European Breakfast Briefing

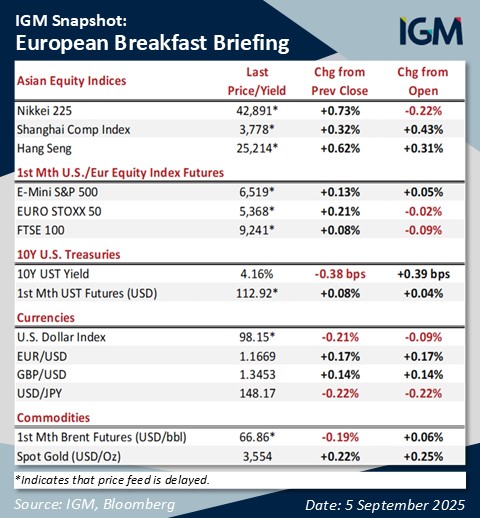

Market Snapshot

- Trump signs order on lower Japanese tariffs; US NFPs due today, but revisions look set to be the main focus

- Gold: Holding within sight of record high as US NFPs loom

- OIL: Remaining near two-week lows as expectations build for more unwinding of OPEC+ production cuts

- FX: Dollar softer in Asia, but extends meandering performance ahead of US NFPs release; USD/JPY back near 148.00 after Wednesday's failed breach of 149.00 (went to 149.14)

- BONDS: Treasuries continue to drift higher as US NFPs loom; JGB futures add to overnight gains as Trump signs US-Japan trade deal, bonds shrug off hot cash earnings data

- JAPAN: Cash earnings comes in hotter than expected in Jul, keeping BOJ rate hike bets warm

- NEW ZEALAND: Westpac suggests RBNZ reform measures with new Governor due "within weeks"

Asian Morning Session

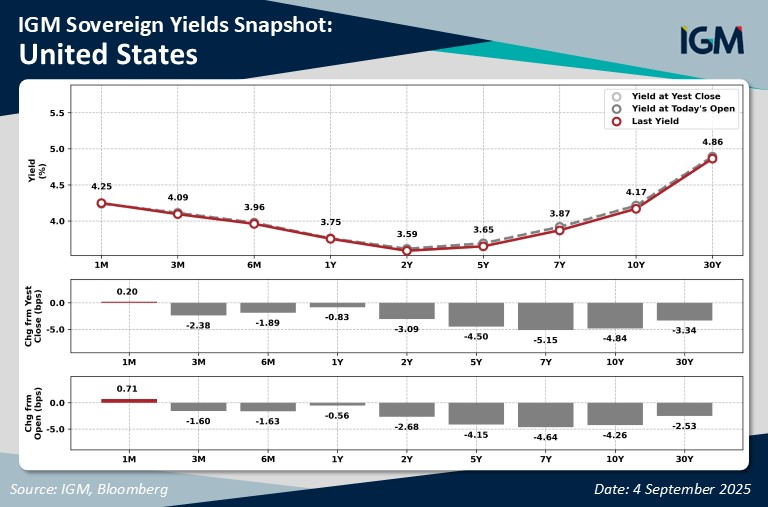

Treasuries have nudged a little higher in Asia, with participants happy to push yields lower for a third straight day as US economic data in the run-up to tonight's US NFPs release (due 1230GMT) has generally pointed to a softening in labour market conditions. Yields out to 10s are trading at around four-month lows at writing, while yields at the longer end of the curve are richened in recent sessions to a lesser extent (three-week low for 30s by comparison), pointing to the continued steepening of the Treasury curve as the Fed has met with pressure to cut rates - as well as the possibility of members of the Board being replaced with Governors of more dovish leanings

- See: US Labor Preview for August 2025: The Good, the Bad, and the Ugly (An Update)

The US dollar (DXY: -0.3%) trades on the back foot at writing, reversing Thursday's more modest ~0.2% gain, with the greenback seen trading in a range around the top of Tuesday's ~0.6% surge - recalling that the buck had surged to a one-week high on the return of the US from the extended holiday weekend. Price action has been unremarkable since then as we have headed into tonight's US NFPs release (due 1230GMT)

Gold is ~$5/oz firmer at ~$3,550/oz at writing, partially paring Thursday’s ~$14/oz decline and holding near the record high of $3,578.51/oz reached during Wednesday’s US session. The metal remains buoyed by political pressure on the Fed’s independence and a recent court ruling that declared Trump-era tariffs unlawful, signalling the prospect of government repayment, though no conclusion has been reached. The greenback and real yields continue to languish near year-to-date lows.

- See: GOLD: Holds Near Wednesday’s Record High Amidst Soft Labour Market Signals Ahead of Today's NFPs Release

WTI (Oct contract) and Brent (Nov contract) are ~$0.15 softer at ~$63.30 and ~$66.85 apiece, with both benchmarks extending Thursday’s ~$0.50 drop for WTI and ~$1.00 decline for Brent. Prices are on track to close lower for a third consecutive day as they head towards ~two-week lows seen in yesterday’s European session at $62.72 (WTI) and $66.35 (Brent). Caution persists heading into Sunday’s OPEC+ meeting, as traders brace for a potential increase in crude output.

- See: OIL: Sticking Near Two-Week Lows As Caution Builds Ahead of Sunday's OPEC+ Meeting; Surprise US Crude Inventories Build

Earlier in the day, US president Trump signed a formal order to reduce tariffs on Japanese goods, with the heavyweight automobile sector set to get their rate reduced to 15% from 27.5% currently. Tariff rates on most products shipped out of Japan will also come under a maximum 15% tariff. The measures will take place seven days from now for some products (mainly aerospace and automobile shipments), although some will be retroactive to 7 Aug. This ends months of uncertainty re: US intent to reduce tariffs on cars (announced back in Jul)

- Elsewhere in the country and on a linked topic, Japanese PM Ishiba stated again that he intends to stay on, pointing to his achievement in getting the US-Japan trade deal signed. Note that Ishiba will face a party vote on Monday to decide if a leadership contest will be brought forward - which would force him to step down

- As it stands, some lawmakers are said to have not made up their minds, leaving Ishiba fate in the balance (at least re: an early leadership election) for now

From Thursday, the ADP labour market report for Aug showed a decent-sized undershoot in employment gains (+54K; BBG median +68K; Jul revised +106K, was +104K). Weekly jobless claims saw initial claims surpass forecasts (237K; BBG median 230K; prev. 229K), while continuing claims were a tad below forecasts (1,940K; BBG median 1,959K; prev. revised 1,944K, was 1,954K). The latter measure remains elevated despite coming in below projections, pointing to jobseekers finding difficulty in securing fresh employment. Compounding the negative read of labour market matters on Thursday, the ISM Services Employment sub-gauge for Aug undershot forecasts as well (46.5; BBG median 46.7; Jul 46.4)

Looking to the confirmation hearing of Fed Gov nominee Stephen Miran held on Thursday, it seems like Miran is well on his way to fill the seat vacated by former Fed Gov Kugler. Beyond that, this would very likely take the Board to three Fed Govs leaning towards a rate cut, given the present climate under which Miran is being nominated (mainly White House pressure on the Fed to cut rates), while Fed Gov Waller and Fed Gov Bowman have been very vocal about their support for cuts

- Thursday's hearing went about as well as can be expected, with questions largely set along partisan lines in the Senate. In any case, while Miran has emphasised that he will remain independent of Trump, he has decided to retain his role as chair of the White House Council of Economic Advisers (CEA - he's instead taking an unpaid leave of absence), which throws up obvious questions of who his boss will be during his (probable) term at the Fed

NY Fed Pres Williams (permanent voter) said that it remains appropriate to cut rates "over time", essentially declining to name a timeframe for rate cuts when speaking on Thursday. Note that he had said in end-Aug that every meeting from now is essentially "live". He also said on Thursday that the Fed is currently facing a "delicate balancing" of labour market and inflation risks, although risks to employment have nudged "a little higher", while concern over inflation has moved "a little bit lower" - perhaps setting up tonight's NFPs release to be of importance to his views come the Sep FOMC

Cleveland Fed Pres Hammack ('26 voter) said in an interview published on Thursday (conducted on Wednesday) that she sees no case for a rate cut in Sep, saying that "inflation is still too high and we're trending in the wrong direction". Price pressures faced by business leaders seem to be from a mix of tariff- and non-tariff-related causes. She said that many businesses "have been trying to keep prices low to maintain their market share, but that's not going to last forever"

FOREX: DXY is a tad soft in Asia trade, -0.24% at 98.115, and at this rate, -0.1% over the past week, -0.7% in the past month, and -9.5% YTD. USD underperforming against all its G10 peers, and in the Asia FX space, except for MYR and IDR on par. DXY remains subdued below the 100-day MA near 98.690, and it would require a push beyond 98.834 and 99.320 to alleviate the risk of a relapse into the 97.109-97.536 support zone. A close below the 50-day MA near 98.070 is ominous. Key intraday levels to watch: 97.536 and 98.834.

- EUR/USD is poised to surmount $1.1743 and $1.1789 to retest the July year-to-date of $1.1829. However, the pair has closed below the 50-day MA near $1.1665 for a third consecutive session on Thursday, risking a recoil below $1.1574 to hinge on the rising 100-day MA near 1.1525 for support. The pair is still on the front foot, barring a selloff below the August base of $1.1392. Key intraday levels to watch are $1.1574 and $1.1743.

- USD/JPY remains upright after pushing to a 5-week high of 149.14 on Wednesday. The rally stemming from the rising 50-day MA near 147.25 aims at the August peak of 150.92. A recoil below the 50-day MA will compromise the support zone of 145.86-146.21.. Key intraday levels to watch are 146.58 and 149.14.

- AID/USD continues to stay in range of the mid-August lower top of $0.6569 despite Tuesday's fall to $0.6484. The pair looks set to continue its winning ways, but a recoil below $0.6463 could put paid to the scenario by moving against the August tweezers bottom of $0.6415. Notably, the pair is also responding positively to a rising 100-day MA near 0.6485.. Key intraday levels to watch are $0.6484 and $0.6569.

- NZD/USD is prone to strategies fading into interim rallies ahead of the mid-August lower high of $0.5996. Currently, the pair is hinged on the 200-day MA near 0.5830 for support. Impending losses below $0.5800 might reach $0.5728 (61.8% retracement of Apr-Jul's $0.5486-$0.6120 advance). Watch the falling 50-day MA near 0.5950 for a tilt in the balance of risk. Key intraday levels to watch are $0.5818 and $0.5915.

BONDS: Treasuries have nudged a little higher in Asia-Pac hours, putting them on track to richen for a third straight session as we have headed into today's release of US NFPs for Aug (out at 1230GMT). The ongoing bid in Treasuries has sent yields across the curve to their lowest point in around four months (at least out to 10s), with a reduced scale of richening seen in long-end bonds for now as Fed independence-related matters have continued to weigh on longer-dated debt

- The 5s30s spread is at ~121bp last, continuing to hover below its recent multi-year high of ~124bp logged on Wednesday, remaining much higher than levels seen at the start of the year (was at ~40bp), underscoring the recent scale of the curve steepening action

- TYZ5 +0-02+ at 112-29+ on decent volume of ~70K lots, operating around the middle of a 0-03 range established since the open, just off fresh multi-month highs (at 112-31)

- ACGBs are mixed heading into the close, with 10s continuing to provide the sole point of underperformance on the curve, while other tenors are just a tad cheaper on the day. Yields have been seen nudging higher from the open (around 1.5bp of cheapening so far), underscoring the limited scale of today's moves in any case, with nothing on the domestic data docket for participants to latch on to. YM is -0.5, not that much changed from its overnight close (-1.0), having respected the boundaries of its overnight range so far. XM is +1.0, just a tad above its overnight close (+0.5), similarly keeping within its overnight range as well. Bills run flat to 2 ticks cheaper through the reds

- JGB futures are +24 ticks at 137.87 in the second half, off bests (+30 ticks at 137.93 - a three-week high), but still above its overnight close (+10 ticks at 137.73), with JGBs seen buoyed a little by headlines of US president Trump signing an order formalising lower tariff rates on Japanese goods. JGB futures are on track to rise for a third straight day, rallying from a multi-month low of 137.21 logged on 1 Sep in limited fashion

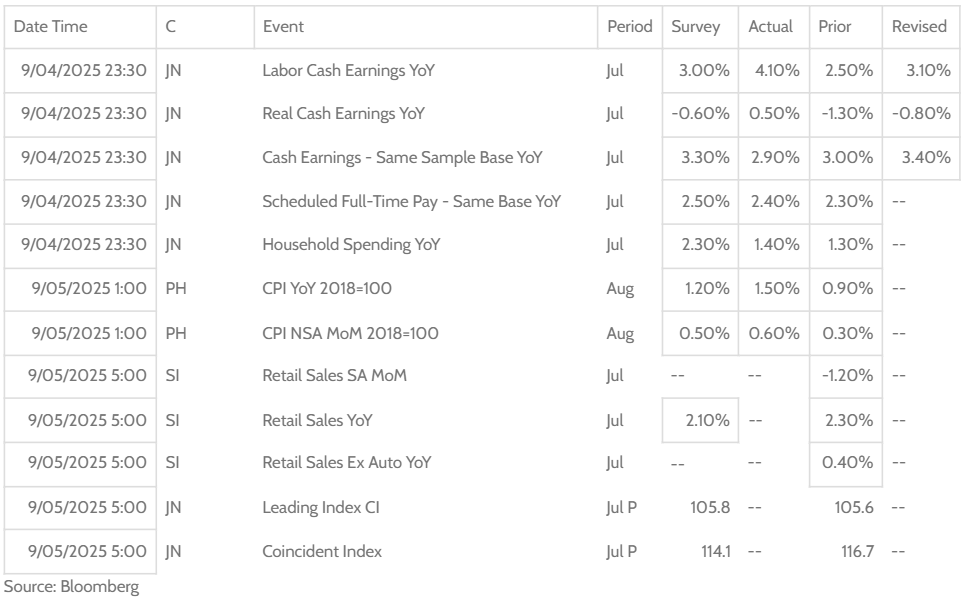

JAPAN: Cash earnings data for Jul was released early today, showing a large upside surprise to both nominal labour cash earnings and real cash earnings. The latter was noted to have climbed out of negative territory for the first time in seven months, while headline cash earnings grew at its fastest pace since Dec '24 as well. Things were a little more restrained in the other metrics, with base salaries seen rising at a more modest 2.5%, while the measure accounting for samping issues and excluding bonuses and overtime was seen coming in a tad below forecasts

All in all, the Jul cash earnings report does point to wage growth momentum in Japan picking up the pace, which should go some way to raising expectations for the BOJ to tighten monetary policy in the coming months - although the timing of such a decision is surely the key topic of debate here. Looking at the latter, OIS markets are still pricing in virtually zero odds of a 25bp rate hike come the 19 Sep monetary policy decision. A cumulative ~13bp of rate hikes is priced in through to the end-'25 monetary policy meeting, pointing to slightly above even odds that the BOJ will opt to tighten monetary policy at the end of the year

Apart from that, real household spending was weak in Jul, with the measure seen coming in below forecasts, growing marginally from Jun on a Y/Y basis. The softness in Jul came in part from a drop in spending on housing (-5.9% Y/Y; Jun +11.6%) and culture & recreation (-4.1%; Jun -1.0%), while also tracking a worsening of real household incomes (-2.5%; Jun -1.7%) as inflation has stayed high. All in all, nothing too surprising here given well-documented pressure on the Japanese consumer from still-nascent wage growth momentum, as well as elevated costs of living

AUSTRALIA: STIR markets are continuing to price in ~12% odds of a 25bp rate cut come the RBA's 30 Sep monetary policy decision, retaining the drop in pricing seen after Wednesday's Q2 CPI release (was ~25% odds prior to that data release). Further out, a cumulative ~23bp of rate cuts is priced in through to the Nov '25 monetary policy decision (was ~21bp on Thursday), still below the ~26bp priced in ahead of Wednesday's Q2 GDP release, pointing to a return of confidence re: the RBA opting for at least one rate cut across the next two monetary policy meetings

NEW ZEALAND: Westpac said that with the appointment of the new RBNZ Gov expected this month, the Reserve Bank should embark on a suite of reforms. The suggestions include:

- Organising formal votes by the MPC re: monetary policy decisions, and publicising the votes of the various members of the MPC - as well as including information on their views of the RBNZ's forecasts

- One more monetary policy meeting in Jan - annual total will be eight

- All meetings should be followed by a press conference

- The three external committee members should be made to deliver more speeches

- Consider raising the actual inflation target to 2.5% (currently stated to be the mid-point between 1% to 3%)

Some of these suggestions are nothing new to the discussion - the RBNZ is looking to add at least one more meeting to its otherwise three-month long summer break period. Note that NZ PM Luxon has said that he expects to name a new RBNZ governor "within weeks"

ASIA-PAC DATA RELEASES

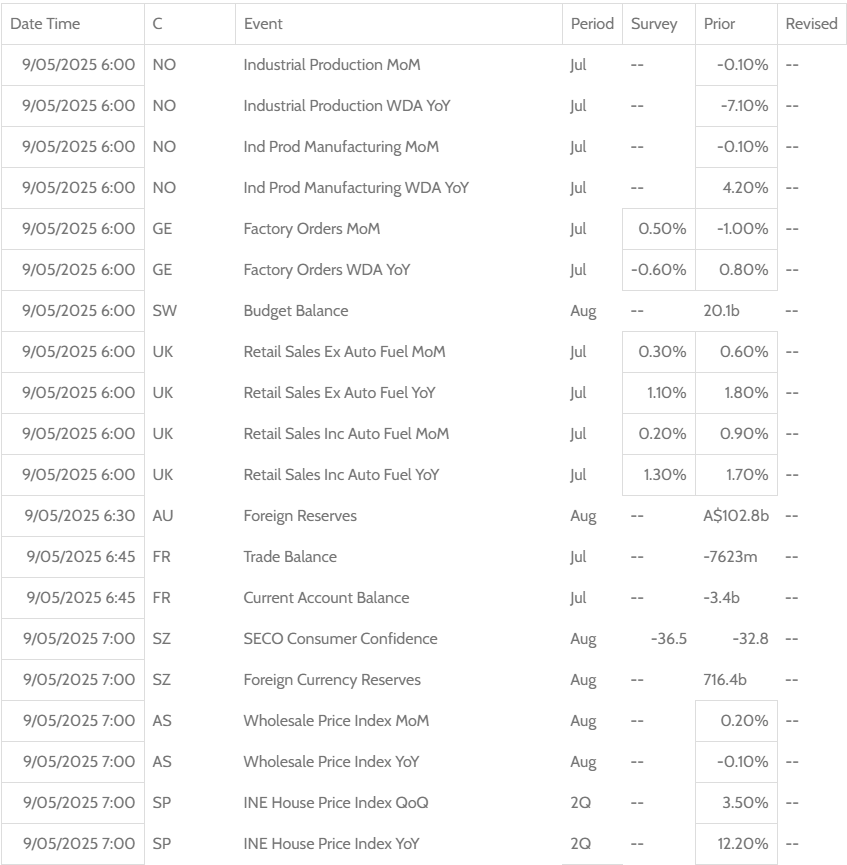

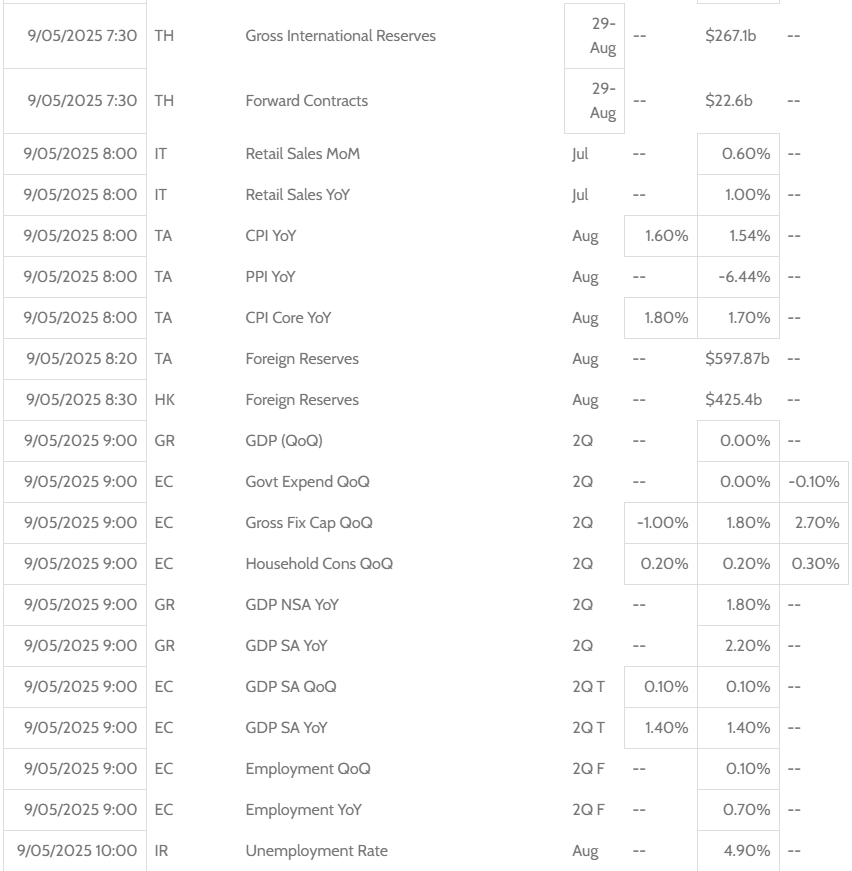

European Preview

Things are expected to get busier in European hours, with UK retail sales for Jul, German factory orders for Jul, and Norwegian industrial production for Jul out at 0600HRS. French trade data for Jul (0645GMT) and Italian retail sales for Jul (0800GMT) are on tap as well, ahead of the third reading of euro-area GDP at 0900GMT

There is no European central bank-speak of note scheduled for Friday, with the ECB noted to be in its pre-decision Quiet Period

Over in NY hours,

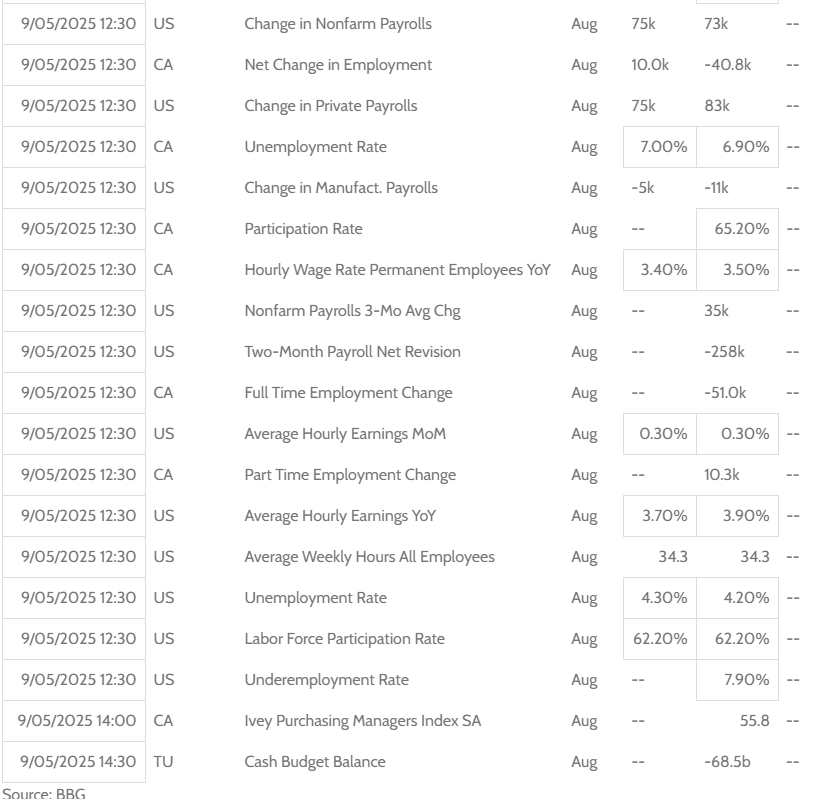

Looking ahead, US NFPs for Aug are the obvious highlight, and will be released at 1230GMT. While the headline number for job gains and the unemployment rate are expected to be in focus, most will be keeping an eye on revisions to prior payrolls, with GS noted to have forecast between 550K to 950K jobs being subtracted from data for the year up to Mar '25 - pointing to a much-weaker-than-thought labour market

Beyond that, expectations are for the unemployment rate to nudge up to 4.3% from 4.2% in Jul, while employment is expected to grow by 75K (Jul +73K). There will be obvious uncertainty around the two-month net revision statistic as usual, but consensus has tilted towards the labour market coming in on the weak side in Q3 so far, with any upside surprise to employment needing to be quite large for any meaningful unwind of that narrative

- See: US Labor Preview for August 2025: The Good, the Bad, and the Uncertain

- Average hourly earnings are expected to decelerate modestly on a Y/Y basis, but otherwise remain well consistent with the Fed's inflation target

- Apart from US NFPs for Aug, the US data docket is practically bare

- No scheduled Fedspeak of note seen on the docket at time of writing. Note that Fed officials will be under their usual pre-FOMC media blackout after Friday

On the data front,

TREASURIES CLOSE

Treasury yields fell to fresh lows on the week as soft jobs data, upcoming reports raised concern that labor conditions are weaker than previously thought

- Estimates for a large downward annual payrolls revision (again) overshadowed Friday’s monthly jobs slate, NY Fed President Williams added his voice to those concerned about deteriorating employment

- See: Things That Stick Out: Annual Payroll Revisions Set to Overshadow August Jobs Report

- Lower oil prices for a second day lent a bid to troubled bond markets in Japan, UK and France

- See: Things That Stick Out: Thursday Morning Meeting

- Most interestingly, the US dollar advanced despite lower rates, appearing to take a cue from long Treasuries in positively reassessing the US fiscal trajectory

- See: Things That Stick Out: Tailwind for Treasuries

The $100bln 4-week bill auction drew 4.175% with 80.91% allotted at the high and a bid/cover ratio of 2.78 vs. 2.68 previously and a prior 5-auction average of 2.68.

- Indirects came away with 60.7% vs 62.4% previously and a 5-auction average of 63.7%, while directs were awarded 6.2% vs. 5.8% last and a prior 5-auction average of 4.2%. This left primary dealers with 33.1% vs. 31.8% previously and a prior 5-auction average of 32.0%.

The $85bln 8-week bill auction drew 4.100% with 59.79% allotted at the high and a bid/cover ratio of 2.79 vs. 2.92 previously and a prior 5-auction average of 2.80.

- Indirects came away with 54.3% vs. 63.5% last and a prior 5-auction average of 61.7%. Directs were awarded 7.0% vs. 4.6% last and an average of 4.8% over the past 5-auctions which left dealers with 38.7% vs. 31.8% previously and a prior 5-auction average of 33.4%

The New York Fed RRP demand was $20.128bln.

There were no bids accepted in the New York Fed repo operation.

FX CLOSE

Fed and labor dynamics remain the focus

- ADP disappointed at 54k vs 68k survey, higher productivity (+3.3%), claims data mixed (higher initial, lower continuing)

- Fed nominee and current Chair of the CEA, Stephen Miran, failed to discourage speculation about who he'll be answering to when he admitted that he would be taking a leave of absence and would likely return to his CEA post after his 6-month's at the Fed are up

- Williams adds his name to the long list of Fed officials seeing downside risks to the labor market; he echoed comments from Waller about the restrictive nature of current policy posing risks to heading off trouble in the labor market

Sanctions fears, rumors of an OPEC+ production bump to keep energy vol elevated

- Big news courtesy of Reuters reporting suggests that President Trump has told European Leaders to stop buying Russian oil; Pushed the Europeans to put economic pressure on China

- WTI dips just below our demand level mentioned yesterday ($62.95) before pushing NYK session wides by $63.70 and settling near $63.36; Production bumps from OPEC+ make longs a tricky proposition until we see actual traction on the Graham Sanctions package

Trade takes a backseat

- Nothing earth-shattering, but signs of building towards more incremental improvements look to be taking shape as Japan's Akazawa is set to meet with Treasury Secretary Bessent, Commerce Secretary Lutnick, and USTR Greer

- Canada's LeBlanc confirmed that "technical talks" with Washington are set to take place around sector tariffs. We don't see any sweeping deals happening here, so expect some chatter around exemptions or rollbacks, but nothing more

FX/Cross Assets cautious ahead of major event risk tomorrow

- DXY holds the 50DMA (98.06) courtesy of the beat in ISM, which allowed the index to put in a slightly higher low heading into NFP tomorrow morning

- JPY weaker vs. the USD after the Japanese 30-year auction goes relatively smoothly overnight and ISM beats - strong showing from new orders (56.0 vs 51.1 survey, 50.3 prior); strengthens modestly against higher-beta FX despite today's equity bid; not exactly risk-averse price action, but interesting divergence nonetheless

- Most of G-10 finishes mid-range; UST's see outperformance in the belly

- BTC -2.18% on a day where tech outperforms; remains confined within a 107k/113k range for sixth straight session

CENTRAL BANKS

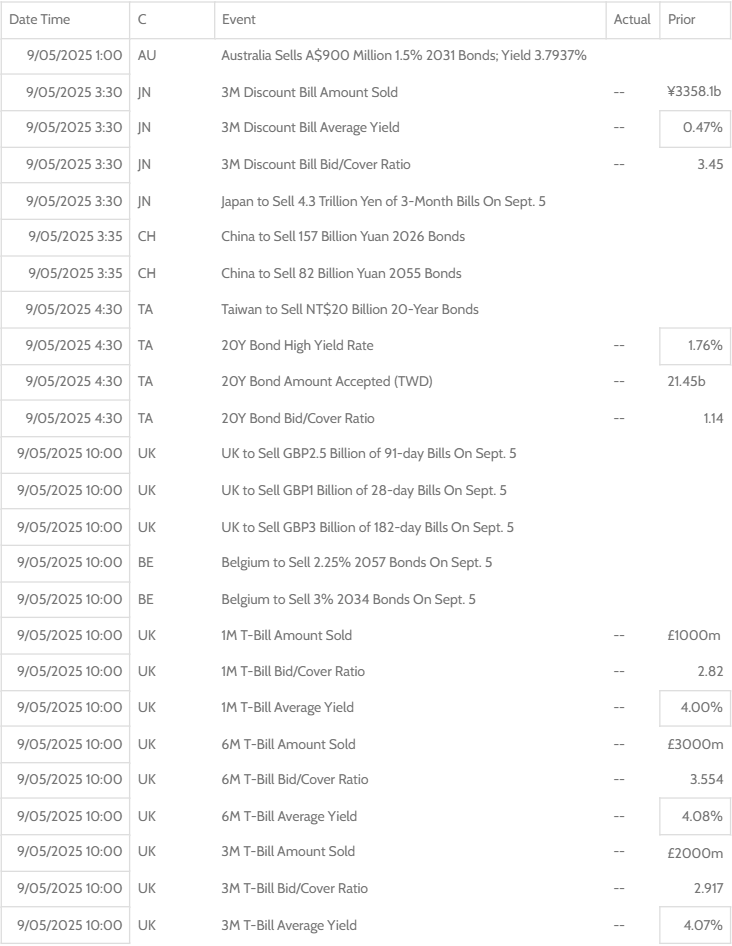

AUCTIONS

To receive this analysis plus much more, subscribe to IGM. Request your free trial of the service today.