A flurry of supply was expected following the Epiphany holiday on Tuesday and the market didn’t disappoint as issuers flocked to the primary market in their droves to raise early-year funding amid attractive issuance conditions.

Demand was huge and minimal new issue premiums noted. In the single currency no fewer than 34 separate lines were issued across the various asset classes, which was more than any day in 2025 and marked the biggest daily number of tranches on record having surpassed the previous high of 30 set on 22-May-2024. Wednesday’s issues, led by some chunky SSA trades from KfW, EIB and Belgium as well as multi-tranche corporate issues, totalled at least a combined EUR50.75bn (with Chile’s two-part deal yet to be sized at the time of writing!) – also meaning it was the biggest ever daily supply total ever having eclipsed the EUR43.3bn issued on 9-Jan-2024. Wednesday’s deluge put the weekly single currency supply total at EUR59.5bn (excluding Chile), meaning that with two days still to go we are already within striking distance of the EUR63bn average estimate put forward by participants in our issuance poll. The highest forecast of EUR85bn also looks under threat at this point, with many names already sat in the pipeline including Italy and Portugal which are set to go big with syndicated lines. See the IGM DAILY EUR NICS & BOOKS for the full breakdown of the record-breaking euro issuance which was complimented by another flurry of transactions in sterling and dollars

** The three major issuers that emerged from the pipeline in euros together accounted for EUR24bn of issuance. Belgium went a little larger than we envisaged with an EUR8bn 10yr printed after orders ballooned to EUR91bn (we saw 2-3bp of NIC but official feedback was at the lower end of that ‘range’). KfW came in line with our expectations at EUR10bn with a EUR6bn 3yr tranche and a larger (than last year) EUR4bn 10yr tranche easily covered by a combined order book that topped out at EUR97bn. There was a slight preference toward the longer line which was in keeping with what we saw with Lower Saxony’s dual tranche earlier in the week. EIB stuck to its very well read script and issued EUR6bn some 3bp inside IPTs and with a NIC of 1bp. The surprise here was that order books exceeded EUR60bn and we only suggested that the EUR50bn threshold might be breached. On the sterling side a trio of issuers each placed GBP1bn deals. AfDB went short with a 3yr that attracted the highest GBP order book on the day (GBP2.3bn) whereas IADB and CADES targeted the 5yr tenor attracting GBP2.2bn and GBP1.8bn in orders respectively. All three trades saw 1bp of spread compression with that small squeeze leaving a 0bp NIC for AfDB and a 1bp concession for IADB. The dollar market continued to set pulses racing with some startlingly high order books achieved on smaller volume transactions that adopted a ‘will not grow’ approach - CoE and AIIB fit that bill perfectly with USD1bn deals (5yr and 10yr tenors) that were inundated with demand of USD6.1bn and USD14.1bn (again a hint of a preference for additional duration). Kommunalbanken and BNG Bank were also noteworthy for their USD1.5bn 5yr and USD2bn 10yr lines which achieved robust cover ratios of 3.47x and 3.85x respectively. Elsewhere, the Province of Quebec continued the rampant advance of Canadian issuers into the mainstream SSA space with a USD4.5bn transaction that was partly enabled by a USD16bn order book. The eye catching deal size extends a trend that the issuer started in recent years whereby each year’s inaugural deal is larger than the previous. If all of that isn’t enough then we are likely to be almost as busy again Thursday with number of names already having circulated IPTs for dollar deals (OeKB, CAF) while Land NRW is bridging the two major currencies with a dual currency mandate involving 3yr USD and 30yr EUR. On the EUR side that will be joined by Italy (7yr and EUR5bn Apr 2046 green BTP), Portugal (long 10yr), ADB (3yr), Rhineland Palatinate (2yr LSA) and JFM (5yr green that went live early today). See IGM’s SSA SNAPSHOT

** Multi-tranche deals were the name of the game in the IG corporate space as four issuers printed 11 tranches worth EUR8.85bn to put the weekly total at EUR9.6bn already and beyond the average estimate of EUR8.5bn. Investors were keen to gain exposure to some of the first corp deals of 2026 and placed combined peak demand of almost EUR40bn, although some orders were pared back (EUR30.34bn at last count) after issuers ramped in pricing from IPTs to price with an average NIC of just 0.77bps. Garnering most attention on the demand front was Enel SpA (EUR1.25bn PNC6 & EUR750m PNC9 two-part) which for the second straight year opened up corporate hybrid supply. The shorter line landed 50bps inside IPTs and flat to fair value at 4.25% whilst the longest PNC9 was ramped in a larger 62.5bps to 4.625%, resulting in a negative NIC of 12.5bps. The tight pricing on the latter came at the expense of a chunk of orders which peaked at EUR5.75bn before settling at EUR3.79bn, whilst the PNC6 hybrid saw demand finish at EUR5.7bn from a EUR6.2bn peak. Three issuers took a triple-tranche approach on the day, including French pair L’Oreal (EUR650m 3yr FRN, EUR500m 3yr & EUR600m 6yr FXD) and Veolia Environnement SA (EUR950m 5yr, EUR900m 8yr & EUR650m 12yr FXD) which offered vanilla paper. The former, which priced all three lines flat to fair value, saw the most measured - but still solid - demand at a combined EUR4.6bn which fell from an earlier high of EUR6.7bn. Veolia left a bit more on the table on the shorter 5yr and 8yrs which priced with pick-ups of 5-10bps, whilst the smaller and longer 12yr priced with a zero NIC. Some sensitivity was also noted here with final orders at EUR6.85bn versus a peak of EUR9.2bn. Rounding off the day’s corporate issuance was Germany’s Amprion GmbH (EUR700m 5yr, EUR1bn 12yr & EUR900m 20yr greens) which also went with a three-part and opened the 2026 euro corporate ESG market. NICs were pegged at 0, 3bp and 3bp respectively on the company’s latest green bonds with aggregated books of EUR9.4bn (EUR11.8bn peak) skewed to the longer tranches. For more details including the official comps lists, see the IGM CORP SNAPSHOT

** The non-covered FIG sector had an extremely busy session on Wednesday with eight issuers printing ten fresh lines. Most issuance was focused on the senior part of the stack, but there were also two Tier 2 trades and one RT1. BPCE SA offered a EUR750m 11NC6 Tier 2 Social bond that caught investors’ attention. IPTs started at m/s +180 area and a whopping final book of EUR5.5bn allowed a 35bp revision for final pricing to land at fair value m/s+145. At allocations the book had increased to a whopping EUR9.4bn, a cover ratio of 12.53x. BBVA was out with a dual-tranche SNP offering comprising a 3yr FRN in tandem with a 10yr fixed rate tranche. Talk started at 3mE +85 area and m/s +125 area respectively, with combined books at first update seen at EUR4.25bn. The final terms were struck at 3mE +55 for the FRN, sized at EUR750m, and m/s +100 on the fixed which looked like a rare 5bp concession, however the deal was sized at EUR1.25bn to justify that. Books were seen at EUR3bn and EUR3.4bn respectively at the final terms before easing back to EUR2.4bn and EUR3.1bn at allocations. UBS Group AG also offered a dual-tranche trade in Senior Holdco format, comprising 5NC4 & 11NC10 benchmarks where talk commenced at IPTs m/s +105 area and m/s +135 area respectively. Combined books at first update were declared at EUR8bn for the ever popular Swiss bank. The final terms were set with both tranches sizing at EUR1.5bn with the 5NC4 pricing at m/s +73 and the 11NC10 at m/s +103 - both appearing to show 3bp concessions, with books seen at EUR5.1bn and EUR5.4bn respectively. Despite this, at allocations the books regressed to EUR4.2bn and EUR4bn, maybe the size putting off some subscribers. French based RCI Banque S.A was out with a Feb 2032 senior preferred transaction that started at m/s +155 area, with demand again strong with the final book reaching EUR5.2bn. The deal as sized at EUR900m and the final spread came at m/s+120 again on fair value. At allocations books had grown to EUR5.5bn. NatWest Markets Plc offered a 5yr Senior OpCo deal where talk started at m/s +95 area. Books grew slowly, being declared at EUR2bn at first update. The trade finalised at EUR1bn at m/s +67 and bang on fair value with books seen at EUR3.7bn. At allocations these eased back to EUR3.3bn. Similarly Standard Chartered Plc was in play with a Green senior unsecured 8NC7 trade that commenced marketing at m/s +135 area with books seen at EUR2bn at the first update. Final terms were struck at m/s +105 again on fair value with the deal sized at EUR1bn and books seen at EUR3.9bn. These retreated at allocations to EUR3bn, a loss of 23% of subscriptions. The day’s business was completed by two subordinated deals including a 10yr Tier 2 bullet from Italian insurer Assicurazioni Generali S.p.A, where the EUR650m no grow saw massive demand with EUR4.25bn worth of orders allowing final pricing on fair value at m/s +125, having started back at m/s +160 area. At allocations this proved too rich for some investors with final books seen at EUR2.65bn, a drop of around 37%. French based Insurer Groupama Assurances Mutuelles offered the year’s first RT1 trade, a EUR600m no grow PNC7.5 that commenced IPTs at 6.375% area. Books at the first update were seen at EUR2.75bn. A bumper final book of EUR5bn allowed a 62.5bp revision for the deal to finalise at 5.75%. At allocations this proved too much for some subscribers as the book was communicated at EUR2.5bn, a loss of 50% of orders but still producing a 4.17x ratio. See IGM’s FIG SNAPSHOT

** The covered bond sector saw a very busy session with six borrowers accessing the market, five in the single currency and one in the sterling sector. Three previously mandated deals all saw good interest. Unicredit Bank GmbH was out with a 5yr HP deal, starting talk at m/s +30 area, before strong demand enabled final pricing to land at m/s +21 as the trade was sized at EUR1.5bn with books at EUR5.7bn. DZ HYP AG launched its 10.1yr HP trade which commenced marketing at m/s +35 area, where a final book of EUR3.9bn allowed a 7bp revision to land at m/s +28 leaving no concession - the deal was sized at EUR1bn. At allocations books had grown slightly to EUR4.15bn. Credit Agricole Public Sector SCF offered a 7yr OF trade that also saw good investor demand. Talk started at m/s +50 area and with final orders of EUR5.5bn the deal finalised at m/s +41 for a EUR750m size. An opportunistic trade also came from Caisse de Refinement de l’ Habitat CRH Corp with a dual 5yr and EUR500m no grow 10yr that commenced marketing at m/s +38 area and m/s +63 area respectively. Order books were again strong, allowing a 9bp revision on each tranche, with the 5yr year leg sized at EUR1.25bn. Books were seen at a massive EUR6bn and EUR5.2bn respectively, these held at allocations. There was also a dual-tranche sterling trade from Nationwide Building Society comprising a 3.5yr FRN in tandem with a 7yr fixed rate tranche. Talk started at SONIA +47 area and SONIA m/s + 64 area. The deal finalised at SONIA +42 on the FRN and at SONIA m/s +60 on the fixed leg. Books were seen at GBP1.8bn and GBP1.4bn respectively with the deals being sized at GBP750m and GBP1bn. These held at allocations, as did all the covered deals Wednesday

Thursday's primary prospects

SSA:

** The Republic of Italy (Baa2/BBB+/BBB+/AL/BBB+) hired mandated Barclays, BNP Paribas, Credit Agricole CIB, Monte dei Paschi di Siena, Morgan Stanley and NatWest as Joint Lead Managers for a dual tranche transaction including a new EUR 7yr (Mar 2033) benchmark and a EUR5bn no grow tap of the Apr 2046 green BTP

** The Republic of Portugal (A3/A+/A/AH/A) mandated Barclays, BBVA, BNP Paribas, CaixaBI, Citi and HSBC as Joint Lead Managers for a forthcoming EUR 10yr Portuguese Government Bond (PGB) maturing Jun 2036

** The Asian Development Bank (Aaa/AAA/AAA) hied Barclays, BofA Securities, Citi and UBS to lead manage a new EUR 3yr EUR fixed rate benchmark

** The German State of North Rhine-Westphalia (Aa1/AA/AAA/AAA) mandated Barclays, Deutsche Bank, DZ BANK, JP Morgan and LBBW to lead manage its new EUR1bn no grow 30yr transaction. The borrower has also hired mandated BMO Capital Markets, CIBC Capital Markets, HSBC, RBC Capital Markets and Scotiabank to lead manage a new USD 3yr benchmark transaction with Its released at SOFR m/s +33 area IPTs

** The German Federal State of Rhineland Palatinate (AAA) mandated DekaBank and LBBW to lead manage its upcoming EUR 2yr benchmark fixed rate Landesschatzanweisung

** Japan Finance Organization for Municipalities (JFM) mandated JP Morgan, BofA Securities, Credit Agricole CIB and Mizuho to lead its forthcoming senior unsecured EUR benchmark 5yr fixed rate green bond (. The transaction is expected to be rated A1 (stable) by Moody's and A+ (stable) by S&P. IPTs are m/s +38 area

** Oesterreichische Kontrollbank AG (Aa1/AA+) is working a USD 5yr Global at SOFR m/s +37 area IPTs via BofA, Citi, Deutsche Bank and JP Morgan

** Corporacion Andina de Fomento (Aa3/AA+/AA-) is taking IoIs for a USD 10yr benchmark at SOFR m/s +90 area IPTs via Barclays, BofA, JP Morgan, Standard Chartered and TD Securities

Corp:

** Sveafastigheter AB (publ), a Swedish owner and manager of residential rental properties in Sweden, rated BBB- (positive) by Fitch, mandated Goldman Sachs Bank Europe SE, JP Morgan and Nordea as Joint Bookrunners to arrange a series of fixed-income investor calls commencing Monday 5th Jan. A EUR300m (exp) 5yr senior unsecured offering is to follow

Covered:

** Commerzbank AG mandated Commerzbank as Global Coordinator and ABN AMRO, BayernLB, DZ BANK AG, Erste Group, Helaba, Natixis and Nordea as Joint Bookrunners for its forthcoming EUR covered bond dual-tranche benchmark transaction. The issue will consist of a EUR 5yr Oeffentlicher Pfandbrief (Public Sector Covered Bond) and a EUR 10yr Hypothekenpfandbrief (Mortgage Covered Bond). Both tranches are expected to be rated Aaa by Moody's

** BPCE SFH hired BBVA, Commerzbank, Credit Agricole, Erste Group, ING, Natixis, Nykredit and UniCredit as Joint-Lead Managers for its upcoming EUR benchmark 10yr Obligations de Financement de l’Habitat transaction, 100% backed by prime French residential mortgages. Expected ratings of Aaa/AAA (Moody's/S&P)

** The IGM Roadshow Calendar is your one-stop window on who, when and where. The calendar view provides an instant snapshot of which days are already earmarked for meetings in a convenient PDF format, with clickable links that take you directly to the known schedule

Wednesday's broader market developments

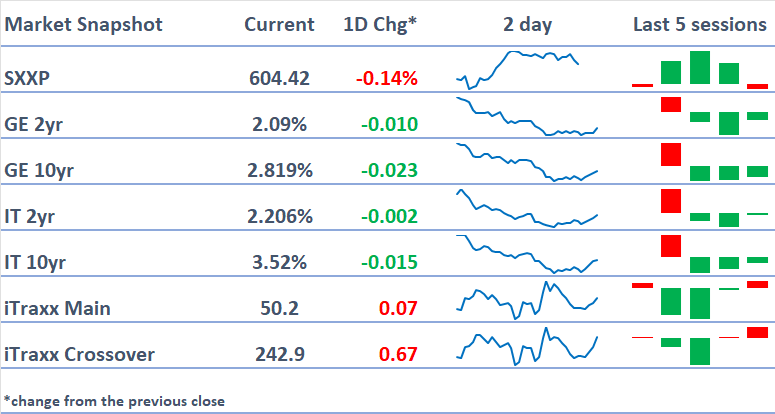

** A steady opening for European stocks subsided into some losses as the day progressed, albeit among constrained moves. Continuing geopolitical tensions (first in Asia and also with a continuing focus on the US, with reports of oil tanker seizure) mean there is constant threat to market stability. That being said, stock losses were minimal at the time of writing in Europe, while the US indices were actually resilient. The Nasdaq was up 0.44% and the S&P 0.11% at the time of writing. Eurozone inflation came in at 2% as expected, easing from 2.1% to reach the ECB’s target. The core figure, however, was 10bp below forecast at 2.3% when no change from 2.4% was anticipated. Italian CPI was as expected, at 1.2% YoY, which followed lower than expected prints from France and Germany on Tuesday. Data releases included weaker than anticipated German retail sales but lower inflation prints from the States of Bavaria and Baden Wuerttemberg and a 5 point bump up in the HCOB Construction PMI. The UK PMI missed forecast, however. In the US, the jobs reports showed the ADP Employment Change 9k below expectations at 41k and the JOLTS Job Openings falling someway short of the forecast at 7146k (expected 7648K). The ISM Services releases were mostly better than anticipated

** Stoxx600 facing a small loss as the day moved towards a close, seen 0.04% lower, settling back after hitting a fresh record high on Tuesday. Real Estate the outperformer (+2.86%) but Energy down 3% as a major drag on the index

**Govvies: EGB yields lower across the market as curves flatten, although some of the morning moves given up. Biggest short-end yield drop came in SP (-1.7bp), long-end dopped the most in FR and GE (-3.9bp), which was 2-3bp off the morning’s lows at the long end. UKTs holding at -2.8bp/-7bp

** Data

- GE Nov Retail Sales missed at -0.6%/-1.8% MoM/YoY (f/c 0.2%/0.1% prev rev to 0.3%/2.1% from -0.3%/1.3%)

- FR Dec Consumer Confidence in line at 90 (f/c 90, prev 89)

- GE Dec HCOB Construction PMI higher at 50.3 (prev 45.2)

- GE Dec Unemployment Change missed at 3k (f/c 5k, prev 1k)

- UK Dec S&P Global Construction PMI missed at 40.1 (f/c 42.3, prev 39.4)

- IT Dec P CPI in line at 0.2%/1.2% MoM/YoY (f/c 0.2%/1.2%, prev -0.3%/1.1%)

- EC Dec P CPI in line at 0.2%/2% (f/c 0.2%/2%, prev -0.3%/2.1%)

- US Weekly MBA Mortgage Applications rise to 0.3% (prev -10%)

- US Dec ADP Employment Change missed at 41k (f/c 50k, prev -29k rev from -32k)

- US Dec ISM Services Index/Prices Paid/New Orders/Employment mostly beat at 54.4/64.3/57.9/52 (f/c 52.2/64.9/52.6/49, prev 52.6/65.4/52.9/48.9)

- US Nov JOLTS Job Openings missed at 7146k (f/c 7648k, prev 7449k rev from 7670k)

- US Oct Factory Orders missed at -1.3% (f/c -1.2%, prev 0.2%)

What to watch Thursday – FR/GE auctions

** Key Data: GE Nov Factory Orders (07:00), IT Nov Unemployment Rate (09:00), EC Nov ECB 1yr/3yr CPI Expectations (09:00), EC Dec Consumer/Economic/Industrial Confidence (10:00), EC Nov PPI (10:00), EC Nov Unemployment Rate (10:00), US Weekly Initial/Continuing Jobless Claims (13:30), US Q3 P Nonfarm Productivity (13:30) and US Oct Trade Balance (13:30)

** Key Events: No major events of central bank speakers scheduled for Thursday 8th Jan

** Auctions: SP to sell EUR5.5-6.5bn 2030, 2033 & 2034 Bonds, as well as EUR250-750m 2036 Linkers (09:30). FR to sell EUR11.5-13.5bn 2040, 2042 & 2056 OATs (09:50)

All times GMT

FIG + Covered Priced / FIG + Covered Pipeline