Summary

Friday's inflation report is shaping up to be one of the most consequential economic releases of the year. The Bureau of Labor Statistics will release September's Consumer Price Index data on October 24, a date that's been pushed back due to the ongoing government shutdown. This isn't just another monthly data dump; it's the critical piece of evidence that could determine whether the Federal Reserve continues its cautious easing cycle or hits the pause button.

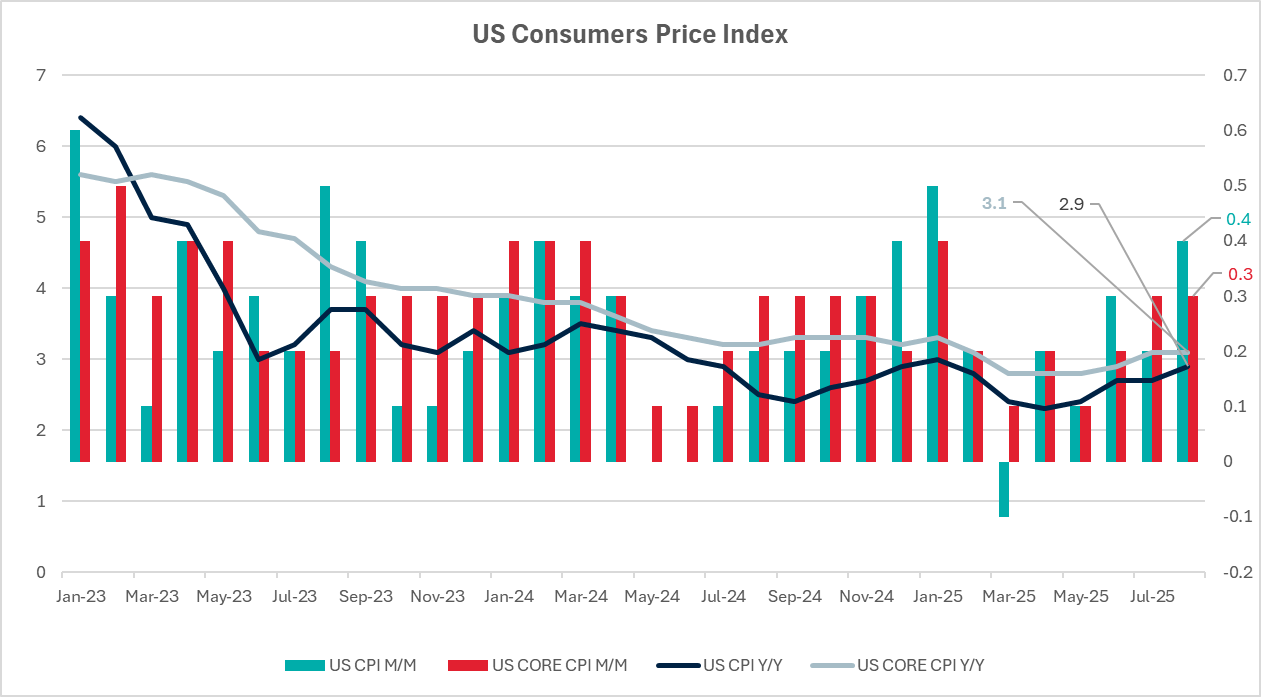

The consensus forecast paints a picture of gradual but uneven progress on inflation. Market consensus expects headline CPI to rise 0.4% month-on-month, pushing the annual rate to 3.1%, up from August's 2.9%. Core CPI, which excludes volatile food and energy prices, is projected to increase 0.3% monthly, keeping the annual rate steady at 3.1%. These numbers tell a story of inflation that's proving more stubborn than many hoped, remaining well above the Fed's 2% target.

Key Takeaways

- Headline CPI expected at 0.4% m/m, 3.1% year-on-year (up from August's 2.9%)

- Core CPI projected at 0.3% m/m, maintaining 3.1% y/y

- Data quality concerns: Government shutdown may have affected normal collection processes

- Fed implications: Markets pricing in 25bp cut at October 28-29 FOMC meeting with near certainty

- Consumer expectations rising: Inflation expectations jumped to 3.4% in September, the highest in five months

- Shutdown impact: This is one of the few economic releases continuing during the government shutdown due to Social Security COLA requirements

Analysis

Several key factors are shaping the inflation outlook heading into Friday's release:

- Housing Costs Continue to Dominate: Shelter components, which account for roughly one-third of the CPI basket, remain the biggest contributor to core inflation. While there are signs that rent growth is moderating, the pace of deceleration has been frustratingly slow for Fed officials.

- Services Inflation Stays Sticky: The "super-core" services category, excluding housing, which Fed officials watch closely as a gauge of underlying inflation pressures, has remained elevated. This reflects the persistent nature of domestic inflation tied to wages and business costs.

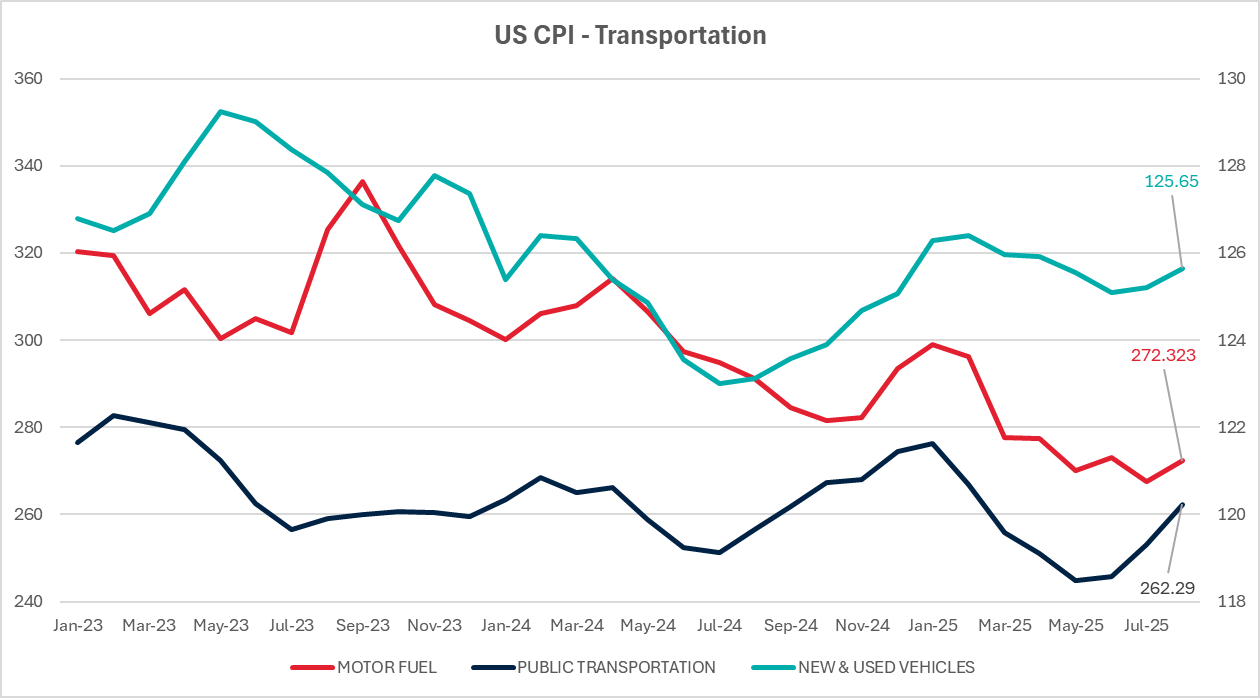

- Energy Price Volatility: Gasoline and energy costs have been volatile, adding uncertainty to the headline inflation picture. Geopolitical tensions continue to create upside risks for energy prices.

- Consumer Expectations Rising: Perhaps most concerning, consumer inflation expectations for the year ahead jumped to 3.4% in September, the highest in five months and up from 3.2% in August. When consumers expect higher prices, it can become a self-fulfilling prophecy as businesses feel more comfortable raising prices.

- Data Quality Concerns: The government shutdown has created unprecedented challenges for data collection. The shutdown may prolong into November, which raises concerns about the quality of data, as it is unclear how the BLS will deal with real-time collections. We suspect that the sampling methodology may have relied more heavily on online surveys than usual.

Historical Parallels and Context

The current inflation environment shows concerning parallels to previous periods of persistent price pressures. Since early 2024, headline CPI has fluctuated between 2.4% and 3.5%, demonstrating just how stubborn these price pressures have been despite aggressive monetary tightening.

This persistence echoes inflation challenges from the late 1970s and early 1980s, though thankfully at much more manageable absolute levels. The key difference is that we're seeing inflation expectations starting to drift higher again, which was a critical factor in the prolonged inflation battles of that earlier era.

The Cleveland Fed's inflation nowcasting model has been projecting continued elevated readings, suggesting that the disinflationary process may be stalling. This is particularly concerning given that the Fed has already cut rates significantly from their peak levels.

Consumer inflation expectations provide historical context for concern. The recent jump to 3.4% for the year ahead, along with increases in longer-term expectations, suggests that inflation psychology may not be fully healed. Historical experience shows that once inflation expectations become unanchored, they can be extremely difficult to bring back down.

Market Implications

Treasury Markets: The 10-year Treasury yield is operating at 3.97% at the time of writing, reflecting uncertainty about the Fed's path forward. A hotter-than-expected CPI reading could send yields spiking higher across the curve as rate cut expectations get pushed out. The 2-year yield would be particularly sensitive to any Fed policy recalibration. The 2s10s spread has flattened by 11bp to 51bp since August 2025. Conversely, a softer reading could accelerate the bond rally, potentially pushing the 10-year yield toward the April YTD low of 3.86%, and steepen the yield curve as markets price in more aggressive easing.

Equity Markets: Stock markets have been riding high on rate cut optimism, but this rally could be vulnerable to an inflation surprise. Growth and technology stocks would be particularly sensitive to any recalibration of Fed expectations, while value sectors might outperform if the easing timeline gets extended. If CPI surprises to the downside, broad market indices could extend gains, with interest-rate sensitive sectors like real estate and utilities potentially outperforming.

US Dollar: The Dollar Index (DXY) is trading at 98.990, posting weekly gains of about 0.7% and up about 1.8% monthly. However, the index is still down more than 8% over the past year. A hotter-than-expected CPI would likely provide immediate support to the dollar against major currencies and potentially reverse the recent downtrend. This would help to drive the DXY toward an interim resistance zone of 100.257-100.481, followed by 101.977. On the flip side, a softer reading could accelerate dollar weakness and benefit emerging market currencies and commodities. This scenario may result in a compression of the DXY inside the 96.218-97.462 area.

Intermarket Relations To Watch

Bond-Dollar Correlation: Watch for the traditional inverse relationship between Treasury yields and the dollar to potentially break down if inflation concerns resurface. Higher yields typically support the dollar, but if inflation fears drive both yields and dollar strength simultaneously, it could create stress in other markets.

Equity-Bond Dynamics: The recent positive correlation between stocks and bonds (both rallying on rate cut hopes) could reverse sharply if inflation surprises to the upside. This would mark a return to the more traditional negative correlation where rising yields hurt stock valuations.

Commodity Complex: Energy prices have been volatile, and an inflation surprise could reignite commodity momentum across the board. Gold, which has been sensitive to real interest rate expectations, could see significant moves in either direction based on how the CPI data affects Fed policy expectations.

Emerging Market Spillovers: EM currencies and bonds have been benefiting from dollar weakness and rate cut expectations. An inflation surprise that strengthens the dollar and reduces Fed easing expectations could trigger significant outflows from emerging markets.

Analyst Insight

We're approaching a critical inflection point for Fed policy, with Friday's CPI release carrying outsized significance for the rates outlook across APAC and global markets. Fed Chair Powell has framed recent cuts as "risk management" to prevent labor market deterioration, but that narrative faces a stress test if inflation shows signs of reacceleration. The Fed's hard-earned credibility on inflation control—built through the aggressive 2022-2023 tightening cycle—remains its most valuable asset, and it won't risk it lightly.

The market consensus around "temporarily hot" inflation, as LPL Financial's Jeffrey Roach characterizes it, could face serious scrutiny if Friday's data suggests price pressures are becoming more entrenched rather than transitory.

The government shutdown has created unusual data collection circumstances, adding an extra layer of complexity to interpreting the release. We'll need to look beyond headline numbers to understand underlying trends, particularly given potential sampling methodology changes that could distort the signal.

The November FOMC meeting (October 28-29) becomes absolutely crucial for understanding how the Fed processes Friday's data. While markets are pricing another 25bp cut with high confidence, the real focus will be on dot plot updates and Powell's press conference for insights into the forward path.

This CPI release carries particular weight given the interconnected nature of global monetary policy. The ECB, BoE, and BoJ are all watching US inflation data closely, as it directly influences their own policy calculus and global financial conditions.

Charts

To receive this analysis plus much more, subscribe to IGM. Request your free trial of the service today.