11th June, 2025

** It was a busy midweek session as expected, with plenty of variety on offer as a mixture of previously pipelined and opportunistic names decided to make the most of strong issuance conditions. The EIB was the volume booster with a EUR5bn 10yr CAB EARN, but the IG corporate market led the way by deal numbers, as has been the case for large parts of 2025 so far. All in, the day’s euro total finished up at EUR17.8bn to add to Tuesday’s EUR13.775bn, putting the weekly total at EUR31.575bn. Of that, EUR29.46bn has come via IG issuers and means we are just short of the average supply forecast of EUR31.5bn given in our weekly issuance poll, whilst a number of names are already in the pipeline ahead of Thursday’s business, meaning the highest guess of EUR44.5bn looks like it could be in play. See the IGM DAILY EUR NICS & BOOKS for the full breakdown of Wednesday’s single currency trades

** Wednesday's SSA new issue market featured three issuers raising a combined EUR7bn across sustainability and green bonds, all demonstrating strong investor demand and continuing recent robust investor reception. As expected, the European Investment Bank (EIB) dominated proceedings with a EUR5bn 10yr CAB EARN green bond that attracted an impressive EUR53.4bn order book (10.7x oversubscribed). The deal priced at m/s +36bp, tightening 3bp from initial price talk and leaving a minimal (1bp) NIC. French agency issuer Agence Francaise de Developpement (AFD) issued a EUR1.5bn long 5yr sustainability bond with a EUR4bn order book which equated to a 2.7x cover ratio. Final pricing on that one landed at OAT+21bp, representing a 3bp spread compression from IPT to re-offer. The Autonomous Community of Galicia rounded off the day's action with a EUR500m 7yr sustainability bond that was sold into a EUR1.85bn order book (3.7x) at SPGB+12 and a full 6bp inside initial talk. See IGM's SSA SNAPSHOT

** It was a busy session for the European IG corporate bond market Wednesday with six borrowers offering euros and one sterling, all having held roadshows or calls earlier in the week. Garnering the most headlines, and indeed orders, was RWE AG (EUR1bn no grow two-part 30NC5.25 and 30NC8 green hybrid) which offered its first subordinated paper in ten-years. Combined demand for the trades peaked at EUR10.5bn and allowed leads to cut 55bps off the respective IPTs of 4.75% area and 5.25% area. Urenco saw the keenest price of all on the day, printing its EUR500m no grow 10yr some 42.5bps inside the mid-point of IPTs and with a -5bp NIC, although that came at the expense of some investor orders which ended up at EUR2.4bn from a EUR3.7bn peak. Three more names added to the year’s bumper reverse yankee haul in the form of Amphenol Corp (EUR600m 7yr), Realty Income Corp (EUR1.3bn equally weighted 6/10yr two-part; +2bp/-4.5bp NICs) and Oncor (EUR700m 9yr secured). No books were communicated on the two former trades due to the SEC-registered natures, but Oncor saw strong interest of EUR2.8bn (also peak). Rounding off the day’s euro issuance was Alfa Laval (EUR300m Sep 2031s) whose sub-benchmark deal landed at m/s +92 (4.5bp NIC) on fairly measured final demand of EUR800m. Away from the single currency, ABP Finance plc (GBP300m no grow 12yr secured) offered a sterling option alongside a tender offer of its only outstanding note, with the new trade 5.33x covered. See the IGM CORP SNAPSHOT

** Wednesday’s activity in the non-covered FIG sector saw five borrowers tap the market across a variety of formats. Assicurazioni Generali S.p.A led the way with a EUR500m no grow 11yr Tier 2 deal which priced at m/ s+155, tightening 30ps from IPTs with books seen at EUR1.35bn at allocations although earlier had peaked at EUR2.6bn. Investec Bank plc offered a 3yr OpCo senior FRN - the first time since 2004 that the issuer had chosen that format. However, the EUR500m no grow deal struggled to gain traction and it eventually priced in line with IPTs after attracting orders of EUR780m. Julius Baer Group Ltd, an infrequent visitor, also chose the senior unsecured route in bringing a 5yr EUR500m no grow deal. Pricing at m/s +125 from IPTs of m/s +150 area left an implied NIC of 5bps. Books were seen at EUR1.9bn at allocation. OP Corporate Bank plc was out with a 5yr senior preferred transaction, the EUR500m sized offering pricing at m/s +65 from IPTs of m/s +90 area. Books peaked at EUR1.2bn but eased to EUR825m at allocation. Finally, Pacific Life Global Funding II who have not been seen in the single currency since 2002 returned with a 6yr Green FABN deal, no doubt on the back of last week’s successful FABN trades from New York Life Global Funding and MassMutual Global Funding II. The EUR600m trade priced at m/s +95 and 20bp inside IPTs of m/s +115 area (books were seen at EUR1.4bn at allocation). See IGM’s FIG SNAPSHOT

** Another three names hit the covered bond market to raise EUR2bn, putting the weekly total at EUR5.85bn. Emerging from the pipeline on the day we had Bank of New Zealand (EUR750m 5yr NZ mortgage-backed) and Nord/LB (EUR500m no grow Sep 2029 Hypothekenpfandbrief) which priced with NICs of around 1bp and 2bps respectively. That after BNZ was squeezed in 6bps from initial guidance of m/s +52 area on demand of EUR1.45bn (EUR1.7bn peak), whilst NordLB saw books of EUR1.175bn (EUR1.35bn peak) facilitate a 5bps compression to land at m/s +31. Taking an opportunistic approach on the day was Monte dei Paschi di Siena S.p.A (EUR750m Jan 2031 Conditional Pass Through Obbligazioni Bancarie Garantite Europee). Investor interest on this one settled at EUR1bn (EUR1.55bn peak) to see the bond go from guidance of m/s +60 area to a +54 reoffer. The final NIC was seen around 1bp. Looking ahead to Thursday and OTP Mortgage Bank (EUR500m no grow 5yr Hungarian residential mortgage loans-backed) finished calls Tuesday for its own offering and announced that it was seeking feedback in the m/s +low 80s having engaged with over 40 investors. Fresh in the pipeline Wednesday was Equitable Bank with a EUR long 3yr line backed by Canadian residential mortgages. That will come after peer BNS issued a EUR1.25bn Jun 2029 Canadian line on Tuesday at m/s +36 into demand of EUR1.9bn+

Thursday's primary prospects

SSA:

** Council of Europe Development Bank (Aaa/AAA/AAA) mandated Barclays, BNP Paribas, Morgan Stanley and Nomura to lead manage a new EUR 10yr benchmark

** SFIL (Aa3/AA-/AA) hired Credit Agricole CIB, Deutsche Bank, Goldman Sachs Bank Europe SE, HSBC Continental Europe, La Banque Postale and Nomura to lead manage its upcoming EUR 7yr

** Investitionsbank des Landes Brandenburg (AAA) asked Deutsche Bank, Helaba, LBBW, NORD/LB and UniCredit as joint lead managers for its upcoming EUR500m no grow Mar 2031 senior unsecured transaction

** Nederlandse Financierings-Maatschappij voor Ontwikkelingslanden N.V mandated HSBC Continental Europe, ING, J.P. Morgan SE as Joint Lead Managers to arrange a series of fixed income investor calls commencing 10-Jun. A new EUR300m no grow 11NC6 Tier 2 subordinated transaction, which is expected to be rated AA+ (Fitch), will follow

** The City of Madrid (Baa1/AH) hired Banco Sabadell, Deutsche Bank and Santander as Joint Bookrunners to arrange a series of fixed income investor calls commencing 10-11 Jun. A EUR220m no grow Oct 2035 senior unsecured trade is to follow

** Export Development Canada (Aaa/AAA) is working a USD 5yr global benchmark at SOFR m/s +45 area IPTs via BofA, CIBC, Nomura, RBC and TD

Corp:

** Belgium’s leading postal operator and a provider of international third-party logistics and global cross-border services bpost SA/NV (A-), has mandated BNP Paribas, BofA Securities and ING as Joint Global Coordinators and Joint Bookrunners and Belfius and KBC as additional Joint Bookrunners, to arrange a series of fixed income investor calls 10-11 Jun. A EUR 7yr benchmark transaction is to follow. Net proceeds from the issue of the bonds will be applied by the issuer towards the cash tender offer for its outstanding EUR650m 1.25% Jul 2026 fixed rate notes issued in 2018 (ISIN BE0002601798)

FIG:

** GA Global Funding Trust mandated BNP PARIBAS, Morgan Stanley, NATIXIS, and KKR Capital Markets to arrange a series of fixed income investor calls 10-Jun. A EUR 7yr benchmark offering backed by a funding agreement issued by Forethought Life Insurance Company may follow. Expected issuance ratings of A2 (Stable), A (Stable) and A (Stable) by Moody’s, S&P and Fitch respectively

** Malakoff Humanis Prevoyance asked Natixis and Societe Generale as Global Coordinators, and Credit Agricole CIB, JP Morgan, Natixis and Societe Generale as Joint Bookrunners to arrange a series of fixed income investor calls commencing 10-Jun. A EUR 10yr benchmark Tier 2 offering will follow. The transaction is expected to be rated A- by S&P

** Gothaer Allgemeine Versicherung AG has mandated Citi & Deutsche Bank as Joint Structuring Advisors and Joint Global Coordinators to the Issuer and Citi, Deutsche Bank and LBBW as Joint Lead Managers to arrange a series of fixed income investor calls commencing 10-Jun. A EUR250m (exp) 20NC10 Tier 2 transaction is expected to follow. The notes are expected to be rated BBB+ by S&P

** Volkswagen Bank GmbH (A1/BBB+/A-) hired ABN AMRO, Commerzbank, RBC Capital Markets and Santander as Joint Active Bookrunners to arrange a series of fixed income investor calls on 11-Jun. A debut EUR dual-tranche MREL-eligible senior preferred benchmark bond offering in green format with 3yr and 6yr tenors is expected to follow

Covered:

** Equitable Bank mandated Barclays, Commerzbank, DZ BANK, Erste Group, LBBW, Scotiabank and TD Securities as Joint Lead Managers to arrange a series of virtual fixed-income meetings commencing 11-Jun. A EUR long-3yr EUR benchmark soft-bullet covered bond backed by Canadian residential mortgages will follow. Expected to be rated Aa1 by Moody’s and AA+ (pos) by Fitch

** OTP Mortgage Bank Ltd mandated BNP Paribas, Commerzbank, Erste Group, Helaba and OTP Bank as Joint Bookrunners for its EUR500m no grow 5yr covered transaction backed by 100% Hungarian HUF-denominated residential mortgage loans. The issue is expected to be rated A1 by Moody's

HY:

** Bausch & Lomb mandated Barc, Citi, GS, HSBC, Wells Fargo as Joint Bookrunners and DB, DNB, RBC, Truist Securities as Co-Managers for a EUR600m 5.5NC1 secured FRN. IPTs are 3mE +425-450. Expected ratings are B1 / B / BB (Moody’s/S&P/Fitch)

** The IGM Roadshow Calendar is your one-stop window on who, when and where. The calendar view provides an instant snapshot of which days are already earmarked for meetings in a convenient PDF format, with clickable links that take you directly to the known schedule

Wednesday's broader market developments

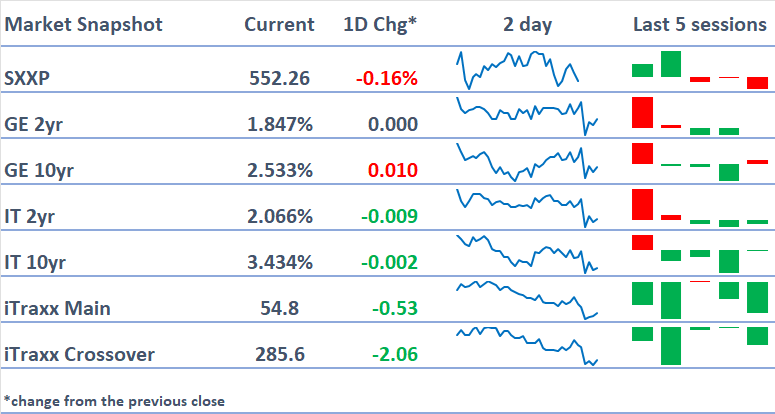

** European stocks lacked a clear direction on Wednesday, with moves small in nature. The day’s main attraction was the US CPI print which was ultimately softer-than-expected. The headline YoY was +10bp to 2.4% as expected, although the MoM slowed 10bp to 0.1% vs the 0.2% consensus. The core y/y was unchanged at 2.8%, -10bp under consensus - which is the fourth straight month data has come in less than forecasts. US president Trump said that a deal with China is “done” and that he will work with China’s Xi to open up trade to China. That after talks in London at the start of the week where US Treasury Representative Lutnick described that a "framework" for trade implementation had been agreed

** Stoxx600 traded in a narrow +0.2%/-0.24% range. Real Estate and Tech underperformed

** Govvies: EGB yields mostly higher with a whiff of bear steepening on the day

** Data:

- JN May PPI lower than exp at 3.2% (f/c 3.5%, prev rev to 4.1% from 4.0%)

- US Weekly MBA Mortgage Applications jumped to 12.5% (prev -3.9%)

- US May CPI as exp at 2.4% YoY (prev 2.3%), whilst MoM number lower than exp at 0.1% (f/c & prev 0.2%)

---- Subscribe to read more ----

To receive this analysis plus much more, subscribe to IGM. Request your free trial of the service today.