Asset-Backed Market Thrives on Investor Demand

Neither the shortened holiday week schedule nor the market noise from Davos over Greenland and tariffs could dampen investor demand for asset-backed consumer sector paper. Seventeen deals, totaling over $12 billion in asset-backed paper (largely from the consumer sector), were priced during the week, with eight of the offerings upsized due to strong investor demand.

The largest among them, the $1.5 billion Enterprise Fleet Financing (EFF) 2026-1, LLC Fleet Lease ABS, issued via MUFG (Structuring)/BC/JPM/MZHO, saw a 25% upsize from its original size of $1.2 billion. All senior classes priced 2 to 8 basis points inside the original price guidance, reflecting robust investor appetite.

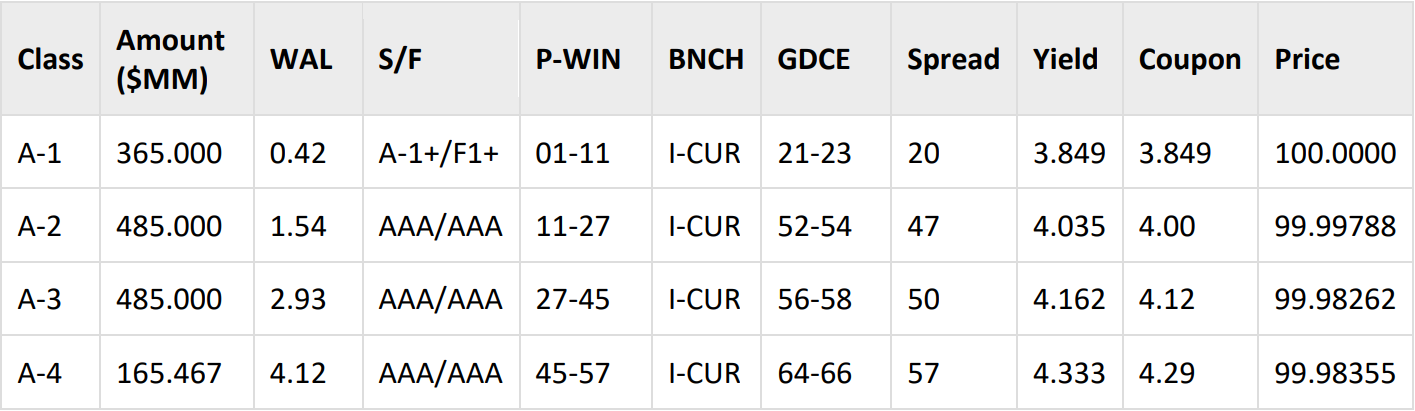

Pricing Details for EFF 2026-1:

The second-largest deal, the $1.3 billion Ford Credit Auto Lease Trust (FORDL) 2026-A Prime Auto Lease ABS, issued via RBC (Structuring)/DB/TD (Active)/Lloyds/Scotia (Passive), was upsized from $1 billion and priced at levels well inside the initial price guidance.

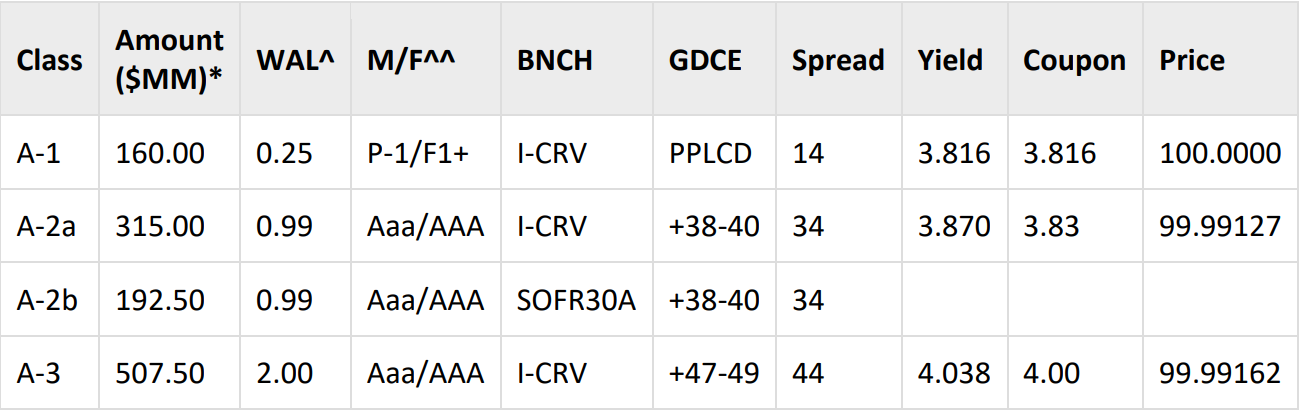

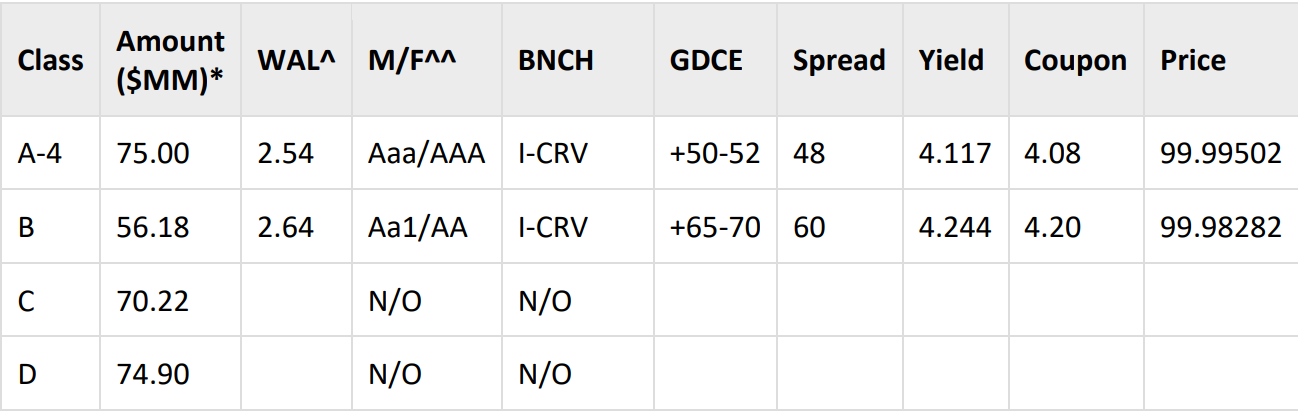

Pricing Details for FORDL 2026-A:

Additionally, the A-2 class 1-year WAL bonds priced well inside the FORDL 2025-B class A-2a/A2b bonds with a 1-year WAL, which priced 5 basis points wider at 39 basis points over the interpolated curve and SOFR back in July 2025.

Please see full report: IGM_Structured_Finance_Monitor_- Weekly_US_Edition January 23 2026.pdf

To receive this analysis plus much more, subscribe to IGM. Request your free trial of the service today.