The importance of sustainability when investing in private markets

The only constant in life is change, and capital markets are no exception. Approaches that generated returns in the past may not continue to do so. To help investors keep pace with rapidly changing times, sustainability is increasingly coming into focus. Public markets, both domestically and internationally, reflect the global economy right now, but not necessarily the most potential for future growth, especially as the world increases its focus on sustainability. Private markets offer opportunities for long-term investors to capitalise on sustainability, as they are uniquely positioned to identify where the global economy is headed.

Approaches that generated returns in the past may not continue to do so. To help investors keep pace with rapidly changing times, sustainability is increasingly coming into focus. Public markets, both domestically and internationally, reflect the global economy right now, but not necessarily the most potential for future growth, especially as the world increases its focus on sustainability. Private markets offer opportunities for long-term investors to capitalise on sustainability, as they are uniquely positioned to identify where the global economy is headed.

Most of the world’s public companies began as smaller innovators who needed access to private capital. As they have grown, they have shifted to smaller suppliers for the ideas and technology that will help maneuver them to the next stage of their evolution. Part of this evolution involves incorporating sustainability in the core of their operations. These smaller suppliers are usually private companies and rely on private capital to fund their expansion and growth. As such, a private market investment often has significant overlap and connection with a sustainable investment.

Over the last few years, we have seen investors increase their allocations to both private markets and sustainable investment strategies as they look for ways to future-proof their portfolios. With careful asset selection and strong due diligence, investing in innovation through these private companies can help to drive growth within a portfolio and add diversity to the risk-return profile.

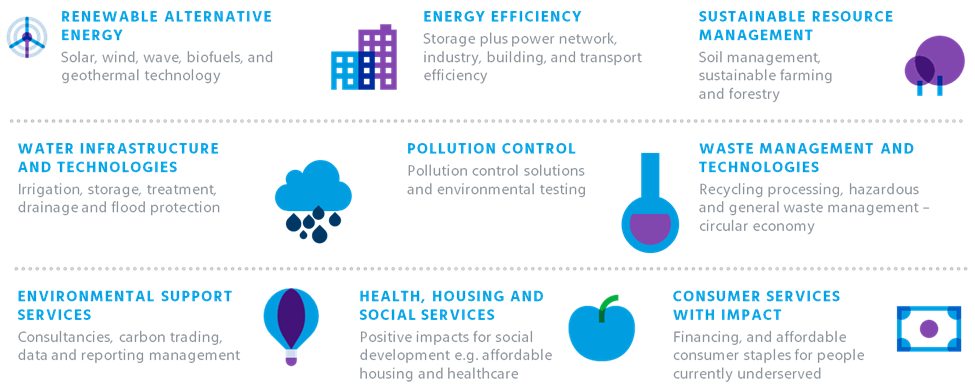

Key sustainability themes to consider

Incorporating sustainability in decision-making

Investors should view private markets and sustainability as distinct but complementary strategies within a portfolio. By considering the two, investors can make more informed choices with respect to their long-term strategy, potentially enhancing returns and minimising downside risk. Private markets are a natural home for sustainability strategies, due to the typically longer hold periods and greater degree of involvement, which underlying fund managers have in their portfolio companies.

There are many ways in which a sustainable investment approach can create and preserve long-term investment capital:

- Environmental, Social and Corporate Governance (ESG) factors can have a material impact on long-term risk and return outcomes and should be integrated into the investment process.

- Taking a broader and longer-term perspective on risk, including identifying sustainability themes and trends, is likely to lead to improved risk management and new investment opportunities.

- Climate change poses a systemic risk, and investors should consider the potential financial impacts of both the associated transition to a low-carbon economy and the physical impacts of different climate outcomes.

- Stewardship helps the realisation of long-term shareholder value by providing investors with an opportunity to enhance the value of companies and markets.

Exposure to these themes and trends can be direct or indirect, but in all cases the focus should be on sustainability integration, with sustainability allocations seen as an area for development over time.

Notably, as sustainability in private markets is still an evolving area, it remains difficult to fully determine the impact of investing with sustainability managers on investment returns. However, there is growing empirical evidence that suggests diverse private markets funds have the potential to outperform their benchmarks.

Sustainability risk in private markets

Sustainability risk is a key consideration in private markets. Organisations need to identify, mitigate and monitor these risks to successfully implement a private market allocation. Otherwise, downside risk from a sustainability investment could be larger than anticipated. These risks include:

- The risk of a lack of awareness of sustainability themes and trends in decision-making

- A lack of awareness can lead to sub-optimal risk management (either at the asset or portfolio level), and can lead to missed opportunities.

- The risk that sustainability integration is viewed as only being applicable to certain asset classes

- This view can lead to sub-optimal outcomes when portfolios of different private markets asset classes are being constructed.

- The risk that stewardship (or active ownership) is lacking in privately held companies

- This can lead to sub-optimal financial and operational performance, and reputational damage for both companies and their owners.

- The risk that not all sustainability-related factors are appropriately integrated into the asset selection and portfolio construction processes

- Private markets managers may focus overly on one particular aspect (e.g. climate change) at the expense of other relevant factors.

- The risk that investments in certain geographies, sectors and development stages can have a different exposure to specific ESG-related factors than others

- The assumption that all ESG-related risks are equal across all types of investment can lead to sub-optimal asset selection and portfolio construction outcomes.

Integrating Sustainability in Core Portfolio Objectives

The opportunity to capture sustainability factors via private market investments is substantial and cannot be ignored. While risks exist, the careful management of these risks can help investors to capitalise on these opportunities and integrate them into broader portfolios. Sustainability must also be viewed in the context of broader portfolio objectives.

Join Cara Williams at IMpower Incorporating FundForum 2022. Find out more about the agenda and speakers here >>