FIG VIEWPOINT: Bumper year ends with a flourish as thoughts turn to 2023

16 Dec 2022 | David Corbell

Bumper year ends with a flourish as thoughts turn to 2023

While 2021 offered relative stability and issuers almost continual access to funding, 2022 provided more challenging conditions where war in Ukraine, aggressive and synchronised central bank tightening, not to mention China's zero Covid policies, were key drivers of higher volatility.

With that came a significant volume of “no-go" days in Europe's single currency primary market (a total of 50 across all asset classes in the first 11 months of 2022), giving those days when the window was open an altogether more frantic feel.

Despite that, it was a bumper year for bank supply in the single currency with non-covered issuance rising to EUR218.91bn in 2022, easily topping 2021's EUR201.35bn, and representing the highest annual tally since 2009.

Also prospering in the more volatile environment, the lower beta covered market has seen its busiest year ever.

Rising supply from banks came in contrast to a 25% decline in supply from high grade corporates and also a 20% slowdown in supply from SSA borrowers.

Altogether, that meant overall EUR supply across the asset classes slowed for a second year running to EUR1.22tn from EUR1.39tn in 2021 and the record breaking EUR1.48tn in 2020.

Rapid repricing catches many off guard

With the Fed having pivoted to a more hawkish stance at its final meeting of 2021, few doubted that policy rates would rise substantially in 2022 but the speed and magnitude of the repricing caught many by surprise. That was highly evident in the more policy sensitive short end of the UST curve where the 2yr yield rose as high as 4.80% in Q4 having started the year below 0.8%.

For those accustomed to the more restrained pace of hikes seen in prior Fed cycles, that produced a challenging environment for fixed income markets to say the least.

In Europe, yields rose by less, but combined with the significant widening in spreads, it was still enough to produce the most negative annual total returns of the euro-era for credit investors.

Equity markets were far from immune to the repricing in rates although losses were heavily pared in Q4 as markets started to sense that the moment of peak hawkishness was approaching.

Primary market shows resilience

War came early in the year to Europe as Russia invaded Ukraine on 24th February, exacerbating inflationary pressures, bringing extreme volatility to global markets and temporarily shuttering the primary market.

However, in a little over two weeks following the invasion, banks were back in size, with March seeing EUR24.11bn of non-covered supply crammed into the latter half of the month, not far short of January's jumbo EUR27.85bn.

Resilience in Europe's primary markets (and its ability to quickly reprice and move on) is nothing new of course.

That was something also seen back in Q1 2020 when rapidly accelerating Covid cases outside China, and the ensuing tailspin in global risk assets, closed the European primary market for only a few short weeks.

Also highlighting the degree to which buyers were prepared to re-engage this year was the supply flourish seen in November as investors rushed to take advantage of historically attractive spreads to follow a very challenging period from August through to late October.

That resulted in a huge EUR38.325bn coming to market, to mark second busiest month ever for non-covered bank supply, just behind the EUR39.47bn raised in January 2020.

While issuers flooded the market with paper in November, the abundance of investor cash chasing down the fresh supply meant that average cover ratios actually nudged higher. That dynamic handed issuers greater pricing power too, facilitating the lowest monthly average NIC since May.

Europe EUR Banks (ex-covered)

Based on a much smaller sample, average NICs fell further in December too in an environment where uninvested cash also supported secondary paper as options to put money to work via primary offerings dwindled.

All things considered, the year as a whole showed that demand remained reassuringly solid (as measured by average cover ratios). NICs understandably trended higher for much of 2022, until the resurgence of investor interest and improved sentiment in Q4 handed greater pricing power back to issuers.

Lower risk senior paper drives supply

In a volatile 2022, it was notable that the least risky end of the capital structure drove supply where rising volumes were led by senior issuance.

At the same time, investor caution aligned to pervasive volatility dented appetite for the riskier part of the capital structure, evidenced by declining volumes of Tier 2 and AT1 supply compared to 2021.

If volatility persists into 2023, then the same script could remain in play while also continuing to provide larger and/or better known lenders with superior access to markets.

EUR Banks - Annual Issuance

Green bonds lead a year of record ESG supply

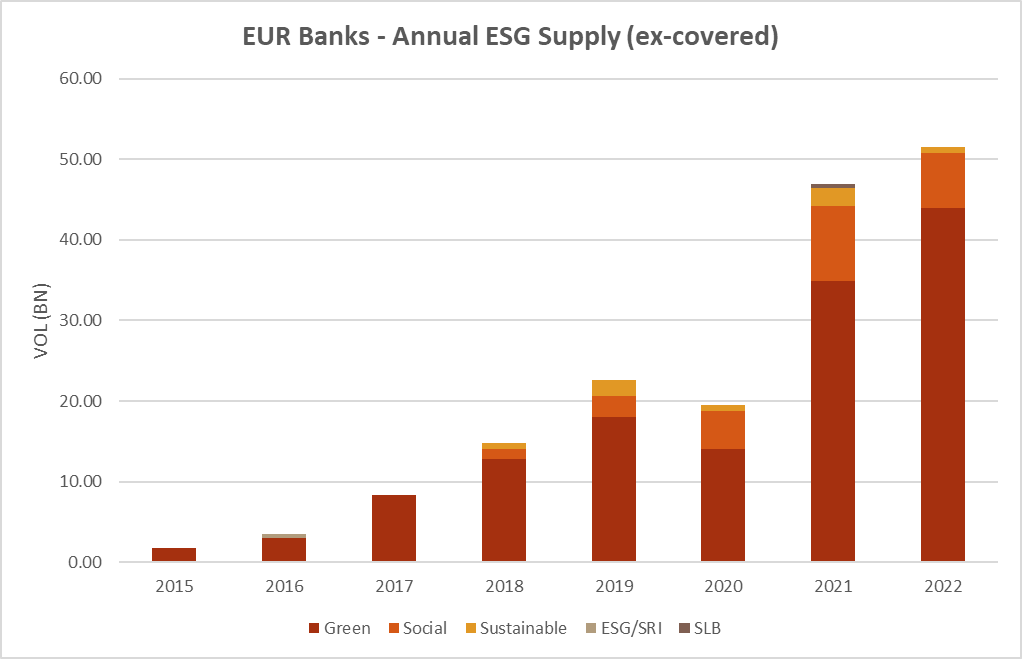

It was also another very busy year for ESG supply where banks raised a record EUR51.55bn via non-covered single currency paper, continuing the general upward trend which has held since sales began in 2015.

Overall, ethical debt sales accounted for 23.6% of all supply in the asset class, just topping to the 23.3% share achieved in 2021.

As the race to decarbonise portfolios continued, it was once again the ever dominant green segment which led ethical supply from banks, accounting for 85.4% of all ESG paper.

The increased dominance of green bonds came in contrast with falling supply via both social and sustainable paper, while there was no issuance of SLB paper at all.

EUR Banks - Annual ESG Supply

Thoughts on 2023

If activity during the latter part of 2022 is any guide, all other things being equal, issuers will be hoping to enjoy relatively easy access to funding in the early stages of 2023, albeit at a significantly higher cost than at the start of 2022.

Investors will, however, be mindful that recession risks and stickier than previously envisaged inflationary pressures bring with them concerns over asset quality while the impacts of the aggressive policy tightening seen in 2022 are yet to be fully felt.

However, as seen in the latter part of this year, once investors sniff the bottom, given the right conditions, huge amounts of cash can come off the side-lines from buyers keen to take advantage of higher yields and/or wider spreads.

Whatever the case, investor demand can be expected to receive a significant test in January as the traditional new year funding rush ensues.

While no two years are ever the same, looking back at January issuance in each of the past ten years shows that non-covered issuance from banks in the month has averaged EUR26.2bn, with that average boosted by a bumper January in 2020.

Underpinning expectations of another busy year for bank supply is the high volume of the ECB's TLTRO III operations which are set to mature or be repaid next year.

However, the exact extent to which banks will turn to market based sources of funding remains to be seen given the higher absolute costs stemming from this year's repricing of both rates and spreads.

EUR Banks - January Supply

Source: IGM