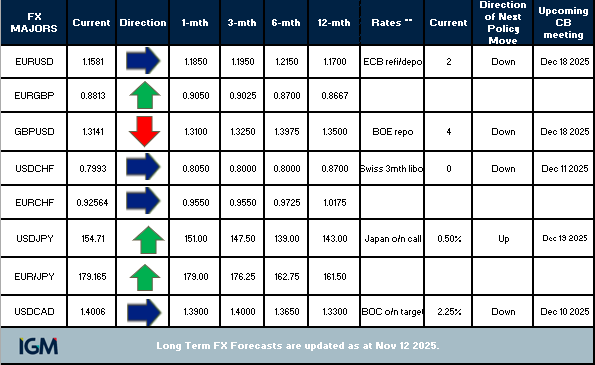

November 12 - LONG-TERM FX FORECASTS UPDATE - THE NOVEMBER 2025 UPDATE

- USD wins continued since September's update.

- DXY USD Index even traded above 100.00 again (100.36 high, November 5), but there is no big and sustained break above the psychological mark yet.

- Risk has improved this week amid reports the US government shutdown looks set to end after more than 40 days, with the Senate passing a temporary funding bill 60-40. The House is expected to vote on the measure today. Equities though lead risk/growth FX so far.

- The Fed lowered its benchmark interest rate by -25BPs to 3.75-4.00% in late October, as expected. One ongoing USD prop though has been Powell's warning that a “further reduction in December is not a foregone conclusion, far from it.”

- The expected end to US exceptionalism has been questioned of late, another USD prop, though a weakening US labour market threatens new-found confidence.

- On the tariffs front, apparent improved US-China relations has been warmly received; the Swiss are hopeful on reduced tariffs, but Canada seemingly continues to be punished.

- Trump's plan to mail Usd 2000 dividend payments from tariffs to US citizens marks a throwback to the stimulus checks of the COVID era and with similar economic risks (particularly relating to inflation).

- GBP comes under two-pronged pressure - a possible more dovish BOE and constant worries over the UK budget on November 26.

- Despite some disparities between estimates and price, this is largely a holding month as we await further information.

EUR/USD -The ECB is 'in a good place,' but a series of lower tops have emerged after topping out at 1.1919 and EUR/USD is less positive than in our previous update. We acknowledge forecasts are looking a bit bullish, but while 1.1500, 1.1392-01 and 1.1364 and the 200-dma we'll hold for now. Markets could well be surmising Lagarde and co are too optimistic on growth, French governmental and budget worries remain and German data remains mixed. EUR/USD topside seems too reliant on a (less than) dovish Fed outlook at this stage.

- Unchanged, but less convincing. Underlying bid/topside momentum has been waning.

USD/YEN - October 6 was turning point (and gap from 147.82 - 149.05 with no closure since) and USD/YEN has traded 150.00-plus since for the very most part. Catalyst was the semi-surprise victory by perceived pro-stimulus Takaichi as new LDP leader and Japan PM (in a weakened coalition?). The 'Abenomics' comparisons may be overplayed, but investors are sceptical. A summary of the BOJ’s October MPM signaled the next rate hike may come as soon as (December), but markets price it at less than 50%. USD/YEN currently sits just south of the MOF's beginning of a perceived line in the sand (155 - 160). Watch for possible increased verbal intervention from big hitters Fin Min Katayama, top FX official Mimura and comment on 'one-way', 'disorderly' or 'excessive' market moves.

- Forced to move after big 150.00-plus break. We do not see these levels holding for too long, but September's near-term estimates now look way off.

GBP/USD - Still a 2025 winner, but an underperformer in H2 amid constant worries pre-November 26 UK budget. Worries over a fresh GBP crisis could be overdone, but Chancellor Reeves looks to have chosen tax rises (with private sector middle, high income owners seen targeted) over spending cuts and could break pre-election promises. Tighter fiscal and easier monetary policy looks GBP unsupportive. The BOE delivered a (5-4) dovish hold last week, but December cut expectations are up with around -24BPs priced. GBP could be vulnerable post-Budget if those central bank expectations are deemed too conservative.

- Forced to move near-term estimates in particular lower.

USD/CHF - CHF holds firm and chances of a fresh prop rise amid reports Switzerland is close to securing a 15% tariff on exports to the US vs the the current outsize 39% levy. That would be positive for the growth outlook even as real Eurozone expansion stays elusive (to lean anew on EUR/CHF?). The SNB is concerned over Franc strength and FX intervention in Q2 was Chf 5bln, a highest since 2022. However, we think continued heavy official CHF sales and negative rates are unlikely now and so options look limited for Zurich, particularly as US-Swiss trade relations finally look back on track.

- Estimates unchanged though few signs of that topside advance our longer-term forecasts are anticipating.

USD/CAD - Tentatively tops out recently at 1.4140 for now, as the Loonie has been boosted by October's huge beat in Canada employment (6.9%, 66.6k). And, after cutting rates by -25BPs to 2.25% in October (on continued economic weakness, inflation expected to stay near 2%) the BOC stated policy is 'about the right level' and look done for several months. The economy stays soft though and another -50BPs of easing cannot be ruled out in 2026. CAD to stay an underperformer, as Canada continues to be punished by Trump on tariffs - at 35% on most Canada goods.

- Estimates fairly neutral near-term, cautious on chances of a big, sustained break above 1.4000, but casting doubts on optimistic Loonie view further out.