THE USD WEEK - BIAS IS NEUTRAL

Expected DXY USD Index trading range is 98.50 - 100.00

RISK 1 - Official US data was releases are beginning to filter through. When the numbers do drop, there is the clear risk of the data creating more volatility for the markets.

Scheduled through the week are Empire manufacturing and construction spending today followed by the likes of ADP weekly employment preliminary estimate, IP, factory orders, initial claims and September NFPs Thursday as well as the Michigan sentiment and those long-term inflation expectations.

Again, a number of releases will be uncertain, but if unveiled they could have a greater FX impact than normal, particularly on a surprise.

Otherwise, ADP figures and evidence of a weakening labour market will be main focus.

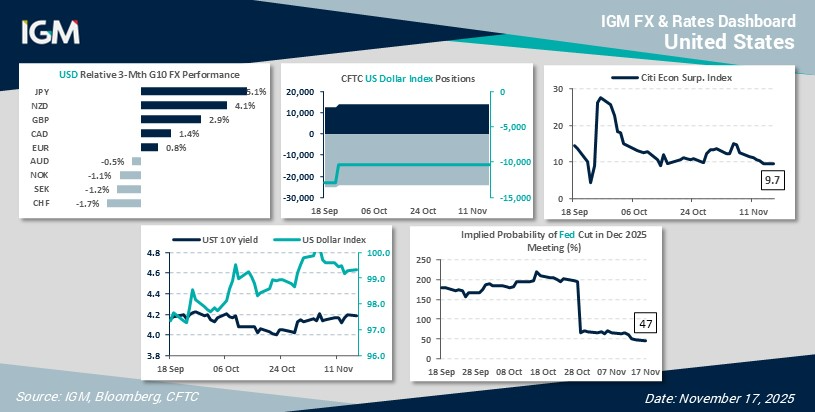

RISK 2 - Ahead, implied probability of a Fed rate cut in December stands at a near coin toss 47%.

Plenty of Fed chat through the week, including Williams, Jefferson, Kashkari and Waller today followed by the likes of Barkin, Logan, (dovish dissenter) Miran, Hammack, Goolsbee and Paulson.

We also get Minutes from the October 29 -25BPs rate cut and Powell's notable comment that a “further reduction in December is not a foregone conclusion, far from it.”

Latterly, Kashkari and Hammack both indicated latterly they weren’t sold on another reduction, which has worked to cool easing expectations.

Can the dial move materially this week?.

RISK 3 - US Treasury Secretary Bessent said President Donald Trump’s proposal to send Usd 2000 “dividend” payments from tariffs to US citizens would require congressional approval.

RISK 4 - Tariffs and Trump also warned that any country that does business with Russia will be sanctioned.