We're taking a slight chance in producing Dec and early 2016's estimates ahead of five G10 FX central banks' monetary policy verdicts this week. However, we're fairly confident on the likely BOE, ECB and BOJ outcomes ahead.

- Talking of central bank verdicts, the USD has been a material loser since Wednesday's less hawkish than envisaged by some -25BPs Fed outcome; an easing bias still; the pricing of two more cuts in 2026; the deep divisions on the Board; worries over Fed independence ahead and the possible Powell replacement of an expected more dovish Hassett.

- Yield differentials have therefore been impacting, particularly as the market has (mistakenly?) been betting on next moves by the likes of the ECB, RBA, RBNZ and BOC potentially being hikes!

- Much of the market's negative USD focus presently has been on the weakening labour market, but what happens if that stabilises/improves in 2026? So, a big week data wise, with the release of Nov's NFPs.

- Even through the now over US government shutdown, growth concerns seemed to abate through the year. At the Dec Fed, Powell said overall the baseline expectation for 2026 is to see a pick-up in growth from today’s relatively low level of 1.7%.

- Markets have been eager to price the end of the era of US exceptionalism, but hard evidence is required. At present, the US stays a relative growth outperformer.

- However, pre-Dec meet, ECB officials have been expressing optimism, referencing growth surprising on the upside. The slightest of greenshoots maybe, but German factory orders and IP produced huge beats in October amid massive government outlays on infrastructure and defence.

- US equities have performed strongly in 2026, but not been outsize winners. Innovation stays a major US prop, enabling domestic firms to outgrow foreign peers; attain higher profits and boost productivity. However, increased competition is seen increasing globally.

- The DXY USD Index is currently -9% lower in 2025 so far, in part on the resilience of US trading partners hit by Trump tariffs.

- Geopolitics stays front and centre and conflicts/diplomatic fallouts have undermined some currencies progress this year, especially Europe FX with the continued war in Ukraine and the YEN with the China-Japan standoff. In each instance, the USD has maintained some sort of haven status.

- A new year can also bring relatively new conflicts, while the path to civil wars in some major nations cannot be ruled out either.

- So, US-RoW rate convergence could play an increasing role in 2026 and prove a USD weight though whether risk-sensitive FX/high betas or funders perform best looks risk appetite dependent.

- It's also worth going back to views aired in early 2025 Forecasts updates. There, we wrote that after the November 8 2016 election and Trump's surprise victory over Clinton, the DXY literally spiked from circa 97 to a range best just shy of 104 by the opening days of 2017, a rise of +7%. There it stopped, falling to a term low of around 88.25 in February 2018. From around 101 on January 20 2017, the USD Index fell to around 90.50 by the end of Trump's term on January 20 2021, a fall of over -10% in office. The backdrop is different now, but we maintain some bullish caution looks required.

- Further, Trump doesn’t like the USD too strong or interest rates too high, for that matter. In 2024, he called a high USD/YEN a "disaster;" said the strong USD was a “a big currency problem” and a “tremendous burden” and latterly a “disaster for our manufacturers and others.” It's worth keeping this in mind through 2026.

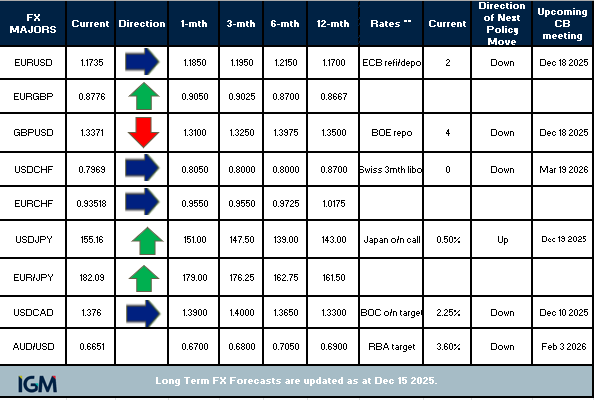

EUR/USD - Buoyed recently by the negative broad USD response to the Dec Fed as we all as remarks from ECB's Schnabel who is comfortable with investor bets that the Bank’s next interest rate move will be a rise. The ECB is fully expected to be on hold (DFR at 2.00%) this week. Lagarde could reiterate her neutral language that the ECB is in a ‘good place,’ and it will be interesting to see whether the ECB President chooses not to push back forcefully on market pricing. If so, it could prove a prop, particularly if this comes with growth forecast upgrades; and if the NFPs prove soft we could see a test of key 1.1919 highs before the year is out. We still see some mixed drivers. More positives come via cheaper energy costs and cheaper hedging costs (investors could use lower US rates to increase hedge ratios), while domestic politics (French budget etc) and geopolitics could negatively impact. Despite US pressure, an imminent end to the Ukraine War looks unlikely and the EU-China have been falling out over trade recently.

- Unchanged. Stay bullish, expecting a 1.20-plus move in 2026.

USD/YEN - Peaks for now at a lower top high of 156.95-94, but retains an underlying bid despite last week's Fed cut and expected +25Bps BOJ rate hike to 0.75% this week. Expectations of just one near-term hike looks insufficient now to spark a YEN turnaround. Markets will focus on a revised estimate of the neutral rate. Gov Ueda will likely maintain the current real interest rate remains very low, but it's also possible the Bank fails to meet the elevated market expectations on hawkishness needed. And, some watchers think intervention is required (post-hike) to get this market moving materially lower. But, recent verbal intervention has been limited. Note Japan’s car industry union will seek a slightly more ambitious wage hike goal in the next round of negotiations compared to the previous year. Other impacters, less than positive currently, centre on new Japan PM Takaichi. The 'Abenomics' comparisons may be overplayed, but investors are sceptical. She is viewed as stimulus friendly, while a continued deterioration in Japan–China relations looks a medium-term YEN risk. Reduced Chinese tourism could cut the annual travel account surplus by up to Jpy 2.0tln, implying up to 3.0 YEN of depreciation pressures (YEN/USD) depending on severity.

Unchanged, but aware that estimates look behind the curve. To reassess post-BOJ, NFPs.

GBP/USD - Has also enjoyed an independent UK budget-related relief rally. Notable new eight week highs of 1.3438 have been made following the credible statement, with the Gbp 22bln of fiscal headroom suggesting the Gilt market should avoid any near-term new debt crisis even if near-term growth falters. The BOE is expected to cut the Bank rate by -25Bps to 3.75% Thu. It's not a complete given after remarking last time the 'Bank Rate is likely to continue on a gradual downward path. Bailey probably has the casting vote, while the next two CPI and labour reports more could well be the ultimate guide to expectations for Feb and beyond. Morgan Stanley said last week they see four cuts by June, which could lead to a near full erosion of GBP’s current carry attractiveness. Politics a worry here too amid worries over the two-party monopoly, with possible leadership challenges to UK PM Starmer in 2026, with the country not sold on Chancellor Reeves either.

- Unchanged. Looking underpriced currently. Awaiting those key data reports.

USD/CHF - SNB were on hold at 0% in Dec, as fully expected. There is a high bar to take rates negative, as the Bank highlighted a tolerance for inflation at/near the bottom of the target range. The SNB slightly upgraded the 2026 growth outlook after Washington lowered tariffs on Swiss exports. Also, the Franc remains highly valued but there has been little in the way of topside spikes, suggesting more aggressive official action is not coming any time soon, via large FX purchases or further rate cuts. Investors may see CHF as a potential funder in 2026, but much will depend on EU growth prospects; possible hawkish turns from central banks peers and progress in Ukraine war peace talks.

- Unchanged.

USD/CAD - Worthy or not, the BOC is viewed as one of those banks where hawkish risk is being priced and Funds has made a sustained drop below 1.4000. Yield differentials a mover, as optimism increases following the big beat in Canada 3Q GDP of 2.6% (annualised) and a surprise drop in the unemployment rate to 6.5%. Resilient equities (outperforming Canada!) are also an indirect positive, but we do not expect a major drop at this stage. We think a hawkish BOC outlook is way premature; oil looks vulnerable just north of the psychological Usd 60/brl mark and with Trump-Carney relations still uncertain major risk here remains the upcoming USMCA renegotiations.

- Unchanged.

AUD/USD - YTD highs of 0.6707 could be vulnerable through the holiday period and a clear break above could well stoke 0.7000-plus expectations for 2026. In leaving the cash rate target at 3.60%, as expected last week, the RBA board stated recent data suggest the risks to inflation have tilted to the upside. Further, governor Bullock explicitly stated the Board may consider rate hikes next year. Much will depend on broader market risk and if the Fed is to cut by at least -50BPs next year, some bulls think the likes of the S&P 500 could rocket towards 7800-8000. In that backdrop, 0.7000 here could be deemed realistic at some point in 2026.