20th May, 2025

** The mood was positive in Europe on Tuesday and that provided the backdrop for another host of issuers to pull the trigger on either opportunistic or pre-announced deals which spanned euros, sterling and dollars. Another 26 tranches (IG & HY) priced in the single currency on Tuesday worth EUR22.1bn to follow Monday’s EUR14.15bn/18 line opening weekly salvo, whilst the near-term pipeline was also replenished on the day. On a note of caution to the next batch of issuers looking to go, a number of Tuesday’s issuers saw some sensitivity in the books as investors put up a bit of resistance to pricing levels which were well inside IPTs and tight to existing curves. That said, overall demand was still very strong on the whole, as fully detailed in the IGM DAILY EUR NICS & BOOKS. In sterling and the UK’s well-flagged GBP4bn 2056 syndicated gilt led a mini-flurry on Tuesday, with info in IGM’s DAILY GBP NICS & BOOKS

** The day’s volume booster again came from the IG corporate sector as Novo Nordisk became the second borrower in as many days (and just the fourth this year) to bring a five-part benchmark. Following up on Siemens’ EUR4bn issue the previous session, Danish pharma company Novo Nordisk went even bigger and printed EUR6bn in what was the sector's second largest transaction of 2025 having only been beaten by Alphabet’s EUR6.75bn five-part on 29-Apr. The offering comprised a EUR1.4bn 2yr floater as well as EUR1.45bn 3yr, EUR1bn 5.25yr, EUR900m 8yr and EUR1.25bn 12yr fixed-rate tenors, with the deals squeezed in 30-35bps from initial talk to land with 0-5bp NICs. Demand for the transactions peaked at EUR14.8bn but was last communicated at EUR12.5bn, less than seen for Siemens (EUR16.3bn final/EUR18.7bn peak). Novo Nordisk was joined in the senior market Tuesday by Daimler Truck (EUR350m 2yr FRN & EUR650m long 4yr FXD two-part; 1.6bn/2.5bn bks & -2bp NIC on FXD) and Kering (EUR750m long 4yr; 7.5bp NIC & 1.5bn bk). Elsewhere, the recently revitalised hybrid market saw deals from EDP (EUR750m 30NC6.75 green) and Arkema (EUR400m PNC5) which both priced their deals 56.25bps inside the mid-point of IPTs and flat to fair value. Similarities didn’t end there either with final demand on each deal settling at EUR1.6bn, having earlier peaked at EUR2.8bn and EUR2bn respectively. Looking ahead and 8 more IG corporate names are already sat in the euro pipeline after recent roadshows and could pull the trigger as early as Wednesday’s business, including Robert Bosch (EUR 18m FRN, as well as 3yr, 6yr, 9yr and 12yr FXD) which is the next to line-up a five-part euro benchmark. See IGM's CORP SNAPSHOT for full details

** Non covered FIG saw a very busy calendar as seven borrowers lined up to launch across the capital stack. In total EUR5.2bn of new paper was issued with peak books around EUR20bn, although there was some attrition as issuers tightened pricing. The AT1 space saw two new offerings. KBC Group launched a PNC5.5 with peak orders of EUR3.5bn for the EUR1bn deal that priced at 6% having tightened in 50bps from IPTs, although the book was reduced to EUR1.75bn at allocation. Banco BPM SpA also saw heavy demand for its EUR400m no grow PNC5.5 with orders of EUR3.2bn at final terms, allowing a 62.5bp reduction from 6.875% area IPTs to land at 6.25%. Aviva plc returned to the euro market after a near seven-year absence with a 31.25NC11.25 Tier 2 deal. The EUR600m no grow deal was priced at m/s +205 with books at EUR1.45bn (peak EUR2.35bn), moving in 30bps from IPTs. The senior non-preferred space was also active with three new deals, where Banco Santander led the way with a 7yr bullet attracting EUR2bn plus of orders (EUR2.5bn peak) for its EUR1bn-sized print, finalizing at m/s +90, from +115 area IPTs. They were closely followed by Credit Agricole SA who also chose the bullet structure, issuing EUR1bn 10yr social deal at m/s +130, with a very healthy book of EUR3.8bn, reduced to EUR2.4bn at allocation, allowing a 35bp reduction from initial talk. Danske Bank A/S also revisited the SNP space bringing an EUR500m 8NC7 deal at m/s +115, with books at EUR1.25bn (EUR2.4bn peak) and IPTs +145 area. Nomura Holdings Inc were the final entity in the market, bringing an inaugural EUR700m 5yr senior deal. IPTs of m/s +145 area were chopped to a +120 reoffer, again on a robust book of EUR2.2bn (EUR2.5bn peak). See IGM’s FIG SNAPSHOT

** Tuesday's SSA primary bond market demonstrated robust investor appetite across multiple currencies and maturities, with Rentenbank making a notable appearance with its USD1.5bn 5yr USD-denominated bond. The German development agency for agribusiness and rural areas priced its offering at SOFR m/s +42, tightening from IPTs of SOFR m/s +46 area on the back of impressive USD10bn in orders, achieving a NIC of -1bp. This transaction forms part of Rentenbank's EUR10bn funding plan for 2025, where the agency intends to raise up to 50% through benchmark bonds denominated in euros and US dollars. Meanwhile, International Development Association (IDA) successfully placed a EUR2bn 5yr sustainability bond with EUR4.1bn in orders, while Republic of Iceland returned after a 14-month absence with a EUR750m 5yr bond that tightened significantly from initial guidance. Province of British Columbia continued the trend of strong demand for Canadian regional issuers with its EUR1.7bn 15yr bond attracting EUR10.4bn in orders. The United Kingdom maintained its exceptional demand pattern with its GBP4 billion 30yr Gilt generating GBP74bn in orders, while Instituto de Credito Oficial (ICO) made its first 2025 appearance with a EUR500m 7yr green bond pricing at its tightest spread to Spanish government bonds since late 2021. Other transactions from Caisse des Depots et Consignations and KfW (both in sterling) rounded out a day characterized by strong investor demand despite generally tight pricing. The exception came from Ville de Paris where an arguably aggressive starting spread of OAT+13 meant that cover whimpered to a final 1.09x (average since 2022 of 3.7x) and left the issuer pricing in line with IPTs. We stated earlier in the day (see IGM's SSA SNAPSHOT) that it would be interesting to note how Spanish and French issuers would fare given narrowing spreads over respective govvie yields and we think we are starting to get answers - if spreads are too tight then excess demand will not be a given and in order to facilitate a smooth transaction issuers should still be looking to offer a starting NIC of at least 3-5bp

** Two more covered bonds hit the market on Tuesday for EUR1.25bn, taking the weekly total to EUR3bn, and the May tally to EUR13.75bn. Bayerische Landesbank came with a EUR750m 7yr OP and Tatra Bank a EUR500m 5yr Slovakian offering. The former, which set out for a benchmark size, took EUR750m out of the market. Books opened at m/s +43 area and the spread was squeezed to +37 on orders of EUR1.49bn (peak over EUR1.6bn, with EUR225m of JLM). The issuer had Sep 2031 and Jun 2032 OP bonds outstanding quoted at m/s +36 and m/s +37. As such, the new deal with a May 2032 tenor came right on top, or perhaps offering a sliver of a NIC at 0.5bp. Tatra Bank set terms at m/s +50 for its EUR500m no grow 5yr deal, some 5bp inside +55 area guidance. Books had peaked at over EUR900m (including EUR75m of JLM) and eased back slightly to close in excess of EUR790m. This was the second CEE covered bond this year, following VUB Banka on 13-May with a EUR500m 7yr. New to the pipeline on the day was Erste Bank Group AG, with a 10yr Austrian mortgage covered bond

Wednesday's primary prospects

SSA:

** The African Development Bank (Aaa/AAA/AAA/AAA) hired Barclays, Citi, RBC Capital Markets and UBS to lead manage its new EUR 5yr global social benchmark

** The Federal State of Brandenburg (Aaa) mandated Barclays, DZ BANK, Goldman Sachs Bank Europe SE, NORD/LB and TD Securities to lead manage its upcoming new EUR500m no grow 10yr fixed rate Landesschatzanweisung

** MFB Hungarian Development Bank Private Limited Company (Baa2/BBB) hired BNP Paribas, Erste Group, ING, JP Morgan, Morgan Stanley and Raiffeisen Bank International as Joint Lead Managers in connection with an EUR 5yr senior unsecured benchmark transaction

** The Asian Development Bank (Aaa/AAA/AAA) is taking IoIs for a USD 5yr global benchmark at SOFR m/s +45 area IPTs via BNP Paribas, Credit Agricole CIB, RBC Capital Markets Europe and Wells Fargo Securities

** Oesterreichische Kontrollbank AG (Aa1/AA+) is working a USD 3yr global benchmark at SOFR m/s +37 area IPTs via BofA Securities, Deutsche Bank, Goldman Sachs Bank Europe SE and HSBC

** Kommunalbanken Norway (Aaa/AAA) is taking IoIs for a USD Aug 2029 benchmark at SOFR m/s +53 area IPTs via BMO, Citi, NBFI and TD

Corp:

** Australian state-owned telecom NBN Co Limited (Aa3/AA+) mandated Barclays, BNP Paribas, Credit Agricole CIB, Deutsche Bank and HSBC as Joint Bookrunners to arrange a series of fixed income investor meetings commencing 16-May. A EUR 7.5yr senior unsecured benchmark sustainability offering may follow, subject to market conditions. The notes will be issued in accordance with NBN Co Limited’s Sustainability Bond Framework. The net proceeds from the Offering will be exclusively applied to finance or refinance, in part or in full, new and/or existing eligible green and social projects that meet one or more of the categories of eligibility as recognised in the Green Bond Principles as Eligible Green Projects or the Social Bond Principles as Eligible Social Projects, each as outlined in the Framework. The allocation of funds is estimated to be a minimum of 80% for eligible green projects

** Finnish producer of folding boxboard and white kraftliners Metsa Board (Baa2/BBB-) mandated Danske Bank and SEB as Joint Lead Managers to arrange a series of fixed income investor calls and meetings commencing 19-20 May. A EUR 200-250m 6yr senior unsecured green bond offering will follow. The bonds are expected to be rated Baa2 by Moody’s. The Green Bond offering will be issued in accordance with Metsa Board's Green Finance Framework

** Unrated Belgian international energy infrastructure company Fluxys SA mandated BNP Paribas as Global Coordinator along with Belfius, Credit Agricole CIB, ING and SMBC as Active Bookrunners to arrange a series of investor calls on 19-20 May. An inaugural EUR500m no grow 5yr senior unsecured bond offering is expected to follow. The net proceeds of the issue of the notes will be used for general corporate purposes

** Belgian specialty chemicals company Syensqo SA (Baa1/BBB+) hired BNP Paribas, BofA Securities and Credit Agricole CIB as Global Coordinators together with Citi, JP Morgan, KBC and Morgan Stanley as Active Bookrunners to arrange a series of fixed income investor calls 19-20 May. A EUR two-part 6yr and 10yr benchmark fixed rate trade is expected to follow. The issuer intends to use the net proceeds for general corporate purposes. The notes are expected to be rated Baa1 by Moody’s and BBB+ by S&P

** German technology and services provider Robert Bosch GmbH (A/A) hired BNP Paribas, Deutsche Bank and Mizuho as Global Coordinators and Commerzbank, LBBW and Santander as Active Bookrunners to arrange a series of fixed-income investor calls commencing on 19-20 May for a multi-tranche euro benchmark. The deal will be made up of an 18-month floater as well as 3yr, 6yr, 9yr and 12yr fixed-rate issuers. The notes are expected to be rated A by S&P and A by Fitch. Net proceeds will be used for general corporate purposes and partial financing of the acquisition of the global HVAC business for residential and light commercial buildings from Johnson Controls International and Hitachi

** Suedzucker AG (Baa2/BBB-), a German integrated group of companies with plant-based solutions for food, animal feeding and energy industries, mandated BNP Paribas, Deutsche Bank and HSBC as Joint Global Coordinators and Structuring Agents and together with BofA Securities, ING and Rabobank as Joint Active Bookrunners, to arrange a series of fixed income investor calls commencing 19-20 May. A EUR PNC5.25 hybrid benchmark offering may follow. The bonds will be issued via Suedzucker International Finance B.V and guaranteed by Suedzucker AG. Expected to be rated Ba1/BB by Moody’s/S&P. The proceeds will be used for general corporate purposes, including refinancing of the outstanding EUR700m non-call Jun 2025 hybrid notes (ISIN: XS0222524372) which are subject of a tender offer

** Ceske drahy a.s. (Baa2), the 100% state-owned Czech national railway operator, mandated BNP Paribas and Erste Group Bank as Joint Global Coordinators and Joint Bookrunners and ING, KBC and Raiffeisen Bank International as Joint Bookrunners to arrange a series of fixed-income investor calls commencing 19-20 May. A EUR500m no grow 5yr (Jul 2030) bond offering will follow. The notes are expected to be rated Baa2 by Moody’s

** Metso Corporation (Baa2/BBB), a Finnish frontrunner in sustainable technologies, end-to-end solutions and services for aggregates production, mining, and metals refining mandated Citi, Commerzbank, Nordea, and SEB as Joint Bookrunners, to arrange a series of fixed-income investor meetings commencing 19-20 May. A EUR300m no grow 7yr will follow. The notes are expected to be rated Baa2 by Moody’s

FIG:

** J&T BANKA a.s hired BNP Paribas, Goldman Sachs Bank Europe SE, J&T BANKA, a.s, Morgan Stanley Europe SE and UniCredit Bank GmbH as Joint Lead Managers to organize a series of fixed income investor calls commencing 19-20 May. A EUR300m no grow 6NC5 Senior Preferred may follow

** Kvika banki hf mandated BofA Securities, J.P. Morgan and Morgan Stanley as Joint Bookrunners to arrange a series of fixed income investor calls commencing 19-20 May. A EUR200m 4yr Senior Preferred offering is expected to follow. The transaction is expected to be rated Baa2 by Moody’s

Covered:

** Erste Group Bank AG mandated BayernLB, Commerzbank, Credit Agricole CIB, Erste Group, Helaba, LBBW, Nykredit Bank and RBC Capital Markets to act as Joint Bookrunners for a new EUR benchmark 10yr fixed-rate Mortgage Covered Bond (Hypothekenpfandbrief). The transaction is expected to be rated Aaa by Moody’s

HY:

** Spie SA (BB+/BB+) mandated BNP Paribas, Credit Agricole CIB, Natixis and Societe Generale as Global Coordinators to arrange a series of fixed income investor meetings 19-20 May. A EUR 5yr Sustainability-Linked Bond benchmark may follow. Joint bookrunners on the offering are CIC, Commerzbank, ING, J.P Morgan and La Banque Postale

** The IGM Roadshow Calendar is your one-stop window on who, when and where. The calendar view provides an instant snapshot of which days are already earmarked for meetings in a convenient PDF format, with clickable links that take you directly to the known schedule

Tuesday's broader market developments

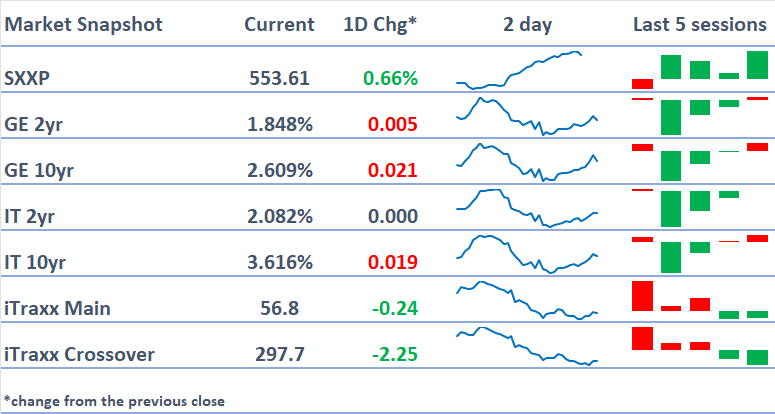

** European stocks were back to making gains on Tuesday, pushing indexes to long-term highs. Germany’s DAX hit a new all-time high in the process, surpassing 24,000 for the first time. US stocks opened up lower though, after Wall Street eked out minor gains Monday as early losses for US stocks and bonds relating to Moody’s rating cut proved transient. Over in Asia, regional indices were higher on Tuesday with positive sentiment partly chalked up to ebbing trade tensions but also comes amid some excitement generated by a successful IPO for Chinese EV battery maker CATL whose shares popped sharply higher on the Hong Kong exchange. Little in the way of data to move the needle on Tuesday, but eurozone May consumer confidence came in less negative than expected at 15.2 (f/c -16.0)

** Stoxx600 gained as much as 0.89%. All sub-sectors in the green with move higher led by Utilities

** Govvies: EGB yields were biased lower in the morning before flipping in the afternoon, with the longer-end seeing biggest jumps

** Data:

- GE May Apr PPI lower than exp at -0.6%/-0.9% MoM/YoY (f/c -0.3%/-0.6%, prev -0.7%/-0.2%)

- EC May P Consumer Confidence higher than exp at -15.2 (f/c -16.0, prev rev to -16.6 from -16.7)

What to watch Wednesday

** Key Data: JN Apr Imports/Exports (00:50), UK Apr CPI (07:00) and US Weekly MBA Mortgage Applications (12:00)

** Key Events: ECB’s Guindos (09:00), Centeno (11:00), Lane (17:00) & Escriva (18:30) speak along with Fed’s Barkin & Bowman (both 17:15)

** Auctions: UK to sell GBP4.25bn 2031 Gilts (10:00), GE to sell EUR4bn 2035 Bunds (10:30) and US to sell USD16bn 20yr Bonds (18:00)

** Earnings: 7 Stoxx600 & 4 S&P500 companies release results

All times BST

---- Subscribe to read more ----

To receive this analysis plus much more, subscribe to IGM. Request your free trial of the service today.