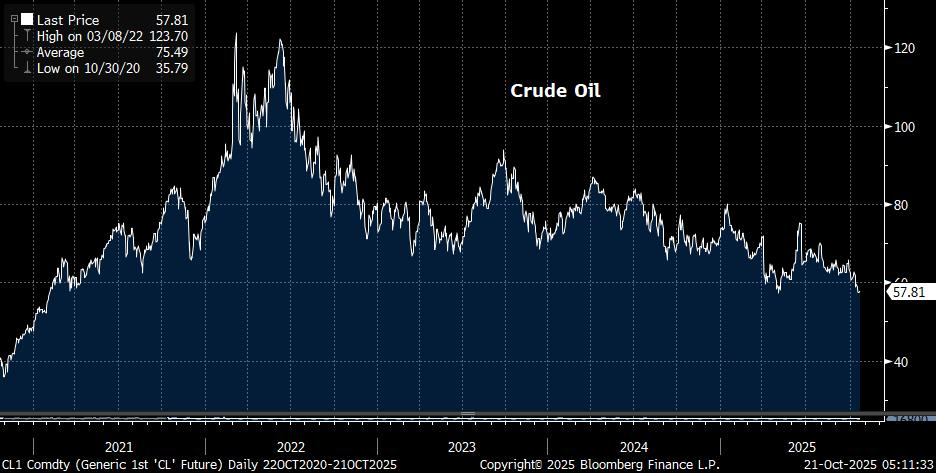

Quiet start to markets early Tuesday as stocks consolidate gains from the last two sessions and the benchmark 10-year Treasury yield holds below 4%, thanks to a four-year low in oil prices and slowing retail sales data from China.

Sentiment remains solid ahead of next week’s tech earnings, although the steady bid in Treasuries and haven currencies (like the Swiss franc) have the macro guys’ antennae up for signs of trouble.

Asian markets moved higher as optimism grows for a meeting of the minds between President Trump and President Xi next week at APEC in South Korea.

The dollar is the notable mover so far, getting a lift from a sharp decline in the Japanese yen after Sanae Takaichi was confirmed as prime minister, immediately naming Satsuki Katayama as finance minister. The message here is unmistakable, as both are known as fiscal expansionists.

In Washington, September CPI will be published on Friday after a skeleton crew at BLS was called back to crunch the numbers. Not because they’re doing us a favor, the government needs it for next year’s COLA adjustments for social security.

Betting odds for an end to the government shutdown later this week got a modest pop late yesterday as pressure increases on Congress to get something on Trump’s desk before he leaves on a six-day trip to Asia.

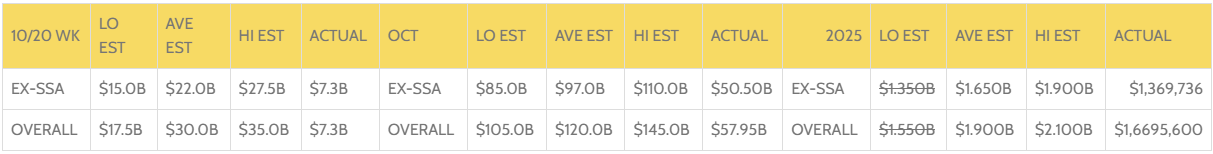

Corporate issuance is expected to continue at a similar pace today, with two Yankee borrowers already marketing deals overnight

2025 HIGH GRADE ISSUANCE - 10/20, OCTOBER & 2025 ESTIMATES

To receive this analysis plus much more, subscribe to IGM. Request your free trial of the service today.