Tis against some men’s principle to pay interest, and seems against others interest to pay the principle. - Benjamin Franklin

As long as the music is playing, you’ve got to get up and dance. -Charles Prince

Professor Larry Summers chides financial valuation as being a limited pursuit with little to offer beyond the conclusion that one 16-oz ketchup bottle can’t be priced at anything other than the price of two 8-oz ketchup bottles. Not impressed by the implied proximity of 16 – (8+8) with zero, he lamented the lack of any insight that had to offer on what governed the unit price of ketchup.

Now if one purchased empty 16-oz bottles and squeezed the 8-oz bottles into them, one would encounter challenges associated with stickiness of the ketchup and the occasional spill and the uncertainty in being able to redeem the two emptied bottles at the exact price as that of the larger one. The new bottle would also need a new marketing wrap…. Conducting a ketchup economics experiment - with sincerity - will involve learning more than zero about ketchup.

Professor Summers’ chide about ketchup economics is still relevant in the world of derivatives. Analysis of derivatives remains entrenched in a make-belief risk-neutral world. An assumption of immaculate replication (i.e., zero residual risk) generally precedes analysis of derivatives that do not address irreducible risks associated with attempted replication. An alternative framework is demonstrated here that does not start with the zero residual-risk assumption. I present the problem of hedging a bond with a default swap and highlight the conditions where perfect replication does not work and irreducible residual risk shows itself while attempting replication. The resulting framework for calculating residual risks around break-even averages of attempted replication opens the door to behavioral interpretations of derivative prices that are informed of both the power and the limitations of attempted replication.

1 Introduction

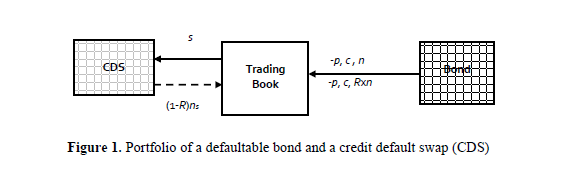

Changing credit quality and interest rates can result in bonds trading at a significant discount or premium from par. Recoveries in cohorts of similar subordination vary significantly, making it impossible to have perfect foresight about recovery while entering into a swap agreement. The variance of the change in wealth of a portfolio of a defaultable bond and purchased default swap is minimized in a static hedging framework, accounting for recovery uncertainty and differences between market value and notional value of the bond. The swap-notional that minimizes the variance of wealth change is assessed along with the zero-mean wealth change based break-even premium of the default swap. The irreducible risks associated with attempting to hedge a bond with a default swap are quantified.

To focus on the random default time and the associated random recovery, I simplify other parameters of the problem. I do not consider interest rate uncertainty. For simplicity of presentation I do not consider the term structure of interest rates and default probability – however the hedging framework described here lends itself readily to computations with interest rate and default probability term structures. The approach outlined here is applicable regardless of the parameterization for default time and recovery uncertainty. Correlated recovery and default time is handled in the static hedging framework computationally. For a primer on Credit Derivatives the reader is referred to Douglas (2007).

2 Change in Wealth of a Portfolio of a Defaultable Bond and Default Swap

The formulation below does not rely on any specific probabilistic description of default and recovery. It provides a framework to assess the optimal hedge, associated break-even average spread, and it enables assessing residual risks. In contrast, the risk-neutral approach involves taking expectations of discounted cashflows under a risk-neutral-measure that is fit to observed prices – a tautology that can’t entertain the notion of irreducible risks.

A risky bond with a par value of n promises to pay a continuous coupon of c dollars per notional dollar per unit time over the time interval [ 0,T ]. The market value of the defaultable bond is p. The notional of the CDS is ns and the premium paid to purchase default protection is s dollars per CDS notional dollar per unit time. The non-defaultable CDS counterparty pays (1-R)×ns in the event of default of the bond (Figure 1).

To read the full article, with references, click here.

Vivek Kapoor, is the Chief Executive Officer and Chief Investment Officer of Volaris Capital Management LLC (https://www.volariscapital.com/), an Options focused investment boutique with $1.7 Billion in mandates. Vivek has led Volaris since 2012. He has implemented an analytical basis for strategy design and has brought technology to bear on all aspects of the investment-management process.