Running dry: How water risk can threaten a company’s bottom line

Climate change is forcing investors to evaluate two new types of risk: transition risk, the cost of companies transitioning to low-carbon operations, and physical risk, the cost of increased drought, floods, severe weather and a rising sea level.

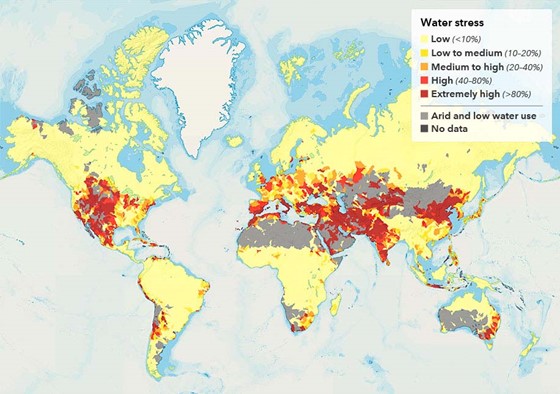

Water stress is one of the most pronounced physical risks from climate change that investors must consider.

Droughts and water scarcity are idiosyncratic events with a proven ability to stop or reduce production quickly, cause late-stage project cancellations and ultimately alter industry market share. Within water-intensive industries, understanding how companies manage their water supplies can be a key factor in anticipating their longer-term performance.

The semiconductor industry provides a good case study: It is among the most water-intensive industries on a relative basis, and several “hubs” where chips are produced have been exposed to severe, long-term drought in the past. In response, several leading companies have found new approaches to water management, allowing them to recycle upward of 90% of water used and reinforcing long-term sustainability of operations.

Water risk becomes material when companies operate in high-stress zones

Source: World Resources Institute

In the past year, several large semiconductor companies announced new investments to build capacity in the US, several of which will be in a growing manufacturing hub in Arizona. However, the drought situation in Arizona is worsening. For the first time ever, in August 2021, the US federal government declared a water shortage on the Colorado River that would trigger cutbacks starting in 2022. Arizona is set to lose 18% of its water allocation, or 63 million cubic meters. This amount represents the equivalent of total annual water consumption for the city of Phoenix, or the total annual water withdrawal of Intel, the largest semiconductor producer in the region.

Yet despite anticipated water shortages, Intel is likely able to access the amount of water it needs. In a meeting with Capital Group, the company explained its processes to be able to recycle 80%–90% of water. It now consumes a very small percentage of fresh water in the region because of its on-site water reclamation facilities, which recycle water back into its own processes or into the municipal water system.

In addition, Intel’s water efficiency has significantly improved. In the 1990s, Intel needed 2 gallons of municipal water for every gallon of ultrapure fresh water used in its chipmaking process (50% efficiency). Today, the company uses only 1.1 gallons of municipal water per gallon of ultrapure water (90% efficiency).

Other sectors face tough challenges

The success of semiconductor companies may show a path forward for other water-intensive sectors, but some specific industries, such as utilities, are likely to struggle.

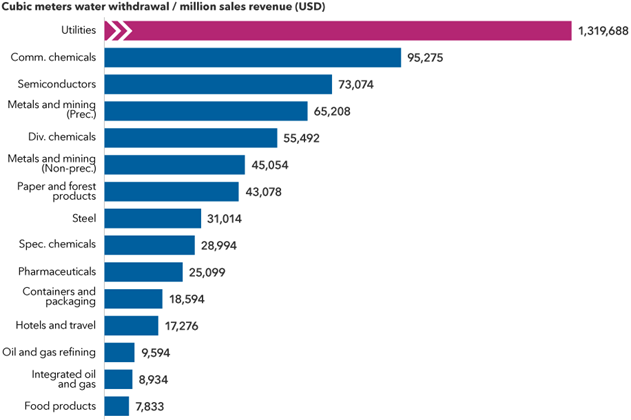

Utilities, which are by a factor of 25 times the largest users of water in Capital Group’s investment universe, cannot scale up their water recycling programmes to mitigate their risk.

Utility companies’ water usage is off the charts

Source: Bloomberg, Capital Group. Average annual water withdrawal normalised to total revenue of companies within the MSCI World Index split by industry. Water withdrawal includes total water diverted from surface, ground and municipal water sources. The utilities industry data is not plotted to scale due to its much larger relative size. Data as of 1 September 2021.

Utilities use water for two major purposes: 1. hydroelectric power, and 2. cooling thermoelectric and nuclear power. It’s intuitive that hydro-powered electricity requires water, but the volume of water needed for cooling thermal and nuclear power plants is enormous relative to other industries’ water use. Three of the five largest water users in Capital Group’s universe do not have significant hydro-generation operations. And protecting against drought risk could require these companies to move their production sites or, if that’s not possible, shift away from hydro and thermal power altogether.

Implications for investors

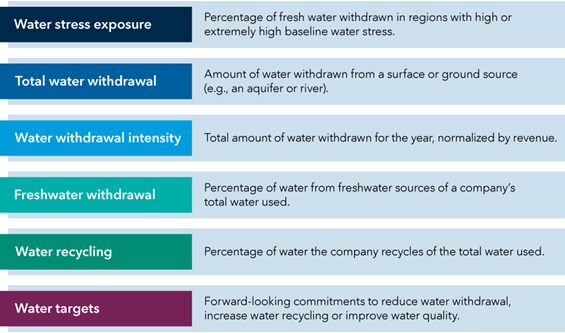

As climate change continues to impact the planet, investors need additional approaches to understand essential risks and opportunities for resource-intensive sectors and companies. As part of our fundamental investment research process, we analyse how efficiently water-intensive companies manage their water usage.

Our analytical framework includes six different factors, which we use to gauge a company’s exposure to water risk:

By integrating these types of frameworks into our analytical processes, we seek to better identify companies that are successfully adapting to meet the new challenges, as well as those that are likely to struggle to continue delivering value as conditions change. This new type of fundamental analysis can provide a crucial filter to help separate likely winners and losers in the future.

Capital Group are gold sponsors of IMpower Incorporating FundForum 2022. Find out more about the 2022 event and agenda here >>

Emma Doner is an ESG senior manager with 9 years of industry experience (as of 31 December 2021). She holds an MBA in finance & sustainable development from ESLSCA in Paris and a bachelor’s degree in international business management from Missouri State University.

Matt Lanstone is the head of ESG research and investing at Capital Group with 29 years of industry experience (as of 31 December 2021). He holds a first-class bachelor’s degree in economics and accounting from the University of Bristol and is a qualified chartered accountant.

Matthieu Chateau is an ESG specialist with 5 years of industry experience (as of 31 December 2021). He holds a master's degree in carbon management from the University of Edinburgh and a bachelor's degree in political science and geography from Trinity College Dublin.

This material is a marketing communication

Past results are not a guarantee of future results. The information included on this site is neither an offer nor a solicitation to buy or sell any securities or to provide any investment service. Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. The American Funds are not registered for sale outside of the United States.

While Capital Group uses reasonable efforts to obtain information from third-party sources which it believes to be reliable, Capital Group makes no representation or warranty as to the accuracy, reliability or completeness of the information.

The information included on this site is of a general nature and does not take into account your objectives, financial situation or needs. Before acting on any of the information you should consider its appropriateness, having regard to your own objectives, financial situation and needs.

The information included on this site has been produced by Capital International Management Company Sàrl (“CIMC”), which is regulated by the Commission de Surveillance du Secteur Financier (“CSSF” –Regulator of the Luxembourg financial industry) and its affiliates, as appropriate (“Capital Group”).