- Broader market sentiment took a bit of a battering in October, but as previous months have shown the recovery can be quite dramatic too. The war of words between the US and China over trade/tariffs earlier in the month rocked sentiment, only for more agreeable conversations to ease the tension. The bid for haven assets saw record highs for Gold, before a correction. Equities surged, even with the focus on havens, amid building expectations for faster rate cuts by the Fed. However, dovish votes/comments from the Fed caused some volatility while stretched tech valuations are never far from market participants’ minds.

- In Europe, there was political chaos in France as PM Lecornu quit after less than a month in the job, only to be reappointed with a pillar of his policy being the scrapping of Macron’s proposed pension changes. It was a volatile period for French bonds, with OAT yields exceeding BTPs. Data releases were mixed, although Eurozone GDP was better than forecast, while the inflation trajectory continued as expected with the ECB expected to hold rates for some time. UK CPI was below forecast and so market participants adjusted rate bet cuts.

- In the structured finance market, October grabbed the top spot for the busiest month since the GFC as 67 deals for EUR30.6bn priced across asset classes and placement strategies. In only two other months YTD the total placed deal count hit 50 (51 in July and 50 in September 50). CLOs were the driving force again, accounting for around 58% of the month’s issuance. This included new issues pushing through the EUR50bn mark for the year, with resets at EUR48.8bn, including a record EUR10.6bn issuance in October. RMBS sellers contributed EUR5.8bn, which was down 19% on the previous October.

- Auto ABS was quieter in October than in September as just five deals priced for EUR2.8bn versus nine offerings (EUR6bn) last month. Consumer loan ABS repeated September’s pattern to print five deals. There was also some CMBS activity. Overall, demand was solid, with particularly strong coverage at the mezzanine and junior level while originators made good use of the preplacement strategy. YTD supply running ahead of previous years, with CLOs, RMBS and auto ABS the stalwart asset classes. Total sales are at EUR188bn, up 23% on 2024.

October busiest month of year for RMBS

- 12 deals price in the month for EUR5.6bn equivalent

- Sales down 19% on September but higher than in recent years

- Placement exceeded EUR5bn in a month just once in 2025

___________________________________________________________________________

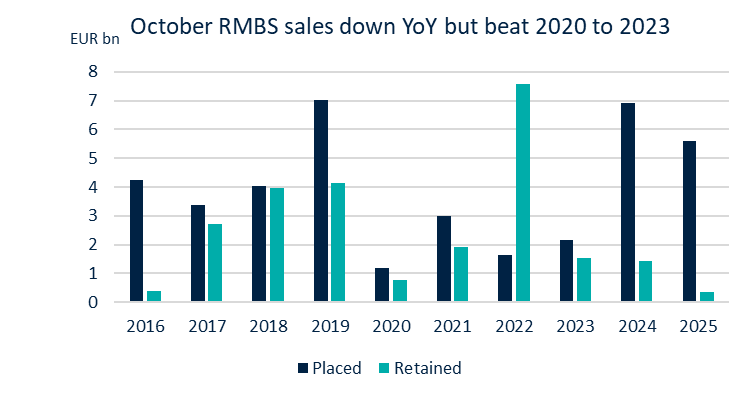

- October was the busiest month of the year for RMBS issuance with 12 deals pricing, raising EUR5.6bn equivalent. There was a decent mix of jurisdictions, with UK, Dutch, Irish, and Spanish transactions being sold. Among the debut/novel deals were a new master trust from BPCE while StrideUp Homes Limited sold a debut Shariah-compliant deal. This was the first such deal since Al Rayan Bank printed the UK’s first Islamic RMBS back in 2018.

- October sales were down 19% on the EUR6.9bn to have been placed in the equivalent month in 2024, although issuance was still significantly higher than in the preceding four Octobers.

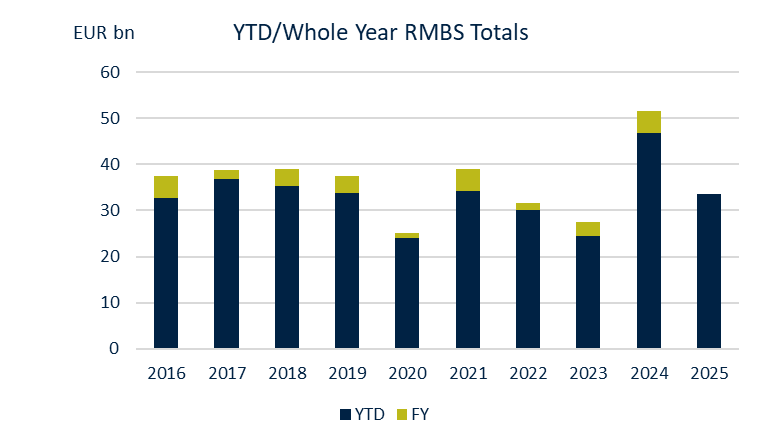

- A glance at the chart shows that YTD sales are in line with most years over the past decade except 2024, when EUR46.8bn had priced in the January to October period. The YTD total for 2025 is EUR33.5bn, or a EUR13.2bn shortfall (28%).

- In November and December supply has not hit EUR5bn in the last decade. 2024 fell just short of that at EUR4.9bn, which if repeated this year would give 2025 a FY tally of EUR38.5bn. That would mean a 25% decline on the 2024 total. With six weeks or so left of the year to conduct business it remains to be seen whether that EUR5bn figure can be achieved.

YTD RMBS issuance down 28% on 2024

- RMBS placement at EUR33.5bn YTD versus EUR44.8bn in 2024

- UK sellers make up 69% of 2025 issuance

- Netherlands in second place at 15% and Ireland third with 7%

___________________________________________________________________________

- YTD RMBS placement is around the EUR33.5bn mark YTD. This does represent a large decline of 28% from the EUR46.8bn seen at the same stage in 2024, but when compared to previous years the differential is not so stark.

- Between 2016 and 2023, for instance, placement over the first ten months ranged from EUR24.5bn to EUR36.8bn. The average in those eight years was EUR31.4bn. As such, this year compares well to that period.

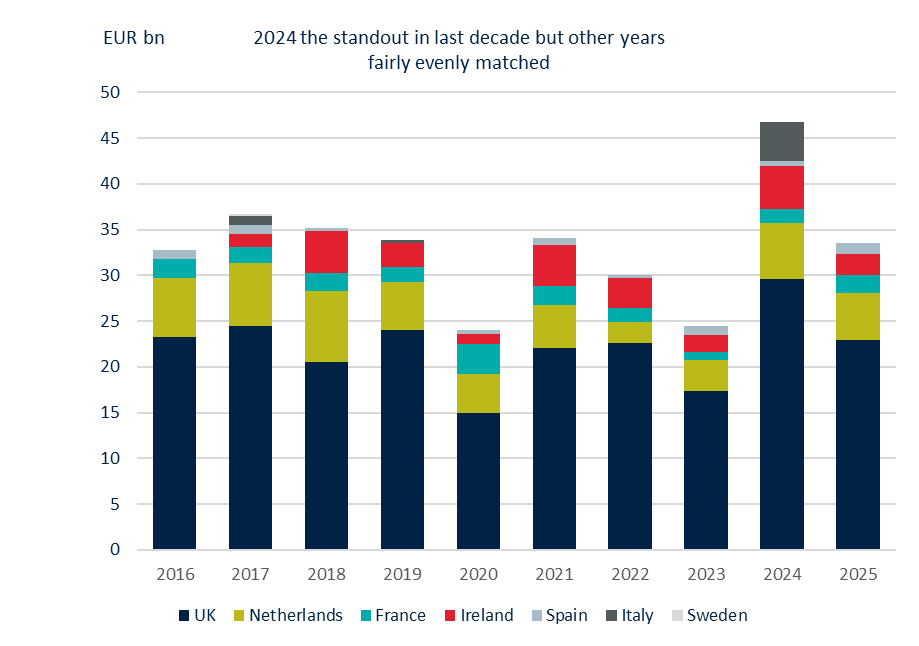

- As is typically the case, UK issuers dominate the market. Over the last ten years the UK allocation of placed RMBS bonds ranged from 58% (in 2018) to 71% (achieved three times, in 2016, 2019 and 2023). Based on a EUR equivalent amount, UK sales represent 69% of placed bond in 2025. In second place is the Netherlands with 15% and Ireland in third spot with 7%. France is just behind that with 6%.

- Dutch issuers used to represent a greater share of RMBS, having hit 22% in 2018 before edging back towards the low-teens over the last few years. It had been as low as just 7% in 2022 as sellers tap the capital markets in different formats, such as covered bonds.

- In terms of an outright volume analysis over the last decade, measured by jurisdiction across the January to October period, the busiest time was for UK RMBS in 2024 with EUR29.6bn equivalent. Since 2016, no other jurisdiction has hit EUR10bn in the January to October period, the closest being from Dutch sales in 2018 at EUR7.7bn.

Euro CLO issuance sets record

- October deals take YTD new issue CLO tally through EUR52bn

- EUR6.8bn of new issues in the month outpaced by EUR10.6bn of reset

- YTD total CLO supply surges through EUR100bn barrier

___________________________________________________________________________

- European CLO market participants stepped up the activity in October, as total issuance surged to EUR17.8bn in the month across all pricing formats. This was up 66% from September’s EUR10.7bn and almost double the October 2024 total of EUR9.65bn (up 85%).

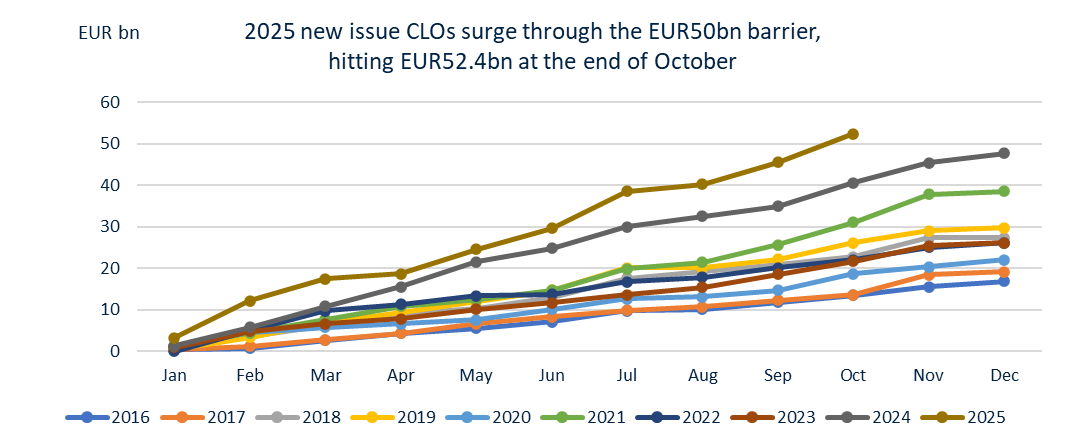

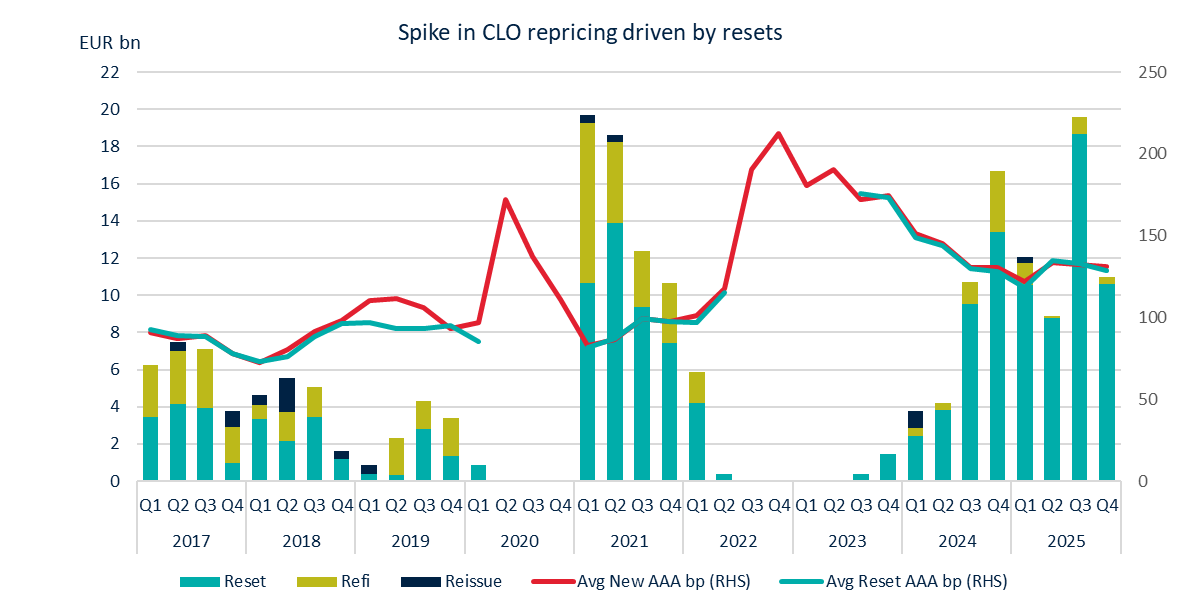

- A lot of attention is on the new issues market which has now pushed through EUR50bn to EUR52.4bn, including a rare dual-currency offering (Barings middle market CLO) in the month. But it was in resets where most of the volume came. In October, EUR10.625bn of resets priced – the first EUR10bn+ month since the market reopened post-GFC.

- Total YTD CLO issuance now stands at EUR103.8bn, of which over EUR100bn is in new issues and resets. The EUR52.4bn of new issues were added to by EUR48.6bn of resets, while refinancing and reissues contributed EUR2.5bn and EUR323.6m as at the end of October.

CLO run rate races ahead

- 2025 extending lead over previous years with six weeks still to run

- In last decade 2021 and 2025 are dominant years for CLOs

- EUR17.8bn priced in October

___________________________________________________________________________

- With YTD new issues sitting at over EUR52bn, it is no surprise to see the 2025 line in the run-rate graph below soaring above previous years. With around six weeks of business left in the year there is plenty of time for the 2025 tally to take an even greater lead. There was a flattening of issuance in April, as “Liberation Day” interrupted market momentum and pushed spreads wider, but issuance has continued almost unchallenged since then.

- A look back over the last decade shows 2021 and 2025 as the dominant years for euro CLOs. The top ten months for total issuance feature five each from those two years. Standing out among those is October 2025 with EUR17.8bn, just ahead of July 2025 with EUR17.3bn.

- In 2021 refinancing was more prevalent, as the prevailing spreads offered more of an opportunity to refi rather than reset deals that had printed in the preceding couple of years. YTD 2025 refinancing totals just EUR2.5bn, versus EUR17.2bn between January and October 2021.

CLO averages on trend

- Average Triple A spread tightest since March, excluding middle market deal

- Non-call and reinvestment periods little changed

___________________________________________________________________________

- Average Triple A new issue spreads widened in October to 130.88bp from 130.5bp in September, due mainly to the middle market CLO coming at 150bp. Excluding that, Triple As averaged 129.6bp in the month, which was the lowest since March. The average non-call and reinvestment periods were little changed, at 1.64-years and 4.65-years, but par subordination pushed up to 38.47% courtesy of the thicker level of support on the middle market deal.

- The Triple A level is not the only consideration for managers when making repricing decisions, but this year the average monthly new spread has ranged from 126bp to 134.69bp, as a guide to where resets could land. Refinancing played a much greater role in 2021. At the start of Q1 2021 refinanced Triple As were pricing as tight as 3mE+low-60s, but widened towards the high-80s/90bp mark towards the end of the year. Resets have been dominant in repricing since issuance in this format took off again from Q4 2023.

Auto ABS sales accelerate

- EUR2.8bn of placed auto ABS in October takes YTD total to EUR24.8bn

- Pre-Covid years were busier for October auto sales

- YTD total already passed 2024 FY tally

___________________________________________________________________________

- European auto ABS has set a new high with October’s EUR2.8bn of sales topping up a strong few months for the sector. YTD supply is at EUR24.8bn. The contribution from October may not be as large as in previous years (between 2019 and 2021, for example, October sales were EUR4.6bn, EUR4.8bn and EUR5bn) and none of the monthly tallies so far are records, but originators have produced a steady flow of deals.

- In the last decade the highest single month for issuance was September 2023 with EUR7bn. September 2025 was also busy, but it could not match that, hitting EUR6bn. YTD issuance has pushed past the FY 2024 tally of EUR24.6bn with a month had a half of business yet to come.

- Between 2016 and 2025 October auto ABS sales averaged around EUR3.4bn. From 2017 to 2021 there was a steady rise in sales for what is typically one of the busiest months for structured finance as a whole.

- The October peak for auto issuance came in 2021 with close to EUR5bn printed, but in the subsequent years four sales have failed to reach EUR3bn.

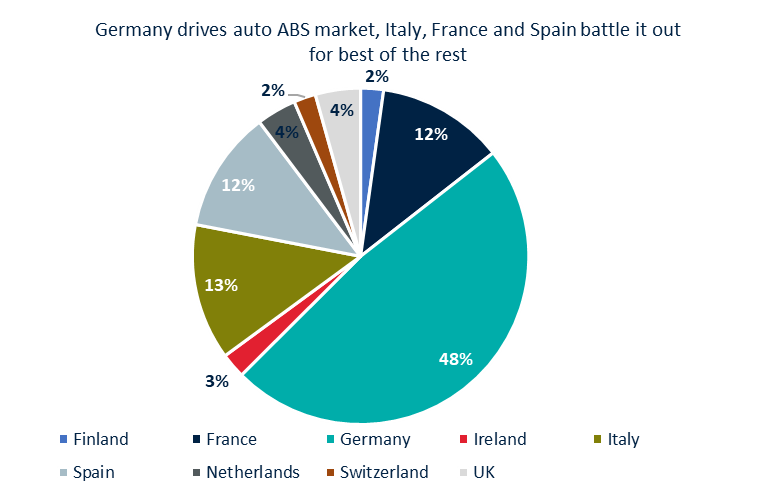

Germany stays way out in front for YTD allocation

- Italian assets lead October placement, accounting for 33%

- Germany sits in second place on the month but still accounts for 48% YTD

- Italy, France and Spain distant competitors

___________________________________________________________________________

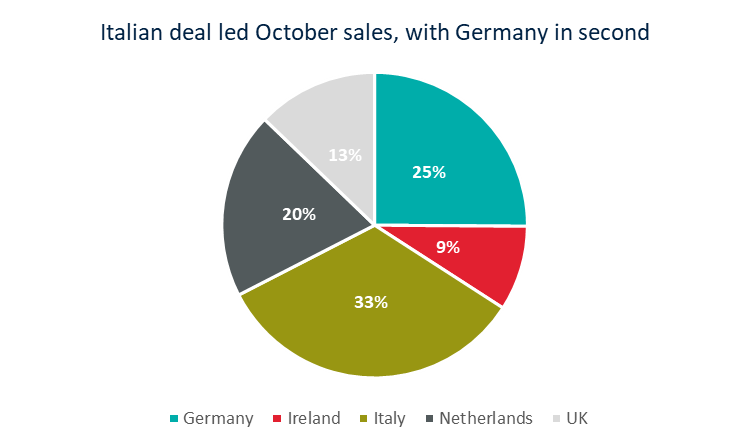

- A restructured Italian deal (CA Auto Bank SpA) led the October placement volumes, with EUR928.8m or 33% of the month’s supply. In second place was Germany with EUR700m (Mercedes-Benz Bank AG pricing the tightest ABS YTD at 1mE+43bp) for 25% while a Dutch offering (Axus Nederland) provided EUR550m or 20% in third. An Irish deal for EUR250.8m (First Citizen Finance) and a UK trade (BMW) for GBP400m completed the month’s line-up.

- As is usually the case, German issuers lead from the front in the European auto ABS market, when assessing issuance patterns over a longer period than a month. Bonds backed by German collateral sold to investors tally EUR11.9bn of 48% of the YTD volume.

- After that, it is quite a gap to those following, although there is little to separate the next three. Italy has EUR3.25bn, France EUR3.04bn and Spain EUR2.9bn giving each a share in the range of 12-13%.

Consumer loan and CMBS issuance hits multi-year high

- Consumer loan ABS sets new record with YTD supply at EUR14.5bn

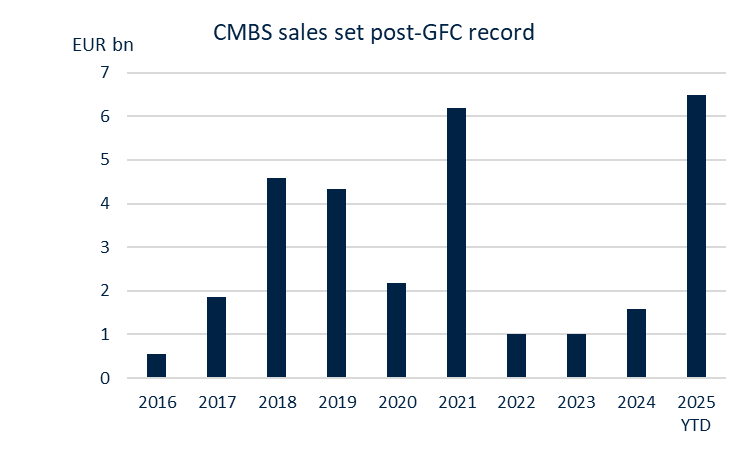

- CMBS sales reach post-GFC record at EUR6.5bn

___________________________________________________________________________

- For both the consumer loan ABS and CMBS sectors it was the busiest year since the GFC, and there is scope for more to come with around six weeks of business left in 2025, assuming market activity slows to a close from mid-December.

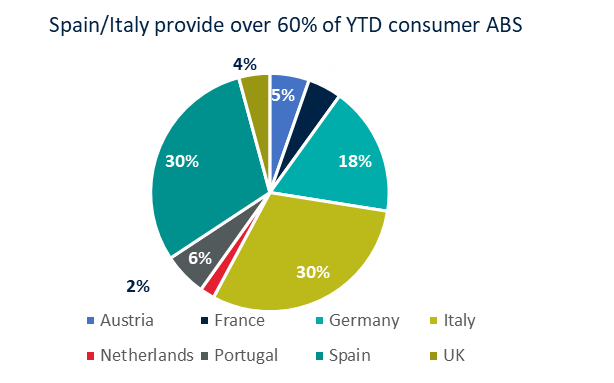

- Five consumer loan ABS priced in October, with Santander accounting for four (portfolios in Austria, Germany, Italy and Spain). The other was a debut UK deal from Admiral Financial Services. Some EUR2.9bn equivalent placed bonds made it 2025’s second busiest month after September’s EUR4.1bn. That month was dominated by a EUR1.4bn Santander Spanish deal, with EUR610m of Class As preplaced, a strategy that has featured prominently in other deals.

- The Spanish and Italian markets are dominant, with around EUR4.5bn (30%) each of the YTD consumer ABS supply. Germany is third with EUR2.6bn or around 18%. No other country contributes more than 6%. YTD sales are at EUR14.9bn, versus the EUR14bn FY total of 2024.

- Consumer loan ABS is not the only sector to experience a resurgence as CMBS sales have hit a post-GFC high too, registered at EUR6.5bn equivalent YTD. There was one deal in October, a GBP507m UK offering backed by logistics assets. Blackstone was the sponsor. There was decent demand for the deal, as the blended spread across the notes of around SONIA+199bp was inside the 225bp achieved on the previous deal in the programme in April.

To receive this analysis plus much more, subscribe to IGM. Request your free trial of the service today.