by 15bps to SQ ASW+170bps at reoffer from the +185a starting point. See the full distribution statistics here.

While this forthcoming trade represents the Australian toll road operator’s first visit to its home market this year, Transurban has successfully made its presence felt in European bond markets on a couple of occasions recently.

The outcome of the group’s most recent trip to Europe was a CHF120m 1.43% 22-Aug-2033 offering earlier this month which marked the issuer’s first CHF bond in more than four years.

That followed on the heels of the group’s blowout dual-currency exercise on 10-Apr-2025 when it successfully placed EUR650m 4.143% 17-Apr-2035 and an inaugural GBP300m 6.6087% 17-Apr-2040 issues which were oversubscribed by a solid 8.00x and 7.33x at reoffer respectively, IGM data shows.

Meanwhile, sources close to the new deal assembled the following pricing points of reference

**AUD Comps (Tradeweb mids, close 20 May 2025)

Ticker Coupon Issue Rating Maturity ASW (q)

TQLAU 6.350% BBB/-/- May-30 +141

TQLAU 3.250% BBB/-/- Aug-31 +158

TQLAU 5.623% BBB/-/- Aug-34 +165

SYDAU 5.500% BBB+/Baa1/- Apr-32 +145

SYDAU 5.900% BBB+/Baa1/- Apr-34 +158

QPHFIN 5.302% BBB/-/- Mar-32 +142

QPHFIN 5.695% BBB/-/- Mar-35 +153

We’ll discount the issuer's outstanding Aug 2031s as a relevant barometer to determine relative value as it's an older line sold back in April 2021. Instead, we will look solely at the 2030 and 2034 pair where an interpolation takes us to the ASW+154 area camp as fair value on the new 7.25-year (Aug 2032) line.

Macquarie Bank poised to boost its Sub Tier 2 curve with first deal in 2025

The latest name to announce their plans to hit the market was Macquarie Bank Ltd, rated Aa2/A+/A+(all stable) by Moody’s/S&P/Fitch, which is now taking IOIs for a new AUD-denominated 10.5NC5.5 floating rate and/or 15NC10 fixed-to-floating rate Subordinated Tier 2 transaction. This follows a fixed income investor call that was held earlier today at 11:00am AEST. The Subordinated notes are expected to be rated A3/BBB+/BBB+ by Moody’s/S&P/Fitch.

Initial Price Guidance: 10.5 NC 5.5 FRN at 3mBBSW+205a / 15NC10 Fixed-to-Float at ASW+225a

This marks the lender’s first foray into its domestic bond market in 2025 with its previous visit taking place last August when it also raised Subordinated funding through a 10.5NC5.5 structure comprising A$350m 5.603% 20-Feb-2035 (Callable: 20-Feb-2030) and A$900m 3mBBSW+185 20-Feb-2035 (Callable: 20-Feb-2030) lines.

As a reminder, those priced at SQ ASW / 3mBBSW +185, which was revised from +200-205bps area. That was supported by >A$1.3bn and >A$2.65bn of orders at reoffer, equating to cover ratios of 3.71x and 2.94x respectively.

Sources close to the deal have assembled the following pricing points of reference which unsurprisingly includes those MQDAU Feb 35-30 notes which closed out and an average of +176.5 (as per Tradeweb)

*** COMPS ***

Issuer | Rating | Maturity | FRN TW Close (20/05) | FXD TW Close (20/05) |

MQGAU | A3/BBB+/BBB+ | 20 Feb 35-30 | 175.5 | 177.6 |

WSTP | A3/A-/A- | 12 Feb 35-30 | 157.3 | 158.5 |

CBAAU | A2/A-/A- | 27 Nov 39-34 | - | 157.4 |

ANZ | A3/A-/A- | 25 Jul 39-34 | - | 162.2 |

NAB | A3/A-/A- | 06 Jun 39-34 | - | 160.3 |

Comparing between the MQGAU A$650m 3mBBSW+195 Mar 34-29 (not in the official comps list) and the MQGAU Feb 35-30, we see a differential of 7bps for that 11-months or so of curve. Applying the same curve and extrapolating from the MQGAU Feb 35-30, and we therefore derive FV of 3mBBSW+182bps for the new 10.5NC5.5 Subordinated line.

We refrained from trying to pinpoint FV on the new 15NC10 tranche at this point in time given a paucity of meaningful pricing points of reference that would allow us to do that with any measure of confidence.

Bank of us eyes comeback with short-dated 1-year senior unsecured issue

Making up the quartet of new announcements is B&E Ltd, trading as Bank of us, rated BBB+ (Stable) by Fitch, has mandated ANZ for an AUD-denominated 1-year senior unsecured repo eligible transaction. The transaction is expected to launch in the near future, subject to market conditions.

The Tasmania headquartered financial institution, and the oldest building society in Australia having been established in 1870, has visited the denomination on only one occasion in the past, placing an already matured A$27.5m 3mBBSW+95 31-May-2024 line in May 2023, IGM records show.

Lloyds Banking Group poised to bolster senior curve with well-received 6NC5 exercise

Finally, Lloyds Banking Group plc, rated A3/BBB+, is continuing to market its AUD benchmark 6NC5 (due 28-May-2031 and callable on 28-May-2030) FXD/FRN Holdco Senior Unsecured offering which is now launched.

The last update we received saw the combined order book in excess of A$2bn skewed slightly in favour of the FRN at >A$1.03bn

Price guidance has been revised to SQ ASW / 3mBBSW +155 (#) (indicative yield refresh at 5.19%) with a volume guidance of A$750m-A$1bn.

The order book closed at 12:30pm Sydney time (10:30am HKT/SGT) with pricing expected to follow later today.

As a reminder, we calculated fair value at ca. 3mBBSW / SQ ASW+157 compared to the UK lender’s most recent Mar 2030s (callable Mar 2029) or a more eye catching 21bps when also factoring in Lloyds’ existing GBP and USD lines.

More on that (incl. the official comps) can be found in Tuesday’s AUD Credit Report.

Source: Informa Global Markets (IGM)

Source: Informa Global Markets (IGM)

Snapshot of AUD issues live on 21-May-2025 at the time of writing. Click on the links for the most recent updates:

| Issuer | Country | Market | Type | Issue Rating (M/S/F) | Terms | IPG/IPTs | FPG/Guidance | Spread Set | COMPS | Latest Book Update | JBRs/JLMs |

| Lloyds Banking Group PLC | UNITED KINGDOM | Kangaroo | Senior Unsecured Holdco | A3/BBB+/A+ | AUD benchmark 6NC5 | SQ ASW+165a | SQ ASW+165a | SQ ASW+155 (#) | >A$970m at ca 10:32 HKT/SGT | ANZ / BARC / Barrenjoey Markets Pty Ltd / CBA / JPM / LLOYDS / NOM | |

| Lloyds Banking Group PLC | UNITED KINGDOM | Kangaroo | Senior Unsecured Holdco | A3/BBB+/A+ | AUD benchmark 6NC5 | 3mBBSW+165a | 3mBBSW+165a | 3mBBSW+155(#) | >A$1.03bn at ca 10:32 HKT/SGT | ANZ / BARC / Barrenjoey Markets Pty Ltd / CBA / JPM / LLOYDS / NOM | |

| Metropolitan Life Global Funding I | UNITED STATES | Kangaroo | Aa3/AA-/AA- | AUD 5-year | SQ ASW+115a | COMPS | BARC / Barrenjoey Markets Pty Ltd / DB / NAB / TD | ||||

| Metropolitan Life Global Funding I | UNITED STATES | Kangaroo | Aa3/AA-/AA- | AUD 5-year | 3mBBSW+115a | COMPS | BARC / Barrenjoey Markets Pty Ltd / DB / NAB / TD | ||||

| Macquarie Bank Ltd | AUSTRALIA | Domestic | Subordinated Tier 2 | A3/BBB+/BBB+ | AUD 10.5NC5.5 | 3mBBSW+205a | COMPS | ANZ / BOC / CBA / MBL / NAB / WESTPAC | |||

| Macquarie Bank Ltd | AUSTRALIA | Domestic | Subordinated Tier 2 | A3/BBB+/BBB+ | AUD15NC10 | SQ ASW+225a | COMPS | ANZ / BOC / CBA / MBL / NAB / WESTPAC | |||

| Transurban Queensland Finance Pty Limited | AUSTRALIA | Domestic | Senior Secured | -/BBB/- | AUD 7.25-year | SQ ASW+170a | COMPS | ANZ / CBA / SMBC NIKKO |

AUD New Issue Pipeline

See the AUD new issue pipeline for details of issuers who have made their funding plans known.

ACGBs

Round up of price action in the AUD government bond market on Wednesday 21st May 2025 and the drivers behind it. This report was originally published at 14:59 Sydney time today by Mooris Tjioe from the IGM Asia

ACGBs are mostly in the red heading into the close, having sharply reversed a richening bias seen at the open, erasing the bullish impetus derived from the moves in Aussie bond futures overnight. Yields steadily worked their way higher following the release of results from today's sale of A$1.2bn of ACGB Dec-35, adding to bearish pressure from the more modest cheapening in US Treasuries seen across Sydney dealing

YM is -3.0, down from a session high of +7.0 made at the open, notching fresh session lows at writing. XM is -5.0, down from its overnight close of +1.5, operating just above session lows as well (-5.5). Bills run 1 tick cheaper to 3 ticks richer through the reds, twist flattening

- 3-Year ACGB yields are at ~3.48%, far down from its 15 May 1.5-month high of ~3.68%, and currently only trades ~15bp cheaper than levels seen at the start of May

- 10-Year ACGB yields are at ~4.44%, retreating further from its 15 May four-month peak of ~4.57%, and currently running ~25bp cheaper than levels seen at the start of May

The AOFM sold A$1.2bn of ACGB Dec-35 (#TB171) earlier in the day, drawing cover at 3.10x, lower than the 3.53x seen at the last auction in Mar '25, although noting that there was a larger amount on offer today (A$1.2bn vs A$800mn prev.) which would have negatively skewed cover. The weighted average yield printed 0.55bp through prevailing mids - not stellar, but certainly decent enough

- There were 39 bids in total (37 prev.), of which 20 were successful (14 prev.), and 12 were awarded in full (5 prev.)

- The amount allotted at the highest accepted yield as a % of the amount bid at that yield was 34.5% (39.5% prev.)

The auction comes a day after the RBA's monetary policy decision (cash rate target cut to 3.85% from 4.10% prev., as had been widely expected), and signals staying power in demand for Aussie bonds - noting that demand has shown signs of weakness over in US Treasuries and JGBs

The six-month annualised growth rate within the Westpac-MI Leading Index report for Apr fell to +0.2% (Mar +0.5%), signalling a slower pace of economic activity relative to trend three to nine months into the future. Westpac observed that "the above-trend growth pulse that emerged at the start of the year has all but disappeared", and reflects "heightened uncertainty around global trade and a less supportive commodity price backdrop" (Westpac report here)

- Apr Westpac-MI Leading Index -0.01% M/M; Mar revised -0.15%, was -0.11%

- Apr Westpac-MI Six-Month Annualised Growth Rate +0.2%; Mar +0.5%

---- Subscribe to read more ----

To receive this analysis plus much more, subscribe to IGM. Request your free trial of the service today.