Top megatrends shaping renewable energy investing

With SuperReturn Global Infrastructure coming up, we did an interview with speaker Prof. Henrik von Scheel, renowned as the futurist our century by CNBC who ignited the Digital and Industry 4.0 themes of today, to discuss the megatrends shaping the future of renewable energy investment.

Interviewer: Let's dive right in. What are the key megatrends that will shape the decade for renewable energy investment landscape?

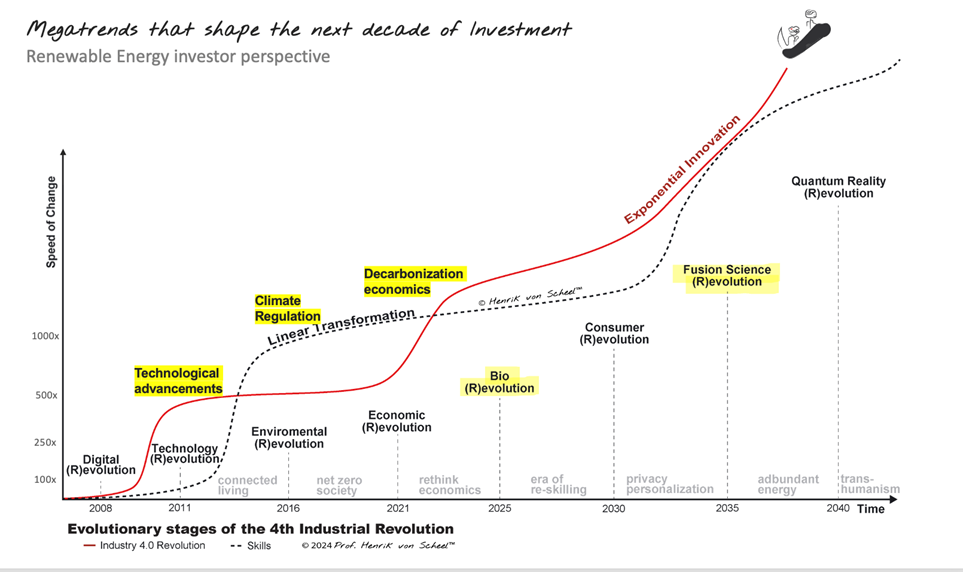

Prof. von Scheel: Certainly. The renewable energy sector is poised for significant transformation, driven by several megatrends. These include technological advancements (such as the energy storage and the global energy transition), climate regulation, (i.e. Fit for 55, EU Climate Law, European Green Deal, Sustainability Finance Disclosure Regulation and verified certification programs under the EU Climate Law). the decarbonization economic imperative, and the Bio Revolution and Fusion Revolution.

Table 1. Investor Megatrends that shape the next decade

Mostly propelled by the collision of 77 Megatrends of the Industry 4.0. Any revolution emerges as an evolution, as those the Industry 4.0. The evolutionary stage manifest by the collision of megatrends in of Science & Technology, Workforce, Economic, Environmental, Regulatory, Demographics, Globalization, and Consumer megatrends.

Interviewer: Starting with technological advancements, what should investors keep an eye on?

Prof. von Scheel: Technological advancements are at the forefront of the renewable energy revolution. Breakthroughs in solar, wind technologies, nuclear technologies, fusion technologies, energy storage are making these energy sources more efficient and cost-effective. Additionally, advancements in digital technologies (such as Internet of Things (IoT), artificial intelligence), smart material for infrastructure, water, energy and resource management. This include desalination of water, waste management, recycle lifecycle, smarter grid, energy management systems to name a few. These advancements are crucial in enhancing energy production, grid stability, and overall efficiency.

Interviewer: How are EU climate regulations influencing renewable energy investments?

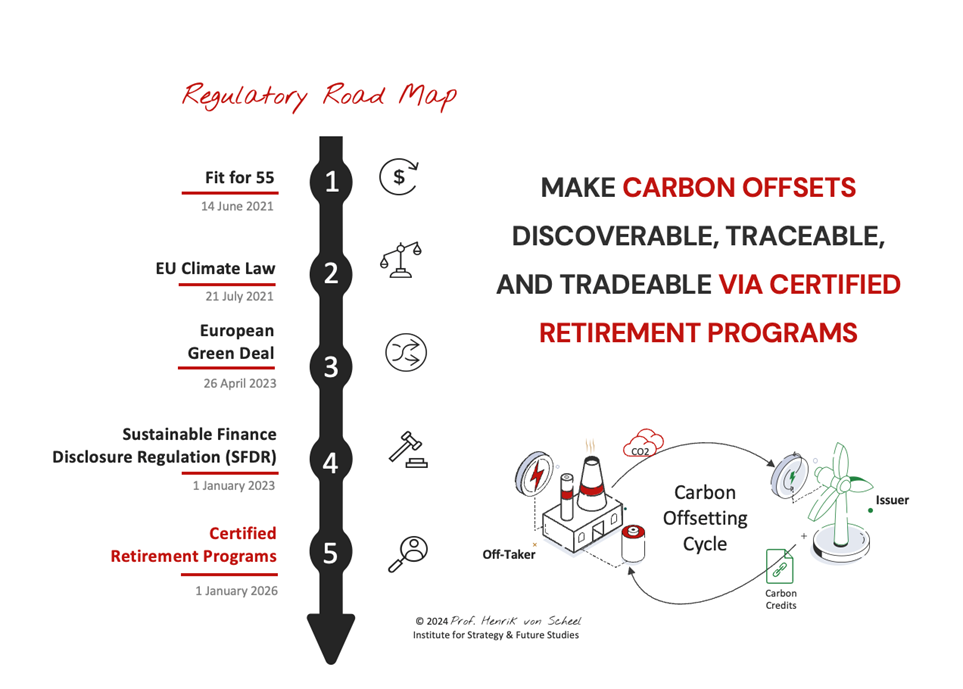

Prof. von Scheel: EU climate regulations are a major driver of investment in renewable energy. The regulatory landscape is undergoing significant disruption, with ambitious targets set by the Paris Agreement and EU climate laws. Key regulations, such as the Fit for 55 package, the European Green Deal, and the Sustainability Finance Disclosure Regulation, are compelling companies to decarbonize. Compliance with these regulations is not just a legal obligation but also a strategic investment. Companies that embrace decarbonization can gain competitive advantages and avoid escalating tax burdens. This is one of the biggest investment opportunities as asset backed Carbon Credit bases on a smart contract providence are a non-depreciable assets.

Table 2: EU Climate Regulatory Roadmap

Interviewer: Could you elaborate on the decarbonization imperative?

Prof. von Scheel: EU Climate Regulation will that impact the balance sheet of every Company. In response to the Paris Agreement's ambitious targets to reduce greenhouse gas (GHG) emissions, EU regulators are spearheading efforts towards a 90% reduction and achieving net zero emissions by 2050. This commitment is backed by five pivotal regulatory laws, presenting a stark choice for companies: embrace decarbonization as a strategic investment or face escalating tax burdens.

Key Regulatory Laws:

- Fit for 55 Package: Aimed at reducing EU GHG emissions by at least 55% by 2030.

- EU Climate Law: Legally enshrines the 2050 climate-neutrality goal.

- European Green Deal: A comprehensive plan to make the EU's economy sustainable with large-scale investments in renewable energy.

- Sustainability Finance Disclosure Regulation (SFDR): Requires financial market participants to disclose how they integrate sustainability risks.

- Verified Certification Programs: Under the EU Climate Law, ensuring compliance with emission reduction targets.

For investors, these regulations represent a transformative opportunity. By prioritizing investments in technologies and projects that contribute to a low-carbon economy, investors can capitalize on the financial benefits of sustainability. Unlike traditional regulations often viewed as hidden taxes or burdens, these climate regulations offer a rare investment opportunity. The push for decarbonization can act as a catalyst, propelling investors toward substantial profits while fostering environmental responsibility.

Investment Insights:

- New Digital Financial Assets: The EU Climate regulatory roadmap creates a new set of verifiable asset-backed digital carbon credits that make carbon offsets discoverable, traceable, and tradeable via certified retirement programs.

- Strategic Investment in Decarbonization: Embracing decarbonization not only ensures compliance but also positions companies for long-term profitability and sustainability.

- Market Competitiveness: Companies that proactively invest in renewable energy and sustainability are likely to gain a competitive edge in the market.

The evolving regulatory landscape is thus a powerful driver for both corporate strategy and investment decisions, offering significant rewards for those who align their portfolios with the future of a sustainable economy.

Interviewer: The energy storage revolution is often mentioned as a game-changer. Can you explain its significance?

Prof. von Scheel: Energy storage is indeed a game-changer. It addresses the intermittency issues associated with renewable energy sources like solar and wind. Advanced battery technologies, such as lithium-ion and emerging solid-state batteries, are crucial for storing energy and ensuring a stable supply. Efficient energy storage systems enable the integration of more renewable energy into the grid, enhance energy security, and open new revenue streams for investors.

Interviewer: What are the key drivers of the global energy transition?

Prof. von Scheel: The global energy transition is driven by a combination of environmental, economic, and social factors. On the environmental front, the urgency to combat climate change is pushing nations to adopt cleaner energy sources. Economically, the declining costs of renewable energy technologies are making them more competitive with fossil fuels. Socially, there is growing public support for sustainable practices and corporate responsibility. Together, these drivers are creating a favorable investment landscape for renewable energy.