Headlines (25-Sep-2025)

- UBS successfully kick-starts AUD AT1 supply with first such issue since APRA announced phase out for domestic banks

- A very enthusiastic response from yield hungry investors allowed UBS to lock-in attractive funding inside its USD AT1 curve

- The milestone transaction should appeal to other offshore banks which could benefit from an ever-deepening pool of AUD liquidity

UBS headlined an active week in the AUD primary bond market with a very rare A$1.25bn 6.375% Perp-Mar2031 Additional Tier 1 (AT1s) Capital note, setting some notable milestones in the process.

The Equity Conversion transaction marked the first benchmark Additional Tier 1 (AT1) in the denomination since the Australian Prudential Regulation Authority (APRA) announced at the tail end of last year that, following extensive industry consultation, it will phase out the AT1 capital stack for domestic banks by 2032.

Investor appetite proved exceptional, underpinned by the scarcity value and attractive yield on offer for what represents the riskiest form of bank debt available to investors. That was reflected by the considerable final orderbook of >A$7.22bn, translating into a robust cover ratio of 5.78x, IGM data shows.

That in turn provided the flexibility for pricing to be slashed by a hefty 62.5bp to a reoffer yield of 6.375% versus initial guidance at 7.00% area, with final terms around 40bp inside the lender’s outstanding USD-denominated AT1 curve, an extremely economic outcome for the Swiss institution.

And not only that, the A$1.25bn deal size boasted the largest ever Additional Tier 1 bond from an offshore bank in the AUD market, almost doubling UBS’s previous debut A$700m AT1 issue back in 2019.

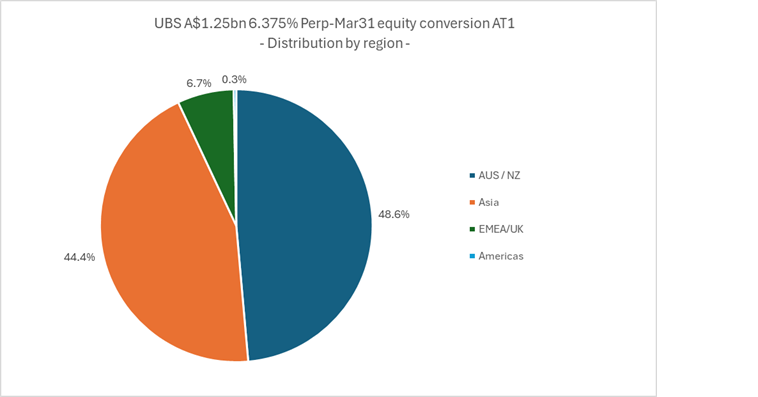

The transaction also benefited from a well-diversified distribution profile. Demand was broadly balanced across Australia/New Zealand (48.6%) and Asia (44.4%), underscoring the deal’s regional appeal while by investor type, Asset Managers (43.5%) and Official Institutions (28%) anchored the book. For a more detailed breakdown, see the full distribution statistics outlined in the pie charts below.

Meanwhile, the sharp price revision during execution proved to be no barrier to performance, where the transaction was bid ca. 100.85 on the screens on Thursday morning (25-Sep-2025), equating to a YTC of 6.175%, or 20bps tighter in yield terms.

The Joint lead managers are ANZ, CBA, NAB, UBS and Westpac.

The successful outcome of UBS’s landmark transaction should send a positive message to other offshore banks eager to bolster their capital buffers through the AUD Additional Tier 1 market, while at the same time capitalising on an ever-deepening pool of liquidity available, competitive funding costs and the potential opportunity to diversify their investor base. That in a broader AUD primary market which has grown and matured exponentially in recent years.