The sentiment in junk bonds this week was upbeat as equity markets continued to froth following last week's comments from NY Fed President Williams.

He and Governor Waller both voiced support for a December rate cut. Stocks were generally higher for the week by 4-6%. Market odds for Dec cut have escalated to 85% Sentiment has solidified and crypto has stabilized , while the dollar pulled back as market participants see red flags on global liquidity, macroeconomic activity. Economic data this week showed K-shaped Retail Sales data, stable inflation, and little pressure in the jobs market. The Beige Book reports showed some regions with modest slowing in economic activity and jobs.

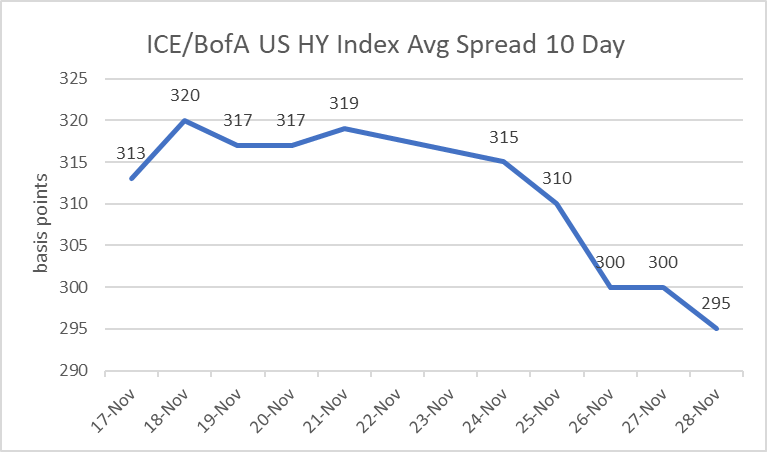

Junk bonds continue to take direction from the health of the equity markets. The ICE / BofA US HY Index closed higher every day this week. The Index had almost incremental moves this week, closing higher by about 0.2% three of four trading days this week, and higher on Friday by + 0.133%. The weekly return was (+ 0.723%) with narrower spreads (- 22) and narrowed each trading session. The Average spread is wider by one basis point month-to-date.. Weaker credits are underperforming better quality, and CCC's are narrower by three (- 03) basis point this week. Month-to-date, BBs are higher by + 0.603%, while CCCs are lower by - 0.977%..

Yields moved higher today, and the curve bull steepened despite improved December cut odds. The FOMC remains divided on whether to cut rates or pause, but recent remarks from prominent Governors (Williams, Waller) favoring a cut will likely win out over those urging caution (Hammack, Goolsbee, Schmid, Musalem) on stubborn inflation. The Fed starts its pre-meeting blackout on Saturday at 12:00PM EST. The next meeting will likely have lively debate but should result in a 25bp rate cut. Secretary Bessent concluded his general search and reports that White House NEC Director Kevin Hassett had emerged as frontrunner to replace Jerome Powell. Hassett is known as a staunch advocate for lower interest rates.

Ukraine and Russia continued to negotiate an end to the Russian incursion. The two sides are negotiating separately with hopes of joining the two sides when demands can be closed to match. President Putin is the wild card in the equation as he remains difficult in his demands and problematic in trust. Should two sides come to terms, energy (oil) prices should retreat to lower levels.

NEW ISSUES THIS WEEK (11/24 - 11/28) :

This week, (Nov 24 - Nov 28), there was one (01) USD high yield deals in one (01) tranches priced. Volume for the week was $1.50bn. 2025 year-to-date volume is $298.50bn vs $261.75bn in 2024. 2025 volume is now ahead of last year (2024) by 14.04%.

Avg | +$0.125 | |||

Issue | Price | Bid | Ask | Δ |

URI 5 3/8 11/15/33 | 100.000 | 100.125 | 100.375 | +$0.125 |

TODAY'S MARKETS:

- High-Yield ICE/BofA index higher today (+ 0.133%). The average spread on (11/28) was narrower by five (- 05) basis points at 295. The BB sector spread was narrower by six (- 06) at 173. The B sector was narrower by six (- 06) at 306. The CCC sector was wider by three (+ 03) at 917.

- Over the prior past five trading days, the Average is narrower by - 22bps, BB's narrower by - 22bps, B's are narrower by - 28bps, and CCCs narrower by - 03bps.

- The largest HY ETFs are HIGHER today (11/28) by + 0.07% on average and are HIGHER by + 1.15% over the past five trading days, on average.

- The CDX HY Index is HIGHER today, Nov. 28, by + 0.095 at 107.457. The best performers are Liberty Interactive LLC (LINTA), Xerox Corp. (XRX), and iHeartCommunications Inc.(IHRT).. The worst performers are Domtar Corp. (UFS), TEGNA Inc. (TGNA),and Genworth Holdings Inc. (GNW)

- Oil (WTIJan26) is LOWER today by - $ 0.10 at $58.55 per barrel. Oil is higher for the week by + $ 0.49 per barrel

- The Dollar Index (DXY) is LOWER today by - 0.101% at 99.436. The DXY is lower for the week by + 0.780 pts

- Spot Gold is higher today by + $57 at $4162 per ounce. Gold is lower for the week by $50/ oz

ICE / BofA US HY Index 10-day Average Spread

* HY ETF Fund Flow Data *

| Week Ending | Weekly Flow ($) | Weekly Trend ($) |

| Nov 26 | 1.533bn | 2.515bn |

| Nov 19 | - 982m | - 1.447bn |

| Nov 12 | 465m | 924m |

| Nov 05 | -459m | -2.859bn |

* HY Managed Funds Flow Data *

Week Ending | Weekly Flow ($) | Weekly Trend ($) |

| Nov 26 | 706.1m | 1.039bn |

| Nov 19 | - 333m | + 33m |

| Nov 12 | -366.5m | 589m |

| Nov 05 | -955m | -1.414bn |