In an era marked by profound market volatility and the transformative potential of artificial intelligence (AI), the venture capital (VC) landscape is undergoing a significant redefinition. At the heart of this evolution is R136 Ventures, a Silicon Valley-based firm with $400 million AUM, dedicated to investing in technology and tech-enabled companies globally.

Our approach is shaped by a team of seasoned technologists, operators, and investors, with a track record of successful investments in companies like eToro, Roofstock, Rescale, ThetaRay, Insurify, Ridecell and Deci AI (acquired by NVIDIA). We understand the complexities of the market and the potential of AI or other innovative technologies that have driven the success of VC as an asset class.

The following insights will delve deeper into the current VC landscape, exploring the challenges, opportunities, and importance of strategic investing in this new era.

The shifting market

In 2024, the once vibrant VC market is undergoing a seismic shift. The intense activity of the early 2020s, driven by a tech boom and widespread FOMO, has cooled, leading to recalibrated valuations and cautious investor sentiment. Despite these challenges, AI is emerging as a transformative force within the industry.

This is a story of resilience, transformation, and opportunity. Amidst downturns, those with foresight and agility find new possibilities. VC is evolving, becoming more sophisticated and data-driven, much like earlier technological revolutions. At the core of this evolution is AI, which is driving VC and companies of all sizes into a new era of innovation and growth.

The 2020-2021 Gold Rush: A Double-Edged Sword

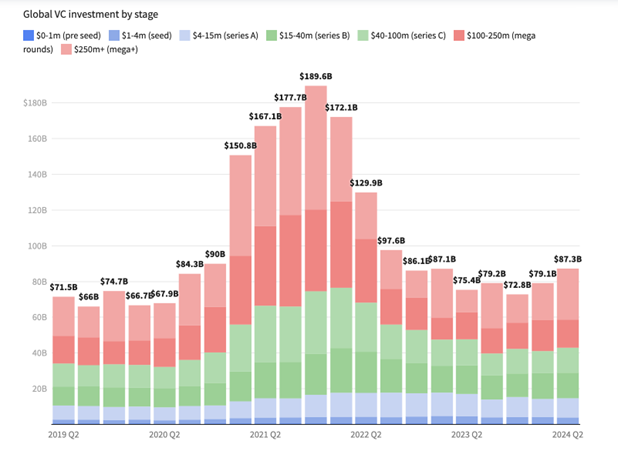

The COVID-19 pandemic triggered an unprecedented surge in VC investment. Flush with cheap capital and driven by a sense of urgency, investors poured billions into startups, often overlooking fundamentals in favor of rapid growth. Pitchbook data reveals that global VC investment soared from $298.2 billion in 2019 to a staggering $643 billion in 2021. The result was a bubble of inflated valuations and unsustainable business models.

2021 was a particularly striking example. While it was a banner year for exits, the deployment of capital was equally remarkable. Despite the strong exit environment, the ratio of capital called to distributed was approximately 2x, indicating the sheer volume of capital being poured into the market.

Source: Dealroom.co

The downturn, due to prior overexuberance, offers a painful yet necessary recalibration. It reminds us that VC, like any investment, is fraught with inherent risks. The market dynamics of 2023 highlighted this, as we witnessed the highest ratio of capital called to distributed this century, peaking at an unprecedented 4.5x. This trend underscores a cautious investment climate, where limited partners (LPs) are wary of deploying capital, and general partners (GPs) primarily focus on safeguarding existing investments.

While a slight easing is expected in 2024, the uncertain rate environment, even with anticipated cuts, suggests that robust exit activity may not fully resume until 2025. If the IPO and M&A markets rebound as predicted, coupled with the continued growth of GP-led secondaries, we can anticipate a gradual return to historical norms in the 2025 to 2026 timeframe.

The AI Renaissance: A Beacon of Hope

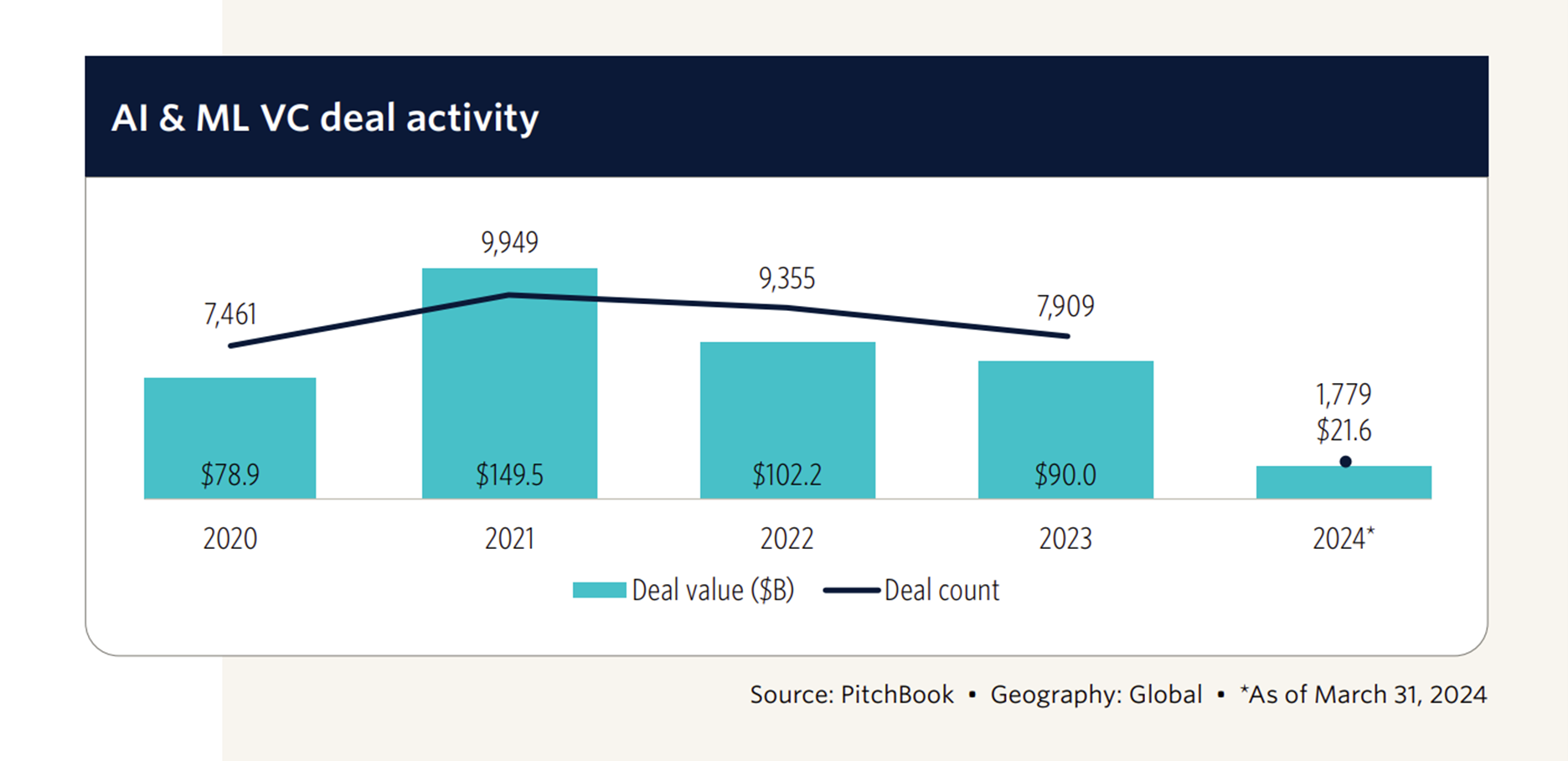

While the current market may seem bleak, a transformative force is at play: AI. Pitchbook reports that the number of AI-related startups receiving VC funding has grown by over 460% since 2020. This AI investment surge underscores this technology's immense potential to disrupt industries and create significant value.

This presents a once-in-a-lifetime opportunity akin to other groundbreaking technologies that transformed the tech world and our everyday lives. Many draw parallels to the internet or mobile revolution, but we believe AI's impact will be far more profound and less immediately apparent. Think of it like the "transistor" technology—it enabled semiconductors and computers, acting as a fundamental enabler in addition to being a core technology itself.

We anticipate AI following a similar path, its benefits permeating every industry and pushing other technologies into new paradigms, just as the transistor did. It's not just about AI's direct applications but its role as a catalyst for broader technological advancement.

The Enduring Appeal of VC: Beyond the Hype

Despite the current challenges, VC remains an attractive asset class for sophisticated investors. Cambridge Associates data shows that top-quartile VC funds have historically delivered annual returns of 15-27%, significantly outperforming public market indices.

But perhaps the most compelling reason to invest in VC today is the AI revolution. AI is not just another tech trend; it's a paradigm shift that is poised to reshape industries and create unprecedented value. By investing in VC, you're not just betting on individual startups; you're investing in the future of innovation itself.

The Rise of the Strategic Investor: Navigating the New Normal

The downturn has exposed the flaws of the "spray and pray" approach that characterized the boom years. Today, successful VC investing requires more than just capital; it demands expertise, discipline, and a long-term perspective. Every year there are only 10-20 deals that matter and that can drive most of the alpha in the industry, so an investor needs to be able to not only see such deals but be able to spot them out before others.

Research by Harvard Business School suggests that VC firms with experienced partners and a focus on deep industry expertise tend to outperform their peers, particularly during market downturns. These firms are able to leverage their knowledge and networks to identify high-potential startups, even in challenging environments.

The VC firms that will thrive in this new environment are those that possess a deep understanding of the industries they invest in, conduct rigorous due diligence, and focus on building sustainable businesses, not just chasing quick exits. They are the strategic investors who see beyond the hype and recognize the true potential of AI-driven innovation. Their focus is not just on generating high multiples on invested capital (MOIC), but also on ensuring that their portfolio companies have the potential to create lasting value.

Consistently investing in the asset class ensures limited partners don't miss out on these high-growth opportunities. Research by Cambridge Associates shows that top-quartile VC funds have historically outperformed public markets, highlighting the potential for superior returns.

Shape the Future with R136 Ventures

As the venture landscape evolves, R136 Ventures invites visionary investors to explore AI's potential with us. Contact us at info@r136.vc to invest in and drive the future of innovation.

About the author

Ratan Manehani is a Partner at R136 Ventures, specializing in mid to late-stage technology investments. With significant experience across investment firms and growth-stage startups, Ratan has a deep background in enhancing corporate strategies and leading high-stakes investments.