Option pricing, trading and volatility: Insights from QuantMinds Edge

On July 12 our second virtual event QuantMinds Edge kicked off. This time we brought together leading researcher in quantitative finance to discuss Option pricing, trading & volatility. Among topics covered were how best to use AI, applying advanced technologies, hedging bitcoin options and modelling implied volatilities, and best practice applications.

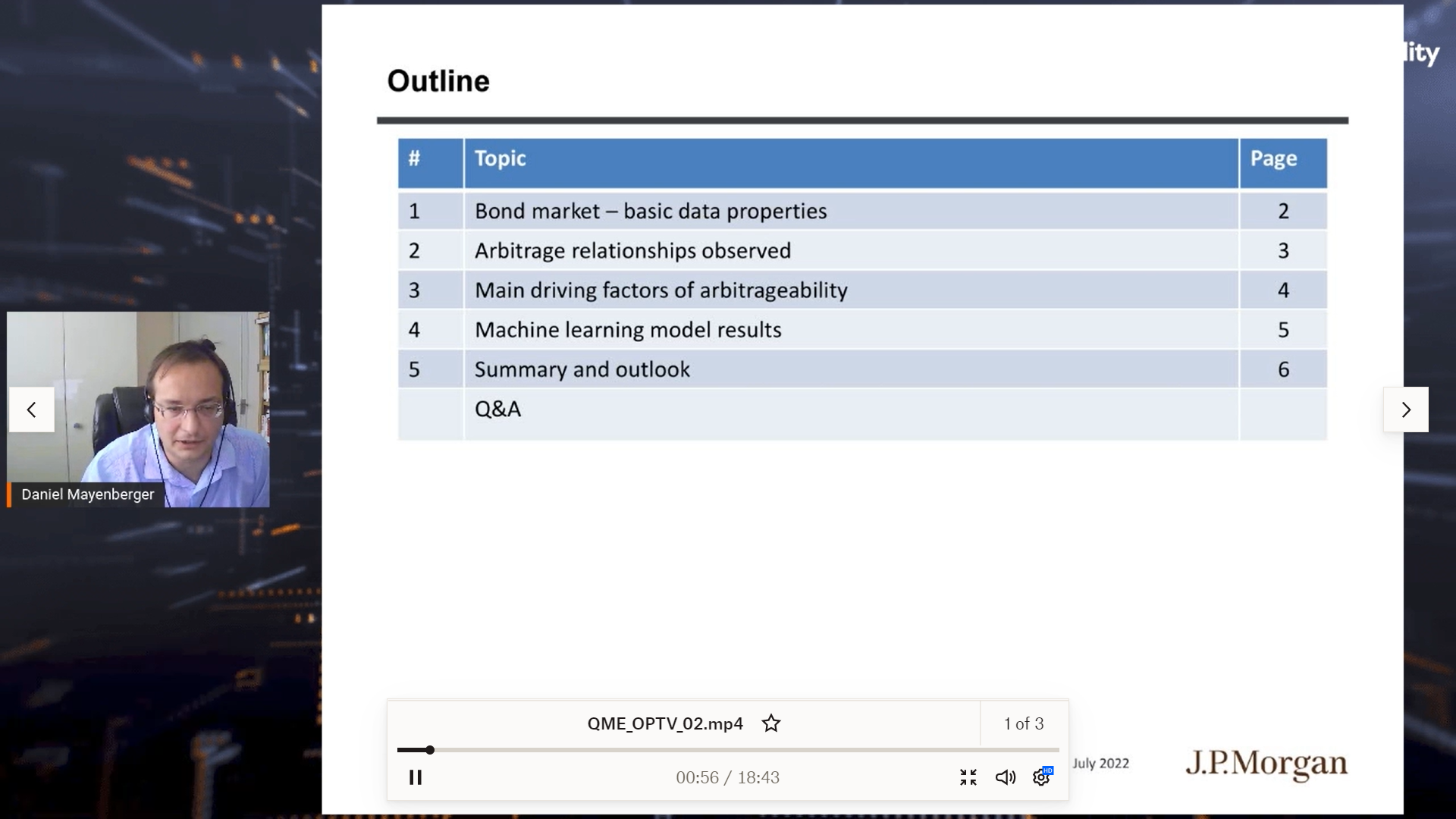

Predicting arbitrage in bond trading – AI approaches

First speaker of the day was Daniel Mayenberger, CIB Data, Analytics & AI, J.P. Morgan, who presented his research on predicting arbitrage in bond trading.

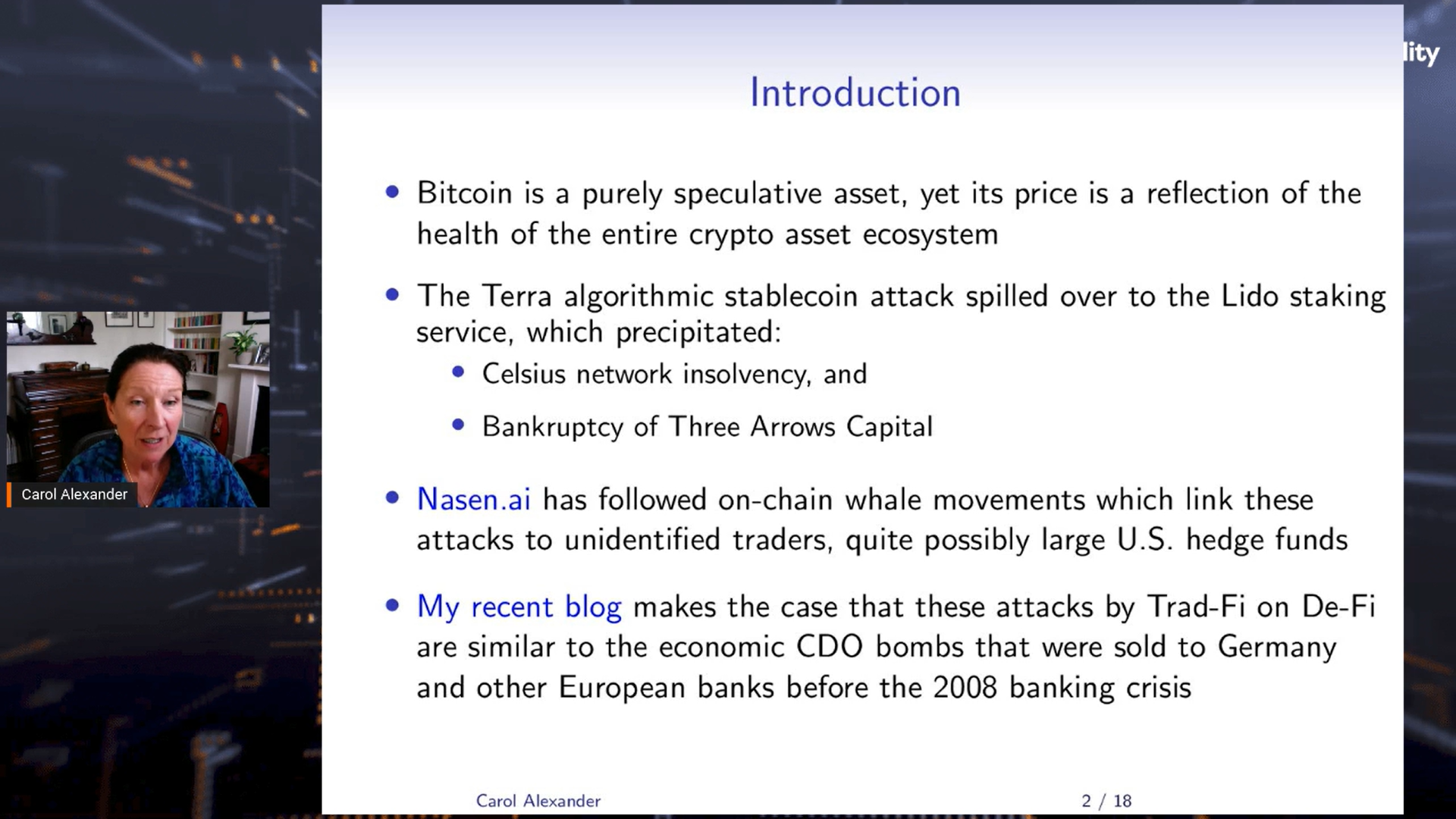

Hedging Bitcoin options and modelling implied volatilities

Carol Alexander, Professor of Finance and lead of the Quantitative Fintech research group in the Business School, the University of Sussex, joined us to share her research into Bitcoin volatility. If you didn't catch her session, don't worry. You can read an outline of her research into what drives Bitcoin volatility here. If you're interested in reading more of Carol Alexanders work, don't miss her path-breaking research on microstructure and information flows between crypto asset spot and derivative markets.

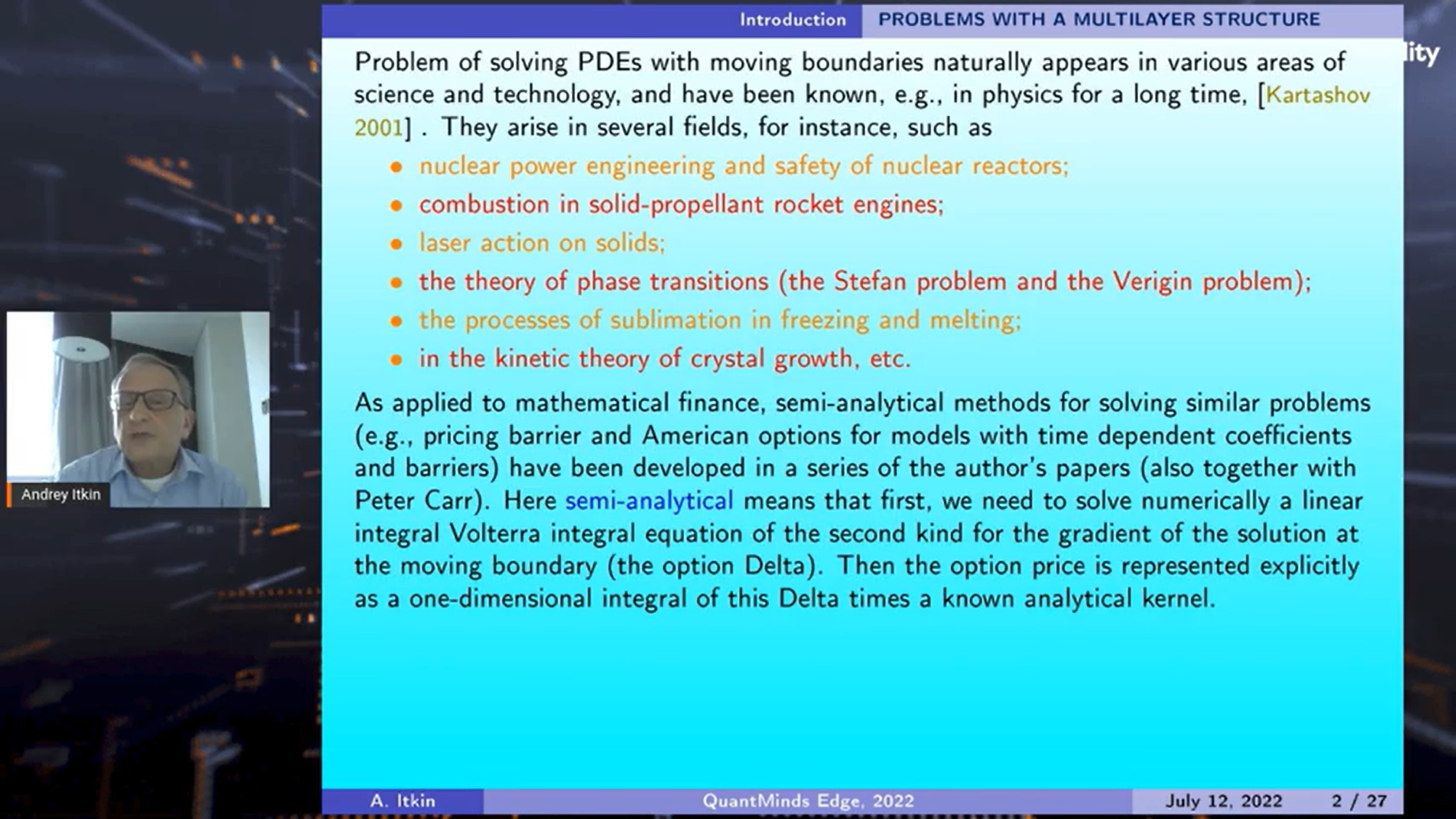

Multilayer heat equations and their solutions via oscillating integral transforms

Joining us on the day was also Andrey Itkin, Adjunct Professor, Department of Finance and Risk Engineering, New York University. He spoke about multilayer heat equations, a subject he has previously published research on with QuantMinds. Andrey Itkin has also previously written for us about the lambda-SABR model and generalized integral transforms in mathematical finance.

Don't miss any more quantitative research. Join us for our next QuantMinds Edge event, which will focus on risk management and modelling on 9 August.

Don't miss any more quantitative research. Join us for our next QuantMinds Edge event, which will focus on risk management and modelling on 9 August.