30th May, 2025

- The SSA bond market significantly surpassed issuance expectations this week, with EUR16bn priced overall, driven by a massive EUR13bn 10yr deal from the Kingdom of Spain. Our issuance estimate survey indicated just EUR8.5bn.

- Strong performances from Ontario Teachers' green bond (6.6x covered) and BNG's dollar offering (rare 10yr tenor for the issuer) contributed to a robust week, with a healthy pipeline of green initiatives suggesting continued activity.

Weekly Volumes Surge Past Expectations

The SSA primary bond market delivered a blockbuster week, significantly outpacing initial volume forecasts, largely thanks to a jumbo 10yr issue from the Kingdom of Spain. While early indications suggested a week potentially mirroring the prior period's EUR10.85bn (excluding emerging markets) and with an average estimate around EUR8.5bn, the final tally for single currency SSA issuance surged to EUR16bn. This comfortably surpassed even the most optimistic pre-week guesses of EUR15bn, a figure many thought achievable only with the emergence of a substantial sovereign deal.

Spain's Sovereign Powerhouse Drives Euro Issuance

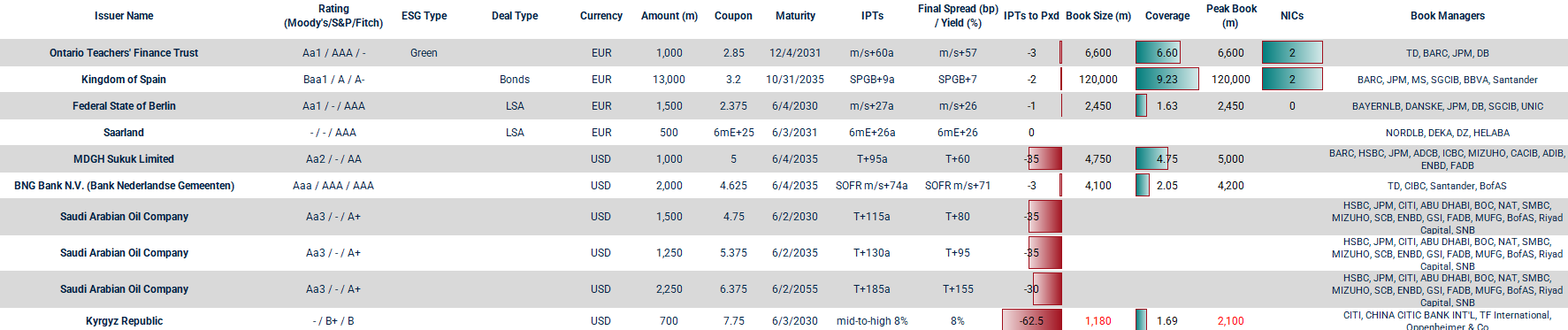

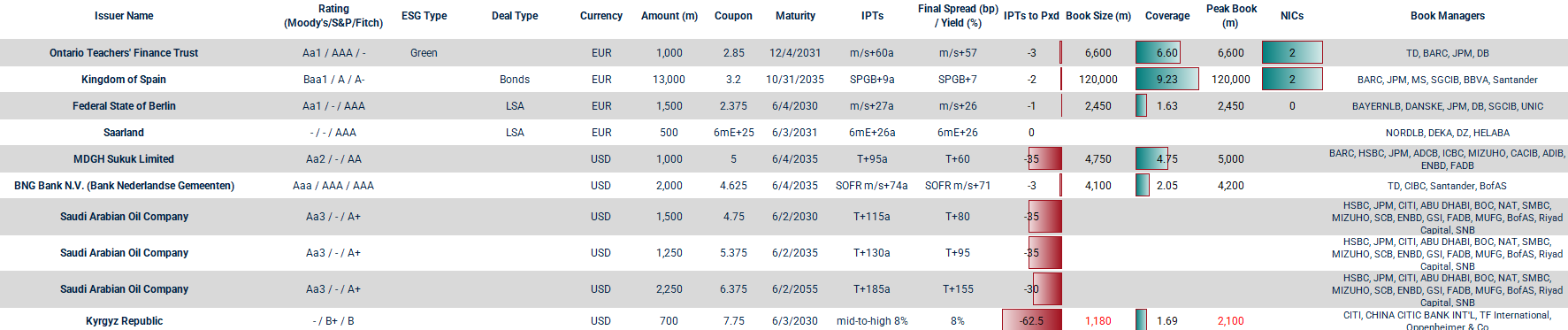

That sovereign anchor arrived emphatically with the Kingdom of Spain's third syndication of the year. The new long 10yr bond, its second at this tenor in 2025, was initially anticipated by some (including us) to be in the EUR8-10bn range, based on previous issuance patterns. However, tapping into stellar demand (again) that saw order books peak at a whopping EUR120bn, Spain priced a EUR13bn transaction. The bonds were priced at SPGB+7, following a 2bp compression from initial guidance, and came with a minimal 2bp new issue concession. That compares to its second 10yr deal in 2024 (which came on 29th May as opposed to 28th May this year), which raised EUR10bn from EUR125bn of orders at SPGB+6.

Green and Agency Deals Add Depth to Euro Market

Adding to the week's impressive euro-denominated funding was Ontario Teachers' Finance Trust, which achieved a spectacular outcome for its new 6.5yr green bond. Attracting a robust EUR6.6bn order book for its EUR1bn issue, the deal achieved an easily calculable, but no less impressive, 6.6x coverage. While pre-deal commentary noted the exceptionally large order books for Canadian issuers like CDP Financial (EUR11bn) and CPPIB (EUR10.6bn) earlier in the year, Ontario Teachers' coverage ratio underscored strong investor appetite. This transaction marked its second foray into the green bond market and priced at m/s+57 after tightening 3bp from IPTs.

The German Länder also contributed to the early week activity. The Federal State of Berlin successfully placed a EUR1.5bn 5yr LSA. Quick to act on investor interest, which saw EUR1.4bn in orders within the first hour and grew to EUR1.8bn (including JLM interest), Berlin set the final spread at m/s+26, tightening from the initial m/s+27 area. Saarland had also entered the market on Monday (whilst the UK was out for its Bank Holiday), pricing a EUR500m 6yr floating-rate LSA at 6mE+26.

BNG Delivers Upside Surprise in Dollar Segment

In the dollar market, activity continued at a healthy pace, reflecting ongoing strong demand and attractive funding levels for issuers. BNG Bank N.V. surprised to the upside with a rare 10yr USD transaction, printing USD2bn. This was notably larger than its most recent 10yr deals in May 2020 (USD1.25bn) and earlier (USD1bn) and exceeded our expectation for a trade of around USD1.5bn. The deal, which followed a EUR2bn 5yr transaction just two weeks prior, garnered a USD4.1bn order book and priced at SOFR m/s+71, after initial price thoughts were around SOFR m/s+72 area. The decision not to push pricing tighter despite significant book growth after guidance hinted at the issuer’s potential focus on achieving a larger size.

The strong issuance window was largely concentrated in the first half of the week, as much of Europe observed the Ascension Day holiday on Thursday, leading to a predictably quiet end to the period for new euro deals.

Looking Ahead: Green Initiatives Dominate Pipeline

The pipeline continues to build with a strong focus on environmentally conscious funding. The State of Hessen is preparing a EUR green LSA, with investor calls scheduled for June 2nd to June 6th. Comunidad de Madrid has already held investor calls this week for an inaugural EuGBS aligned green bond which should now become next week’s business. Potentially further out, NRW.Bank and the Grand Duchy of Luxembourg announced intentions to issue debut blockchain-based digital bonds, though neither are expected imminently, such has been the pace of new digital bonds coming to the market in recent months.

This week’s issuance estimates survey is suggesting a slowdown in volume with an average that looks likely to come out in the mid to high single digits, although that gives little information on the number of transactions we might see (after only 4 in euros this week). What we do know is that the ECB is scheduled to meet on Thursday so next week’s supply, whatever there is, will be front-loaded.

---- Subscribe to read more ----

To receive this analysis plus much more, subscribe to IGM. Request your free trial of the service today.