Bank of Korea Monetary Policy Decision: Thursday, November 27, 2025

Summary

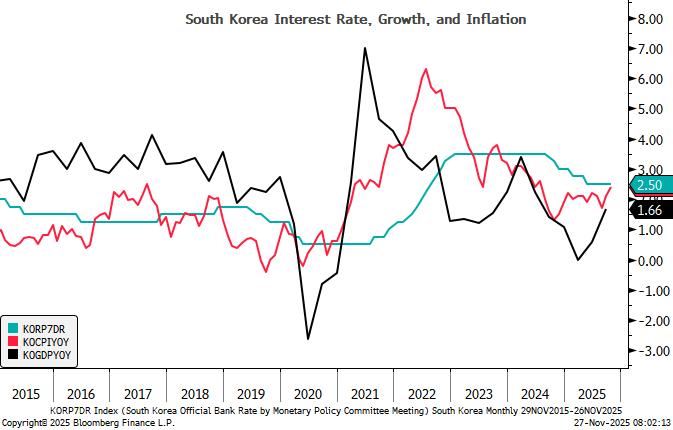

The Bank of Korea (BoK) decided to keep its benchmark interest rate unchanged at 2.5% during its monetary policy meeting on Thursday, November 27, 2025. The decision aligns with market expectations and reflects the central bank’s cautious approach to balancing inflationary pressures, housing market concerns, and external risks. Governor Rhee Chang Yong emphasized the need to monitor financial imbalances while signaling that future policy adjustments will depend on economic data and global developments.

Key Highlights of the Decision

- Rate Decision: The BoK held its policy rate steady at 2.5%, citing persistent housing market pressures and volatility in the foreign exchange market.

- Housing Market: Seoul apartment prices have risen for 42 consecutive weeks, despite government measures to cool the market. Elevated household debt remains a key constraint on further monetary easing.

- Currency Concerns: The Korean won has depreciated by approximately 3% this month, reaching a near 16-year low. The central bank is closely monitoring the risk of imported inflation due to the weaker currency.

Economic Context

- Growth: South Korea’s economy grew by 1.2% in the third quarter of 2025, the fastest pace in over a year, driven by strong semiconductor exports and resilient household spending.

- Inflation: October inflation accelerated to 2.4%, the highest since July 2024, raising concerns about price pressures.

- Trade Risks: A recent trade agreement with the United States capped tariffs on Korean goods at 15%, providing some relief but leaving export momentum vulnerable to global uncertainties.

Governor Rhee Chang Yong’s Commentary

Governor Rhee Chang Yong highlighted the importance of monitoring financial imbalances and external risks while maintaining an accommodative policy. He noted that the central bank remains cautious about further easing, given the ongoing challenges in the housing market and foreign exchange volatility. Rhee also indicated that future policy adjustments will depend on inflation trends and global economic conditions.

Market Implications

- Currency Market: The decision to hold rates may provide some stability to the won, but traders should remain vigilant about potential fluctuations driven by external factors. USD/KRW is down 0.2% to 1465.

- Bond Market: The pause in rate cuts is likely to keep bond yields steady, with limited upside unless dovish signals emerge in future meetings. KTB 2-year yield is flat at 2.727%, 10-year yield also unchanged at 3.249%.

- Equity Market: Export-driven sectors and consumer-focused industries may benefit from stronger growth, while housing-related stocks could face pressure due to financial stability concerns.

Forward Guidance

The BoK’s decision signals an extended pause in its easing cycle, with future adjustments contingent on inflation trends, housing market developments, and external risks. Governor Rhee’s comments on the vote count and the board’s three-month rate outlook will be closely scrutinized for hints on the policy path ahead.

For traders, the focus remains on monitoring the won’s performance, housing market interventions, and any signals of dovish shifts in the BoK’s stance.