The rising importance of brand in Europe

Marketing budgets are rising in 2022

Marketing evolves

The coronavirus pandemic has had a significant impact on marketing departments across many industries. In the asset management sector, the switch to remote working forced firms to use technology to prevent any major break in commercial activity. This allowed marketing staff to experiment with how best to capture the attention of investors, both old and new—something that became more important as lockdowns dragged on.

The coronavirus pandemic has had a significant impact on marketing departments across many industries. In the asset management sector, the switch to remote working forced firms to use technology to prevent any major break in commercial activity. This allowed marketing staff to experiment with how best to capture the attention of investors, both old and new—something that became more important as lockdowns dragged on.

Today, marketing teams are still fine-tuning their approaches and seeking to ready themselves for life after COVID-19. Marketing budgets are set to rise in 2022, whereas last year, 56% of the managers we surveyed expected their marketing budgets to remain flat. This shift suggests that uncertainty is fading and optimism is increasing.

Of asset managers Cerulli surveyed in Europe, 34% expect social media to be the main focus of their marketing activities over the next two years.

Social media is set to be the biggest beneficiary of increased marketing budgets: 34% of the asset managers Cerulli surveyed in Europe expect social media to be the main focus of their marketing activities over the next two years. In addition, 52% intend to recruit brand specialists. The proliferation and commoditisation of investment products in recent years has made it increasingly difficult for asset managers to compete on price or product alone. It has also demonstrated the increased importance of brand perception in the industry.

Although brand plays a relatively minor role in asset management compared to industries such as fashion, in a highly competitive environment where the differentiation of value propositions is becoming more challenging, brand is gathering momentum.

Brand perception

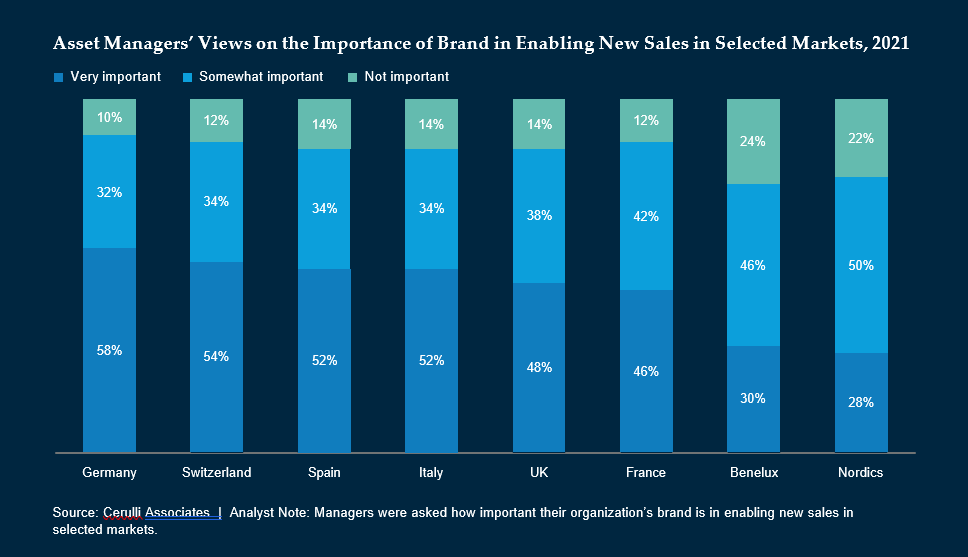

Cerulli’s survey of asset managers operating in Europe found that 46% of respondents consider brand a very important element of sales and 15% consider it not important. The importance of brand also varies across Europe.

As the exhibit below shows, 58% of the asset managers Cerulli surveyed consider brand a very important element of enabling sales in Germany, compared to only 28% of respondents in the Nordic region. In addition, 46% of the managers we surveyed believe brand is very important in France, compared to 30% in the Benelux market.

Despite the differences across Europe, Cerulli’s research shows that marketing departments at asset management firms throughout the region see brand specialism as an area of expertise they want to build over the next two years.

Several of the managers we interviewed said that brand has become strategically important when building partnerships with external distributors. In addition, 32% of the managers we surveyed identified brand awareness as a very high priority for their marketing teams over the next 12 to 24 months.

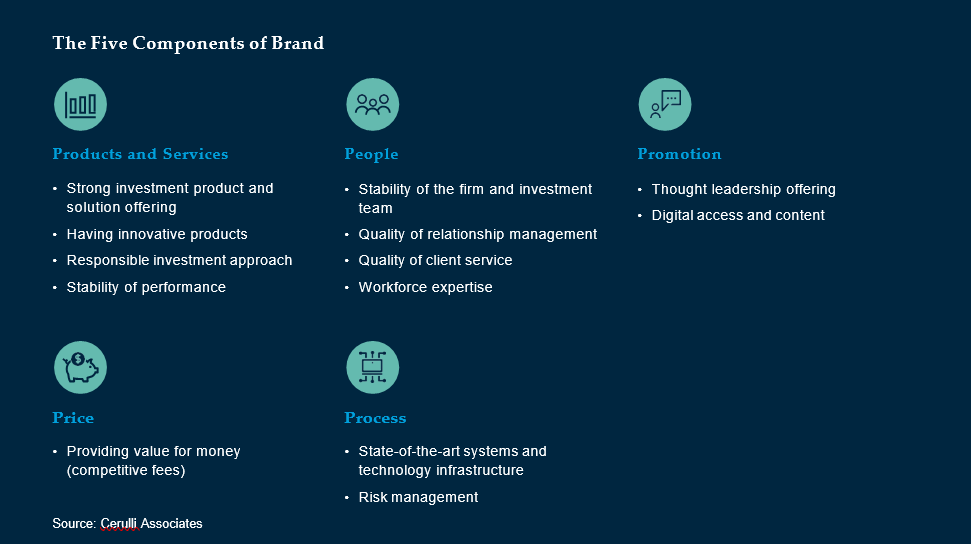

Brand perception remains difficult to define and even more difficult to quantify. Cerulli uses five main components when assessing an individual asset manager’s brand. We called them the “five Ps” of a brand: product and services, people, processes, price, and promotion. As the exhibit below shows, each category has multiple subcomponents. These include the stability of performance, investment strategies and product suite, the stability of the investment team, risk management, value for money, and thought leadership.

Some brand subcomponents are more important than others to investors when they are deciding whether to work with an asset manager. For example, 54% of the asset managers Cerulli surveyed believe that the quality of relationship management is highly valued by institutional investors. In addition, 48% of respondents believe that risk management is important to such investors and 46% believe they value the quality of client service.

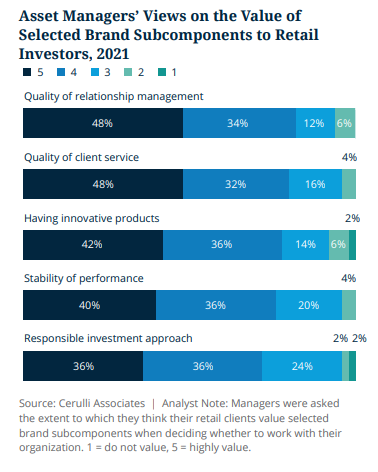

In the retail sector, the scenario is broadly similar, but some differences exist. For instance, although 48% of the managers Cerulli surveyed believe the quality of relationship management and client services is of high value to retail investors, respondents believe such investors also prioritise the stability of performance.

The fund selectors’ view

However, the fund selectors Cerulli surveyed have slightly different views to the asset managers we surveyed. Fund selector respondents identified the following as their top five subcomponents of asset manager brands: the robustness of investment products and solution offerings, (with a score of 4.1 out of 5), value for money (4.1), stability of performance (4.0), stability of the investment team (4.0), and quality of client service (4.0).

The strategies asset managers offer are becoming more sophisticated in line with their clients’ needs. Managers are interacting more with distributors as fund selectors look at funds in increasing detail, which means they need timely and rich flows of information.

The quality of managers’ client service is therefore becoming an important element of the perception of their brand. A fund selector at a private bank in Italy told Cerulli that timely and meaningful interactions with managers’ client service personnel help to establish trust.

During due diligence, fund selectors tend to ask a series of questions about the investment process and how the investment team is structured (how many people are in the team, what expertise they have, how the portfolio manager is generating alpha, how performance is attributed, and so on). Managers that provide the required information smoothly are well placed to build trust and long-term relationships.

Private banks’ fund selectors tend to attach more importance to cost, quality of client service, quality of relationship management, digital access and content, and manager’s responsible approach.

What fund selectors want most varies by market and channel. For example, the three brand subcomponents that fund selectors operating in the UK value most in asset manager brands are strong investment products, competitive fees, and stability of performance.

In Germany, the top three subcomponents are the stability of the investment team, digital access and content, and strong investment products. In Italy, cost, stability of performance, and quality of client service are the top three; in Spain, fund managers focus on product strength, the stability of the investment team, and quality of client service.

Private banks’ fund selectors tend to attach more importance to cost, quality of client service, quality of relationship management, digital access and content, and manager’s responsible approach. In contrast, independent wealth managers’ fund selectors pay more attention to managers’ product ranges (because they are looking for highly specialised investment strategies to include in their clients’ portfolios), the stability of the investment team, and innovation.

Fund selectors at independent financial advisors look at value for money, stability of performance, and managers’ investment products and solutions. Asset managers should tailor their brand awareness efforts, taking into account the different requirements in different markets and channels.

Although the fund selectors Cerulli surveyed believe managers’ responsible investment approach is still not a key subcomponent of their brand, it has become more important over the past two years. Many of the fund selectors we spoke to said that, in the future, managers that do not have strong, diversified, and clearly disclosed responsible investment credentials will be at a disadvantage.

Third-party fund selection is also gradually changing and fund selectors in Europe are increasingly taking into account less tangible elements of an asset manager’s value proposition (such as the quality of its relationship management and client service) alongside traditional quantitative metrics (such as risk- adjusted returns, multi-year track record, and cost).

There is no one-size-fits-all approach and many fund selectors told Cerulli that brand perception and the value attached to different intangible elements are evolving—and can differ substantially by country and investor channel.

Fund selectors at independent financial advisors look at value for money, stability of performance, and managers’ investment products and solutions.

Find out more about the IMpower Incorporating FundForum 2022 event and agenda here >>