American companies are hitting the European bond markets this week in a supply rush inspired by a favorable basis swap rate, or the cost to issue in a foreign currency and then swap into USD, and to take advantage of a wide differential between US and European interest rates as the ECB has cut rates faster than the Fed.

Verizon and Booking Holdings became the latest US issuers to tap the single currency European bond markets on Tuesday, backing up deals from Alphabet and Colgate-Palmolive at the start of the week. And Bristol-Myers Squibb, Dover Corp, NextEra Energy and PACCAR are all sat in what remains a bustling pipeline.

US IG/split-rated corporates have now issued EUR78.61bn in the single currency this year, making it the second-largest year ever for reverse yankee supply.

That is currently still short of the EUR99.08bn all-time high recorded in 2019, following a collapse in reverse yankee sales seen in 2018, linked to Trump administration tax changes that were seen as increasing the appeal of bringing home cash held offshore to invest instead of tapping bond markets, but we look set to get closer to that record in the near future.

The flurry comes amid what is a favourable dollar and basis swap rate for US companies and the lower costs this side of the pond with the ECB having cut rates at a faster pace than the Fed.

Showing the attraction for US names issuing in euros versus dollar, Alphabet paid a 4.375% coupon on its EUR1.25bn Nov 2064 which made up part of a EUR6.5bn six-part on Monday, compared to a larger 5.45% on the shorter USD4bn Nov 2055s which was included in the company’s bumper USD17.5bn eight-part on the same day.

So, whether issuers want to swap the proceeds back into dollars for domestic funding purposes or have European ventures to fund, the euro market looks set to remain an attractive proposition for US companies.

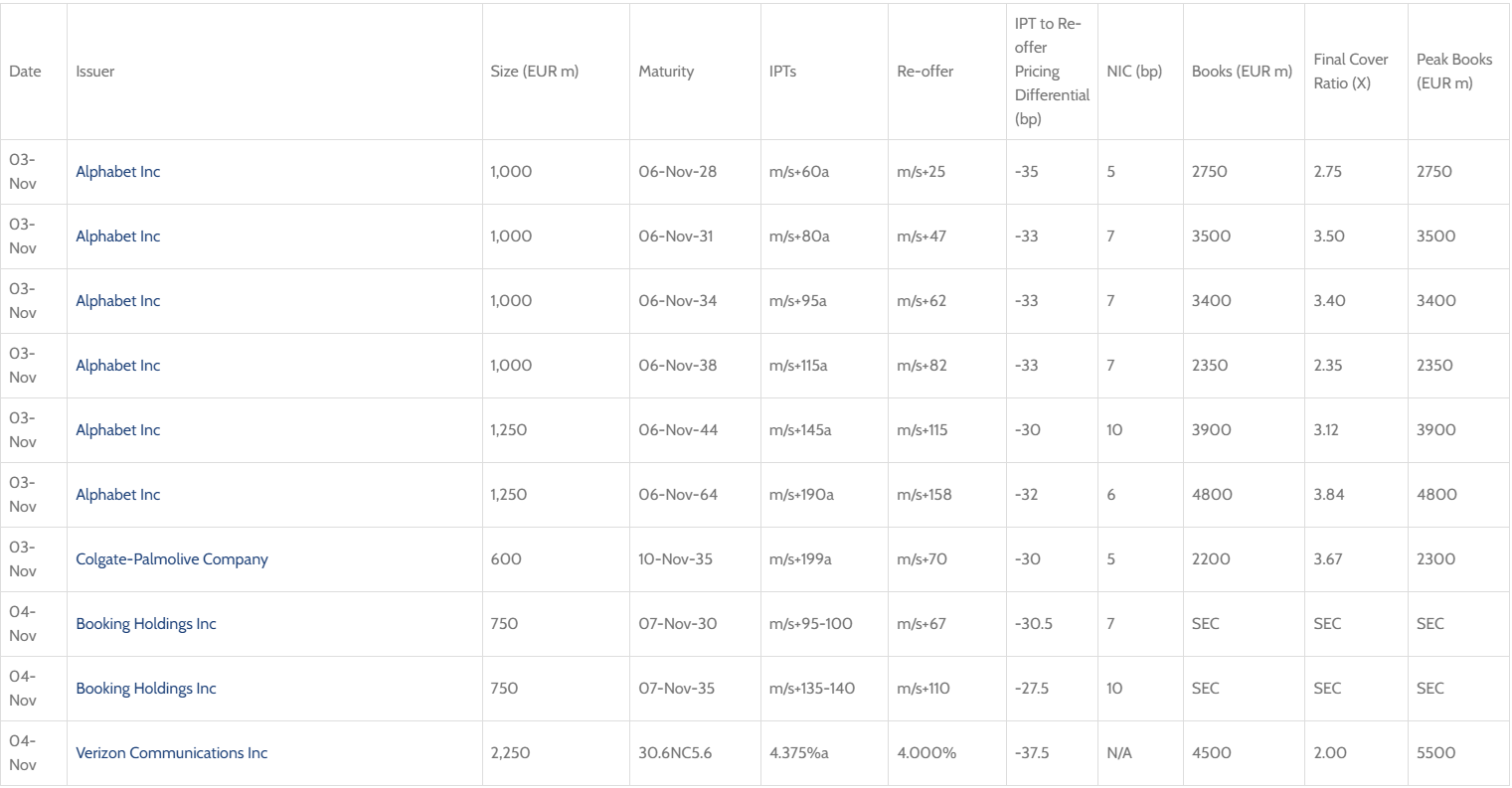

Below are a list of American company deals that have priced this week:

US names in the EUR pipeline:

** Bristol-Myers Squibb Company (A2/A) mandated Citigroup, Barclays, BNP Paribas, J.P. Morgan, and Societe Generale to organize a series of European fixed income investor calls to be scheduled 3-4 Nov. A EUR 5-, 8-, 13-, 20-, and 30-yr fixed-rate senior unsecured SEC-registered benchmark transaction to be issued by BMS Ireland Capital Funding DAC, is expected to follow

** Dover Corporation (Baa1/BBB+) mandated BofA Securities, Citigroup, and ING as Joint Active Bookrunners to organize a series of European fixed income investor calls 3-4 Nov. A EUR500m (exp) 8yr SEC-registered trade is to follow

** NextEra Energy Capital Holdings Inc (Baa1/A-/A-) hired Barclays, BBVA, BNP PARIBAS, Crédit Agricole CIB, Morgan Stanley, Santander, and Wells Fargo Securities to arrange a series of fixed income investor calls commencing 3-4 Nov. A debut EUR hybrid SEC-registered benchmark transaction consisting of new 30.5NC5.5 and 30.5NC8.5 lines, with expected ratings of Baa2 (Moody’s) / BBB (S&P) / BBB (Fitch), is expected to follow

** PACCAR Financial Europe B.V (A1/A+) mandated BNP Paribas, ING, J.P. Morgan and Societe Generale as Joint Bookrunners to arrange a series of fixed income investor meetings commencing 3-5 Nov. A EUR300m (exp) 3yr bond will follow

To receive this analysis plus much more, subscribe to IGM. Request your free trial of the service today.