Sugar market fundamentals to remain strong in 2021/22

This article was first published by F.O. Licht on 25 March 2021. For an updated analysis, listen to the latest Digital Dialogues on the World Sugar Balance which took place in June.

Sugar futures prices have been heavily influenced by the coronavirus-induced volatility in global financial markets over the past year which led to significant movements of crude oil prices as well as the Brazilian currency – two key factors for sugar price formation.

In late February raw and white sugar futures hit 4-year highs of 18.94 cents per pound and $490.10 per tonne but prices have fallen back to 15.50 cents and $445 per tonne at the time of writing, not least due to recent weakness in crude oil.

The May/May white sugar premium is currently trading at $100 per tonne.

It is against this background that we are presenting our first full look at the world sugar balance for 2021/22 (Oct/Sep). Of course, this still comes with a rather high degree of uncertainty, especially for the northern hemisphere cane sugar producing countries - where the 2020/21 crush is only coming to an end in some countries over the next couple of weeks.

We would like to recall that F.O. Licht does not include the sugar equivalent of beet and cane that were not processed into the end product crystal sugar (such as those used for fuel ethanol or biogas) in its sugar production estimates, which differs from the approach used by some sugar associations and official EU statistics. As always, all production figures are in raw value terms, which can be converted to white value terms by multiplying by 0.92.

Last but not least, it may be pointed out that our World Sugar Production forecasts are based on national crop years, while each country's numbers are recalculated to a uniform time period (in our case October/September) for our World Sugar Balance forecasts - the precondition for the calculation of the change in stocks (i.e. the surplus/deficit) during a given year. While this may sound boring for expert readers it is still imperative to do this as anecdotal evidence suggests that the numbers are still mixed up from time to time.

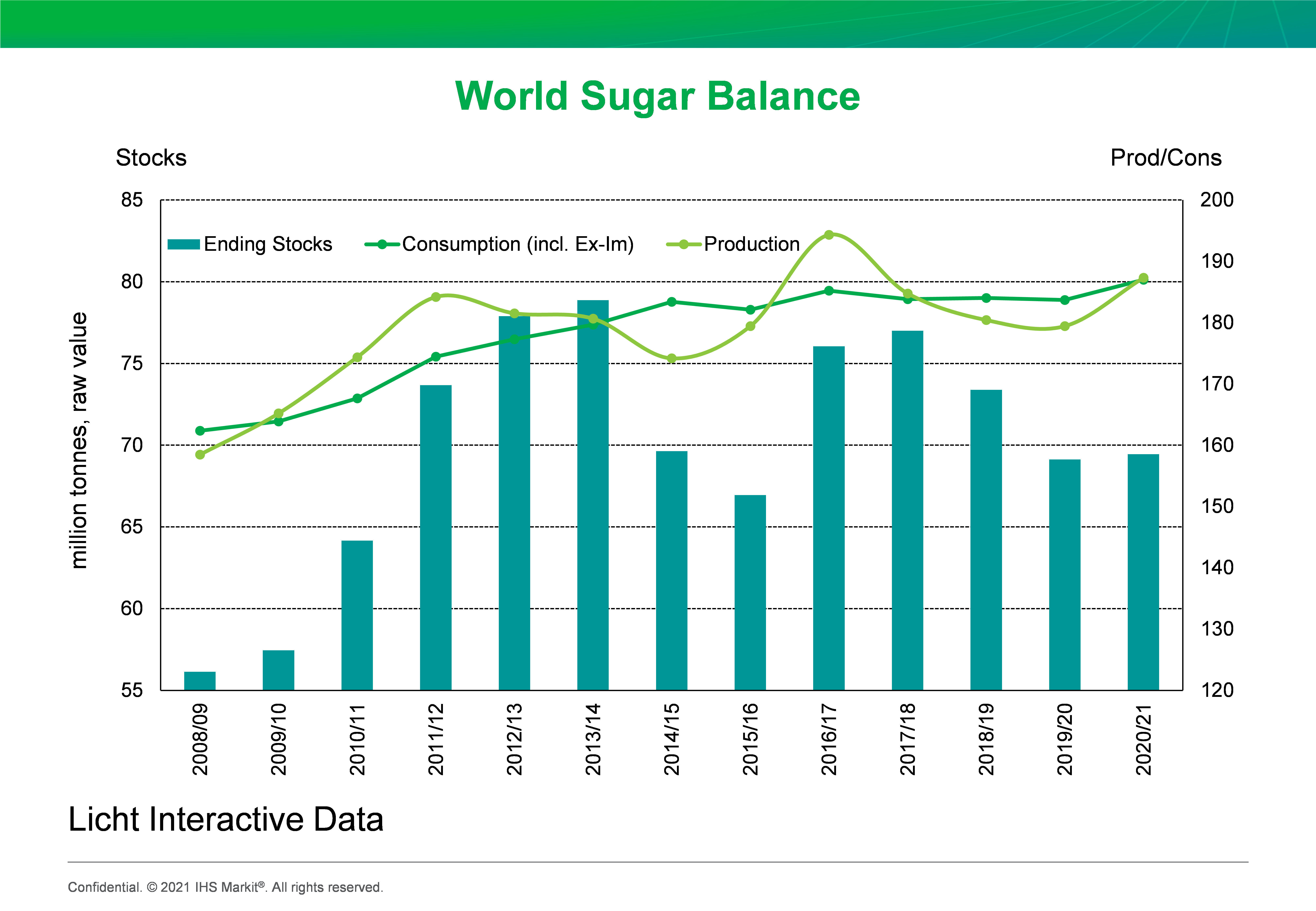

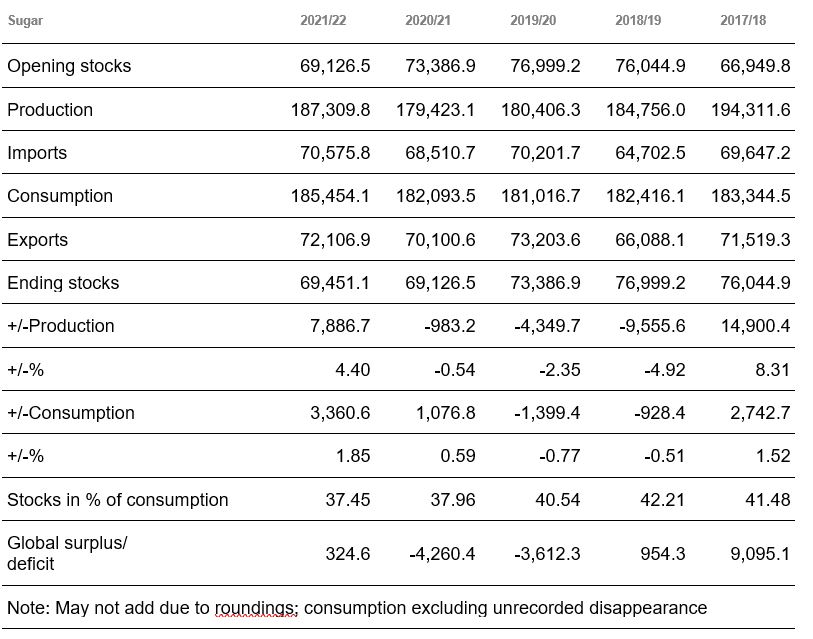

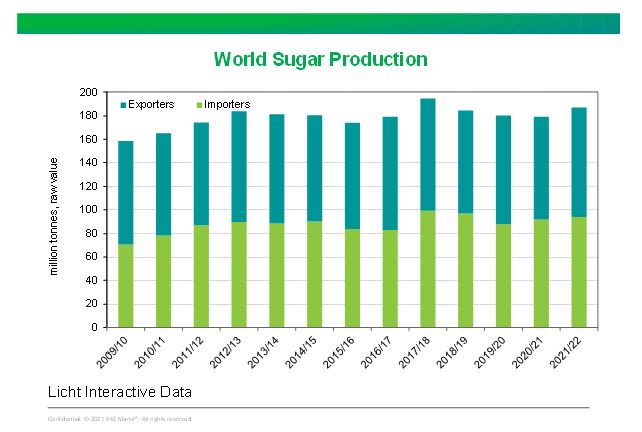

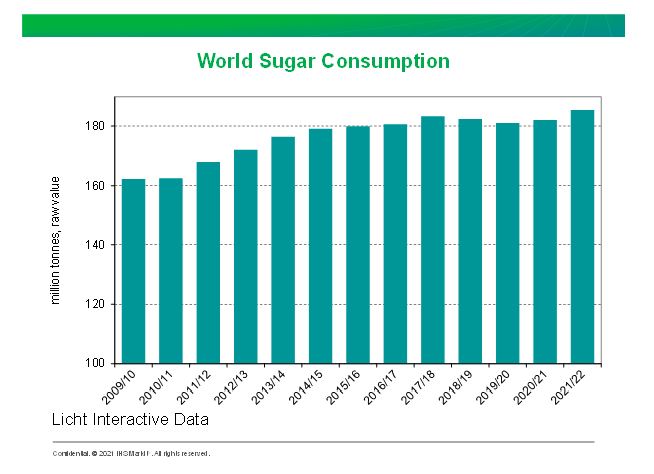

Current indications are that global sugar production in 2021/22 (Oct/Sep) may rise by 7.9 million tonnes to 187.3 million tonnes from this season’s 179.4 million, while apparent consumption is projected to rise about 3.4 million tonnes (1.9%) year-over-year to 185.5 million tonnes amid a global economic recovery with only 1.1 million tonnes growth projected for the current sugar year.

This means that this season's large deficit of 4.3 million tonnes is likely to be followed by a fractional surplus of 0.3 million tonnes in 2021/22. That includes an allowance for unrecorded disappearance (the difference between world exports and imports) of 1.5 million tonnes in 2021/22. It is worth to note that the deficit for the current 2020/21 season is now 0.6 million tonnes smaller than the 4.9 million tonnes projected at the beginning of this month due to an upward revision of Brazilian production in the upcoming 2021 crush.

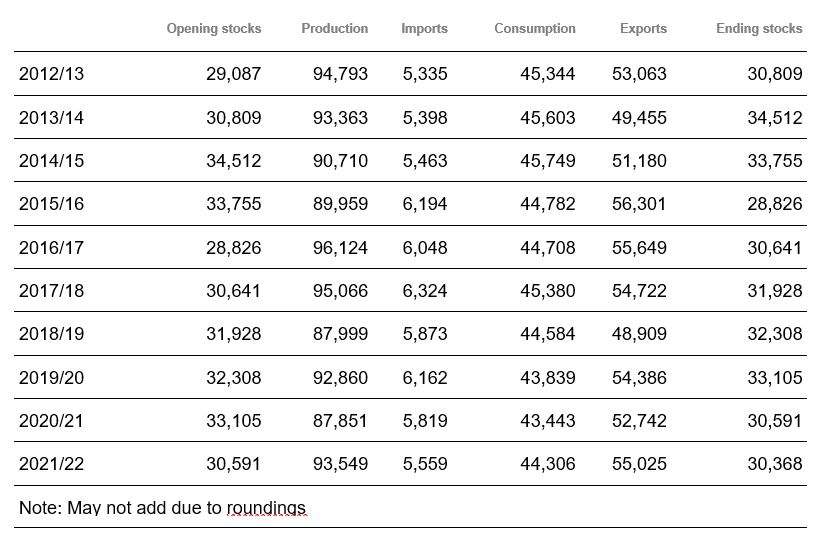

World Sugar Balance

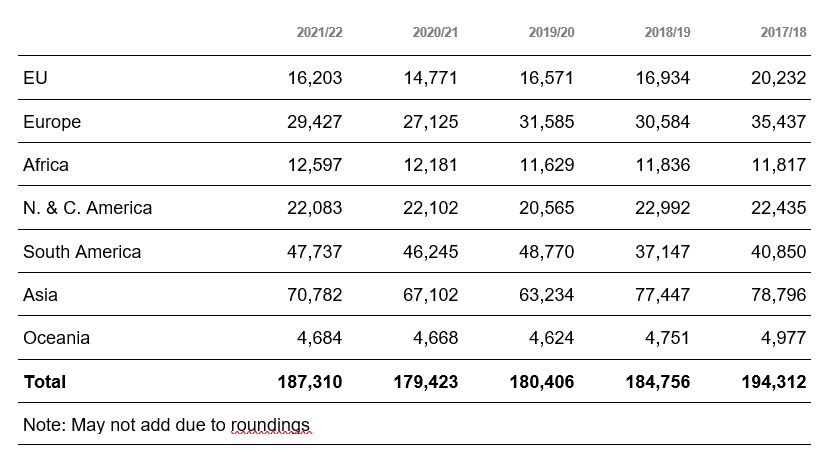

Asia to lead the growth in global production in 2021/22

Overall, the sharpest increase in output in 2021/22 is seen in Asia where sugar production is projected to rise by 3.7 million tonnes to 70.8 million due to a sharp recovery in Thailand and a further, albeit smaller increase in India.

An increase by 1.5 million tonnes to 47.7 million could be on the cards for South America in 2021/22 as the cane crush in Brazil’s Centre/South in 2022 is seen recovering from a drought-induced drop currently projected for the 2021 crush of which most (Mar-Sep) falls into the 2020/21 sugar balance year.

Sugar production in Europe is projected to rise by about 2.3 million tonnes to 29.4 million in 2021/22 due to a rise in area under cultivation in Russia and a yield recovery in the European Union.

Sugar production in North & Central America could be unchanged at 22.1 million tonnes, while sugar production in Africa could rise by 0.4 million tonnes to 12.6 million due to an expansion in Egypt. Last but not least, Oceania's sugar production could stay at 4.7 million tonnes next season.

Europe

European sugar production may rise by about 2.3 million tonnes to 29.4 million in 2021/22 due to a rise in area under cultivation in Russia and yield recovery in the European Union.

Sugar production in the European Union suffered a further reduction in 2020/21 and reached a 5-year low of only 14.8 million tonnes due to unprecedented yield losses in France, which has been hit heavily by the beet yellowing disease. While the area under cultivation is seen falling further in the new season, this is currently expected to be more than offset by a yield recovery as the top producers France and Germany have now joined the league of countries that have granted emergency authorisations for beet seeds treated with neonics. This should lessen disease pressure in the new season and is currently projected to lead to a recovery of sugar output to 16.2 million tonnes. Yet, this would nonetheless be below the 16.6 million tonnes produced in 2019/20.

World Sugar Balance October/September (1,000 tonnes, raw value)

Russia’s sugar beet area is projected to rise by 14% in 2021 as the strong drop in sugar output in 2020/21 to 5.8 million tonnes from a record 8.1 million the year before has led to spiking prices. The rise in area under cultivation together with a recovery of the beet yield to the 5-year average of 42.7 tonnes per ha should ensure a beet crop of about 45 million tonnes and sugar production of 6.6 million tonnes.

Africa

African sugar production is expected to rise by 0.4 million tonnes to 12.6 million in 2021/22. Top producer Egypt may raise production further to 3.0 million tonnes next season from an estimated 2.8 million tonnes this season due to an ongoing expansion of beet sugar production in the country. In contrast, sugar output in second-ranked South Africa is estimated to stay flat at 2.3 million tonnes as the country’s sugar industry is still in a critical state due to falling domestic consumption. Sugar production in Ethiopia is preliminarily projected to rise by 0.1 million tonnes to 0.5 million as the country’s sugar production is remaining far behind projected volumes.

North & Central America

Sugar production in North & Central America is estimated to remain unchanged at 22.1 million tonnes next season. The largest producer is the US followed by Mexico and Guatemala.

US sugar production is forecast to fall back somewhat to 8.3 million tonnes in 2021/22 after surging to 8.5 million tonnes in 2020/21 from a devastating 7.4 million in 2019/20 when bad weather hit the crop. Output this season is extraordinarily high as cane sugar output in Louisiana recovered from weather-damage in 2019/20 and even set a record, while production in Florida is also expected above the 2019/20 level due to an increased area harvested along with a smaller increase in cane yield. Besides, sugar recoveries from beet in all regions except the Upper Midwest are projected to be at historically high levels, and some sort of a normalization is expected for 2021/22.

While Mexico’s sugar production is projected to remain flat at 6.2 million tonnes next season after this year’s recovery from just 5.4 million in 2019/20, Guatemala (2.9 million tonnes) and Cuba (1.0 million tonnes) are both projected to produce about 0.1 million tonnes more sugar in 2021/22 than this season when they are seen producing rather poor crops.

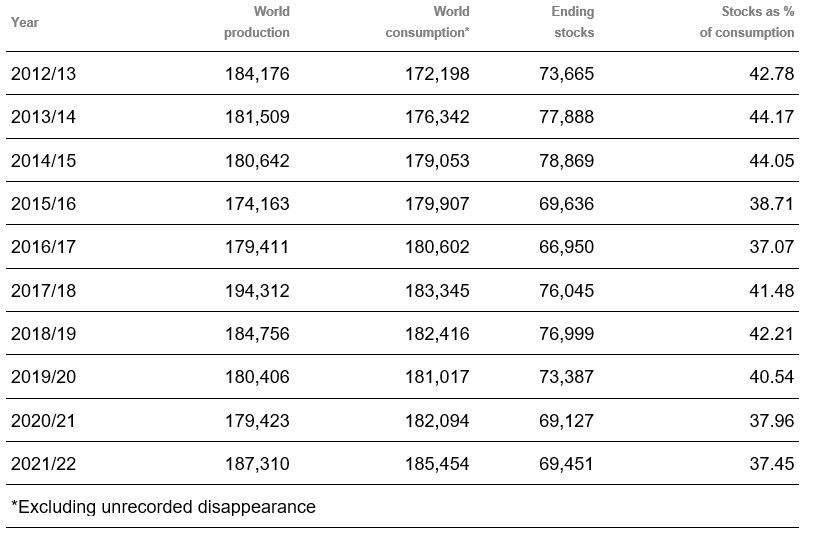

World Production, Consumption and Stocks of Centrifugal Sugar October/September (1,000 tonnes, raw value)

South America

South American sugar production is estimated to reach 47.7 million tonnes in 2021/22, up from 46.2 million this season.

Brazil's 2021/22 balance year production cuts through two Centre South (CS) campaigns. It includes the tail end of the 2021 crush just getting underway (everything produced from 1 October 2021 to the end of crushing operations in the CS) and the beginning of the next 2022 crush (everything produced up to 30 September 2022). Sugar production in 2021/22 on an October/September basis will therefore very much depend on the first half of the local 2022 crush, which is difficult to predict at this point.

Our forecast assumes that Brazil's total sugar production in the local 2022/23 (April/March) crush (including the CS and NNE regions) will fall further to 40.0 million tonnes from 41.6 million tonnes currently assumed for the local 2021/22 (Apr/Mar) crop year and 43.4 million in the 2020/21 crop year coming to an end this month.

Among the main assumptions is that Brazil's 2021/22 (April/March) Centre/South cane crush will fall about 20 million tonnes to just 585 million, which together with a drop of the ATR level to 140.0 kg per tonne from 144.6 this season and a sugar allocation of 47.0% (up from 46.0% in 2020/21) may lead to the production of about 36.7 million tonnes of sugar, tel quel (0.4 million more than assumed in early March). That would be 1.7 million tonnes less than in 2019/20.

Brazil's sugar production on an October/September basis is estimated to rise to 40.5 million tonnes, raw value, in 2021/22 from 39.0 million in 2020/21 amid an expected recovery in cane crushing in 2022.

World Sugar Production by Regions October/September (1,000 tonnes, raw value)

Colombia's sugar production is projected to remain unchanged at nearly 2.4 million tonnes, while Argentina is also estimated to produce roughly the same quantities of sugar as this season (1.9 million tonnes).

Asia

Asian sugar production is seen rising to 70.8 million tonnes in 2021/22 from 67.1 million this year.

India is experiencing a significant recovery in production this season on account of ample rainfall in the 2019 monsoon season, which triggered significant cane planting in the key sugarcane states of Maharashtra and Karnataka after previous drought. That said, sugar output this season is currently projected to reach 32.8 million tonnes, up from 29.8 million a year earlier.

Sugar output in 2021/22 is seen rising a little further to 33.5 million tonnes for two reasons. First, India's famous monsoon came to an end in September 2020 with the second consecutive year of an "excess" rainy season, which was favourable for cane planting. The rainfall average across the nation reached 109% of normal in 2020. This fell one percentage point shy of 2019's historic season of 110% above normal, which was the wettest monsoon season since 1994. This makes the first time back-to-back rainy seasons had this large of a rainfall surplus since the 1950s. 2019 and 2020 rank as the second and third wettest season's respectively since 1990. Following five consecutive below-average seasons from 2014 to 2018, the surplus rainfall of 2019 and 2020 has helped replenish reservoirs, which is also favourable for irrigation and should aid cane yields.

World Sugar Production

Second, the 2020/21 crush will likely see a 20% drop in output in top producer Uttar Pradesh. While part of this is due to diversion into ethanol production, there is also increased pest infestation due to flooding of cane fields, especially in some eastern and central parts of the state. A yield recovery is therefore expected there next season.

Thailand's sugar production in 2020/21 fell further to 7.7 million tonnes from 8.5 million a year ago and as much as 14.9 million in 2018/19 due to a combination of a drop in area under cultivation and poor yields. This led to a drop of the cane crush to just below 67 million tonnes this season from 75 million last year and 131 million two years ago.

For 2021/22 we currently expect a recovery of the cane crush to 90-95 million tonnes as the sharp drop in output has led to a scramble among millers for scarce cane, leading to higher cane prices paid to farmers than the state-set minimum price. This is believed to have taken area back from competing field crops such as cassava.

Elsewhere on the continent, China's sugar production may stay flat at 11.7 million tonnes with an ongoing expansion in the sugar beet industry likely being offset by pressure on the area under cane cultivation. Pakistan's production is projected to be a little higher in 2021/22 at 6.5 million tonnes compared with 6.3 million this season as the industry is currently in recovery mode and profiting from high domestic sugar prices.

World Sugar Consumption

Oceania

Sugar production in Oceania is estimated at 4.7 million tonnes in 2021/22, hardly changed from this season. Sugar production in Australia is generally challenged by falling cane supply with rival crops and urbanization eating into the cane lands. That said, Bundaberg Sugar closed its 135-year old Bingera mill after the 2020 crush to streamline its operation to just its Millaquin mill. It explained that the Bundaberg region tonnage figures of the past years cannot justify running two mills in the region, adding that the two mills were operating at around only half capacity.

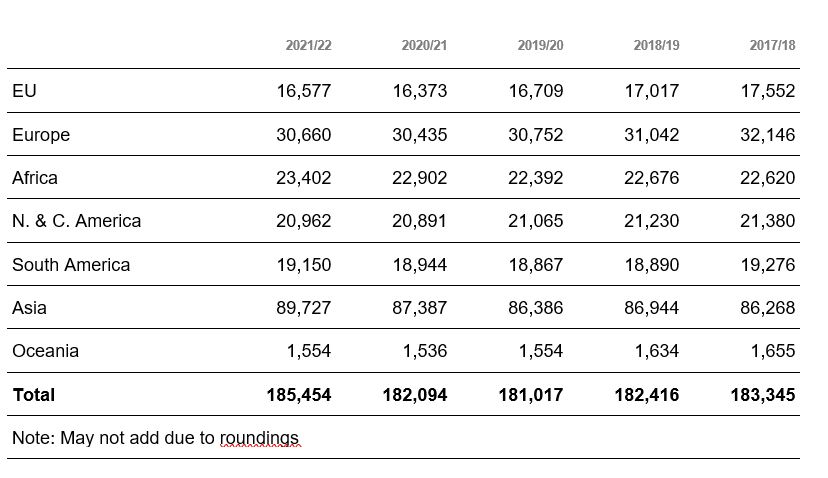

World Sugar Consumption by Regions October/September (1,000 tonnes, raw value)

Harvesting in Australia usually starts around May/June, with large-scale processing taking place from July onwards to October before production volumes drop off significantly up to the end of the crush. The number for 2021/22 therefore includes the tail end of the 2021 crush and the better part of the 2022 crush.

Sugar production in developing countries to rise strongly

Sugar production in developing countries is projected to rise by 5.4 million tonnes to 144.7 million tonnes next season due to larger output in key producers such as Thailand, Brazil and India. Sugar production in industrialised countries is seen recovering by 2.5 million tonnes to 42.6 million tonnes in 2021/22, largely due to the expected rise in the EU and Russia. However, this would still be less than in 2019/20 and far from the massive 49.0 million tonnes produced in 2017/18.

Sugar production in importing countries is expected to rise to 93.8 million tonnes from 91.6 million a year ago. Yet, this would still be significantly below the record 99.2 million tonnes produced in 2017/18. Sugar production in exporting countries may rise to 93.5 million tonnes from 87.9 million a year earlier. The biggest year-over-year increase among the countries forming this group is seen in Thailand (+2.8 million tonnes).

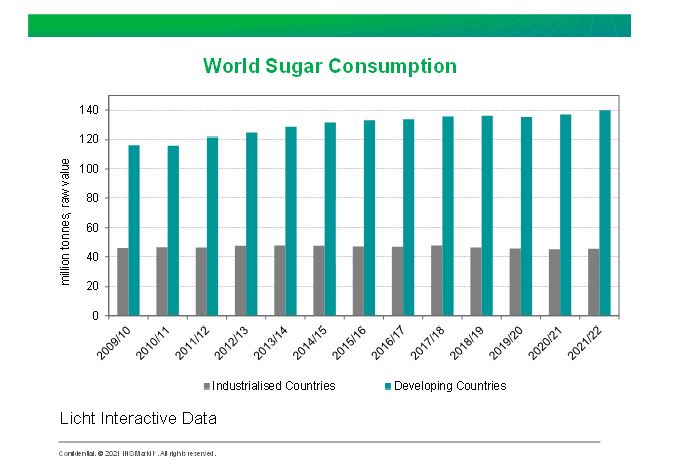

World Sugar Consumption

World sugar consumption growth to accelerate in 2021/22

The growth in world sugar consumption has been rather sluggish since 2015/16 and even reached negative rates in 2018/19 and 2019/20 with a plethora of reasons coming into play.

Of course, one key factor that is contributing to lower sugar consumption is the global war on sugar which is leading to lower use of sugar in the recipes of food and beverage producers or even the complete substitution of sugar through alternative sweeteners. Taxes on sugar-sweetened beverages have accelerated this trend massively and continue to do so with more countries introducing such taxes or raising the applied tax rates in a phased manner (such as in Thailand).

The COVID-19 pandemic dealt global sugar consumption an additional blow in 2019/20 after it started to spread globally since the beginning of 2020. In fact, COVID-19 is continuing to spread around the world, with more than 123 million confirmed cases and 2.7 million deaths across nearly 200 countries.

The lockdown of restaurants, cafes and offices in many countries has led to lower offtake by the industrial sector and it now becomes clearer that this has not been offset by increased sugar use at home for home baking etc.

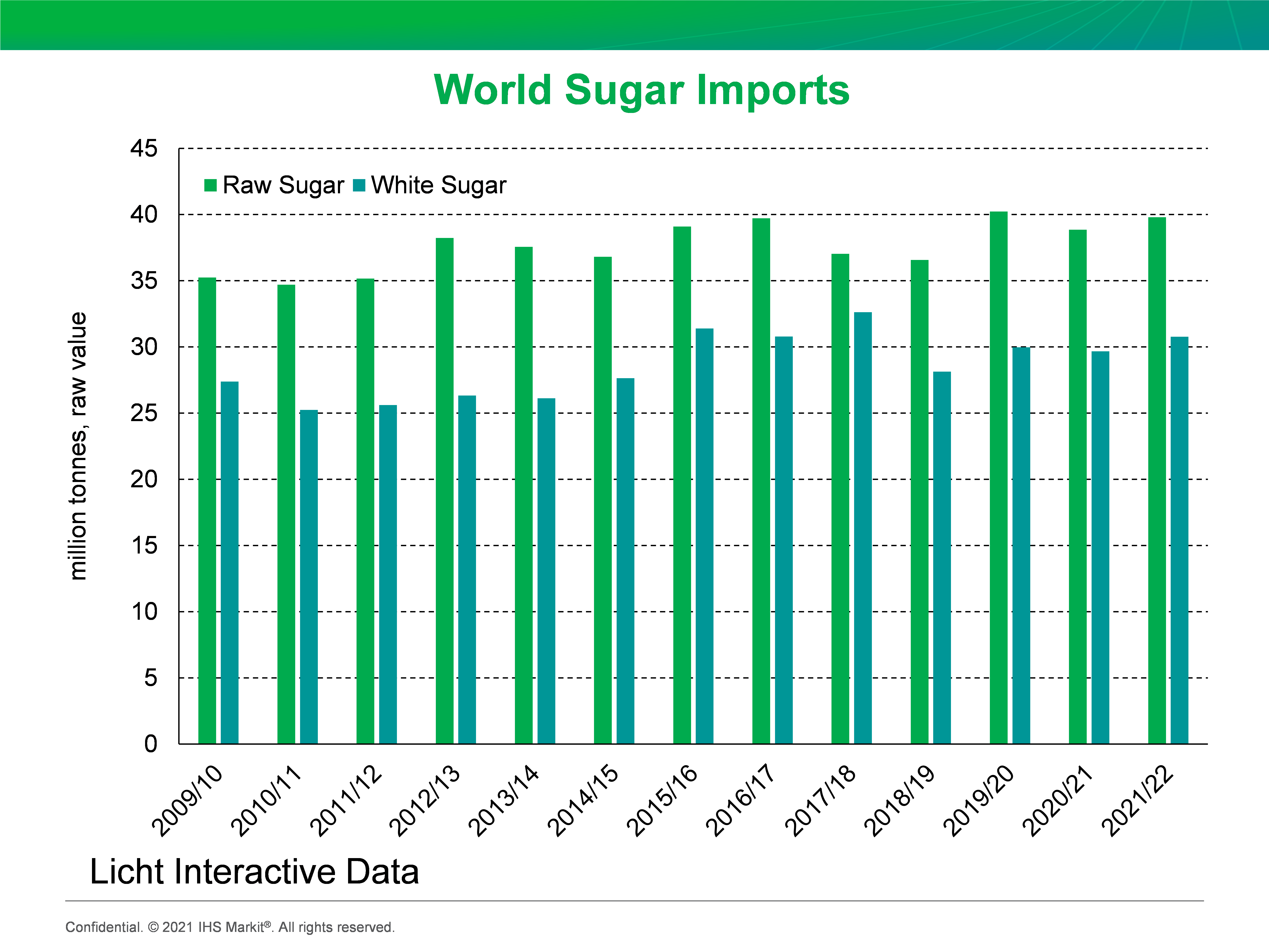

World Sugar Imports

However, there is hope for an improvement of the situation in 2020/21 and particularly 2021/22.Activity in many sectors has picked up and partially adapted to pandemic restrictions, the OECD reported in its interim projection earlier this month. Vaccine rollout, although uneven, is gaining momentum and government stimulus, particularly in the United States, is likely to provide a major boost to economic activity. But prospects for sustainable growth vary widely between countries and sectors. Faster and more effective vaccination deployment across the world is critical.

Anyway, prospects have improved over recent months with signs of a rebound in goods trade and industrial production becoming clear by the end of 2020. Global GDP growth is now projected to be 5.6% this year, an upward revision of more than 1 percentage point from the December OECD Economic Outlook. World output is expected to reach pre-pandemic levels by mid-2021 but much will depend on the race between vaccines and emerging variants of the virus, the OECD said.

Given that economic growth is a key pillar of sugar consumption growth, we currently expect that global sugar consumption may rise by 0.6% in 2020/21 and could accelerate to 1.9% next season. If realized, that would be the highest growth rate since 2013/14.

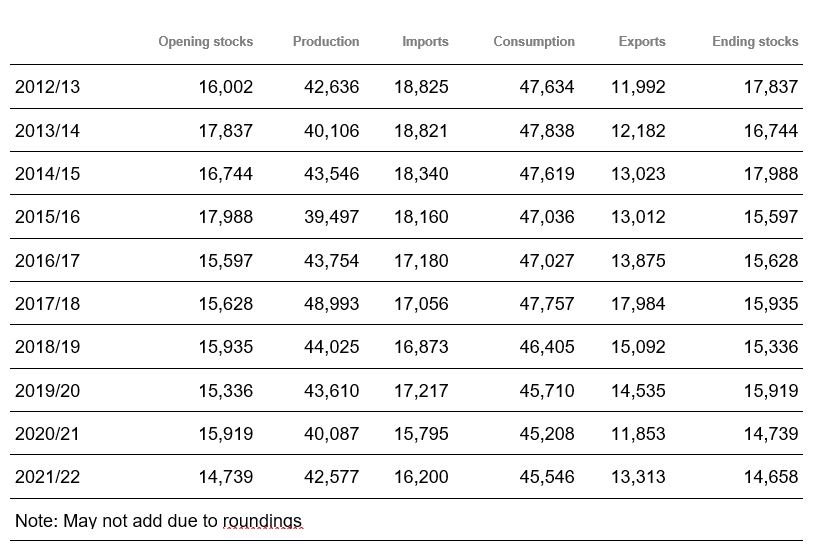

Sugar Balance: Industrialised Countries October/September (1,000 tonnes, raw value)

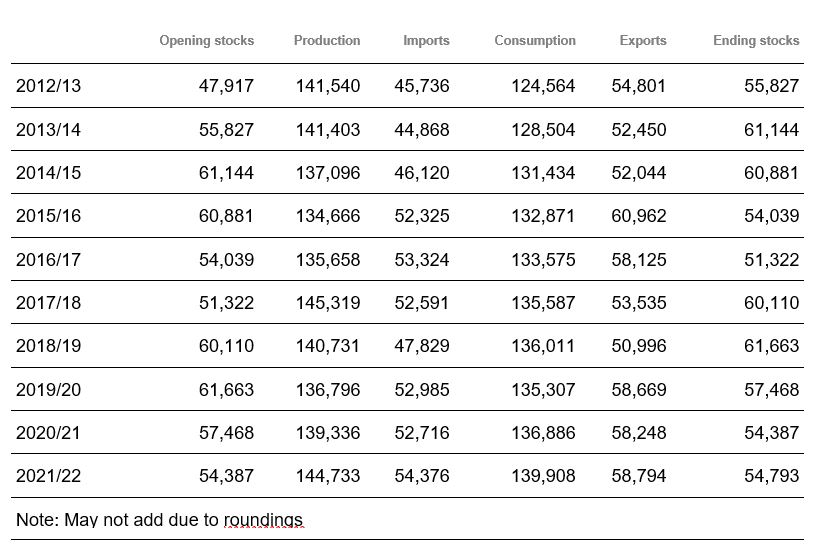

Sugar Balance: Developing Countries October/September (1,000 tonnes, raw value)

Asian sugar consumption to reach new record

Regionwise, Asian sugar consumption in 2021/22 is expected to rise to a record 89.7 million tonnes, up from 87.4 million the year before. This mainly reflects the growth expected for India. Consumption in the world's largest sugar consumer is seen rising by a rather strong 0.7 million tonnes to 29.0 million in 2021/22. That would be a return to more significant growth after a small increase of just 0.3 million tonnes assumed for 2020/21. Indian consumption growth is supported by a rising population with the annual growth rate put at 1.1%.

Chinese sugar consumption is seen rising by 0.4 million tonnes to 16.1 million in the current 2020/21 season and may even rise by 0.5 million tonnes to 16.6 million in 2021/22. The increase is related to a notable economic recovery, after suffering serious pandemic-driven setbacks for the majority of last year. According to some analysts, however, it is the Chinese Communist Party’s ability to strictly enforce disease control measures that helped Beijing to put the economy back on the rails as compared to most democratic countries where governments do not possess such powers. Chinese authorities could easily cut off highly affected areas from the rest of the country and getting factories running in a calibrated fashion.

As a result, China’s gross domestic product expanded by 6.5% in the fourth quarter of 2020. The economy grew 2.3% in 2020, according to Chinese government data. The turnaround has surprised economists because China’s industrial productivity saw a serious decline due to the lockdown imposed in the first and second quarter of last year.

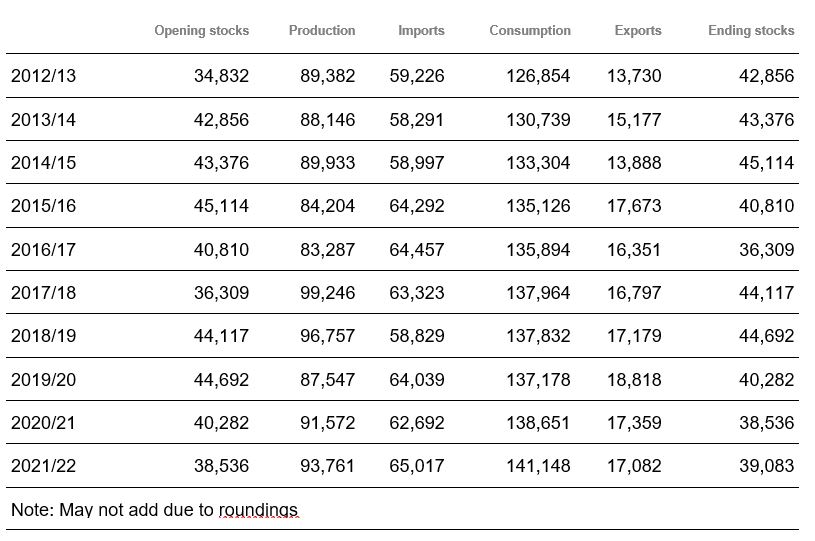

Sugar Balance: Importing Countries October/September (1,000 tonnes, raw value)

Sugar Balance: Exporting Countries October/September (1,000 tonnes, raw value)

European sugar consumption is seen recovering somewhat to 30.7 million tonnes in 2021/22, after falling to 30.4 million this season from nearly 30.8 million a year ago. Sugar consumption in North & Central America may be fractionally higher at 21.0 million tonnes. Sugar consumption in South America is projected to rise to 19.2 million tonnes from 18.9 million last season, with Brazil being by far the largest user and expected to see 0.2 million tonnes growth to 11.5 million tonnes next season. Sugar consumption in Africa is being driven by high population growth rates and may reach a record 23.4 million tonnes in 2021/22, up by 2.2% from 22.9 million this season. Consumption in Oceania, at around 1.6 million tonnes, is very stable with practically no year-on-year change. Australia accounts for the better part of total offtake, estimated at 1.2 million tonnes.

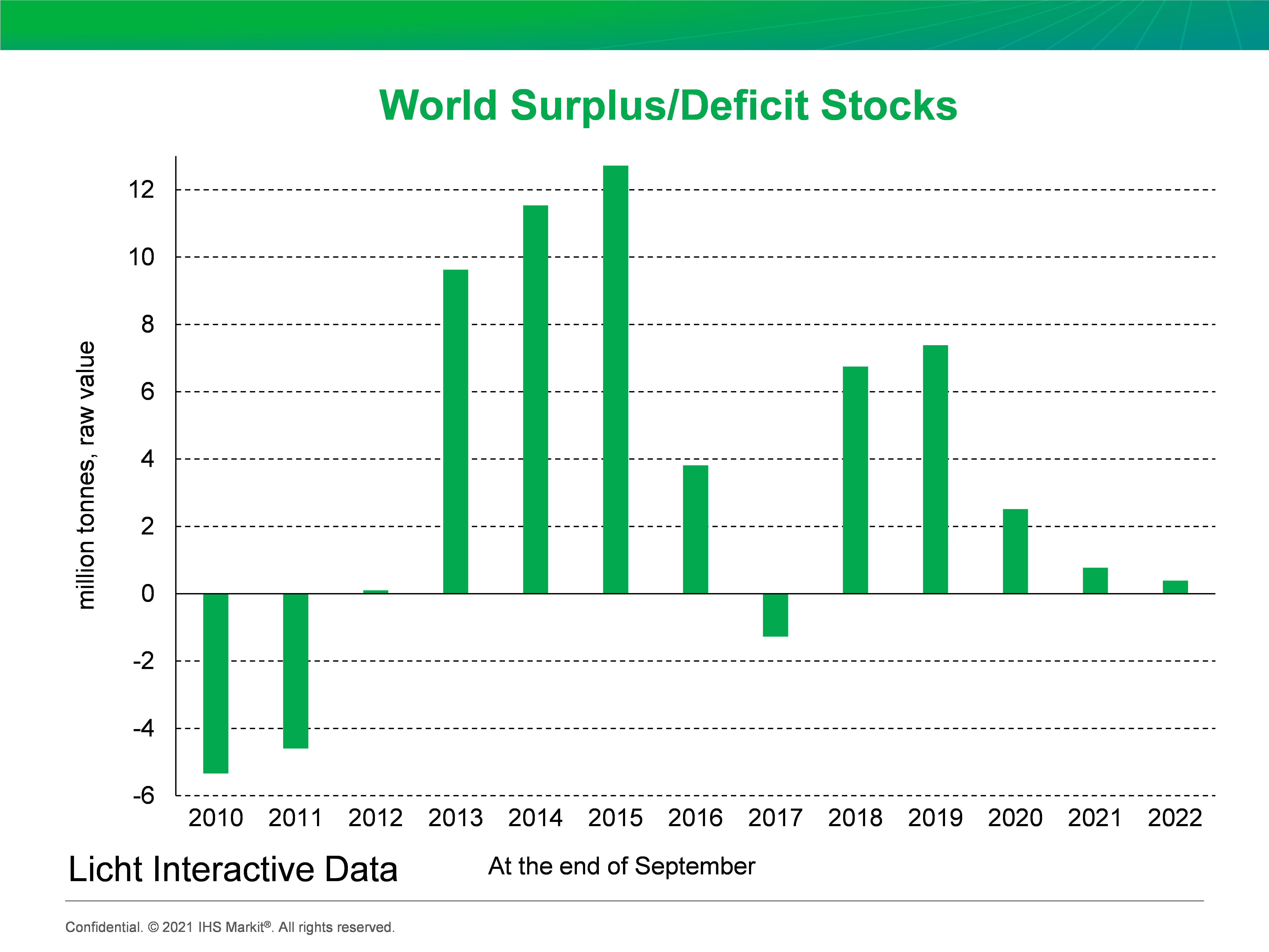

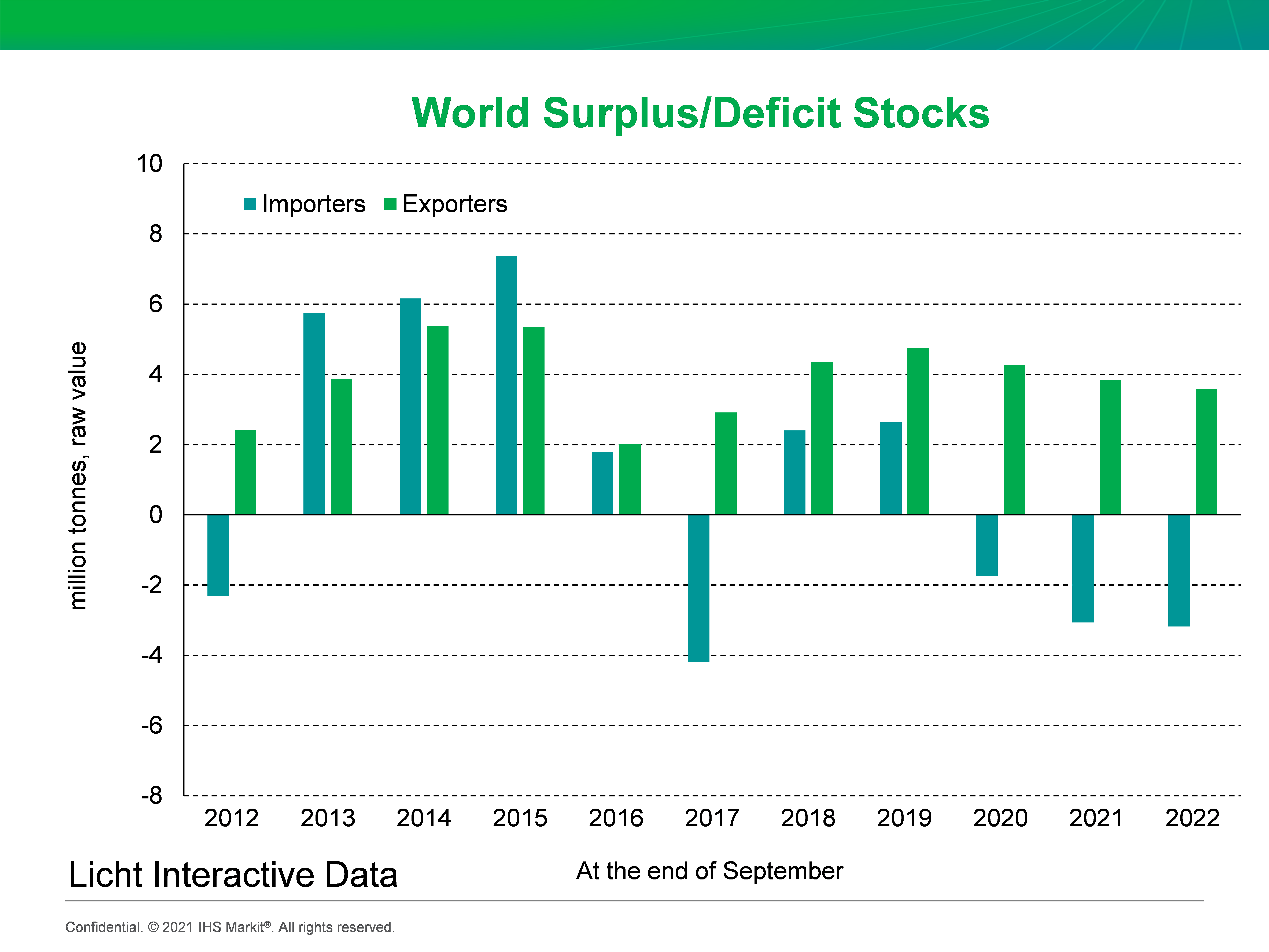

World Surplus/Deficit Stocks

Sugar consumption to rise 2.2% in developing countries

Developing countries are seen recording 2.2% sugar consumption growth in 2021/22 with the total estimated to reach 139.9 million tonnes - or about 75% of global demand. Sugar demand in industrialised countries has been in reverse gear for a number of years with the total seen at 45.2 million tonnes in 2020/21 compared with 47.8 million in 2017/18. The introduction of sugar taxes as well as general health concerns related to sugar is a key factor affecting consumption in this group. This may continue in coming years as sugar taxes are being under discussion in several countries. But for the time being, consumption of this group of countries may bounce back somewhat in 2021/22 to 45.5 million tonnes due to the economic recovery.

Sugar consumption in importing countries is forecast to rise by 1.8% in the new season to 141.1 million tonnes, a new all-time high. This reflects an increase of 10 million tonnes during the past eight years. Sugar offtake in exporting countries is also seen rising by a rather strong 2.0% to 44.3 million tonnes next season.

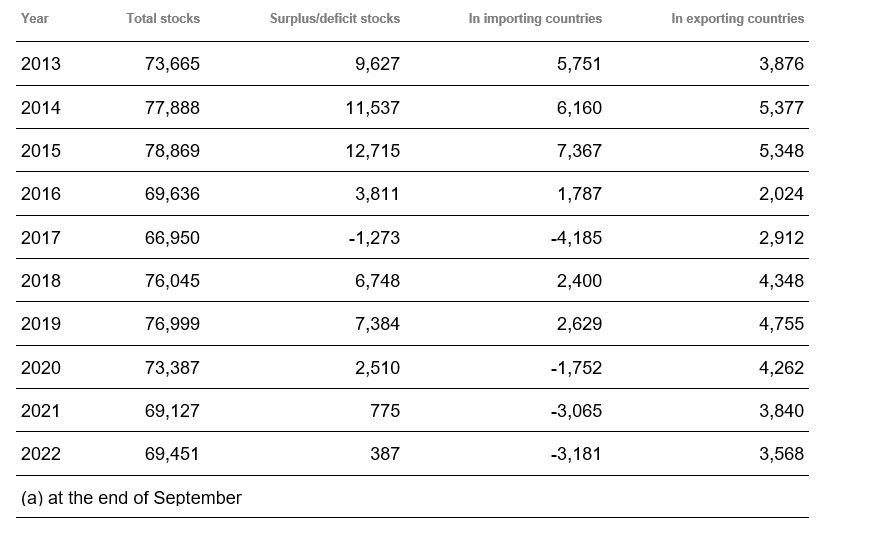

World Surplus/Deficit Stocks (a) (1,000 tonnes, raw value)

Exportable production to rise to 4-year high in 2021/22

World exportable production (production minus consumption) is expected to recover to 58.4 million tonnes in 2021/22 after falling to 53.1 million in 2020/21 from 55.9 million in 2019/20. If realized, this would be the highest since a record 63.5 million tonnes were achieved in 2017/18. The total for 2020/21 represents a small downward revision of 0.4 million tonnes from the previous projection in January.

It is of key significance that this measure does not include stocks, which are still massive in India.

Exportable production in the European Union is expected to rise to 4.3 million tonnes in 2021/22 from 3.0 million a year earlier. Most of this will be exported within the bloc and only a small quantity is expected to be exported out of the bloc.

Exportable production from Africa is seen only marginally higher at 2.5 million tonnes in 2021/22. Export availability on the continent is curbed by increasing domestic consumption due to strong population growth. The rise in output in Egypt is not leading to exports but lower imports.

Exportable production in North & Central America is seen climbing slightly to 5.6 million tonnes in 2021/22 from 5.4 million this season. The projected increases in output in Guatemala and Cuba would be responsible for the increase amid flat export availability (1.7 million tonnes) in the region’s top producer Mexico.

Exportable production in South America is expected to surge to 29.9 million tonnes next year from 28.6 million assumed for 2020/21. This is related to an increase to 28.9 million tonnes from 27.6 million for the continent’s top exporter Brazil where output is expected to bounce back in the 2022 crush from the assumed drop in 2021.

Exportable production in Asia is expected to rise to 12.1 million tonnes in 2021/22 from 9.6 million this season and just 7.2 million a year ago with the expected recovery in production in Thailand being responsible for the entire increase. Thailand’s exportable production is projected to increase to 7.3 million tonnes next season from just 4.8 million this season, which would still be far off values of up to 11.5 million tonnes per annum earlier this decade. India’s exportable production for 2021/22 may be 4.5 million tonnes, practically unchanged from this season.

World Surplus/Deficit Stocks

China’s sugar imports surge in 2020/21

Indonesia is seen importing 5.9 million tonnes of sugar in 2021/22, up from just 4.3 million in 2020/21 but below 6.3 million in 2019/20. Domestic consumption continues to rise due to economic and population growth, while domestic production has been lingering around 2.3-2.4 million tonnes for years due to a lack of investment. Making matters worse for domestic millers, the rise in demand is almost exclusively fuelled by growth in the food and beverage industries, which rely on refined sugar produced from imported raws instead of domestically produced plantation white sugar.

China's sugar imports are seen falling back somewhat to 5.4 million tonnes in 2021/22 after surging to 5.8 million tonnes this season from just 4.5 million in 2019/20. The sharp rise in the current 2020/21 season is related to the phasing out of steep additional import tariffs in May 2020, which lead to a surge in arrivals in subsequent months with 2.8 million tonnes arriving in the last quarter of 2020 alone, i.e. the first quarter of the 2020/21 season. Meanwhile, the problem with smuggled sugar that has plagued China's domestic sugar market for many years has been greatly reduced by the COVID-19 pandemic in 2020, according to a local source.

The United States is expected to import about 2.9 million tonnes of sugar in 2021/22, hardly changed from the current season. Imports had surged to a record 3.7 million tonnes in 2019/20 as a weather-induced sharp drop in production last season had lifted import demand. The recovery in production this season will lead to a drop in imports to a more normal level.

All in all, total Asian sugar imports are estimated to rise to 37.3 million tonnes in 2021/22, up from 35.5 million last season. European imports are forecast to come in slightly higher at 9.8 million tonnes (including intra-EU-trade), with African imports estimated to be only insignificantly higher at 16.7 million tonnes. North & Central American imports are projected to be hardly changed in 2021/22 at 4.8 million tonnes. Sugar imports into South America are negligible and may reach 1.7 million tonnes in 2021/22, down from 1.9 million in the previous season.

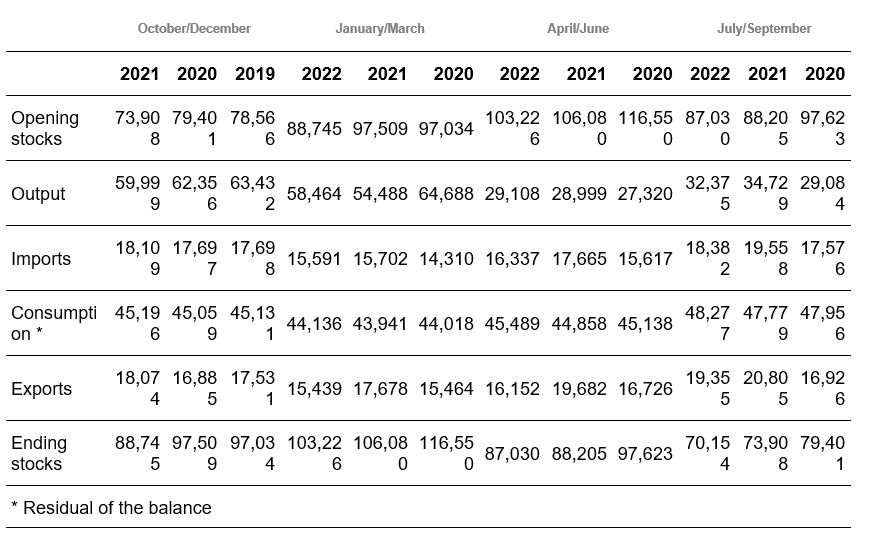

Quarterly World Sugar Balance (1,000 tonnes, raw value)

Stocks-to-use ratio to fall to 5-year low in 2021/22!

The stocks-to-use ratio is forecast to drop a little further to 37.5% in 2021/22 after already falling to 38.0% in the current season from 40.5% a year ago. If realised, this would push the ratio to the lowest level since 2016/17! In other words, the global S&D picture seems to remain tight next season with the projected recovery in global consumption playing a key role.

The surplus or deficit in a given sugar year is understood to be the gap between production and global demand including unrecorded consumption, with the latter being the gap between exports and imports. A closer inspection of this approach reveals that the term surplus or deficit simply means the increase or decrease in stocks.

The expected rather strong rise in world production in the next 2021/22 sugar year is not expected to lead to a sizeable surplus with the latter currently seen at just 0.3 million tonnes compared with a deficit of 4.3 million in the current sugar year.

This means that the sugar market’s fundamentals may remain comparatively strong for the foreseeable future as even an assumed sugar mix of 47% in the 2021 crush in Brazil's Centre/South seems insufficient to lead to a massive global surplus in 2021/22. That said, prices should remain firm further down the road, particularly if the increased rollout of COVID-19 vaccination leads to the assumed global economic recovery which would aid global sugar consumption. Other factors to watch include, of course, the future path of the Brazilian currency and crude oil prices as either of them have the potential to alter the profitability of sugar and ethanol production in the 2022 crush sizeably, which is of key importance for the 2021/22 sugar balance.