Simplifying the process of cloud business innovation

The following is a sponsored post from WSO2.

The customer journey is vital in today’s financial services landscape and cloud-enabled business innovation is the vital ingredient.

A good user experience is a critical factor in helping consumers differentiate between firms and helping brands build lasting relationships with customers.

According to the Harvard Business Review, firms with leading customer satisfaction rankings can grow their revenues two and a half times faster than their competitors. Moreover, research by Forrester demonstrates that customers are over twice as likely to stick with a brand when their problems are solved quickly.

Yet, great digital experiences rely on intuitive GUIs and an agile, cloud native strategy, both of which are not easy to achieve. In this article, we’ll demystify how to get started with cloud computing in software engineering for banking and help you develop a leading customer UX.

What Are the Challenges of Cloud Business Innovation in Banking?

Approximately US$1.3 trillion was spent in 2020 on digital transformation, yet Deloitte data shows 70% of projects fail. That equates to over US$900 billion wasted — so what’s going wrong?

Just as an HD TV relies on good HD content, great apps need high interactivity with data, an always-on presence, security, and scalability to perform under high demand.

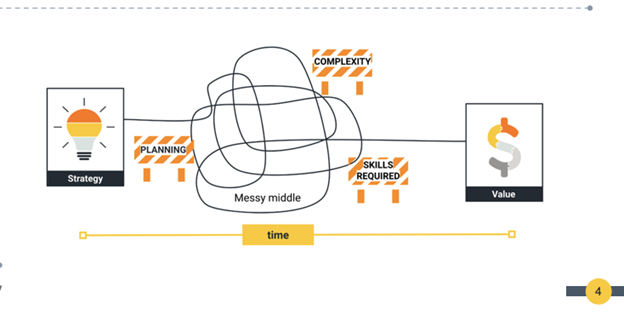

Eric Newcomer, WSO2 CTO, argues that cloud business innovation goes wrong when there’s a messy middle. In other words, when there’s a lack of clarity about how strategy, outcome, and skill coordinate the microservices within a platform, cloud business innovation becomes dysfunctional.

Within banking specifically, the stakes of digital transformation are extremely high. Today’s financial services firms must deal with an onslaught of cyberattacks and regulatory constraints, not to mention increased competition from new fintech entrants better-equipped to deliver excellent customer experiences. So how can financial institutions ensure they foster an innovative and successful cloud-first environment?

How to Overcome These Challenges

Great cloud computing in software engineering needs equally great cloud native practices and technology, focusing specifically on integration and APIs. Without this focus, customers lose the always-on, always integrated feel that today’s users demand.

Therefore, financial services firms require an all-in-one platform delivering accelerated and enhanced engineering processes to speed up innovation in their cloud environment.

Unfortunately, building robust and agile platforms from scratch can be timely and costly.

Instead, partnering with existing solutions providers allows financial service firms to focus on developing cloud banking innovations and better deliver security, compliance, and ideal customer experiences. You can read more about overcoming challenges for banks to generate fintech innovation here.

The Role of Digital Platform-as-a-Service Within Financial Services

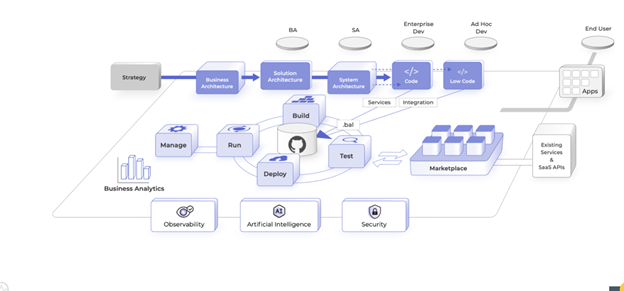

An “opinionated” digital platform-as-a-service (digital PaaS) accelerates cloud banking innovation by tackling some of the core complexities of developing digital applications. As a result, you can build, deploy, and iterate new versions more easily.

Digital PaaS platforms enable diagrammatic and low-code functionality, providing a great developer experience. In turn, your teams can increase their productivity and attention to quality assurance for end-users.

Moreover, digital PaaS integrates with automated deployment tools using Docker and Kubernetes. As a result, you can test, develop, and deploy new user features for maximum customer satisfaction faster than ever before, using just a few clicks.

Digital PaaS solutions deliver seamless platform functionality and integration with your existing data warehouses, allowing you to leverage efficient and scalable consumer solutions.

How Low-Code Digital PaaS Enables Cloud Computing in Software Engineering

There isn’t a one-size-fits-all solution to cloud computing in software engineering, so what makes a digital PaaS-based method the most appropriate for financial services?

A digital PaaS approach provides a highly stable environment to create and manage APIs since it establishes core conventions and assumptions within your workflows. These assumptions include the programming language and dev environment, all the way to the publishing process on software marketplaces. As a result, you can remove barriers to collaboration and shorten project lead times. Similarly, as a cloud-enabled solution, you provide collaborative space for your teams to work.

Moreover, you can easily build platform microservices and provide teams with autonomy over their software output. Software teams can publish updates to critical platform elements accordingly without jeopardizing the rest of your platform or relying on slower project teams, keeping your user experience competitive.

However, the benefits don’t stop when you hit publish. Digital PaaS solutions allow you to run professional DevOps systems and make improvements in step with live user trends. Consequently, you can remain competitive and establish a close relationship with customers.

Finally, once your APIs are built, you can share them through marketplace and import or export data with other SaaS platforms. As a result, you can leverage other data sources for enhanced features. For example, you can capitalize on open banking ecosystems, enhance your security through additional identity checks, and more.

And so, with complex development and deployment tasks that are both easy to learn and use, you can deliver fresh digital services faster — and more accurately — than ever.

Introducing Choreo by WSO2

With around only three in ten digital transformations being successful and the heightened competition within banking today, financial services companies need to innovate at speed and scale.

Choreo is a digital PaaS that helps companies manage and develop APIs, services, and integrations quickly. Choreo enables developers and operations teams to go from ideation to production in hours or days versus weeks and months via a seamless environment that eliminates the complexity of cloud native computing.

Choreo provides a diagrammatic and pro-code environment side by side, allowing you to create an outline and make detailed tweaks in minutes. It includes a developer marketplace with over 400 pre-built connectors that makes it easy to discover, reuse, publish, and share.

With security and transparency at its foundation, you can easily trace code changes and root issues across your entire development history. You can also benefit from AI-assisted coding and enhanced governance features.

Find out more about Choreo and create an API with just a few clicks.