20th May, 2025

The European Financial Stability Facility (EFSF) had the SSA new issue market to itself on Monday, following up on a recent RfP with a EUR3bn no grow long 7yr (maturing Sept 2032). Initial guidance of m/s+36bp area was around 3-4bps back of where we spotted fair value (going off the borrower’s existing well-stocked curve), but strong demand of EUR9.5bn+ saw 2bps chopped off guidance to land at m/s+34bp. That kicked off a week which bankers in our issuance poll expect to yield on average EUR14bn of euro paper, a figure we will be looking to get a lot closer to today after mandates from Iceland (5yr alongside a tender), International Development Association (5yr SDB), MFB Hungarian Development Bank (5yr), Instituto de Credito Oficial (EUR500m no grow Apr 2032 green), British Columbia (15yr) and Ville de Paris (EUR350m no grow 15yr).

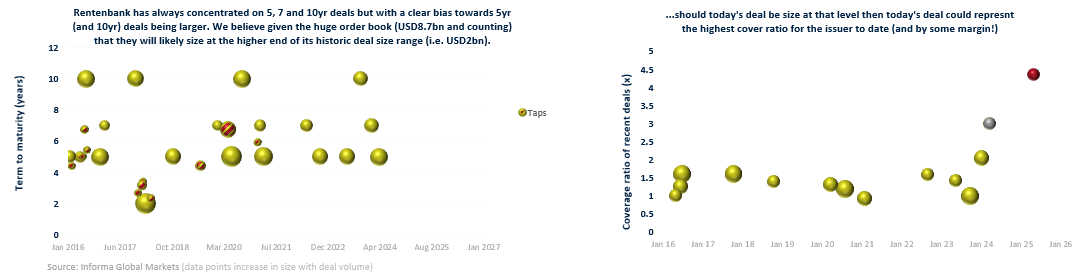

Away from the single currency, the United Kingdom is out with a new syndicated Jan 2056 gilt whilst Rentenbank yesterday released IPTs for a USD 5yr global at SOFR m/s +46 area for which the early book updates (IoIs) looked exemplary (USD6.2bn) but have since continued to grow (USD8.7bn). To put that into some sort of perspective, the issuer's previous largest order book was USD4.5bn and that came on its last outing (a USD1.5bn 5yr that priced in Oct 2024). Its 5yr deals have tended to be larger than at other tenors and on that basis we believe today's deal will be sized in line with its previous largest deal at USD2bn.

Live deals

| Issuer | ESG Deal Type | CCY | Amount (mn) | Maturity | Initial Price Talk | Latest Px Talk | Final Pricing | Book Size (mn) |

| Instituto de Credito Oficial (ICO) | Green | EUR | 500 | 30/04/2032 | SPGB+10a | SPGB+7a | - | 2,500 |

| International Development Association (IDA) | Sustainability | EUR | TBD | 28/05/2030 | m/s+30a | - | m/s+28 | 3,700 |

| Province of British Columbia | EUR | TBD | 29/05/2040 | m/s+92a | - | m/s+90 | 5,600 | |

| Republic of Iceland | EUR | 750 | 27/05/2030 | m/s+50a | m/s+45a (+/-3 WPIR) | - | 2,800 | |

| Ville de Paris | EUR | 350 | 25/05/2040 | OAT+13a | - | OAT+13 | 380 | |

| Caisse des Depots et Consignations (CDC) | GBP | 500 | 28/02/2028 | SONIA m/s+55a | - | SONIA m/s+55 | 650 | |

| Kreditanstalt fuer Wiederaufbau (KfW) | GBP | TBD | 30/12/2026 | - | SONIA m/s+23 | 275 | ||

| United Kingdom of Great Britain and Northern Ireland | GBP | 4,000 | 31/01/2056 | UKT+1.75-2.25 | - | UKT+1.75 | 74,000 | |

| Rentenbank | USD | TBD | 28/05/2030 | SOFR m/s+46a | - | SOFR m/s+42 | 8,700 |

- ICO is in the EUR market for the first time in 2025, having completed 3 deals in 2024 (EUR2bn total across 5, 6 and 7yr deals). IPTs of SPGB+10a represents the narrowest spread for the issuer since late 2021. Whilst there are no book updates as yet we highlight that its last deal (EUR1bn 6yr in Sept 2024) received EUR1.9bn of demand and that its most oversubscribed deal came back in Feb 2023 when a EUR500m 5yr green was 9x covered. Given the tighter spread to SPGBs from the outset, we see little chance for a repeat of that level of excess demand and we will be watching keenly how demand dynamics change from here for both Spanish and French issuers in light of a lower pick-up over underlying govvie yields (we have already seen some French issuers receiving much smaller order books than they have been accustomed to in recent months).

- The IDA had been using the EUR market for longer dated trades until today. Since Oct 2019 it had placed 10 new transactions (and a small tap of a 2053 bond) for a total of EUR16.75bn and with a weighted average term to maturity of 15.3 years. Also notable is that the average cover ratio until its last transaction was just 1.395x (with little dispersion around that value) and so the 10.4x coverage of the new 15yr deal in January came completely 'out of the blue'. It appears to be on a positive path again today with an early book update suggesting EUR3.7bn of demand already indicated (excl JLM interest).

- British Columbia is looking at a new 15yr, a tenor that is ordinarily pretty rare (Ville de Paris also there today) but is doing so with Canadian regional issuers still very much in vogue if key issuance metrics (NICs/XVCRD) are to be believed. 10yr deals have been the go-to for peers Alberta and Quebec in 2025 so far with the latter the most recent, coming just last week with a EUR3bn deal that was almost 4x covered. Both Quebec and today's issuer also went down the 15yr route in 2024 with the Q 3.35% July 2039 seen on screens at i+84a (bid) and its own 2039 line at i+83.5a. An extrapolation from the existing BRCOL curve would suggest a fair value in the region of m/s+86/87 area according to our simple calculation.

- The infrequent issuing Iceland comes for a 2025 installment in the shape of a new 5yr bond over 14 months after its last appearance. On that occasion a EUR750m 10yr green was inundated with EUR7bn of orders for a 9.33x cover. The IPTs to Pxd of -15 and -12 on the last two deals suggest that the issuer usually adopts a pragmatic approach to pricing, although that doesn't appear to be mirrored in today's IPTs which at m/s+50a appear to be offering very little in terms of concession for investors if Iceland's rather limited and illiquid EUR curve is to be trusted as a complete guide. The book update at EUR2.8bn and revised guidance of m/s+45 (+/-3bp) would suggest that investors are looking beyond that.

- Ville de Paris continues with the issuance of small volume (relatively speaking) and long-dated bonds with a new EUR350m 15yr. As noted above we will be watching closely for signs that excess demand may be dwindling as spreads over OATs continue to get slimmer for French agency issuers. For context, the issuer has an average cover ratio of 3.7x for deals since 2022 (where details are available) although that does include the 7.5x recorded in Jan 2024 when a new EUR400m 20yr was swallowed up by EUR3bn of orders (the issuer's largest ever order book - by a 2.5x multiple).

- The UK continues to garner huge order books for its syndicated deals with today's deals no exception (GBP74bn). In 2021, 2023 and 2024 new 30yr Gilts were sized at GBP6bn and placed into order books that ranged from GBP68-77bn and so very much in keeping with what we have seen so far today.

---- Subscribe to read more ----

To receive this analysis plus much more, subscribe to IGM. Request your free trial of the service today.