Liquid gas in an illiquid market: breaking down barriers towards a virtual global gas pipeline system

Over the next half a decade, argue Mashal Jaffery and Erik Rakhou of Baringa Partners, LNG will come into its own as a "virtual pipeline system" linking the world's disparate natural gas markets.

From promoting transparency to diversifying contractual pricing arrangements, the LNG industry has had to overcome multiple barriers along the way.

Unlike its glamorous cousin, oil, gas has historically been a segmented market with essentially three main distinct regional markets in Europe, Asia and Americas. Traditionally these markets have been largely uncorrelated and driven more by local supply and demand.

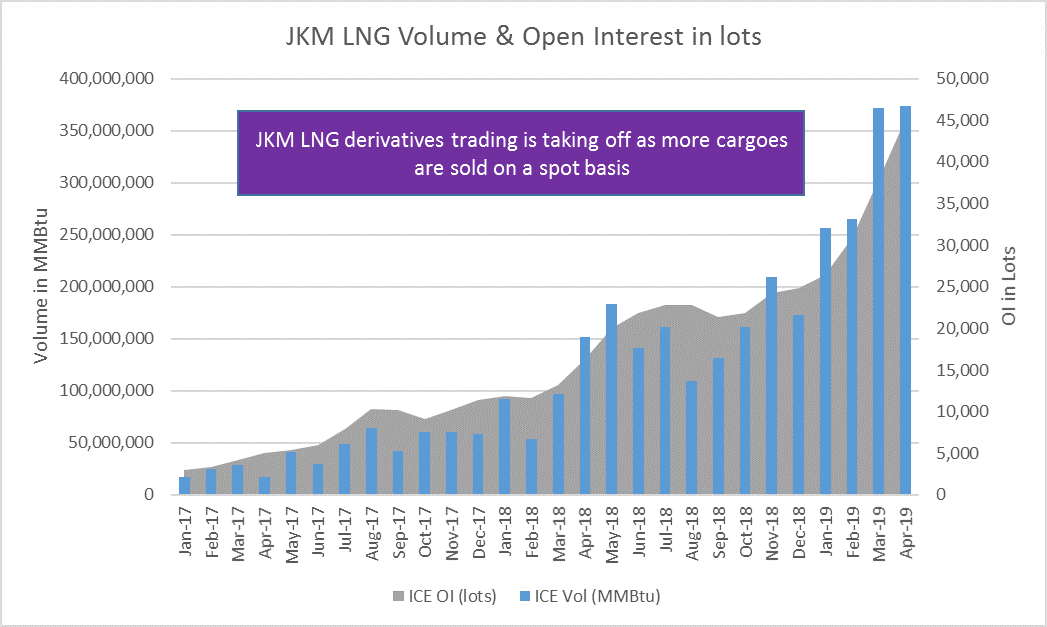

Source: ICE

Since its inception, LNG has held the promise of bridging the continental divide between the global gas markets. It has so far been slow in realising this potential due to a number of factors characteristic of the industry. These are as follows:

Inelastic supply and lack of pricing flexibility

LNG projects require large capital outlay and take years to develop. This, coupled with the need for projects to be underpinned by rigid long-term sale and purchase agreements (SPAs) with destination clauses preventing cargo diversions, meant the industry was slow in its response to demand and price signals over the short term.

As a result, substitute energy commodities such as coal have rushed to fill the supply gap left by gas. Illustratively, increased power generation demand spurred by economic growth in India or China was more likely to be fulfilled by carbon-intensive coal than by gas.

Obscure pricing

There is a general prevalence of secrecy and opaqueness in LNG contracting terms, which prevents consensus on pricing.

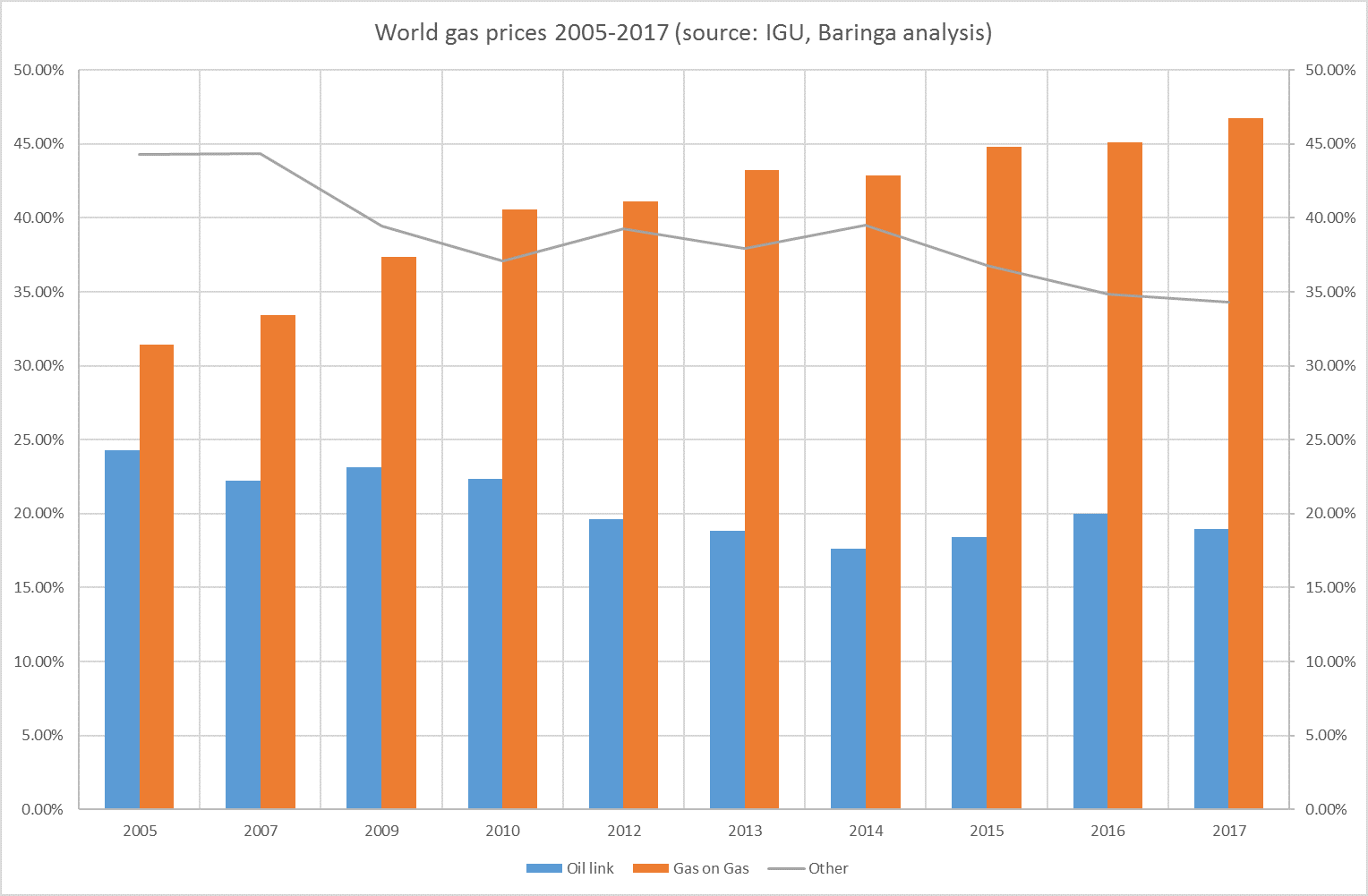

Where pricing has been known it has predominantly been linked to crude oil as a proxy fuel rather than local market gas prices (because representative local market prices for gas did not exist in unliberalised gas markets – although gas on gas pricing is now rising globally, as we explain later).

Explanatory note: There is a long history of oil indexation, which started off originally because gas was priced to substitute (fuel) oil, and because gas was often associated with oil production. Then oil indexation of gas proved sticky because oil was traded globally and provided an index.

Only when markets were liberalised, and you had gas to gas competition did gas hub prices emerge, though the rise of gas on gas pricing is has been relatively slow globally as IGU research shows.

Technological economies of scale

For an LNG project to be economically viable it needed economies of scale to justify the large capital investment, meaning smaller demand centres and supply bases could not fully benefit from the technological advancement.

Disconnected regulatory policy

Geographies and regimes around the world have had varied policies on penalising emissions intensive energy and subsidising clean energy. With such disparate stances on environmental policy regulation, gas has been at a premium compared to coal in regions such as Europe, while lacking demand in certain Asian countries.

Towards a global LNG market

For a global LNG market to emerge, we would have had to see more transparency on LNG pricing globally, underpinned by relatively unconstrained LNG and pipeline gas flows across the globe.

This is something that the global gas market has thus far been slow to achieve, although it is now emerging. Due to accelerating changes in the prevailing characteristics described above, we are now witnessing - if not quite a revolution - then a fundamental evolution and maturing of the LNG industry.

These changes are driving increased regional interconnectedness and, ultimately, a truly global market for gas. A virtual global pipeline system is emerging through the following changes to the global gas ecosystem:

Firstly, proliferation of new markets with ‘Floating Storage Regasification Units’ (FSRUs) has enabled the expediting of the typical long lead timeframes to the physical operationalisation of an LNG import project.

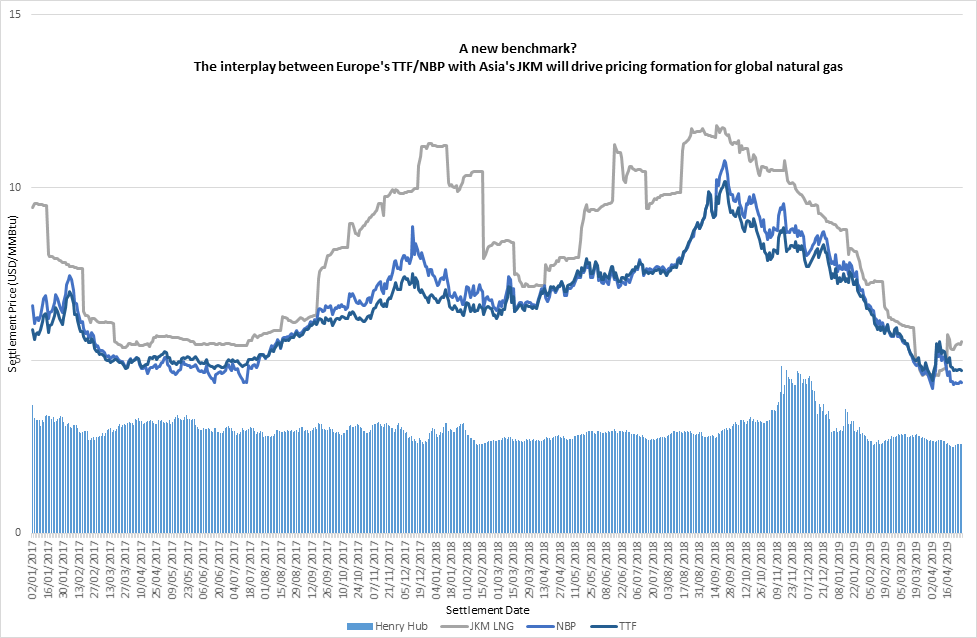

Secondly, globally there has been a gradual but noticeable growth in indexing gas to major gas hub pricing such as NBP, TTF and Henry Hub.

Most of European gas supply is no longer oil indexed. We are observing an increasing number of Asian contracts moving away from oil linked pricing, initially with tolling indexation to Henry Hub for US shale gas supply.

Also on the increase are late destination markets attempting to create local price indices.

This more recent development is evidenced by the likes of JKM and investments in building a derivatives market with the listing of SLiNG on the Singapore Gas Exchange (SGX) for Singapore linked gas trades.

The trend for gas-on-gas pricing has gained momentum with some Asian buyers demanding contract pricing reflective of their home markets.

In markets where coal is the alternative fuel for power generation, coal indexed contracts, led by recent innovative example of Shell, may become the vogue play.

Key:

- Oil-link: Oil Price Escalation (OPE)

- Gas on Gas (GOG)

- Other includes:B/M: Bilateral Monopoly; NET: Netback from Final Product; RCS: Regulation – Cost of Service; RBC: No Price

Source data: IGU Wholesale Gas Price Survey 2018

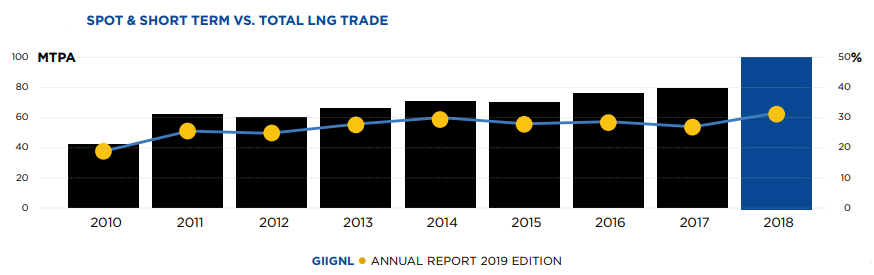

The third major evolutionary change to hit the LNG industry has been the injection of spot liquidity as cargo diversions have become a more prominent feature. This is increasing the transparency and fungibility of LNG across the global gas marketplace.

Pushed by regulatory pressure, LNG producers have started offering destination free clauses. In an important step to liberalise the market, Japan, the largest LNG consumer, banned restrictions on the resale of LNG in 2017.

In 2018 the EU Commission launched an investigation into restrictions to the free flow of gas sold by Qatar Petroleum in Europe.

Source: GIIGNL

Conversely, where previously LNG had been viewed as the poor relation, oil traders are seeing a growth and diversification opportunity in a developing LNG market.

This is driving liquidity and higher turnover of LNG cargo ownership. The increased short-term physical activity is also spurring LNG derivatives trading. LNG contracts listings are available on multiple exchanges including ICE, CME and SGX.

Source: ICE

As a by-product of spot trade volumes growth and increased cargo diversions, the LNG shipping and chartering industry has benefited, and is contributing to globalisation of the gas market:

- Short-term shipping charters are increasing rapidly, and contributing to the global fleet size growth.

- New shipping routes such as the Northern Sea route are being explored to cut down voyage time and contributing to global market interconnectivity. This comes on top of developments like the extension of the Panama Canal in 2018.

A fourth key change is demand growth powered by the green energy and climate change movement. Environmental regulations are favouring gas, and thus LNG. Along with increasing global supply options this is signalling a promising global future for LNG.

We observe evidence of this in power generation due to the clean air push in Asia, the push for cleaner marine fuels by IMO and the global focus on cleaner low carbon energies post-Paris agreement.

High levels of pollution in major Asian cities such as Beijing and Delhi are driving power generation fuel demand away from coal. This may also drive the momentum toward gas on gas pricing for LNG in these markets.

With the Introduction of IMO 2020 LNG is increasingly seen as a bunker fuel option for newer, more energy efficient ships as the industry seeks to meet sulphur emissions standards, and respond to the possibility of future CO2 emissions standards. There has been an uptake of LNG for transport with cruise liners also running on LNG.

The post-Paris decarbonisation effort is an additional catalyst for the increased role of gas globally. The Paris agreement has put observable pressure on the long-term fuel mixes of the global economies.

With EU policy setting the pace by requiring member states to formulate long-term climate strategies and the 2030 national and energy climate plans by the end of 2019, the role of gas in some of these (draft) plans, like in Germany and Italy, is observable. These plans may spur further trading of gas via LNG globally.

Finally, liberalisation of certain key power markets like Japan has changed the utility business model in these countries. Utilities can no longer pass on fuel cost risk to consumers or rely on government subsidies – they have to actively risk manage their fuel exposure. We no longer see them as just price takers but as active risk managers and market makers.

The LNG landscape is ready for change, as a powerful confluence of factors is now going to enable LNG to link global gas markets like never before. The question is then when will we see this shift to a truly globally traded virtual pipeline system - i.e. an efficient global gas market?

We dare to say, 2020-2025 is the period during which we expect to see irreversible acceleration towards a global gas market. The changes and developments in the LNG market are creating the opportunity.

Organisations across the energy and commodity value chain are looking to capitalise on the growth of LNG as a traded commodity. We see LNG now being able to link global markets as one, to enable marginal gas fields’ commercialisation, and to access demand that would not have been possible before. LNG is coming of age!

The views expressed are the personal views of the authors.

About the Authors

Mashal Jaffery, Senior Manager at Baringa Partners: Mashal is a senior manager at Baringa Partners’ Energy and Resources practice. Mashal has worked with a broad spectrum of companies including energy majors, utilities, commodity trading houses and investment banks. She specialises in trading risk management, asset operations & optimisation for the gas to power value chain. She has run major business and technology transformation programmes to start new businesses, enter new markets, commercialise & operate assets and improve business operations. This included LNG-focused clients. Mashal is leading the commercial development of Baringa’s LNG SME offering and has advised a number of clients on their LNG business capability building including LNG producers, buyers and traders. You can find Mashal on LinkedIn.

Erik Rakhou, Alternate member of ACER Board of appeal, and Senior Manager at Baringa Partners: Erik Rakhou is a specialist in European energy market regulation and policy development, with over 15 years of experience in European markets in both commercial and regulatory roles at the national and EU level. Erik works as management consultant for Baringa Partners, advising on variety of European energy markets topics. He assisted clients on a number of projects, including electricity and gas market design. Prior to joining Baringa Partners, Mr Rakhou worked at the European regulatory body for energy (ACER). His projects involved gas markets, network code design and preparations for European energy wholesale markets monitoring. His previous roles have also included working for a National Regulatory Authority, a major European energy utility and a regional distributor. Mr Rakhou is a speaker at various conferences; commands 6 languages. Mr Rakhou is an alternate member of the ACER Board of Appeal (2016-2021). Mr Rakhou authored a hand book on EU gas markets (see www.europegasmarket.eu ). You can find Erik on LinkedIn.

Erik Rakhou will be speaking at the Energy Transition World Forum, co-located with the Flame conference. Register now to join him.