- The EUR IG corporate market saw its biggest volume euro week of the year and the second largest on record this week, as issuers exited earnings enforced blackouts and tapped the market in their droves

- The EUR33.25bn total was spearheaded by US issuers which priced a combined EUR19.2bn, led by chunky deals from Alphabet (EUR6.25bn six-part) and Bristol-Myers Squibb (EUR5bn five-part). The former marked the second biggest deal of the year, whilst the latter was the joint fifth largest, tied with Orange which printed its own EUR5bn five-part this week

- A number of this week’s deals were launched alongside tender offers as issuers refinanced older debt that matures over the next year or so, whilst some were M&A-driven

- NICs rose slightly (average 4.69bps) amid the deluge of supply which allowed investors to be a bit more discerning, but overall demand remained very strong with the paper attracting combined book in excess of EUR100bn

- The sterling market was also active this week, as seven deals priced for GBP2.895bn – the highest weekly total YTD

Summary of this week’s EUR IG/split-rated corporate deals:

| Date | Issuer | Size (EUR m) | Maturity | IPTs | Re-offer | IPT to Re-offer Pricing Differential (bp) | NIC (bp) | Books (EUR m) | Final Cover Ratio (X) | Peak Books (EUR m) |

| 03-Nov | Alphabet Inc | 1,000 | 06-Nov-28 | m/s+60a | m/s+25 | -35 | 5 | 2750 | 2.75 | 2750 |

| 03-Nov | Alphabet Inc | 1,000 | 06-Nov-31 | m/s+80a | m/s+47 | -33 | 7 | 3500 | 3.50 | 3500 |

| 03-Nov | Alphabet Inc | 1,000 | 06-Nov-34 | m/s+95a | m/s+62 | -33 | 7 | 3400 | 3.40 | 3400 |

| 03-Nov | Alphabet Inc | 1,000 | 06-Nov-38 | m/s+115a | m/s+82 | -33 | 7 | 2350 | 2.35 | 2350 |

| 03-Nov | Alphabet Inc | 1,250 | 06-Nov-44 | m/s+145a | m/s+115 | -30 | 10 | 3900 | 3.12 | 3900 |

| 03-Nov | Alphabet Inc | 1,250 | 06-Nov-64 | m/s+190a | m/s+158 | -32 | 6 | 4800 | 3.84 | 4800 |

| 03-Nov | Colgate-Palmolive Company | 600 | 10-Nov-35 | m/s+199a | m/s+70 | -30 | 5 | 2200 | 3.67 | 2300 |

| 03-Nov | LSEG Netherlands B.V | 500 | 06-Nov-31 | m/s+105a | m/s+68 | -37 | -2 | 1350 | 2.70 | 2900 |

| 03-Nov | OMV AG | 500 | 10-Nov-33 | m/s+110-115 | m/s+73 | -39.5 | 3 | 800 | 1.60 | 1950 |

| 03-Nov | OMV AG | 500 | 10-Nov-40 | m/s+155-160 | m/s+125 | -32.5 | 2.5 | 755 | 1.51 | 1450 |

| 03-Nov | Heineken NV | 550 | 14-Jul-31 | m/s+95a | m/s+60 | -35 | 2.5 | 1000 | 1.82 | 2300 |

| 03-Nov | Heineken NV | 750 | 14-Nov-45 | m/s+170a | m/s+132 | -38 | 2 | 1600 | 2.13 | 3300 |

| 04-Nov | Booking Holdings Inc | 750 | 07-Nov-30 | m/s+95-100 | m/s+67 | -30.5 | 7 | 1600 | 2.13 | 1600 |

| 04-Nov | Booking Holdings Inc | 750 | 07-Nov-35 | m/s+135-140 | m/s+110 | -27.5 | 10 | 2100 | 2.80 | 2100 |

| 04-Nov | Verizon Communications Inc | 2,250 | 30.6NC5.6 | 4.375%a | 4.000% | -37.5 | N/A | 4200 | 1.87 | 5500 |

| 05-Nov | Vonovia SE | 800 | 12-Nov-32 | m/s+145a | m/s+115 | -30 | 7.5 | 2800 | 3.50 | 3000 |

| 05-Nov | Vonovia SE (Green) | 850 | 12-Nov-36 | m/s+170a | m/s+140 | -30 | 7.5 | 3100 | 3.65 | 3300 |

| 05-Nov | Vonovia SE | 600 | 12-Nov-40 | m/s+195-200 | m/s+170 | -27.5 | 10 | 1800 | 3.00 | 2000 |

| 05-Nov | AXA Logistics Europe Master S.C.A (Green) | 500 | 15-May-31 | m/s+130-135 | m/s+100 | -32.5 | 5 | 3100 | 6.20 | 3100 |

| 05-Nov | Bristol-Myers Squibb Company | 750 | 10-Nov-30 | m/s+85-90 | m/s+60 | -27.5 | N/A | 2650 | 3.53 | 2700 |

| 05-Nov | Bristol-Myers Squibb Company | 1,150 | 10-Nov-33 | m/s+110a | m/s+80 | -30 | N/A | 3600 | 3.13 | 3700 |

| 05-Nov | Bristol-Myers Squibb Company | 1,150 | 10-Nov-38 | m/s+135a | m/s+105 | -30 | N/A | 3350 | 2.91 | 3350 |

| 05-Nov | Bristol-Myers Squibb Company | 750 | 10-Nov-45 | m/s+160-165 | m/s+135 | -27.5 | N/A | 2750 | 3.67 | 2750 |

| 05-Nov | Bristol-Myers Squibb Company | 1,200 | 10-Nov-55 | m/s+190-195 | m/s+165 | -27.5 | N/A | 3600 | 3.00 | 3600 |

| 05-Nov | Sofina SA | 600 | 13-Nov-33 | m/s+145a | m/s+115 | -30 | N/A | 1300 | 2.17 | 1650 |

| 05-Nov | Dover Corporation | 550 | 12-Nov-33 | m/s+130a | m/s+98 | -32 | N/A | 1800 | 3.27 | 2100 |

| 05-Nov | NextEra Energy Capital Holdings Inc (Hybrid) | 1,250 | 30.5NC5.5 | 4.5%a | 4.000% | -50 | N/A | 3750 | 3.00 | 4600 |

| 05-Nov | NextEra Energy Capital Holdings Inc (Hybrid) | 1,250 | 30.5NC8.5 | 5%a | 4.500% | -50 | N/A | 4250 | 3.40 | 4750 |

| 06-Nov | Smiths Group Plc | 650 | 13-Nov-33 | m/s+145-150 | m/s+120 | -27.5 | N/A | 1600 | 2.46 | 1750 |

| 06-Nov | Enexis Holding N.V (Green) | 500 | 13-Nov-35 | m/s+110a | m/s+78 | -32 | 3 | 1150 | 2.30 | 2000 |

| 06-Nov | Orange SA | 750 | 13-Nov-28 | m/s+80-85 | m/s+37 | -45.5 | -3 | 3100 | 4.13 | 5000 |

| 06-Nov | Orange SA | 1,000 | 13-Nov-31 | m/s+100-105 | m/s+70 | -32.5 | 7.5 | 3000 | 3.00 | 3250 |

| 06-Nov | Orange SA | 1,375 | 13-Nov-34 | m/s+120-125 | m/s+90 | -32.5 | 5 | 2700 | 1.96 | 3900 |

| 06-Nov | Orange SA | 1,375 | 13-May-38 | m/s+140-145 | m/s+110 | -32.5 | 8 | 3000 | 2.18 | 4000 |

| 06-Nov | Orange SA | 500 | 13-Nov-45 | m/s+170-175 | m/s+132 | -40.5 | 2 | 3800 | 7.60 | 5300 |

| 06-Nov | Brisbane Airport Corporation Pty Limited | 500 | 13-Nov-35 | m/s+150a | m/s+120 | -30 | N/A | 3100 | 6.20 | 3100 |

| 06-Nov | Verallia SA | 350 | 14-Nov-29 | m/s+175a | m/s+130 | -45 | -5 | 1600 | 4.57 | 1900 |

| 06-Nov | Verallia SA | 500 | 14-Nov-33 | m/s+225a | m/s+195 | -30 | 10 | 1800 | 3.60 | 1900 |

| 06-Nov | Latvenergo AS (EuGB) | 400 | 13-Nov-30 | m/s+170a | m/s+125 | -45 | N/A | 2200 | 5.50 | 2600 |

| 06-Nov | PACCAR Financial Europe B.V | 300 | 13-Nov-28 | m/s+70-75 | m/s+37 | -35.5 | -3 | 750 | 2.50 | 1350 |

NICS creep up amid deal deluge

This week was a largely negative one for European stocks amid concerns about stretched AI valuations, a cooling US labour market and some mixed earnings reports, but IG corporate names appeared to completely ignore what was happening elsewhere and accessed the euro primary bond market in their droves.

Coming into the week and the average single currency IG/split-rated corporate forecast from bankers in our poll was EUR15bn and the highest forecast was EUR20bn, but in the end we smashed through both of those – and then some.

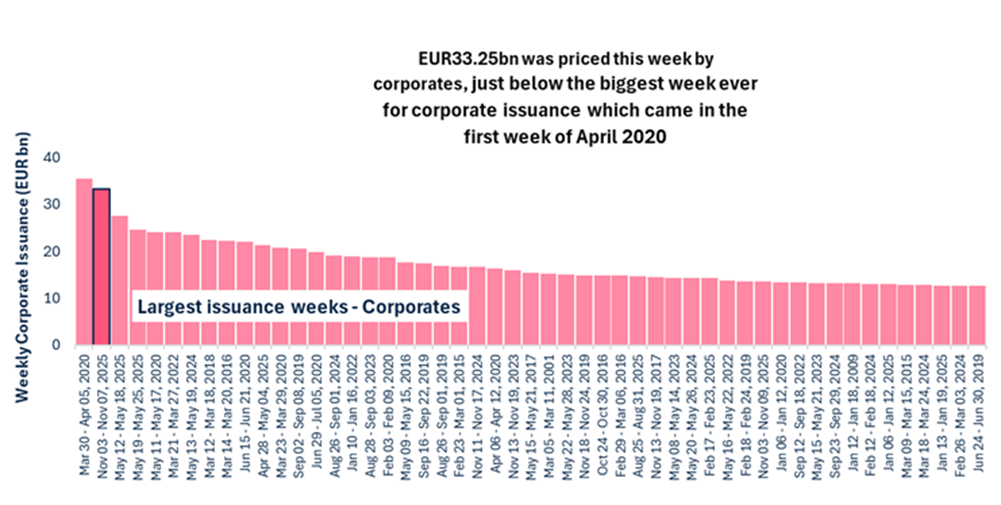

In the end no fewer than 21 IG corporate names printed 40 separate tranches worth EUR33.25bn, making it the sector’s second highest volume week ever for the asset class having only been bettered by the w/e 5-Apr-2020 when EUR35.45bn was issued as issuers flocked to the market amid the Covid-19 lockdowns.

Noticeably, several of this week’s deals were launched alongside tender offers for the borrowers’ older outstanding debt. Issuers also looked to pre-fund 2026 plans amid what remain favourable issuance conditions despite volatility in broader risk markets.

That was shown by the sheer amount of investor cash in play this week, where the EUR33.25bn of paper was chased by peak combined orders worth EUR120.75bn.

The final number dropped slightly to a still very impressive EUR101.055bn, which followed after leads cut an average 33.92bps from IPTs to reoffer.

That spread compression left an average 4.69bps premium on the table at reoffer, which was up from the -3.59bps average paid across the previous week’s 17 tranches that were issued worth EUR9.675bn.

The higher figure is perhaps not a surprise with issuers taking a more pragmatic approach given the crowded nature of the market and the competing supply, whilst some issuer left a bit more on the table in order to print large sizes.

Reverse yankee supply front and centre

Spearheading this week’s issuance were US companies where we saw eight cross the Atlantic to issue 19 tranches which totalled an eye-catching EUR19.2bn.

That continued another busy year for IG corporate reverse yankee supply (euro debt issued by US-based companies), with US corporates flocking to euros to make the most of attractive all-in costs this side of the Atlantic.

US IG/split-rated corporates have now issued EUR83.21bn in the single currency this year, making it the second-largest year ever for reverse yankee supply.

That is currently still short of the EUR99.08bn all-time high recorded in 2019, following a collapse in reverse yankee sales seen in 2018, linked to Trump administration tax changes that were seen as increasing the appeal of bringing home cash held offshore to invest instead of tapping bond markets, but we look set to get close to that record after this week.

The flurry comes amid what is a favourable dollar and basis swap rate for US companies and the lower costs this side of the pond with the ECB cutting having cut rates at a faster pace than the Fed.

Kicking us off for the week was US tech giant Alphabet Inc which bought a EUR6.5bn six-part that marked the second biggest euro IG single currency trade of the year, having only been beaten by its own EUR6.75bn five-part in April.

The deal saw spread compression of 30-35bp across the EUR1bn 3yr, EUR1bn 6yr, EUR1bn 9yr, EUR1bn 13yr, EUR1.25bn 19yr and EUR1.25bn 39yr lines to leave NICs of between 5-10bps.

Final combined demand for the trade was communicated to us (post-pricing) at EUR20.7bn, with the 39yr trade seeing the largest book at EUR4.8bn.

That line marked the longest single currency senior corporate tranche from an issuer since Eli Lilly printed a EUR700m 40yr (1.375% Sep 2061s) back in Sep 2021, so there was some rarity value there and the attractive coupon of 4.375% was obviously enticing for investors on Monday.

The Alphabet transaction, which ranked as the joint 12th largest euro single currency trade on record, was the first six-part euro corporate trade since Oct last year when Danish transport and logistics company DSV A/S issued EUR5bn.

Funds from the euro jumbo will be used to help fund AI expansion, as will the proceeds from the even larger USD17.5bn eight-part trade that priced in the US on Monday (full details here).

Showing the attraction for US names issuing in euros versus dollar, Alphabet paid a 4.375% coupon on its EUR1.25bn Nov 2064 which made up part of a EUR6.5bn six-part on Monday, compared to a larger 5.45% on the shorter USD4bn Nov 2055s which was included in the company’s bumper USD17.5bn eight-part on the same day.

Also crossing the pond and going big was Bristol-Myers Squibb which returned to the euro market after more than 10 years to raise EUR5bn in what was the fifth largest single currency corporate trade of 2025, launched alongside a tender offer.

Going for size, the pharma company took a fairly pragmatic approach, only squeezing in pricing 27.5-30bps on the EUR750m 5yr, EUR1.15bn 8yr, EUR1.15bn 13yr, EUR750m 20yr and EUR1.2bn 30yr tranches.

That ensured strong combined investor demand that peaked at EUR16.1bn before settling at EUR15.95bn.

Back to Europe for a second, and we saw the second corporate EUR5bn five-part in as many days on Thursday as French telecom Orange SA followed hot on the heels of Bristol-Myers Squibb.

Orange’s deal, comprising EUR750m 3yr, EUR1bn 6yr, EUR1.375bn 9yr, EUR1.375bn 12.5yr and EUR500m 20yr lines, was launched to fund the acquisition of MasOrange and saw huge investor demand.

Books for the EUR5bn of paper peaked at a combined EUR21.45bn, which allowed for spread compressions of 32.5-45.5bps from IPTs and NICs ranging from -3bps on the 3yr and +8bps on the 12.5yr.

However, those spread compressions resulted in some resistance being put up by investors, with final combined demand communicated at EUR15.6bn.

Skipping back, and Bristol-Myers Squibb’s jumbo spearheaded a 14-tranche corporate flurry worth EUR11.4bn on Wednesday, with the daily deal total the second most for the asset class this year with only 12-May having seen more at 14, whilst the EUR11.4bn volume total was the biggest of the year and the fourth largest of all time.

That also included more US issuance from Dover Corp (EUR550m 8yr; EUR1.8bn book) and NextEra Energy (debut EUR1.25bn 30.5NC5.5 & EUR1.25bn 30.5NC8.5 hybrids), the latter following hot on the heels of Verizon which offered the first corp subordinated paper from a US issuer since 2021 a day earlier.

That rarity value helped NextEra attract bumper investor interest last seen at EUR8bn (EUR9.35bn peak), allowing 50bps refinement from IPTs to land at 4% on the NC5.5 and 4.5% on the NC8.5.

NextEra followed in the footsteps of Verizon which was the focal point on Tuesday, emerging from the pipeline with a debut hybrid, with the EUR2.25bn 30.6NC5.6 and GBP1bn 30.6NC5.6 lines marking the first corp hybrid tranches in the currencies from a US company since 2021 and 2017 respectively.

Going for size, where notably the euro line marked the joint-fourth largest corporate hybrid on record, Verizon took a fairly pragmatic approach that paid off.

The euro portion saw demand of EUR4.2bn (EUR5.5bn peak) to allow for pricing at 4% from 4.375% area IPTs, whilst books of GBP2.25bn (GBP3bn peak) saw the sterling land at 5.75% from a 6.125-6.25% starting point.

More US supply came Tuesday from Booking Holdings which refreshed its well-stocked euro curve with an opportunistic EUR750m 5yr and EUR750m 10yr two-part, where no books were made public until after pricing due to the SEC-registered nature.

Demand was sufficient for the issuer to shave 30.5bps and 27.5bps off respective IPTs of m/s +95-100 and +135-140, to land with final NICs of 7bps and 10bps. Final books were announced as EUR1.6bn on the 5yr and EUR2.1bn on the 10yr.

Also crossing the pond this week, we had Colgate-Palmolive (EUR600m 10yr) and PACCAR (EUR300m no grow 3yr) which saw cover ratios of 3.67x and 2.5x respectively, with the NICs pegged at 5bps and -3bps.

Sterling market sees YTD supply high

If this week’s euro flurry wasn’t enough, investors also had some sterling supply so get their teeth into, where seven deals priced for GBP2.895bn to make it the sector’s highest weekly total of 2025.

Starting us off on Monday was Platform Housing (GBP250m Nov 2039 sustainability) which saw peak books of GBP1.15bn pared back slightly to GBP900m after IPTs of gilts +95-100 were revised to a +75 landing spread.

More sterling supply was on the menu Tuesday where, alongside Verizon’s aforementioned rare hybrid, there was issuance thanks to a duo of issuers which emerged after calls with secured offerings.

Anglian Water led the way with a GBP420m 8yr and GBP300m 7yr line. These printed at gilts +120 (10bp NIC) and +135 (5bp NIC) from +135-140 and +155-160 IPTs respectively on final combined demand which fell to GBP1.175bn from a GBP1.9bn peak.

Elsewhere, AA Bond Co printed a GBP375m Jul 2032 line at gilts +153 from a +180 area starting point in demand that settled at an impressive GBP1.4bn (GBP1.55bn peak).

Alongside the biggest euro supply of the year and the fourth largest of all time, the corporate market also saw two more tap the sterling currency on Wednesday, following up on investor calls earlier in the week.

UK air traffic control services company NATS (En Route) plc and UK logistics investment company Tritax Big Box REIT plc were the names live in sterling on the day.

NATS stood out, with its GBP250m Mar 2036 senior unsecured line attracting demand of GBP1.5bn (GBP1.75bn) which allowed for IPTs of gilts +95-100 to be taken to a +70 reoffer.

Trtiax’s GBP300m 7yr senior unsecured trade saw more measured books of GBP740m (GBP1.1bn peak) with it landing at gilts +85 from a +105-110 starting point.

French holiday to limit issuance window

Given this week was so busy, the near-term pipeline of issuers looking to tap the market has been thinned out considerably, but bankers expect more supply to come next week as the 2025 issuance window starts to close.

Market participants we have spoken to on Friday morning have put forward a EUR9bn average issuance forecast for the asset class, with some thinking at much as another EUR15bn could cross the tape.

That despite a French holiday (Armistice Day) on Tuesday which is set to limit next week’s issuance window. With many likely to bridge that holiday from the weekend into Tuesday, most of next week’s supply is expected to come in the second half of next week.

At the time of writing there were no deals in the public pipeline, although we would expect some mandates to start coming in as soon as Monday.

Given the attraction of issuance conditions in Europe at this stage, it is expected that we will see more reverse yankee supply next week, with another jumbo trade potentially coming out (hence the EUR15bn high forecast).

Performance tracker of recent EUR IG/split-rated benchmark deals

| Issuer | Deal | Re-offer spread (m/s) | Current i-spread (bid) | Issue Rating |

| SMINLN | 3.625% 11/33 | +120 | +119 | Baa2/BBB+ |

| ENEXIS | 3.375% 11/35 | +78 | +78 | A+ |

| ORAFP | 2.500% 11/28 | +37 | +35 | Baa1/BBB+/BBB+ |

| ORAFP | 3.125% 11/31 | +70 | +70 | Baa1/BBB+/BBB+ |

| ORAFP | 3.500% 11/34 | +90 | +91.5 | Baa1/BBB+/BBB+ |

| ORAFP | 3.750% 05/38 | +110 | +111.5 | Baa1/BBB+/BBB+ |

| ORAFP | 4.125% 11/45 | +132 | +129.5 | Baa1/BBB+/BBB+ |

| BACAU | 3.856% 11/35 | +120 | +116.5 | Baa2/BBB |

| VRALFP | 4.375% 11/33 | +195 | +188.5 | BBB- |

| ANNGR | 3.500% 11/32 | +115 | +113.5 | Baa1/BBB+/BBB+ |

| ANNGR | 4.000% 11/36 | +140 | +135 | Baa1/BBB+/BBB+ |

| ANNGR | 4.500% 11/40 | +170 | +1657 | Baa1/BBB+/BBB+ |

| AXALEM | 3.375% 05/31 | +100 | +96 | A- |

| BMY | 2.973% 11/30 | +60 | +57.5 | A2/A |

| BMY | 3.363% 11/33 | +80 | +77 | A2/A |

| BMY | 3.857% 11/38 | +105 | +104 | A2/A |

| BMY | 4.289% 11/45 | +135 | +130.5 | A2/A |

| BMY | 4.581% 11/55 | +165 | +159 | A2/A |

| SOFBB | 3.707% 11/33 | +115 | +114.5 | A- |

| DOV | 3.500% 11/33 | +98 | +96 | Baa1/BBB+ |

| NEE | 3.996% 30.5NC5.5 | +158.7 | +157 | Baa2/BBB/BBB |

| NEE | 4.496% 30.5NC8.5 | +190 | +187.5 | Baa2/BBB/BBB |

| BKNG | 3.000% 11/30 | +67 | +63.5 | A3/A- |

| BKNG | 3.625% 11/35 | +110 | +106 | A3/A- |

| VZ | 4.000% 30.6NC5.6 | +160.5 | +164 | Baa2/BBB/-/BBB |

| GOOGL | 2.375% 11/28 | +25 | +24 | Aa2/AA+ |

| GOOGL | 2.875% 11/31 | +47 | +46 | Aa2/AA+ |

| GOOGL | 3.125% 11/34 | +62 | +61.5 | Aa2/AA+ |

| GOOGL | 3.500% 11/38 | +82 | +83.5 | Aa2/AA+ |

| GOOGL | 4.000% 11/44 | +115 | +112 | Aa2/AA+ |

| GOOGL | 4.375% 11/64 | +158 | +151.5 | Aa2/AA+ |

| CL | 3.250% 11/35 | +70 | +68 | Aa3/A+ |

| LSELN | 3.000% 11/31 | +68 | +70.5 | A3/A |

| OMVAV | 3.125% 11/33 | +73 | +77.5 | A3/A- |

| OMVAV | 3.875% 11/40 | +125 | +128.5 | A3/A- |

| HEIANA | 2.990% 07/31 | +60 | +62.5 | A3 |

| HEIANA | 4.242% 11/45 | +132 | +135 | A3 |

For the full report in PDF format click 07Nov2025_CorpWeekly.pdf

To receive this analysis plus much more, subscribe to IGM. Request your free trial of the service today.