DAILY CLOSE: Record quarter sees EUR600bn+ in euro supply

By Matthew Barrett March 28 2024

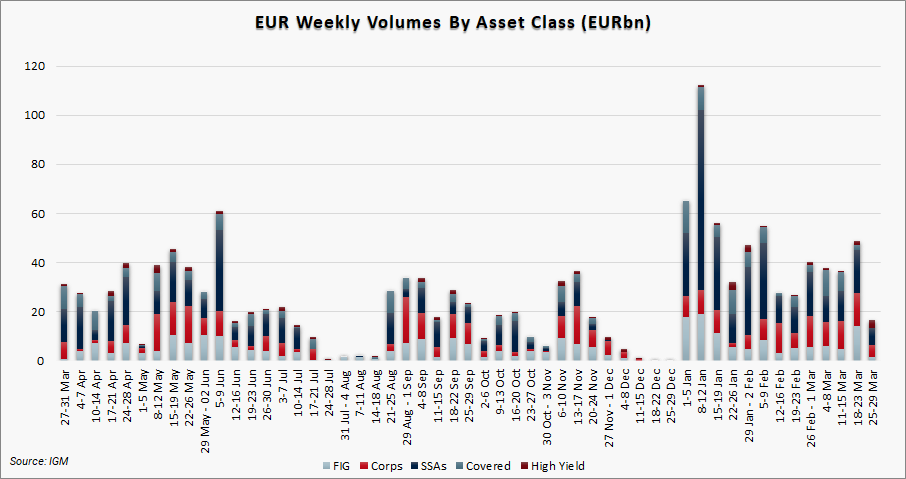

** Given that Thursday was the de facto end to the week, month and quarter due to the long Easter weekend, we didn't expect much to come to market on the day and that proved to be the case. The only issuer to print was high-yielding Neopharmed Gentili which put the finishing touches to a EUR750m two-part secured trade after a roadshow across the week (details here). Those bonds put the weekly single currency haul at EUR16.4bn (breakdown here) which was by far the lowest of any week of what has been a frenetic start to this year. The final Q1 single currency haul finished up at just over EUR602bn, comfortably a new quarterly record having smashed the previous all-time high of EUR517bn set in Q1 2023

** Thursday's blank meant the weekly euro IG corporate supply total finished at the second lowest of the year at EUR4.95bn, and also short of the average estimate of EUR6bn given by participants in our issuance poll. This week's activity rounded off what was the quickest ever start to the year for single currency corporate issuance, where EUR115.25bn of new paper was priced in the first three months of the year. That is more than the previous Q1 record of EUR105.9bn set in 2020, whilst it is the second biggest quarter of all-time for the asset class having only been beaten by Q2 2020 (EUR186.405bn). See the IGM CORP SNAPSHOT for details of this week's deals from BT, Orange, Solvay and Saint-Gobain

** The SSA market again led from the front in terms of volume this week, but the EUR7.05bn total from three issuers was the sector's lowest weekly total of 2024 so far. The volume booster came on Tuesday as KfW brought its year-to-date euro tally to EUR20bn via a EUR5bn (from benchmark) 5yr line that was 3.78x covered at reoffer. More 5yr paper came the next day in the form of a social bond from BNG Bank which was ultimately sized at EUR1.75bn and attracted demand of EUR2.9bn. Away from the single currency and the Province of Quebec hogged the limelight on Tuesday with a USD3.75bn 5yr Global which landed flat to fair value on the back of a bumper USD7.9bn book. In sterling, NRW.BANK (GBP300m Oct 2028s) saw measured demand of GBP345m for its first bond in the currency this year

** With non-covered FIG issuers sticking to the sidelines for a second consecutive session, the week's single currency total remained stuck at just EUR1.3bn from two deals, comfortably short of the EUR5bn average estimate and way down from the prior week's EUR14.05bn haul. What did emerge this week attracted plenty of demand though. Deutsche Bank brought a EUR1bn 6NC5 SNP that priced 35bps inside m/s +185 area IPTs (zero NIC) on a EUR2.5bn final book while Slovenian lender Nova KBM saw its EUR300m 4NC3 senior pref line 6.67x covered at its m/s +190 reoffer, allowing leads to slice 45bps off initial talk. With that, single currency non-covered supply from banks in Q1 totals EUR95.62bn, just shy of the EUR97.72bn which priced in Q1 2023. Looking ahead and next week is expected to be another measured affair although there should be plenty of cash on hand to support the right trade if this week is any guide. See IGM's FIG SNAPSHOT

** It was a blank week for the covered market in terms of euro supply - the first seen yet in 2024. This time last year, five issuers emerged to print a EUR5.25bn total despite the looming Easter break. This week's the lack of issuance leaves the year-to-date number at EUR76.7bn, ~EUR10bn behind last year's volume for the equivalent period. Away from the single currency, Leeds Building Society (GBP500m Apr 2029) and NatWest Bank (EUR750m Mar 2029) raised a combined GBP1.25bn total in the earlier part of the week, taking the sterling YTD volume to GBP4.25bn

** Low issuance volumes are anticipated in yet another holiday truncated week next week, with ca. EUR16bn the average forecast in the IG space. Issuance burden is expected to be spread fairly evenly across the asset classes. See IGM's Euro Issuance Estimates (w/c 01-Apr-2024)

.

.

GM's Legal Notices

This week's tender announcements include Orange (FR0013413887, XS1115498260) and Eutelsat (FR0013369493).

You can find these and more on IGM's Legal Notices story look-up function, where clients can access announcements on tenders, consents, exchanges and stabilisation notices.

For IGM's Legal Notices click here.

IGM Credit Excel spreadsheets and reports

** The IGM European Weekly Credit Overview is your comprehensive round-up of primary European new issue activity including pricing, order book information, new issue concessions and ISINs

** The IGM European Weekly Cheat Sheet provides proprietary intelligence on Euro primary market trends using various key data points in an easily digestible Excel spreadsheet. This includes Euro new issue volumes, average new issue concessions and book cover ratios across asset classes, as well as other key credit proxies

** The IGM Roadshow Calendar is your one stop window on who, when and where. The calendar view provides an instant snapshot of which days are already earmarked for meetings in a convenient PDF format, with clickable links that take you directly to the known schedule

Thursday's broader market developments

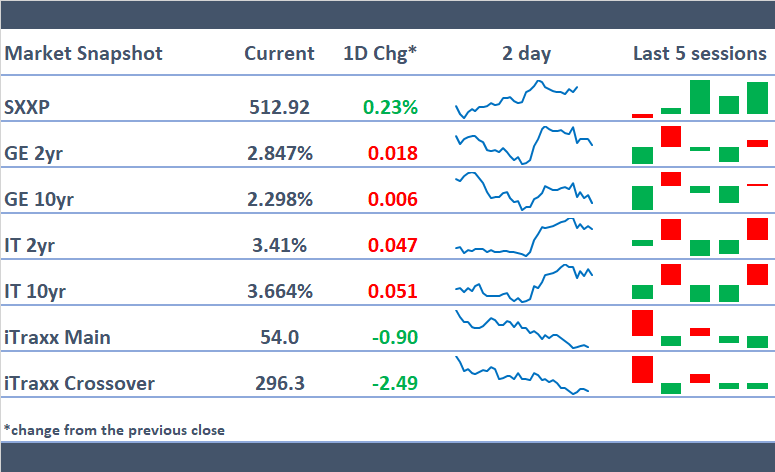

** The path of least resistance for stocks remained higher with the Stoxx600 hitting another record peak despite some central banker push back on potential rate cuts. Fed's Waller said there is no rush for the Fed to cut rates, specifically opining that he needs to see at least a couple months of better inflation data before he's confident enough to cut rates, whilst BoE's Haskel (via the FT) said that rate cuts should be a long way off and that wage growth remains too high. On the data front, European and US releases were mixed (see below)

** Stoxx600 gained as much as 0.34% to an all-time high. Communication stocks lead the way higher while utilities the lagged

** Govvies: EGB yields were on course to close little changed, paring early gains

** Data:

- GE Feb Retail Sales MoM missed at -1.9% (f/c 0.4%, prev rev to -0.3% from -0.4%)

- UK Q4 F GDP QoQ confirmed at -0.3%

- GE Mar Unemployment Change lower than exp at 4k (f/c 10k, rev rev to 12k from 11k)

- IT Mar Consumer/Manufacturing Confidence mixed at 96.5/88.6 (f/c 97.6/87.8, prev 97.0/87.5)

- EC Feb M3 Money Supply higher than exp at 0.4% (f/c 0.3%, prev 0.1%)

- US Q4 T GDP QoQ Annualized upgraded to 3.4% (from 3.2%)

- US Initial Jobless Claims below f/c at 210k (exp 212k, prev rev to 212K from 210k)

- US Mar MNI Chicago PMI below f/c at 41.4 (exp 46.0, prev 44.0)

- US Feb Pending Home Sales AR above f/c at 1819k (exp 1815k, prev rev to 1795k from 1807k)

What to watch Friday - US PCE Core Deflator

** Key Data: JN Feb Housing Starts (05:00), FR Mar P CPI (07:45), FR Feb Consumer Spending (07:45), IT Mar P CPI (10:00), US Feb PCE Core Deflator (12:30), US Feb Personal Income/Spending (12:30) and US Feb P Wholesale Inventories (12:30)

** Key Events: Fed's Daly (15:15) and Powell (15:30) speak

** Auctions: No major term auctions scheduled for Friday 29th Mar

** Holidays: Easter (Good Friday)

.

To receive this analysis each day you'll need to become a subscriber to IGM. Request your free demo here.