30th June 2025

** The week was expected to be quieter and so far we appear to be sticking closely to the script. There were deals on the day amounting to EUR6.4bn, but with EUR3bn of that from EM sovereign Republic of Poland and a further EUR1.9bn from Vodafone alone. The outlook for issuance isn't exactly bleak but at the same time we are struggling to see how we make up the numbers to reach our weekly survey estimate of EUR19bn, let alone the high estimate of EUR28.5bn. For all the details see IGM’s DAILY EUR NICS & BOOKS and IGM's DAILY GBP NICS & BOOKS for the sterling leg of Vodafone's 4-part deal.

** A duo of issuers got the week underway and simultaneously rounded off the month with Vodafone printing a 4-parter that included EUR1.9bn across EUR800m 4yr, EUR600m 8yr and EUR500m 13yr lines and also a GBP500m 25yr line. It appeared that a slightly higher starting NIC was offered on the shortest of the euro lines and even after 37.5bp were carved from the IPT it landed with a small 5bp NIC. The other two euro lines landed in line with fair value after 35bp and 32.5bp spread compressions respectively. The sterling line performed well with a 20bp refinement to land at G+120 (or with a 5bp NIC). Abertis was the only other issuer on the day bringing a new 5yr vanilla line at a deal size of EUR600m (from EUR500m originally expected) as order books peaked at EUR2.2bn. See IGM's CORP SNAPSHOT

** The last day of June signals half year end, and the pace of issuance dropped significantly on Monday in the non-covered FIG Space. Despite benign macro conditions only one issuer was seen out with EUR denominated paper for sale, Eurobank SA launching a EUR500m no grow senior preferred trade with a 3NC2 tenor. The transaction saw investors enthused and a bumper book of EUR3.5bn allowed final pricing to tighten 35bps to land at m/s+90, from IPTs m/s+125, this is 5bps through perceived fair value. Two fresh mandates were also announced, one for Zurcher Kantonalbank with a potential EUR500m no grow 5yr senior unsecured deal and the other for SOGECAP, beginning investor calls on a possible RT1 trade in conjunction with a tender offer for its undated subordinated notes (ISIN: FR0012383982).See IGM’s FIG SNAPSHOT

** The IGM issuance survey suggested a quiet week for SSA activity with an average guess of just EUR6.5bn. The week has kicked off in an interesting manner with a EUR3bn dual tranche deal from the Republic of Poland. Some may consider that to be an EM issuer, and that is how it will be treated in our numbers, but the deal is worthy of a mention nonetheless. The EUR1.75bn 7yr and EUR1.25bn 12yr green transaction saw EUR5.9bn of orders in the book with a skew to the shorter line (peak orders were circulated at EUR7.4bn). The 12yr was the first from the issuer with a green label since Feb 2019. We assigned 5bp NICs on each line after 35bp and 30bp of spread compression respectively. Pointing to a busier Tuesday, in deal numbers at least, we received mandates from the Flemish Community (new EUR 15yr) and Rentenbank (EUR1bn 7yr green) along with notification that a new GBP denominated Oct 2028 could emerge from KEXIM after it concluded a recent round of investor meetings in London last week. See IGM's SSA SNAPSHOT

** While there was no covered issuance on Monday, Crelan Home Loan SCF took the opportunity to announce its first euro CB since 2022. The Belgian borrower is expected to launch a EUR500m no-grow deal via a 5yr soon.

** Participants in our survey predict supply to continue tapering down next week with a EUR19bn average estimate put forward. All the asset classes anticipate reduced activity. See IGM's Euro Issuance Estimates (w/c 30-Jun-2025)

** The IGM European Weekly Credit Overview is your comprehensive round-up of primary European new issue activity including pricing, order book information, new issue concessions and ISINs

Tuesday’s primary prospects

SSA:

** The Export-Import Bank of Korea (Aa2/AA/AA-) has selected Deutsche Bank, HSBC and Morgan Stanley as Joint Lead Managers for a GBP 3yr Reg S senior unsecured notes offering.

** The Flemish Community (AA-) has recruited Deutsche Bank, HSBC, ING and UniCredit to lead manage a EUR 22-Jun-2040 fixed rate transaction.

** Rentenbank (AAA/AAA/AAA), guaranteed by the Federal Republic of Germany, has mandated Commerzbank, LBBW, TD Securities and UBS to lead manage a EUR1bn no grow Reg S Cat1, Bearer Green Benchmark transaction due 08 July 2032.

Corporates:

** Servicios Financieros Carrefour (BBB-) has appointed BNP Paribas, Santander and Societe Generale as Global Coordinators, along with BBVA and Credit Agricole CIB as Active Bookrunners on a debut EUR500m no grow 4yr senior unsecured bond offering.

FIG:

** SOGECAP (A-) has employed Societe Generale as Sole Structuring Advisor and Sole Bookrunner for a EUR PNC10.5 Reg S bearer Restricted Tier 1 notes issue, expected to be rated BBB-.

** Zürcher Kantonalbank (Aaa/AAA/AAA), guaranteed by the Canton of Zurich, has hired BNP PARIBAS, Deutsche Bank, UBS Investment Bank and Zürcher Kantonalbank on a EUR500m no grow 5yr Senior Unsecured Bond, expected to be rated AAA.

Covered:

** Crelan Home Loan SCF (Sponsor: Crelan SA, rated A/A2) has mandated BNP Paribas, Commerzbank, Crédit Agricole CIB, ING and NORD/LB as Joint Bookrunners to lead manage a EUR500m no grow 5yr fixed rate soft bullet covered bond (backed by 100% Belgian Prime residential mortgage) transaction, expected to be rated Aaa.

HY:

** Carnival plc hired JPM, BARC, BNPP as Physical Bookrunners, BOFA, CITI, GS, INTESA, LLOYDS, MIZ, MS, PNC, SMBC, TRUIST, WFC as Joint Bookrunners and BBVA, CITIZENS, COMMERZ, CACIB, NATWEST, SCOTIA, CAIXA, DZ, HUNTINGTON, SANT as Co-Managers for a EUR1bn 6NCL, 3 month par call Senior Unsecured Notes, rated Ba3/BB+. IPTs are 4.5-4.75%.

** Modulaire Group recruited JP Morgan, Morgan Stanley as Joint Global Coordinators and Joint Physical Bookrunners, BofA as Joint Physical Bookrunner and GS, Santander, Wells Fargo, HSBC, ING, SG, Brookfield as Joint Bookrunners for a min EUR500m 6NC2 Senior Secured Note, expected ratings B2/B/B+.

** Omnia Technologies (B3/B/B) has mandated JPM as Sole Physical Bookrunner, JPM, IMI-Intesa Sanpaolo, BNPP, Mediobanca, UniCredit as Joint Global Coordinators and Barclays, BPER, Rabobank as Joint Bookrunners for a EUR100m Senior Secured Floating Rate Notes Fungible Tap of the 05 November 2031 issue, rated B3/B/B. IPTs are 98.5-99.

** The IGM Roadshow Calendar is your one-stop window on who, when and where. The calendar view provides an instant snapshot of which days are already earmarked for meetings in a convenient PDF format, with clickable links that take you directly to the known schedule

Monday's broader market developments

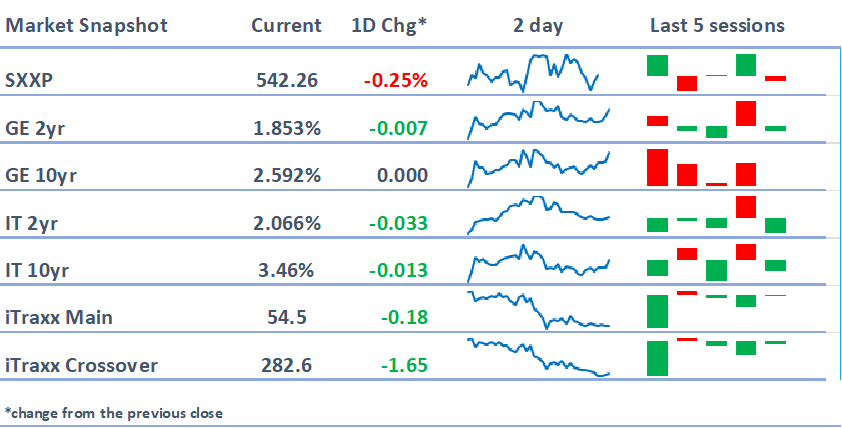

** European stocks appeared to be under a touch of pressure Monday with some light clouds gathering, this time surrounding Trump's Big Beautiful Bill, and the likelihood that it gets completed and signed in before 4th July (Friday). Canada backed down on its digital services tax (and thereby re-opened the door to US talks) and ongoing tariff discussions between the US and EU/China were allegedly progressing well but that didn't translate into a positive risk tone. The ECB's Guindos said early in the day that although Q1 growth "was good", growth in Q2 and Q3 "will be almost flat", citing "brutal uncertainty" surrounding global trade policy. On the data-front, Italy June CPI rose 10bp to 1.7%% MoM. Elsewhere, local Germany CPI came in mostly higher than last month but the headline national CPI figure was below consensus at 2.0% and bang in line with the ECB target.

** Stoxx600: -0.25% at the time of writing having spent much of the day in mildly negative territory. Real estate and consumer staples small positives but most other sub-sectors losing ground.

** Govvies: EGB curves all moved lower in the morning but a small steepening bias won over as the day progressed and long end bonds looked to close the day with marginally higher yields.

** Data:

- JN May P Industrial Production missed at 0.5% MoM (exp 3.5%, prev -1.1%)

- CH Jun Manufacturing/Non-Manufacturing PMIs marginally ahead of f/c at 49.7 / 50.5 (exp 49.6 / 50.3)

- GE May Retail Sales missed at -1.6% (exp 0.5%, prev -0.6%)

- UK Q1 F GDP in line at 1.3% YoY

- EC May M3 Money Supply marginal miss at 3.9% (exp 4%, prev 3.9%)

- UK May Mortgage Approvals slightly higher than f/c at 63k (exp 60.8k, prev 60.7k)

- IT Jun P CPI EU Harmonised lower than f/c at 1.7% YoY (exp 1.8%)

- GE Jun P CPI lower than f/c at 2% (exp 2.2%)

- US Jun MNI Chicago PMI lower than f/c at 40.4 (exp 43)

- US Jun Dallas Fed Manufacturing Activity lower than f/c at -12.7 (exp -10)

What to watch Tuesday

** Key Data: JN 2Q Tankan Large Mfg Outlook (00:50), JN Jun F S&P Global Japan PMI Mfg (01:30), CH Jun Caixin China PMI Mfg (02:45), UK Jun Nationwide House Px NSA YoY (07:00), SP Jun HCOB Spain Mfg PMI (08:15), IT Jun HCOB Italy Mfg PMI (08:45), FR Jun F HCOB France Mfg PMI (08:50), GE Jun Unemployment Claims Rate (08:55), GE Jun F HCOB Germany Mfg PMI (08:55), ECB 1 Year CPI Expectations (09:00), EC Jun F HCOB Eurozone Mfg PMI (09:00), UK Jun F S&P Global UK Mfg PMI (09:30), EC Jun P CPI MoM (10:00), EC Jun P CPI Core YoY (10:00), US Jun F S&P Global US Mfg PMI (14:45), US Jun ISM Mfg (15:00), US Jun ISM Prices Paid (15:00), US May Construction Spending MoM (15:00), US May JOLTS Job Openings (15:00)

** Key Events: ECB's Guindos chairs panel in Sintra (08:30), ECB's Elderson chairs panel in Sintra (09:40), ECB's Schnabel chairs panel in Sintra (11:40), ECB Lagarde, Fed Powell, BOE Bailey, BOJ Ueda, BOK Rhee (14:30)

** Government Auctions: Japan to sell JPY2,600bn 10yr bonds (04:35), UK to sell GBP2bn 2053 bonds (10:00)

** Earnings: 1 S&P500 company releases results

All times BST

---- Subscribe to read more ----

To receive this analysis plus much more, subscribe to IGM. Request your free trial of the service today.