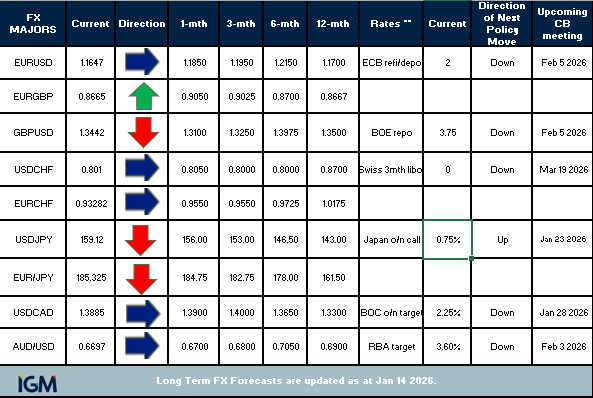

The USD has been in recovery mode so far in early 2026.

- DXY USD has bottomed anew at 97.75 (Dec 24) and has since threatened to reclaim the 200-dma, at 98.78 last.

- Risk-off trade has been dominating proceedings. The USD and gold in particular have proved ultimate havens yet again amid a flight to quality through the latest escalation in geopolitical concerns - Venezuela, Iran, Ukraine and Russia, China-Japan (and Greenland!).

- US data has been mixed at best so far, with Dec NFPs and CPI missing expectations, and Fed rate cut expectations remain alive.

- Some officials (Musalem, Williams) have been less than dovish though the market prices around two rate cuts this year currently.

- Talking of the Fed, independence issues are on the rise again and look a potential negative impacter. Federal prosecutors have reportedly opened a criminal investigation into Powell over the Fed’s renovation of its Washington DC HQ.

- USD/YEN the big winner so far, with JPY independently weighed by numerous reports that Japan PM Takaichi will call for a snap election amid fresh investor concerns over fiscal policy.

- EUR/USD has backed off from late 2025 highs above 1.1800. There is no haven related demand here, as some geopolitical problems impact here, ie Greenland and Ukraine/Russia still.

- GBP has actually been a relative outperformer so far, as the post credible UK budget relief rally continues, while Starmer's reach out to EU and towards closer relations is received net favourably.

- AUD/USD consolidates around 0.6700 as markets continue to wrestle with the prospect/possibility of a RBA rate hike in 2026.

- Again, from Dec's update, a new year can also bring relatively new conflicts, while the path to greater civil unrest/wars in some major nations cannot be ruled out either.

- So, US-RoW rate convergence is seen playing an increasing role in 2026 and prove a USD weight though whether risk-sensitive FX/high betas or funders perform best looks risk appetite dependent.

- It's also worth going back to views aired in early 2025 Forecasts updates. There, we wrote that after the November 8 2016 election and Trump's surprise victory over Clinton, the DXY literally spiked from circa 97 to a range best just shy of 104 by the opening days of 2017, a rise of +7%. There it stopped, falling to a term low of around 88.25 in February 2018. From around 101 on January 20 2017, the USD Index fell to around 90.50 by the end of Trump's term on January 20 2021, a fall of over -10% in office. The backdrop is different now, but we maintain some bullish caution looks required.

- Further, Trump doesn’t like the USD too strong or interest rates too high, for that matter. In 2024, he called a high USD/YEN a "disaster;" said the strong USD was a “a big currency problem” and a “tremendous burden” and latterly a “disaster for our manufacturers and others.” It's worth keeping this in mind through 2026.

EUR/USD - Has backed off from late 2025 highs above 1.1800. There is no haven related demand so far, as some geopolitical problems impact here, ie Greenland and Ukraine/Russia still. We have to stay net bullish though, at least while price continues to hold above the 200-dma (1.1582) and 1.1500. Some recent German data has been encouraging (factory orders, IP) and given the infrastructure and defence spending boost this year optimism is inevitably raised. Much will depend on that Fed-ECB rates convergence story of late 2024, but ECB rhetoric stays less than outright hawkish (understandably). The EUR and bullish desire to take out 1.1800 and 1.2000-plus could ultimately be Fed dependent. Will the board sanction two plus rate cuts in 2026 (the first one before June) and how will the Bank's future independence look? Negative views could inspire outsize gains here, in the world's second biggest and second most liquid markets'.

Unchanged. Stay bullish, expecting a 1.20-plus move in 2026.

USD/YEN - The big winner so far, hitting highest levels since July 2024 amid an increase in political uncertainty from numerous reports that Japan PM Takaichi will call for a snap election amid fresh investor concerns over fiscal policy. We have also focused on the Japan-China diplomatic spat, with possible reduced China tourism could cut the annual travel account surplus by up to Jpy 2.0tln and latest concern is Beijing export controls over critical minerals. Others talk of persistent US-Japan yield gaps, negative real rates, and capital outflows continuing to weigh on the YEN also, as next USD topside targets are 160.00 and 161.95-00. However, this week, Japan’s Finance Minister Katayama and US Treasury Secretary Bessent shared concerns about the one-way weakening YEN during a bilateral meeting in Washington. We think some caution is warranted up there, particularly as yield convergence should apply here too in 2026.

Behind the curve. Pushed higher, but in anticipation of eventual material moves south from current levels.

GBPUSD - Has actually been a relative outperformer so far, as the post credible UK budget relief rally continues; the UK looks sheltered to an extent from the raised geopolitical temperature and Starmer's reach out to the EU and towards closer relations is received net favourably. Amid mixed drivers, topside still looks limited into 1.37-1.38 and sub-1.4000 over domestic political woes, soft data expectations and a school of though that suggests the BOE could cut more than expected in 2026 (back-to-back in April and June?). Next week's labour market report and CPI data will garner plenty of interest.

Unchanged. On amber alert though as arguably looking underpriced currently. Awaiting those key data reports.

USD/CHF - Again, the SNB were on hold at 0% in Dec, as fully expected. There is a high bar to take rates negative, as the Bank highlighted a tolerance for inflation at/near the bottom of the target range. The SNB slightly upgraded the 2026 growth outlook after Washington lowered tariffs on Swiss exports. Also, the Franc remains highly valued but there have been few topside spikes, suggesting more aggressive official action is not coming any time soon, via large FX purchases or further rate cuts. Investors may see CHF as a potential funder in 2026, but much will depend on optimism over EU growth prospects; possible hawkish turns from central banks peers and progress in ending the Ukraine war and other geopolitical flashpoints.

Unchanged.

USD/CAD - The approximate Usd 5/brl rise in oil on Venezuela and Iran stories can be viewed as a CAD prop so far in 2026, but we remain less than bullish on one of the uglier currencies right now. There was a huge beat in Canada 3Q GDP of 2.6% (annualised) in late Nov, but this needs to be followed up and a return to a 7.0%-plus unemployment rate would surely put a dent in those (unwarranted?) recent more hawkish expectations for the BOC in 2026. Uncertainties linger, not necessarily positive ones. Trump-Carney relations still look cool ahead of the upcoming USMCA renegotiations, which could lean on business and consumer sentiment.

Unchanged.

AUD/USD - Consolidates near 0.6700 area range highs as markets continue to wrestle with the prospect/possibility of a RBA rate hike in 2026. Last week, Australia CPI for Nov missed expectations at 3.4% y/y vs 3.8% last, supporting the case (and our view) for unchanged RBA interest rates for now, with a more neutral bias looking more sensible at this stage. As markets continue to price a +25BPs rate hike in 2026, just, we'll stay data dependent. This week's household spending for Nov at a big beat of 1.0% m/m and 6.3% y/y was one such positive. Other positives arguably come via China sentiment, with Beijing-Washington relations fairly cordial (for now), Australia's commodity complex frothy and the country looking relatively attractive as an investment destination. To achieve 0.7000-plus, we probably need supportive changing yield differentials and risk to be mostly on.

Unchanged.