The future of the gas generation

Karen Sund discusses how, with slight adjustment to the gas mindset, there is still hope for some more years of gas generation.

What is the potential for natural gas in “balancing renewables”?

I have been in the gas industry for more than a generation now, and being both female and non-technical, I have a couple of advantages. First, everything technical is well explained, so that even I can understand it. I can get away with asking “silly” questions, that frequently get an answer starting with “well, darling, let me explain, as you are not an engineer…” The interesting thing is that many of the explanations given by different clever energy people are contradictory. So, the second advantage, from working with several parts of generation is that I can ask: “But, the wind industry does this, the coal industry does that, and why are you still believing…”

Finally, the age advantage. When I entered the gas industry, we were “the bridge to hydrogen society” (expected to be fully developed by the magical year of 2000, surely), with hydrogen made, naturally from natural gas. Then it was all about renewables, as fossil fuels were in shortage and peak oil would make us poor and cold. Now, wind and solar are being done, it’s cheap, trendy and often much more profitable than (even their own) engineers had imagined. Hence, dismissed for too long by the gas industry.

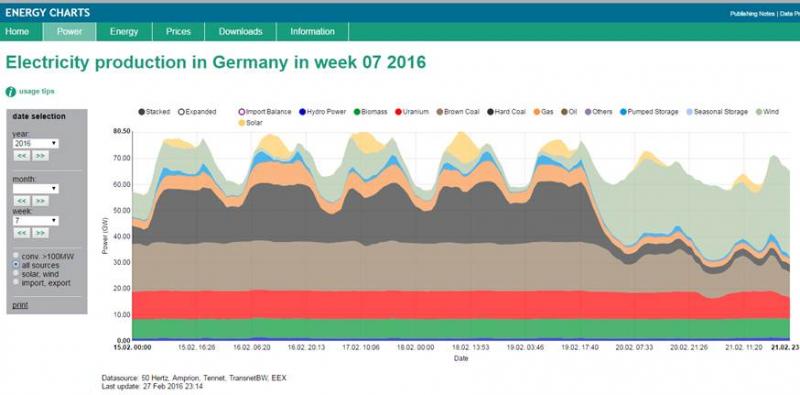

So, the next “truth” has to be tested: If gas is so flexible generation, why it is not used by the German Energiewende? Well, two simple reasons: Coal is actually both flexible and cheap, and “green enough” as long as CO2-quotas are bought and some windmills are visible. Incroyable!

This short blog talks about the result of these different narratives, and how, with slight adjustment to the gas mindset, there is still hope for some more years of gas generation.

Renewable energy is certainly one factor that has been dismissed by some traditional energy suppliers for too long.

Now the contribution and lower cost of renewables are becoming clearer and dismissed by fewer. At the same time, there is the new hope of balancing the “unreliable” renewables: “The markets will run gas when the sun doesn’t shine and the wind doesn’t blow.” Well, that depends! If you are in the UK, gas certainly plays a significant role in flexible generation and even base load. It is easier to make a profit with higher CO2-costs than the rest of Europe. Germany has a very different picture, and coal is the flexible generation there. Gas has a very limited base load and only occasionally is the electricity price high enough to bring a significant increase in generation for a couple of days. This will typically be during higher than normal demand and very limited renewables contribution, and only when coal is running at full capacity. The main challenge with renewable generation in Germany, as I see it, is not their absence (“when the sun is not shining and the wind is not blowing”), but the scale of the contribution on some days: Even if the country turns down coal and exports to several countries, it is not unusual to see negative wholesale prices. This should have a negative impact on new investments, but as a whole, there is very high generation capacity, much of which is in idle gas generation.

Finally, while large utility companies may “switch” between gas and coal in their total generation over capacity, smaller operators of wind and solar will generally stay on.

Illustration from Fraunhofer: Balancing renewables in Germany is by export, import and coal

So gas does not scare renewables away, as many had expected?

The way we see it, coal and renewables scare gas away today. With retiring coal and possible closing down of more nuclear in Europe, there may be a role for gas again, which could well be good for the environment – both for climate and local air quality. According to the IEA, there is a need for 90 GW capacity of dispatchable generation in Europe, expecting 1000 hours operation a year. That means higher spark spreads are needed for gas. There is enough existing gas generation capacity to allow coal to be phased out, so, for some, it is a waiting game for now.

Meanwhile, the electricity demand is expected to be managed down by the current EU policies – efficiency, eco design, smart houses, more own generation from solar etc could well reduce the need for generation, which again will impact the space and role of gas in the generation mix.

Could gas befriend the renewables and power sector better?

The best way to be popular is, naturally, low prices, as we see today in the US. But in Europe, this will have to be even lower than today’s lowish prices, unless CO2-prices increase significantly. This is clear in Great Britain, where higher CO2-prices give higher use of gas than of coal in generation now.

There is now more talk about power-to-gas than gas-to power. If surplus electricity is converted to gas, the current gas infrastructure of pipelines and storage would be helpful. Both storage and transportation of gas is more efficient (less losses) than that of electricity. More system thinking and cooperation of gas and electricity TSOs, where they are not merged already, could help this cooperation or coexistence.

We also see the potential for transitioning to more biogas, which could both reduce possible methane emissions from other sources and gradually replace oil products (especially in transportation). Biogas could also be used in power and heat, as we already see in Denmark. The best biogas, in our view, is the one that captures waste that otherwise would emit methane to the atmosphere – giving double benefits when used to replace fossil fuels. Biogas can be blended with natural gas in pipelines, as CNG and even in LNG, reducing the footprint of natural gas further.

What about the good old heating market for gas?

Well, renewables are here, too. Solar, wood pellets and more. An opening for gas, for all those households that are connected to the grid, could be micro generators. That means that instead of only heating their boiler, electricity can be generated as well from the gas. We must look at the reason many consumers go off-grid: The growing gap between wholesale and retail prices, especially in Germany, combined with lack of trust in government and large utilities are making consumers inventive, not only with solar panels.

We see a need to look at the full picture – not in biased silos that try to fight for political attention for support and thereby appearing to compete more than is the case in reality.

Would CCS help?

CCS is possible, the technology is there, but if a plant is only to run occasionally, the spark spread needed would only be higher with capture costs added to it. Having said that, clean energy from gas generation (base load) with CCS is cheaper to provide than coal generation with CCS, due to the lower CO2 content of gas. This is the opposite conclusion of earlier studies that have focused on the abatement cost. Naturally you cut more CO2 from a coal plant than from a gas plant, as it has more CO2 to begin with, but as explained above, this answers the wrong question.

There is now even CO2 capture initiatives on renewables and waste-fired generation, giving smaller footprints for towns and even “negative emissions” in some cases.

To dance with renewables, gas should change its dress – and tone of voice.

Some basic respect for what has been achieved, on both sides, would also work better than today’s contempt in this “dance”. Dialogue and flexibility, openness on emissions and willingness to try new ways of doing business are adjustments to the current gas mindset that would be needed for the future.

Alternatively, keep on doing business as usual and see demand continue to fall…

Perhaps not this time! There are some fundamentals changing the energy demand now that are different from before!