Treasuries are higher early Wednesday as the dollar advances for a third day. In the absence of official economic data, traders couldn’t help noticing yesterday’s Oval Office session announcing spending, and possibly, job cuts. Small ball, but the clawback of commitments to the auto and green sectors struck many as a step toward fiscal austerity.

Not to keep banging on about the dollar, but it is the denominator in everything that has rallied big this year…stocks, gold, etc.

Stocks are rebounding slightly as Q3 earnings season approaches, and estimates (for the S&P 500) are pushed into low double digits despite Oracle’s loss on chip rentals and the suggestion that expectations are overly optimistic. Q2 earnings ended with about a 12% y/y growth rate.

Notably overnight, New Zealand surprised with a larger 50 basis point rate cut, bringing the total reduction from August 2024 to 300 bps. The country has been hit hard by the disruption in trade.

Treasury auctions $39 billion of reopened 10-year notes at 1 pm ET.

In corporates, today is expected to bring more of the same, with another light slate anticipated. Two companies, Goldman Sachs Private Credit Corp and Banco de Crédito del Perú, held investor calls yesterday and appear likely to come forward this morning.

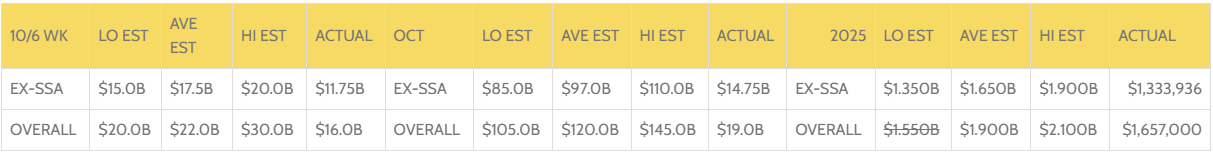

2025 HIGH GRADE ISSUANCE - 10/06 WEEK, OCTOBER & 2025 ESTIMATES

To receive this analysis plus much more, subscribe to IGM. Request your free trial of the service today.