Monday melt up in stocks, with major indices gapping to record highs as traders look to a trade deal with China, a Fed rate cut, and an accelerating earnings season.

Over the weekend, Treasury Secretary Bessent teed up a Thursday meeting between Presidents Trump and Xi, saying a ‘positive framework’ for trade between the two countries had been agreed to.

Given Trump’s volatile negotiating style, we’ll believe it when we see it.

Nevertheless, with a near-certain rate cut on Wednesday and an accelerating earnings season, news flow is overwhelmingly positive.

As of Friday, with 29% of the S&P 500 in the books, blended Q3 earnings growth is running at 9.2% (y/y), up from 7.8% a week earlier.

Five of the Mag 7, representing $15 trillion in market cap, report this week. GOOG, META, and MSFT on Wednesday, and AAPL and AMZN on Thursday. As a group, Mag 7 is expected to print 12% y/y earnings growth on revenue growth of around 15%.

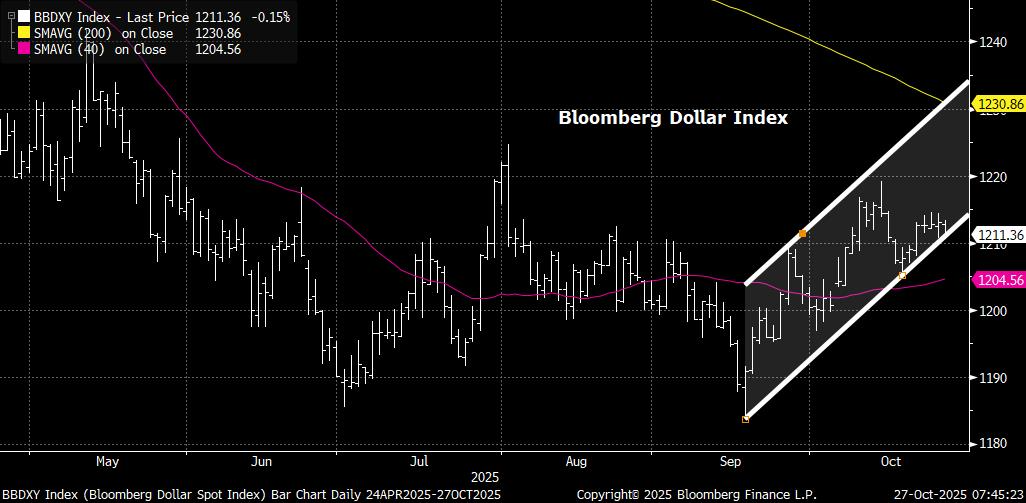

All this friendly sentiment has led to a rebound in risk-sensitive FX, putting a modest offer in the dollar. We like the greenback here, and the pattern of higher highs/higher lows since bottoming last month. As long as that holds, we’ll fade weakness.

Treasury yields are higher as the government’s plan to auction $183 billion in coupons today and tomorrow competes with a potential surge in corporate issuance. My credit colleagues say that a dozen deals could hit today as bankers take advantage of risk-on markets and investors look to lock in rates before the FOMC meeting.

More later.

To receive this analysis plus much more, subscribe to IGM. Request your free trial of the service today.