Smiles all around early Friday after the midweek wobble in stocks was put right by the announcement of a meeting on trade relations next Thursday between Presidents Trump and Xi.

Earnings/outlook beats from Intel, Ford, and Comfort Systems (heating, A/C systems) suggest good things happening across a wide spectrum of the economy, from tech to the consumer and housing.

Treasury yields are slightly higher for a second day ahead of the 8:30 am ET CPI report.

All I’ve heard for days is that the number doesn’t matter and won’t affect the Fed’s decision to cut rates next week. Eh, probably. But it reveals a measure of complacency that often leads to trouble, especially with $183 billion in Treasury coupon supply frontloaded next week on Mon/Tues alongside a potential $38 billion Oracle bond deal in the pipe.

Headline CPI is expected hotter at 3.1% from 2.9% in August. Core CPI is seen steady at 3.1%.

Meanwhile, the dollar is quietly at its high of the week, this time led by a decline in the Canadian dollar after President Trump terminated all trade talks with the country. At the risk of repeating ourselves, keep an eye here as a stronger dollar is an underpriced risk to bull sentiment across equities and credit.

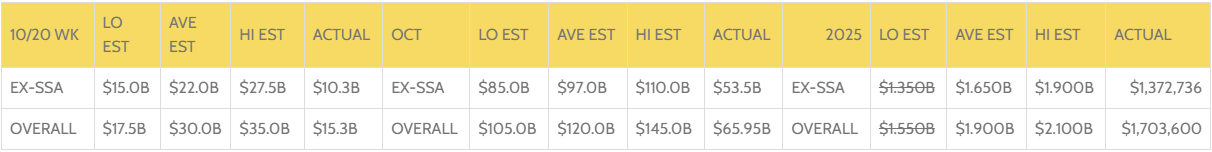

With September CPI data on tap, it's likely the high-grade primary market has wrapped up for the week. Volume stands at $10.3bln, well below even the lowest estimates

2025 HIGH GRADE ISSUANCE - 10/20 WEEK, OCTOBER & 2025 ESTIMATES

To receive this analysis plus much more, subscribe to IGM. Request your free trial of the service today.