Making the Revenue Stack Work for Wind/BESS Hybrids

You have probably seen the buzz around solar and battery energy storage systems (BESS) hybrids. But what about wind/BESS hybrids?

Energy Synapse has been working on a lot of wind/BESS hybrids in recent times and has found that adding BESS can bring significant advantages. In this article, we will cover some of the benefits as recently presented by one of our Course Directors, Marija Petkovic, at the 2025 Australian Wind Industry Forum.

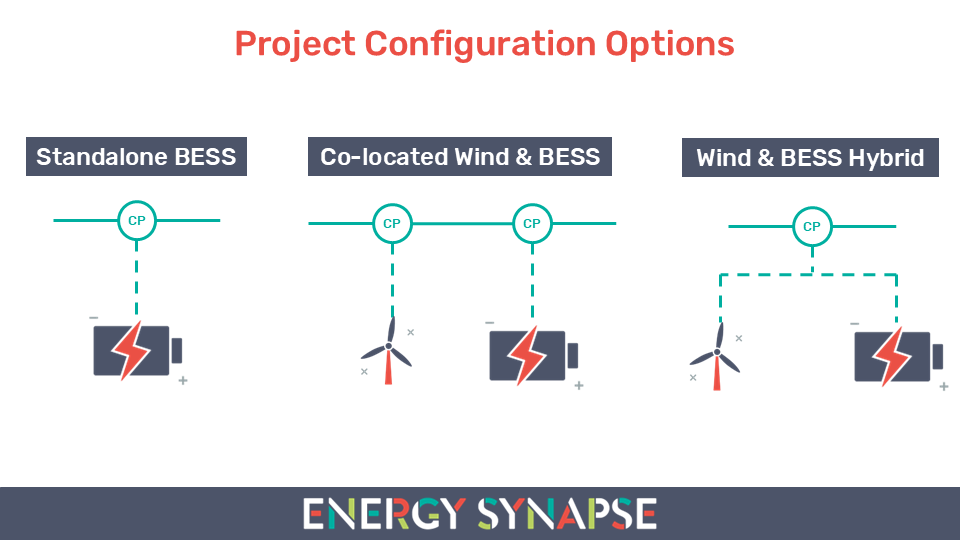

First, let’s clarify exactly what a hybrid project is. A true hybrid is a project configuration where there is more than one asset sharing the same connection point to the grid (see diagram below). This is different from a co-located project where the wind farm and battery might be physically next to each other, but have their dedicated connection to the grid.

BESS hybrids present an opportunity to reduce connection costs

In a hybrid configuration, the total capacity of the power assets typically exceeds the export limit at the connection point. For example, a hybrid project might have 400 MW of assets behind a 300 MW connection.

A wind farm might be rated at 300 MW, but this represents its maximum output capability under ideal conditions. Most of the time, the asset will be producing less electricity. For example, wind farms in NSW tend to have a capacity factor of around 30%. This suggests there is significant room to include an additional asset, like a battery, behind the same connection point. This presents an opportunity to reduce connection costs compared with two standalone assets that have their own dedicated connection.

Adding BESS improves the dispatch weighted average price of the site

Low dispatch weighted average prices are not just a challenge for solar farms. Almost every wind farm in Australia’s National Electricity Market (NEM) is earning a lower dispatch weighted average price than the 24/7 average spot price.

Adding battery storage can increase the dispatch weighted average price of the site by shifting output to more valuable periods in the energy market. This also presents an opportunity to structure more valuable offtake agreements.

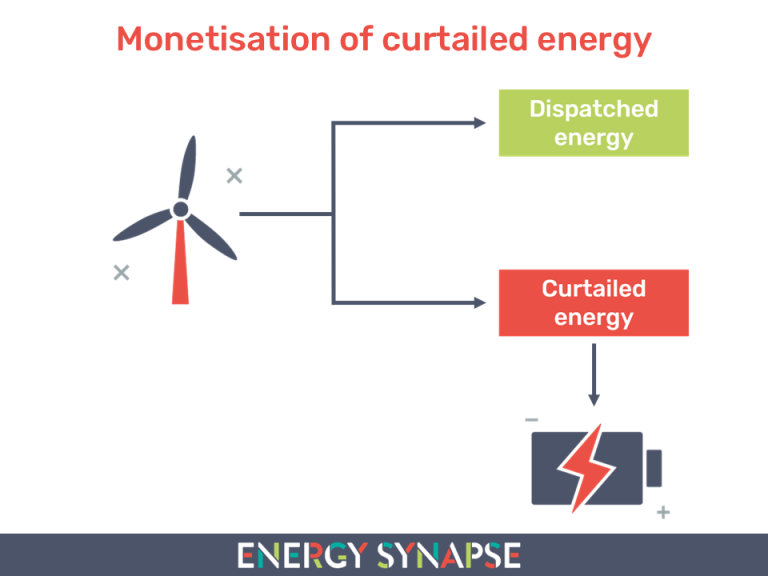

BESS hybrids enable monetisation of curtailed energy

Grid congestion and the risk of curtailment a growing concerns for project developers as more renewable energy is deployed. Adding a battery behind the same connection point as the wind farm provides a way to manage this risk. Electricity that would otherwise be curtailed due to grid constraints can be “saved” in the battery (along with any large-scale generation certificates (LGCs)) and sold at a later time.

Monetisation of curtailed energy can significantly improve project economics. However, it is important to note that it is rarely optimal to try to save all curtailed energy. For example, when the spot price is negative beyond the value of LGCs, it is generally more optimal to charge the battery from the grid rather than the wind farm.

BESS hybrids offer a self-remediation pathway for system strength charges

System strength is the ability of the power system to maintain and control the voltage waveform at any given location in the power system, both during steady state operation and following a disturbance. Inverter-based resources such as wind and solar farms hurt system strength.

Under recent rule changes, a new or altered connection must mitigate its system strength impact by either:

- Paying a system strength charge to the designated System Strength Service Provider (SSSP). SSSPs are the transmission companies in each NEM region, except for Victoria, where the SSSP is AEMO; or

- Self-remediating the impact. This could be achieved by installing a battery with a grid-forming inverter.

Developers and asset owners need to be careful about revenue cannibalisation

While wind/BESS hybrids offer many benefits, they need to be sized very carefully to manage revenue cannibalisation risks. Revenue cannibalistion occurs when the wind farm and battery compete for dispatch and are limited by the export capability at the connection point. If the battery is oversized in a hybrid project, it could result in significant revenue loss. In effect, the developer would be paying for battery capacity that they are unable to utilise effectively.

Wind/BESS hybrids should be sized using 5-minute revenue modelling to understand the tradeoffs between different sizing configurations and total project revenue.

Further Learning with Informa Connect Academy

Commercial Opportunities for Battery Storage in the NEM

Gain insights into market dynamics, revenue models, and investment opportunities for large-scale battery storage in Australia’s National Electricity Market. Find out more

Electricity Industry Fundamentals

Build a clear foundation in how Australia’s electricity sector and the NEM operate, including market design, regulation, renewables, and storage. Find out more