Thierry Bros on Brexit, the US & LNG: What Does the Future Hold?

Feeling chilly? If you're in the UK, you may be able to blame Brexit for higher natural gas prices. That's what a new paper from The Oxford Institute for Energy Studies proposes.

The pound has lost value against the Euro making gas imports more expensive for the UK, and the EU could potentially "add some fees...or taxes when piped gas is exported... with little risk of retaliation". Add to this the fact that Britain's biggest gas storage site is aging and needs repairs plus Reuters reports that "the lack of new-build to replace it will increase dependency on imports over the next few years".

The author of that paper "Brexit's impact on gas markets", Thierry Bros, Senior Research Fellow Gas Programme at The Oxford Institute for Energy Studies, will speak at our LNGgc London event this September on the topic of LNG and Brexit. I got the chance to speak with him and pick his brain about topics ranging from Brexit to US LNG.

The UK needs to reshape its energy diplomacy

Thierry Bros writes in his paper "Brexit's impacts on gas markets": “The UK needs to reshape its energy diplomacy that has in the last decade increasingly been handled by Brussels, with a concomitant decrease in knowledge and power within the UK. In the future, the UK will need to negotiate not only with the EU but also with Norway which provides 38 per cent of its gas.”

The unsurety of new negotiations and potential taxes plague UK LNG post-Brexit. I asked Bros if he foresaw any positives, such as potential new supplies from the US.

KNect365 Energy: Do you think the US has a chance to become the world’s third largest LNG exporter?

Thierry Bros: Looking at actual liquefied trains being built it is obvious that US will become the third largest exporter by 2020.

KNect365 Energy: Do you think the US will target the UK or Europe as an LNG market?

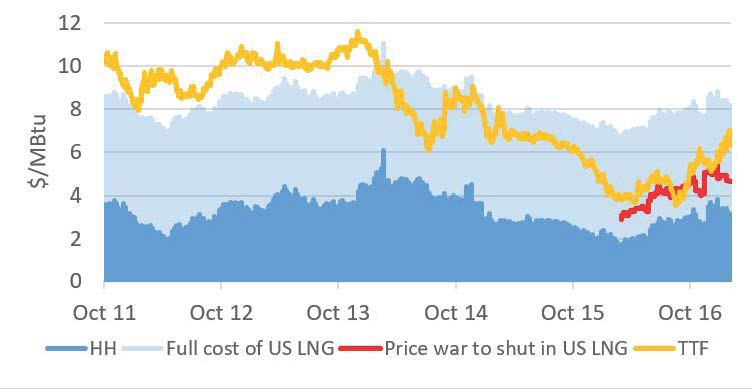

Thierry Bros: US doesn't target any market. LNG is sold free on board and buyers then have to push the LNG according to their own strategy. Since the US started to produce LNG, only a few cargos came to Europe (7%) as the spread between Europe and the US barely covers the marginal cash cost (assuming the liquefaction tolling as a sunk cost). In fact, US LNG managed to go mostly to Latin America (55%) markets where the cost of shipping is much smaller due to the shorter travel distance and where demand is growing fast.

Source: Argus, thierrybros.com

To benefit, the UK needs to have a plan

KNect365 Energy: Do you think the timing of Brexit - with the recent election of Trump - may benefit the UK?

Thierry Bros: Policy makers will have to implement Brexit now. To benefit the UK needs to have a plan.

KNect365 Energy: Is there potential for the UK be actually be better off with LNG than EU if some taxes are imposed post Brexit?

Thierry Bros: Yes this could be the case. Trafigura seeking to reopen an LNG import terminal in the UK shows that some independent trading houses are betting on LNG to take advantage of the NBP premium and volatility to the TTF that could materialise post-Brexit.

Is there a good chance that the US will increase their cargoes to Europe? The Financial Times reported last month that Trafigura's Head of LNG Trading, Hadi Hallouche, had this to say about their new UK import terminal: "Given the growth in volumes globally and the flexibility of US supplies it is likely that LNG shipped from the US will make up the lion’s share".

Don't miss Thierry Bros and over 40 Global experts on LNG at our LNGgc London event this September.

LNGgc London