'Smart asset managers should have an ETF strategy'

Is it plain smart business for an asset manager to secure their ETF strategy now more than ever? Hector McNeil, co-CEO, HANetf, answers.

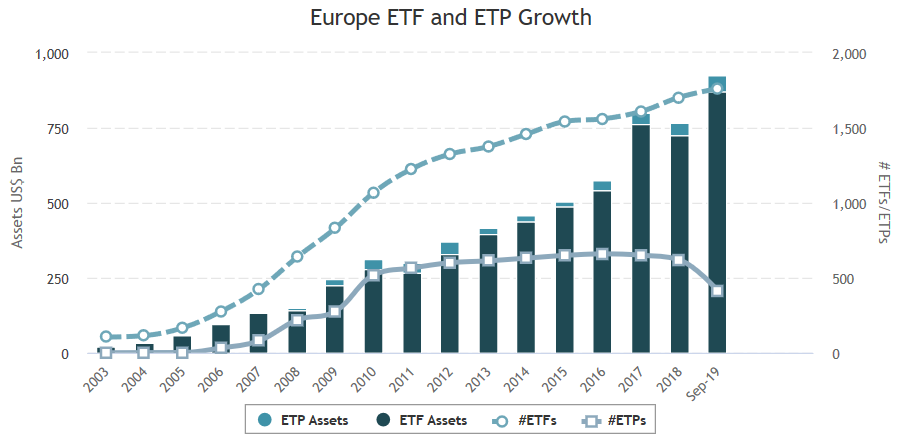

European ETF assets have grown by an unprecedented 60%¹ since 2016, much of that market share won from traditional mutual funds across the world

This accelerated growth in the European ETF market is likely to be the ‘new normal’ as ETFs are superbly positioned to take advantage of a convergence of mega-trends that are driving changes in investor behaviour.

Here, we examine the trends that are behind the rise of ETFs and how smart asset managers can remodel their business to rapidly adapt to these trends.

European ETF Asset Growth: Source ETFGI

The rise of self-directed investors

There is a global shift towards self-directed saving and investing. In the UK alone, an estimated 1.8 million people have invested in Self Invested Personal Pensions (SIPPs).

ETFs are appealing to self-directed investors due to their transparent nature compared to traditional mutual funds. Many mutual funds only reveal their top 10 holdings - and often on a delayed basis.

ETFs are often referred to as “democratic” investment products because smaller investors have access to the same fund, data and trading optionality as institutions, creating a level playing field.

ETFs are typically more cost efficient than mutual funds and have lower minimum investment thresholds, making them an accessible option for even small retail investors.

Regulation driving transparency

New regulation in Europe is improving the quality, timeliness and transparency of information available to investors in a move away from opaque, bi-lateral over-the -counter transactions.

Prior to MiFID II there was no requirement for European ETF trades to be reported, meaning investors could only see the tip of the iceberg relative to the real underlying trading activity.

Due to new trade reporting requirements, investors can now see a complete view of the breadth of ETF trading activity across all European venues.

This is important because liquidity begets liquidity and European investors have less incentive to look outside Europe for trading efficiency and can begin to repatriate liquidity back to domestic markets.

Fees and value

As individual investors take increasing accountability for their own portfolios, they are understandably focussed on costs, fees and value.

The move towards “all-in” fees under MiFID II’s is making it easier for investors to understand and compare fund charges. This is likely to be a boon for ETFs as they are typically more cost effective than traditional funds with equivalent exposures.

Technology driving a distribution revolution

The Millennial generation do not consume like their parents did. They are used to an ‘on-demand’ world where immediacy and responsiveness are valued and where purchasing decisions are informed and influenced by online peer reviews and a broad range of expert voices.

A new generation is emerging that values simplicity, ease of use and immediacy and is turning away from intermediated, high-cost, low-service products.

Due to technological advances, ETFs are making it easier for investors to build a diversified portfolio at a competitive cost which can be accessed through retail brokerage platforms and mobile trading apps.

Not 'Should I Launch' but 'How...?'

The convergence of these trends means that asset managers without an ETF offering risk becoming irrelevant to the next generation of investors– the Wall Street equivalent of the VHS rental store in the age of Netflix.

Those not willing to move quickly are at risk of being out-manoeuvred by more forward-looking and nimble competitors as it’s not far-fetched to imagine that almost all mutual fund strategies will have been translated into an ETF format within the next 15 years.

Three routes to market

For the asset managers asking “How do I launch ETFs?”, there are three options: 1) build their own business from the ground up, 2) acquire an existing business or, 3) partner with a white-label platform. There are pros and cons to each approach:

Building a European ETF business from scratch can be a time consuming and expensive exercise. It can take over 24 months or more to establish a team, build a fund platform, perform product R&D, develop marketing strategies aNond formulate sales plans.

There are also significant overheads to consider in terms of staff, office space and legal fees. All in, an asset manager could spend between £5-£10 million before a penny of assets are raised.

Buying entry to the market is a high commitment and expensive approach – on the assumption that a suitable target can be found. In Europe, there are few takeover targets remaining to make this route to market seem appealing or possible.

If building is too expensive and buying too difficult then asset managers can look at a third option – full-service white-label ETF platforms.

A white-label platform, like HANetf, can enable any asset manager to launch an ETF without having to build their own ETF business from scratch. We provide a comprehensive service that goes beyond the initial set up and launch by including sales, distribution and marketing programs.

With a full-service offering, asset managers don’t need to establish their own platform, expert sales teams, capital markets and service provider relationships or marketing programs and can focus on what they do best – developing and refining investment ideas.

It is important to note that not all white-label platforms provide the same combination of services. Some platforms merely provide the regulatory and operational infrastructure to manage ETFs.

Embracing the future

With more product choice than ever, European ETFs provide a range of low-cost ways to build a huge range of portfolios. ETFs are superbly positioned to be winners in an age where value-for-money is under the spotlight and comparisons between investment products are straightforward to perform.

As trillions of dollars of assets continue to migrate towards ETFs, we believe that every asset manager needs an ETF strategy. For more information about how you can access this market, talk to HANetf.

Read the full whitepaper "Win The Future - Why Asset Managers Need an ETF Strategy".