Viewpoint: Inflation data now key for RBA outlook

04 Apr 2023 | Rachel Bex

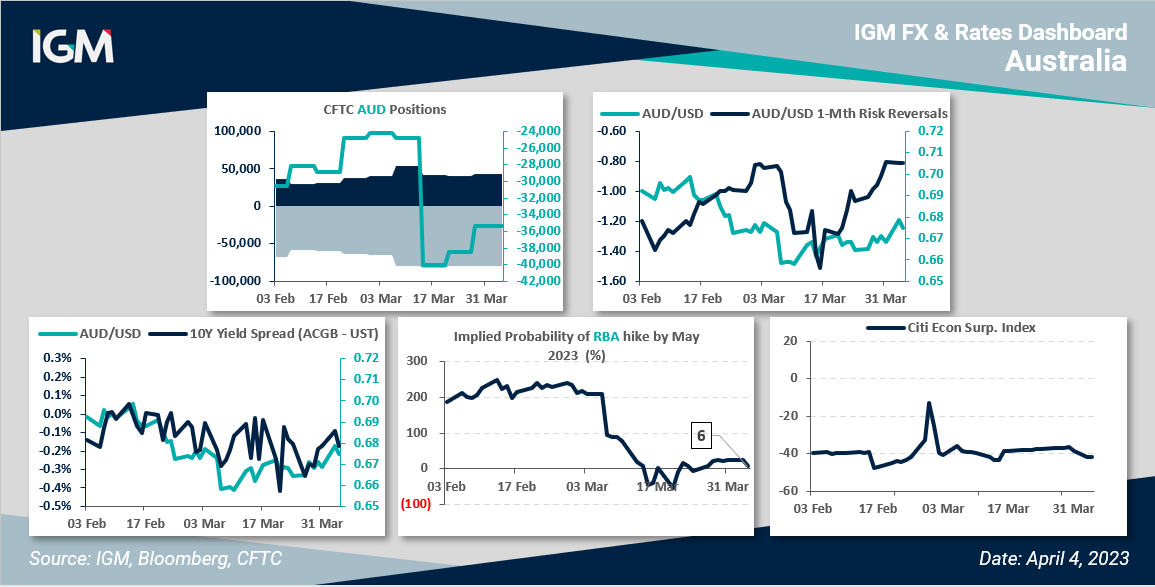

Australia dashboard

AUD/USD fell from highs of 0.6793 to lows of 0.6735 after the RBA kept rates on hold, though price action has quickly settled down as players await key data for clues over the May decision.

To this, the RBA revealed that more hikes may be needed, adding that the board will pay close attention to developments in the global economy, trends in household spending and the outlook for inflation and the labor market when assessing when and how much further interest rates need to be increased.

Focus now shifts to LOWE's speech on Wednesday for more specific clues.

ANZ say the speech will be "critical", as the RBA Chief may give some insight into what additional data will be needed to justify another hike or staying on pause.

ANZ also point out that the most important part of the post-meeting statement is the shift in language from further tightening "will" be needed to "may well" be needed, and say that this, along with the rest of the language in the statement, suggests the RBA is "being careful to avoid the perception that the tightening cycle is done."

WESTPAC also point out that yields only fell slightly following the decision, which is likely due to the wording around further hikes that "may well be needed."

Westpac add that the RBA saying the "decision to hold rates steady this month" implies it is a month-to-month proposition rather than a definite end to the hike cycle. So the CPI data in Q1 will clearly be the deciding factor for May.

DB agree that Australia's first-quarter inflation data is now "more important than normal" believing that if it is relatively tame, the RBA could already be done with its hiking cycle.

AUSTRALIA'S Q1 INFLATION DATA is due on April 26.

DB add that the muted reaction in AUD "makes sense" as only a minority expected a hike. "The RBA's middle path of pausing, while softening the guidance around more hikes, sounded reasonable and consistent and didn't really shock anyone," the German bank concludes.

Note, the RBA's on-hold decision had been expected by 19 our of 30 economists surveyed by Bbg.

Meanwhile, ANZ believe AUD/USD will strengthen to 0.70 in June and 0.75 by year-end as the dollar weakens, suggesting the USD has been largely overvalued based on the bank's models and thus they expect it to mean revert over a period of time.

ANZ also forecast the USD to continue its decline on the back of slower growth in the US (as long as the banking turmoil remains contained within the US), while any expectations of FED cuts and UST yields declines will also reflect moves.

For the AUD, market expectations of terminal rates and real yield differentials will play a larger role for the currency going forward, say ANZ.

Our AUD/USD Chart

Finally broke free on Mon to roam the upside after having spent 5 weeks of trading below the 200-DMA near .6750

A close above the 50-DMA near .6815 bodes well for 50% retracement of Feb-Mar .7158-.6565 fall at .6861, followed by 20 Feb .6921 high

Regaining .7029 (14 Feb lower high) underscores a resumption of the broader uptrend but a drop below Mon's .6651 low belies the rally